Uber (UBER) Stock: Is It Worth The Investment?

Table of Contents

Uber's Business Model and Market Position

Uber's core business revolves around its ride-sharing platform, connecting passengers with drivers through a user-friendly app. However, its success isn't limited to rides. Uber Eats, its food delivery service, has rapidly gained market share, competing directly with giants like DoorDash and Grubhub. This diversification significantly reduces reliance on a single revenue stream.

Uber's market position is a complex picture. While it holds significant market dominance in many major cities worldwide, it faces intense competition from Lyft in the ride-sharing sector and numerous players in the food delivery space. Furthermore, regulatory hurdles and varying legal landscapes across different countries present ongoing challenges.

- Market dominance in major cities globally: Uber maintains a strong presence in numerous metropolitan areas, benefiting from network effects.

- Diversification into food delivery and freight: Uber Freight expands its reach into the logistics sector, creating new revenue opportunities.

- Challenges from competitors and regulatory hurdles: Intense competition and evolving regulations pose significant threats to Uber's growth and profitability.

Financial Performance and Growth Prospects

Analyzing Uber's financial performance requires a nuanced approach. While revenue has shown consistent growth, profitability has been a persistent challenge. Investors need to carefully examine financial reports, focusing on key metrics like revenue growth, net income, and earnings per share (EPS). Looking at historical data alongside future projections, based on market analysis, is crucial.

Technological advancements, particularly in autonomous vehicle technology, could significantly impact Uber's future. Success in this area would lower operational costs, but it also involves substantial investment and considerable uncertainty. Expansion into new markets and the continued growth of Uber Eats will be critical drivers of future growth.

- Historical financial data (revenue, profits, losses): Examining past performance reveals trends in revenue generation and profitability.

- Future growth projections based on market analysis: Understanding market forecasts allows for a more informed assessment of potential returns.

- Key financial ratios and their implications (e.g., P/E ratio): Analyzing financial ratios provides insights into the company's valuation and financial health.

Risks and Challenges Facing Uber

Investing in Uber (UBER) stock isn't without risk. Regulatory changes, especially concerning worker classification and liability, could significantly impact profitability. The intense competition from other ride-sharing and delivery services continuously puts pressure on pricing and market share. Economic downturns also pose a considerable threat, as people reduce discretionary spending on ride-hailing and food delivery.

Technological disruptions could also impact Uber's future. The rise of alternative transportation options or advancements in autonomous vehicle technology from competitors could disrupt its market position. Moreover, cybersecurity risks and potential data breaches are significant concerns for any tech company.

- Regulatory uncertainty and potential legal battles: Ongoing legal challenges and evolving regulations create uncertainty.

- Dependence on gig workers and labor relations: Managing relationships with independent contractors is a significant operational and legal challenge.

- Fluctuations in fuel prices and their impact on profitability: Fuel costs directly impact driver earnings and Uber's profitability.

- Cybersecurity risks and data breaches: Protecting user data is paramount and requires significant investment.

