UBS Alters India And Hong Kong Investment Ratings

Table of Contents

UBS's Rationale for Altering India's Investment Rating

UBS's alteration of India's investment rating reflects a complex interplay of economic, political, and sector-specific factors. Understanding these nuances is crucial for informed investment decisions.

Economic Growth and Stability

India's economy has shown remarkable resilience in recent years. Strong domestic demand, fueled by a burgeoning middle class and increasing digitalization, has been a major driver of growth. However, challenges remain.

- Positive Factors:

- Robust GDP growth averaging above 7% in recent years.

- Rapid expansion of the digital economy, fostering innovation and entrepreneurship.

- Significant investments in infrastructure development.

- Negative Factors:

- Persistent inflationary pressures impacting consumer spending.

- Concerns about global economic slowdown and its potential impact on exports.

- Need for further reforms to improve ease of doing business.

Analyzing India's GDP growth, inflation rate, fiscal policy, and monetary policy is key to understanding the overall economic picture. The interplay of these factors directly impacts the investment rating.

Political and Geopolitical Landscape

India's political stability and its position on the global stage are equally important. While generally stable, ongoing political developments and global geopolitical events can influence investor sentiment.

- Key Considerations:

- The impact of global trade tensions on India's export-oriented sectors.

- The government's initiatives to attract foreign direct investment (FDI).

- India's evolving relationship with key global players.

Understanding the political risk and geopolitical risk associated with investing in India is crucial for mitigating potential downsides.

Sector-Specific Analysis

UBS's rating change likely incorporates a detailed assessment of various sectors within the Indian economy.

- Key Sectors:

- Technology: A rapidly growing sector with significant potential, but also subject to global tech market fluctuations.

- Manufacturing: A key driver of employment and economic growth, but facing challenges in global competitiveness.

- Finance: A vital sector, contributing significantly to the economy, but susceptible to global financial market volatility.

Analyzing the performance of these sectors and their contribution to the Indian stock market is vital for portfolio diversification and risk management.

UBS's Rationale for Altering Hong Kong's Investment Rating

Hong Kong's investment rating adjustment by UBS reflects its unique challenges and opportunities. The interplay of economic outlook, geopolitical factors, and regulatory changes significantly influence investor perceptions.

Economic Outlook and Challenges

Hong Kong's economy is closely tied to mainland China. Trade relations, tourism, and the property market are key drivers. However, several challenges need consideration:

- Key Challenges:

- Slowdown in economic growth due to various global and regional factors.

- Political uncertainties and their impact on business confidence.

- Dependence on tourism and its vulnerability to external shocks.

- Overvaluation concerns within the property market.

Geopolitical Factors and Regional Instability

Regional geopolitical developments significantly impact Hong Kong's investment climate. Tensions between major global powers and regional instability create uncertainty.

- Geopolitical Impacts:

- The influence of US-China relations on Hong Kong's economic stability.

- The impact of global events on investor sentiment and capital flows.

- Regional political risks and their potential consequences for the economy.

Regulatory Changes and Policy Shifts

Government regulations and policy shifts play a crucial role in shaping Hong Kong's investment environment.

- Regulatory Considerations:

- Changes in investment regulations affecting foreign investors.

- Government policies designed to stimulate economic growth.

- Regulatory frameworks concerning various sectors like finance and technology.

Conclusion: Navigating the Changed Investment Landscape in India and Hong Kong

UBS's revised investment ratings for India and Hong Kong reflect the complex interplay of economic, political, and geopolitical factors. For investors, this highlights both opportunities and risks. Understanding the nuances of each market is crucial for successful portfolio management. Investors should carefully assess their risk tolerance, diversify their holdings, and stay informed about the latest developments.

Stay informed about the latest updates on India and Hong Kong investment ratings from UBS and other reliable sources to make informed investment decisions. Remember to conduct thorough due diligence before making any investment choices. Consider consulting with a qualified financial advisor to tailor an investment strategy that aligns with your specific goals and risk appetite. Understanding the nuances of India and Hong Kong investment ratings is vital for navigating this dynamic investment landscape.

