UK Inflation Data Spurs Pound Rally, Dimming BOE Rate Cut Bets

Table of Contents

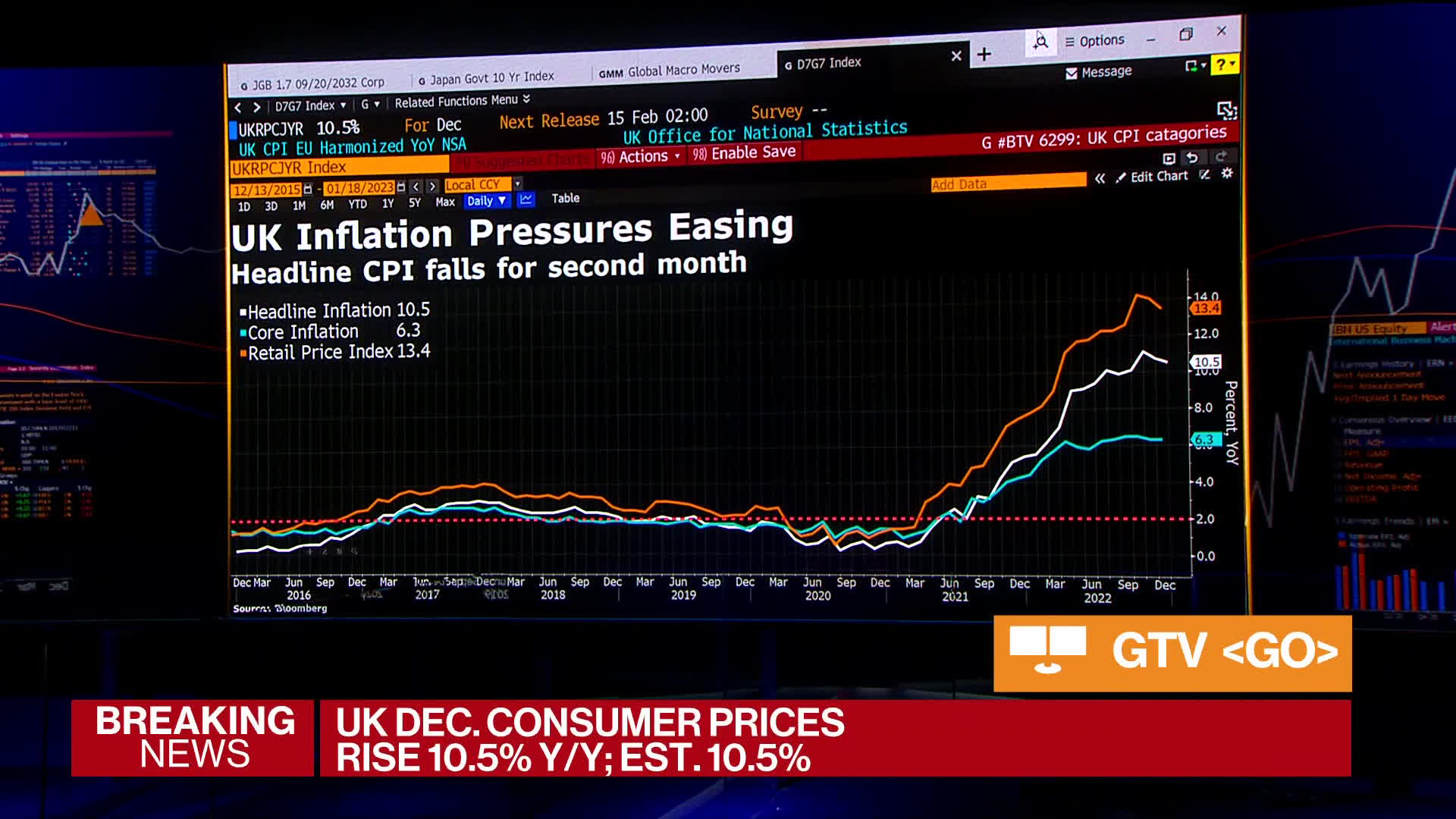

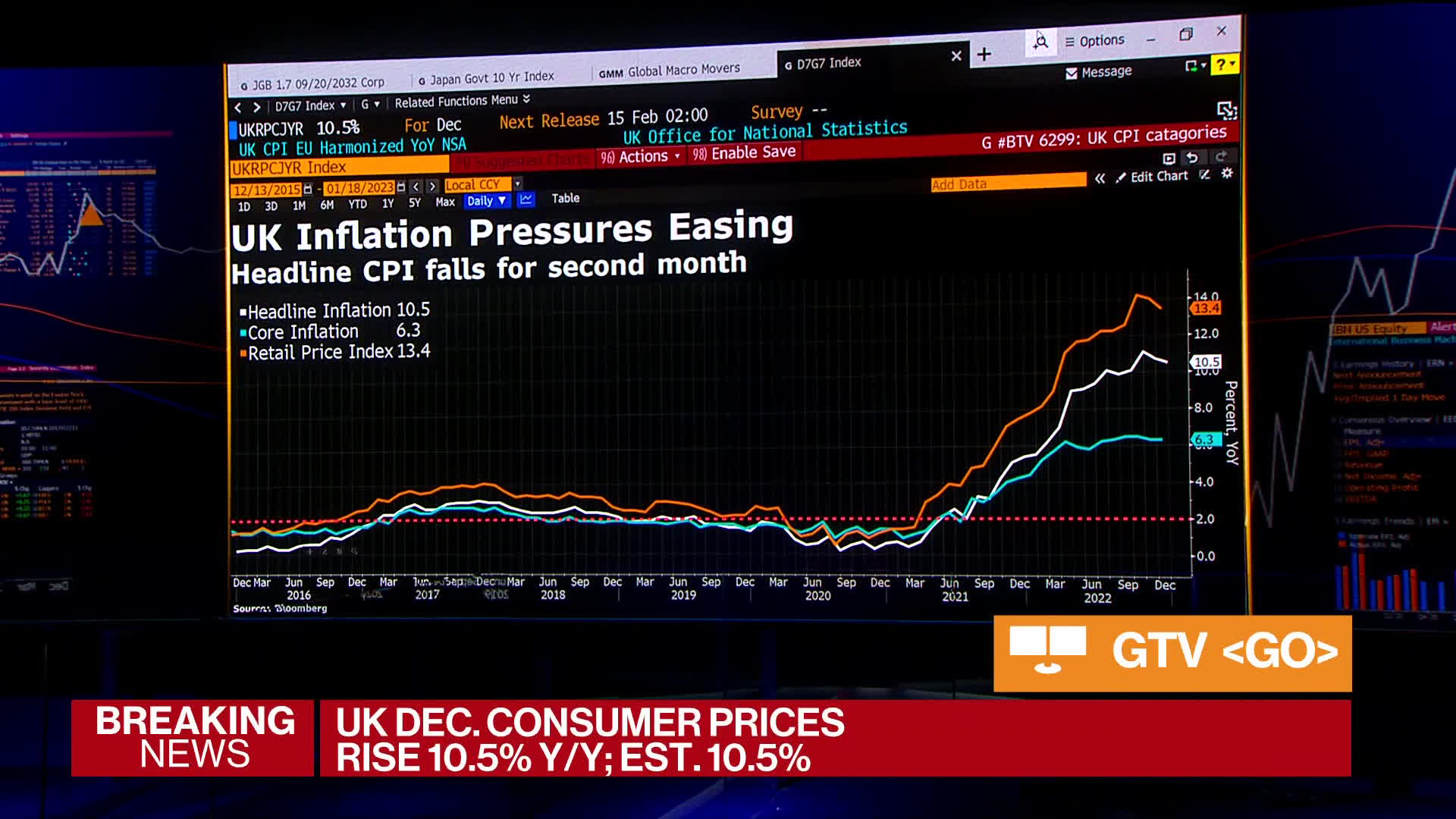

Lower-Than-Expected UK Inflation Figures

The recent release of UK inflation figures revealed a surprisingly benign inflation environment. The Consumer Price Index (CPI) fell to 6.8% in July, compared to market expectations of 7.1% and significantly lower than the 7.9% recorded in June. This unexpected decrease is a crucial factor behind the Pound's rally. The core inflation rate, which excludes volatile items like energy and food, also showed a decline, further reinforcing the positive surprise. This downward trend suggests that inflationary pressures might be easing more rapidly than previously anticipated.

- CPI fell to 6.8% in July, compared to expectations of 7.1%.

- Core inflation (excluding volatile items) also showed a decline to 6.9% from 7%.

- This represents a 1.1% decrease from the previous month.