Valuation and Investment Strategies

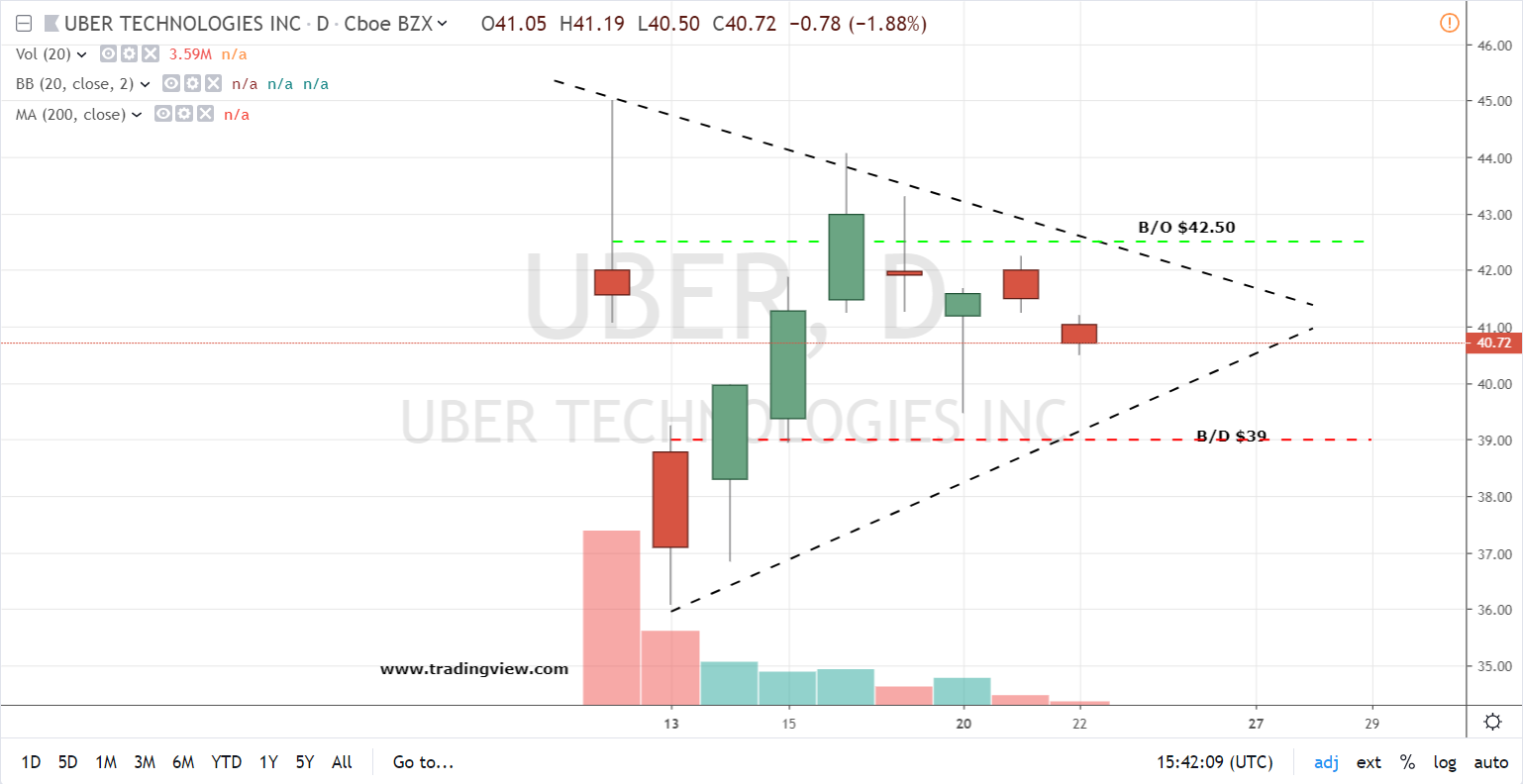

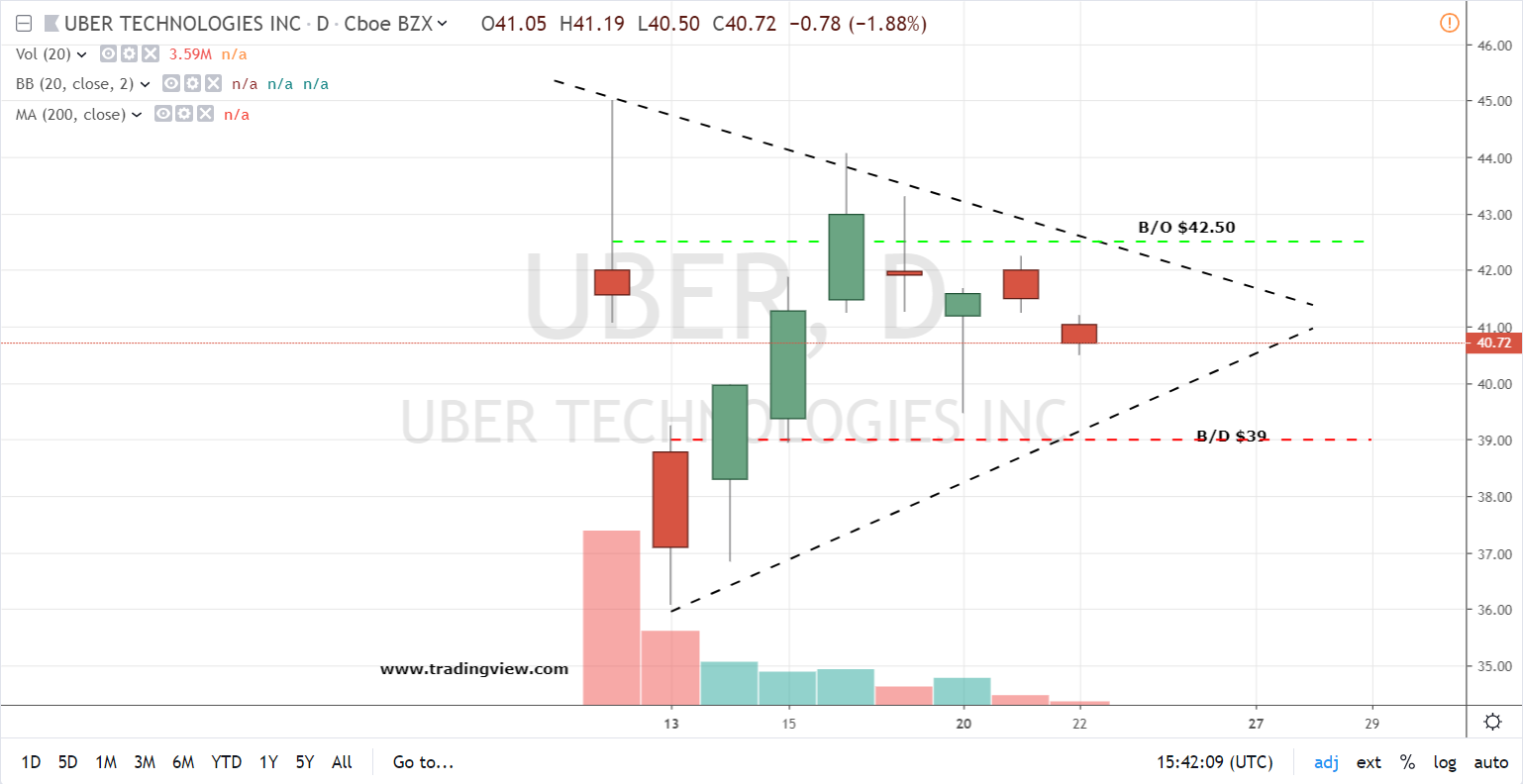

Valuing Uber stock requires using various methods, including discounted cash flow (DCF) analysis and comparable company analysis. By comparing Uber's financials to those of similar companies, investors can gain a better understanding of its relative valuation. Analyzing the current market price against its historical performance and considering analyst ratings and price targets will provide further insight.

Several investment strategies can be employed, including buy-and-hold, value investing, or growth investing. Each approach has its own risk-reward profile, and the best strategy depends on an investor's individual goals and risk tolerance.

- Current stock price and trading volume: Monitoring real-time data provides insights into market sentiment.

- Analyst ratings and price targets: Consulting expert opinions helps gauge the market's expectations.

- Different investment approaches and their risk-reward profiles: Choosing the appropriate strategy depends on individual circumstances and investment goals.

Conclusion: Is Uber (UBER) Stock Right for Your Portfolio?

Investing in Uber (UBER) stock presents a compelling opportunity but also significant risks. The company's strong market position, diversification efforts, and growth potential are attractive features. However, the challenges of intense competition, regulatory uncertainty, and fluctuating profitability must be carefully considered.

Ultimately, whether Uber (UBER) stock is right for your portfolio depends on your individual risk tolerance, financial goals, and investment timeline. Before making any investment decision, conduct thorough due diligence, research the company's financials, and consider seeking advice from a qualified financial advisor. Remember, this analysis is for informational purposes only and should not be considered financial advice.

