UK Households Facing HMRC Scrutiny: New Letters Target £23,000+ Income

Table of Contents

Who is Affected by the Increased HMRC Scrutiny?

HMRC utilizes sophisticated data analysis to identify individuals for review. This HMRC tax investigation process often targets taxpayers exhibiting inconsistencies in their self-assessment tax returns or discrepancies between declared income and information received from employers or other sources. The criteria for selection aren't always publicly available, but certain groups are disproportionately affected.

- Specific Income Brackets: While the £23,000 threshold is a significant marker, those earning significantly more are even more likely to be targeted. HMRC often focuses on higher-income earners due to the greater potential for tax avoidance or errors.

- Professions at Higher Risk: Self-employed individuals, freelancers, contractors, and those with multiple income streams are frequently subject to closer scrutiny due to the complexities of their tax returns. Rental income is also a common area of HMRC investigation.

- Impact on Different Income Types: The HMRC investigation may target discrepancies in salary, self-employment income, dividends, capital gains, rental income, and other sources. Any inconsistency can trigger an enquiry.

Keywords: HMRC tax investigation, self-assessment tax return, taxpayer, income verification, tax compliance.

Understanding the HMRC Letters – What to Expect

Receiving a letter from HMRC can be daunting, but understanding what to expect is the first step to a successful response. HMRC typically sends several types of letters, each with its own purpose:

- Enquiry Letters: These request clarification on specific aspects of your tax return, often highlighting potential discrepancies.

- Tax Investigation Notices: These indicate a more formal investigation and require a detailed response. This often requires professional help.

- Information Notices: These demand specific information related to your tax affairs. Failure to comply can result in penalties.

Ignoring or delaying a response to any HMRC letter is a serious mistake.

- Potential Consequences of Non-Response: Failing to respond promptly and accurately can lead to substantial penalties, including interest charges on unpaid tax and further, more intense investigation. In severe cases, prosecution is possible.

Keywords: HMRC letter, tax enquiry, tax investigation notice, penalty, interest, tax evasion.

How to Respond to an HMRC Enquiry Effectively

Responding effectively to an HMRC enquiry is critical. Here's a step-by-step guide:

- Read the letter carefully: Understand the specific information requested.

- Gather necessary documentation: Collect payslips, bank statements, tax returns, and any other relevant documents to support your claims.

- Seek professional help (recommended): A qualified tax advisor or accountant can provide invaluable support in navigating the complexities of the HMRC investigation process.

- Respond promptly and accurately: Provide clear, concise, and well-documented responses to all of HMRC's questions.

- Maintain accurate records: Keep meticulous records of all communication with HMRC, including dates, times, and the content of all correspondence.

Keywords: tax advisor, accountant, tax advice, tax compliance, HMRC response, evidence.

Avoiding Future HMRC Scrutiny – Best Practices for Taxpayers

Proactive tax planning is the best way to avoid future HMRC scrutiny. Here are some best practices:

- Maintain accurate records: Keep meticulous records of all income and expenses, using accounting software if possible.

- File tax returns on time: Avoid late filing penalties by submitting your returns before the deadline.

- Understand your tax obligations: Stay informed about changes in tax laws and regulations.

- Seek professional tax advice: Consult with a tax advisor to ensure you are meeting all your tax obligations and employing effective tax planning strategies.

Keywords: tax planning, tax return filing, record keeping, tax avoidance, tax compliance, preventing HMRC investigation.

UK Households Facing HMRC Scrutiny: What You Need to Do

HMRC scrutiny is increasing, and understanding your obligations is vital to avoid costly penalties. Responding promptly and accurately to any HMRC communication is paramount. Ignoring letters can lead to significant financial repercussions, including substantial penalties and interest charges. If you've received an HMRC letter or want to proactively avoid future HMRC scrutiny, seeking professional tax advice is highly recommended. Don't face an HMRC tax investigation alone; protect your financial future by seeking expert guidance. Contact a qualified tax advisor today to ensure your tax affairs are in order and you're compliant with all HMRC regulations.

Featured Posts

-

The Ethics Of Wildfire Betting A Look At The Los Angeles Situation

May 20, 2025

The Ethics Of Wildfire Betting A Look At The Los Angeles Situation

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puolassa Huuhkajien Tulevaisuus

May 20, 2025

Kaellman Ja Hoskonen Loppu Puolassa Huuhkajien Tulevaisuus

May 20, 2025 -

Atkinsrealis Droit Inc Avocats Specialises En Droit Commercial Et Civil

May 20, 2025

Atkinsrealis Droit Inc Avocats Specialises En Droit Commercial Et Civil

May 20, 2025 -

Bribery Charges And The Navy Retired Admirals Ethics Scandal

May 20, 2025

Bribery Charges And The Navy Retired Admirals Ethics Scandal

May 20, 2025 -

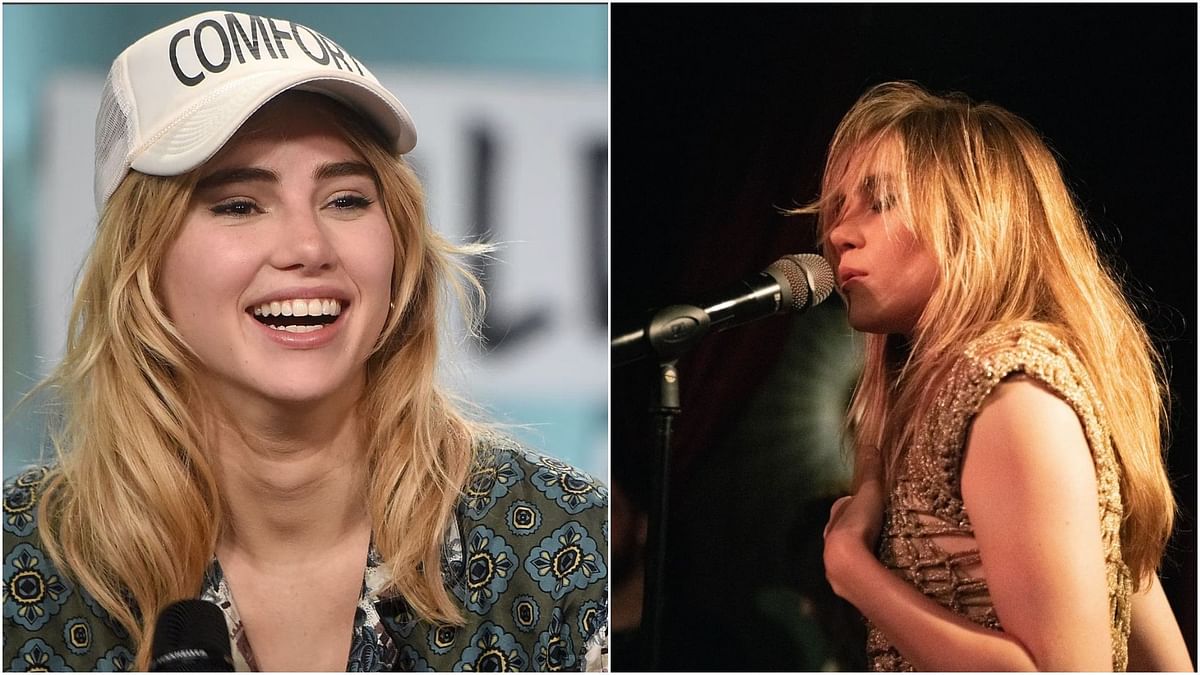

Suki Waterhouses North American Tour Inside The Surface Disco

May 20, 2025

Suki Waterhouses North American Tour Inside The Surface Disco

May 20, 2025