Several factors contributed to this lower-than-expected inflation. Falling energy prices, particularly natural gas, played a significant role. Easing supply chain pressures, though still present, are also contributing to a moderation in price increases. These factors, coupled with a cooling housing market, painted a more optimistic picture of the UK's inflationary outlook than many analysts had predicted.

Pound Sterling's Reaction: A Significant Rally

The reaction in the foreign exchange market was swift and substantial. The Pound experienced a significant rally against major currencies following the release of the UK inflation data.

- GBP/USD rose by 1.2% in the immediate aftermath of the announcement.

- GBP/EUR increased by 0.8%.

- The Pound reached its highest level against the US dollar in three months.

This surge is primarily attributed to investors reassessing the probability of a BOE rate cut. The lower inflation figures significantly reduce the pressure on the central bank to further stimulate the economy through lower interest rates. Consequently, the demand for the Pound increased as investors bet on a more stable and potentially stronger UK economy in the near term.

Diminished Expectations for BOE Rate Cuts

The implications of the lower-than-expected inflation figures for the BOE's monetary policy are profound. The data significantly diminishes the likelihood of an immediate interest rate cut, which was previously considered a strong possibility by many market analysts. The central bank now has more leeway to maintain its current interest rate or even consider a potential rate hike in the future, depending on subsequent economic indicators.

- Reduced expectations of a 25 basis point rate cut.

- Increased probability of the BOE maintaining interest rates at their current level.

- Market forecasts now point towards a potential rate hike in the latter half of 2024.

Market sentiment shifted dramatically after the data release, with many analysts revising their forecasts upwards for the Pound and adjusting their expectations regarding future BOE actions. Experts are suggesting that the BOE is now more likely to prioritize controlling inflation over stimulating economic growth, at least for the short to medium term.

Implications for UK Economy and Investors

The lower inflation figures and the subsequent strengthening of the Pound have broad implications for the UK economy and various investor groups. Lower inflation directly benefits consumers, potentially boosting purchasing power and consumer spending. However, the stronger Pound could pose challenges for UK exporters, making their goods more expensive in international markets and potentially affecting export volumes.

- Positive impact on consumer purchasing power.

- Potential challenges for UK exporters facing a stronger Pound.

- Uncertainty remains regarding future inflation trajectory.

For investors, the implications are varied. Bond investors might see lower returns due to reduced expectations of rate cuts, while equity investors might benefit from a more stable economic outlook. Currency traders, meanwhile, will need to closely monitor the Pound's movements, adapting their strategies to the changing market dynamics. The current scenario necessitates cautious optimism, as the future trajectory of inflation and the BOE's subsequent actions will continue to shape the economic landscape.

Conclusion: Navigating the UK Inflation Landscape and the Pound's Future

In conclusion, the unexpectedly low UK inflation data has triggered a significant Pound rally, substantially reducing market expectations of BOE rate cuts. The implications are far-reaching, affecting consumer spending, export competitiveness, and various investor strategies. While the lower inflation is positive, uncertainties remain regarding the future trajectory of inflation and the BOE's response. Staying informed about upcoming UK inflation data releases is crucial for navigating the evolving economic landscape and making informed investment decisions. Subscribe to our newsletter or follow reputable financial news sources to stay updated on this dynamic situation and effectively manage your investments in the face of changing UK inflation data and Pound Sterling movements.

Featured Posts

-

Hsv Der Triumph Der Rueckkehr In Die Bundesliga

May 25, 2025

Hsv Der Triumph Der Rueckkehr In Die Bundesliga

May 25, 2025 -

Is News Corps Stock Price Underestimating Its True Worth

May 25, 2025

Is News Corps Stock Price Underestimating Its True Worth

May 25, 2025 -

Mia Farrows Urgent Message Following Trumps Congressional Address Is American Democracy In Peril

May 25, 2025

Mia Farrows Urgent Message Following Trumps Congressional Address Is American Democracy In Peril

May 25, 2025 -

Market Update 8 Surge In Euronext Amsterdam Stocks Post Trump Tariff Announcement

May 25, 2025

Market Update 8 Surge In Euronext Amsterdam Stocks Post Trump Tariff Announcement

May 25, 2025 -

Heavy Rain And Flash Flood Threat In South Florida Nws Forecast

May 25, 2025

Heavy Rain And Flash Flood Threat In South Florida Nws Forecast

May 25, 2025