Featured Posts

-

The Evolving Chinese Auto Landscape Implications For Bmw Porsche And Competitors

May 17, 2025

The Evolving Chinese Auto Landscape Implications For Bmw Porsche And Competitors

May 17, 2025 -

The Pope Thibodeau And The Knicks Decoding A Hilarious Comment

May 17, 2025

The Pope Thibodeau And The Knicks Decoding A Hilarious Comment

May 17, 2025 -

Brunson Expected Back Sunday Ankle Sprain Recovery Update

May 17, 2025

Brunson Expected Back Sunday Ankle Sprain Recovery Update

May 17, 2025 -

Nba Game 4 Controversy Pistons No Call Costs Them Victory

May 17, 2025

Nba Game 4 Controversy Pistons No Call Costs Them Victory

May 17, 2025 -

37 Yasindaki Novak Djokovic Yillara Meydan Okuyan Bir Efsane

May 17, 2025

37 Yasindaki Novak Djokovic Yillara Meydan Okuyan Bir Efsane

May 17, 2025

Latest Posts

-

Fiesta Del Cine 2025 3000 Por Entrada Toda La Informacion Aqui

May 17, 2025

Fiesta Del Cine 2025 3000 Por Entrada Toda La Informacion Aqui

May 17, 2025 -

1 Pick

May 17, 2025

1 Pick

May 17, 2025 -

Toni Naumovski Pobeda Na Sedona International Film Festival Za Lena I Vladimir

May 17, 2025

Toni Naumovski Pobeda Na Sedona International Film Festival Za Lena I Vladimir

May 17, 2025 -

Entradas A 3000 Para La Fiesta Del Cine 2025 Peliculas Y Como Conseguirlas

May 17, 2025

Entradas A 3000 Para La Fiesta Del Cine 2025 Peliculas Y Como Conseguirlas

May 17, 2025 -

31st Sedona International Film Festival Filmot Na Toni Naumovski Lena I Vladimir Pobedi

May 17, 2025

31st Sedona International Film Festival Filmot Na Toni Naumovski Lena I Vladimir Pobedi

May 17, 2025