Featured Posts

-

Frankfurts Winning Return Bochum Match Report

Apr 25, 2025

Frankfurts Winning Return Bochum Match Report

Apr 25, 2025 -

Anchor Brewing Company To Shutter A Legacy Ends

Apr 25, 2025

Anchor Brewing Company To Shutter A Legacy Ends

Apr 25, 2025 -

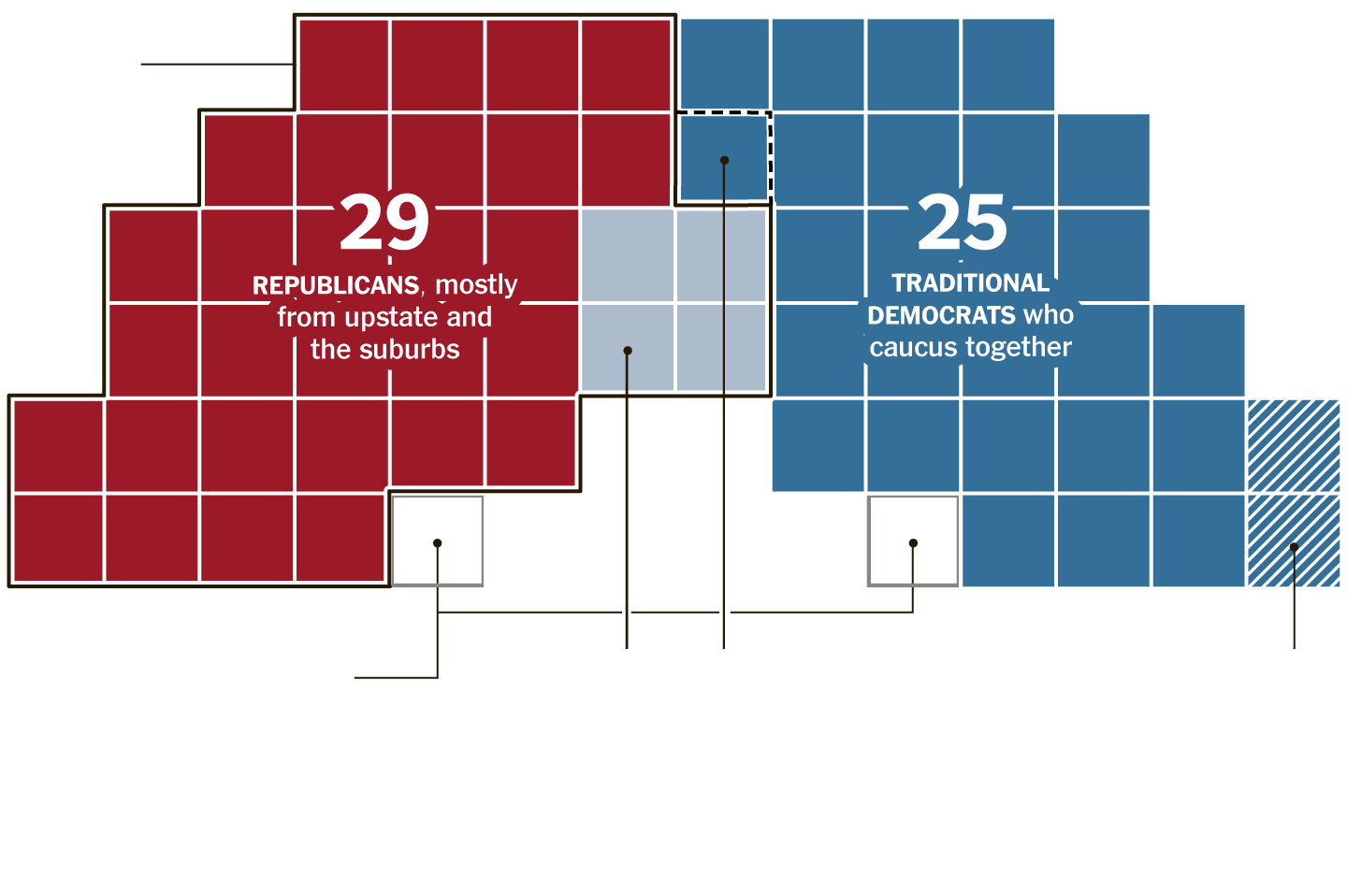

Montana Senate Coalition Of Democrats And Gop Fight For Majority

Apr 25, 2025

Montana Senate Coalition Of Democrats And Gop Fight For Majority

Apr 25, 2025 -

10 Unmissable European Shopping Adventures

Apr 25, 2025

10 Unmissable European Shopping Adventures

Apr 25, 2025 -

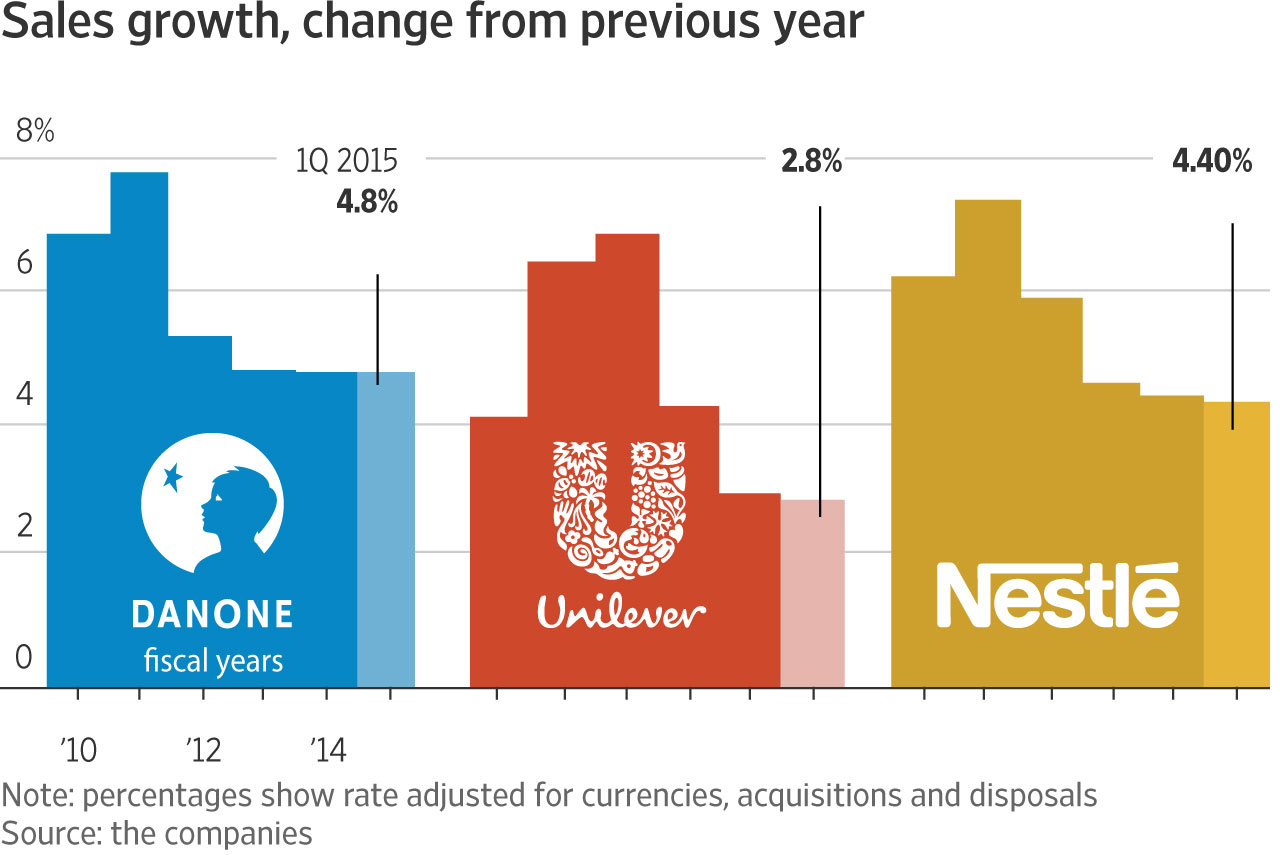

Analysis Of Nestles Nesn Sales The Role Of Pricing In Coffee And Cocoa Products

Apr 25, 2025

Analysis Of Nestles Nesn Sales The Role Of Pricing In Coffee And Cocoa Products

Apr 25, 2025

Latest Posts

-

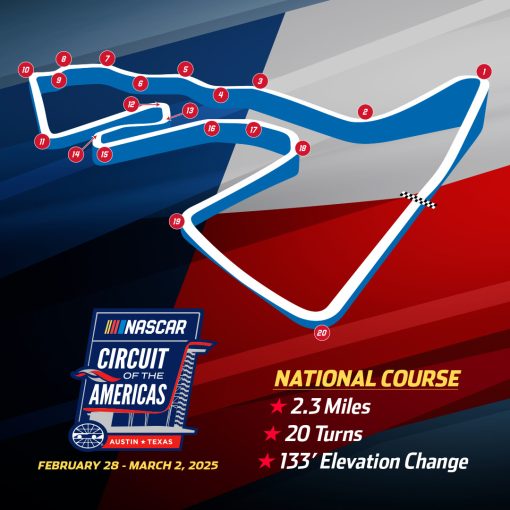

Bubba Wallaces Impact Motivating Austin Youth Before Cota Nascar Event

Apr 28, 2025

Bubba Wallaces Impact Motivating Austin Youth Before Cota Nascar Event

Apr 28, 2025 -

Austin Teens Find Inspiration In Bubba Wallace Ahead Of Cota

Apr 28, 2025

Austin Teens Find Inspiration In Bubba Wallace Ahead Of Cota

Apr 28, 2025 -

Bubba Wallace Inspiring Austin Teens At The Cota Nascar Race

Apr 28, 2025

Bubba Wallace Inspiring Austin Teens At The Cota Nascar Race

Apr 28, 2025 -

Nascars Bubba Wallace Inspires Austin Teens Before Cota Race

Apr 28, 2025

Nascars Bubba Wallace Inspires Austin Teens Before Cota Race

Apr 28, 2025 -

Bubba Wallace On The Encouraging Messages From Michael Jordan

Apr 28, 2025

Bubba Wallace On The Encouraging Messages From Michael Jordan

Apr 28, 2025