Understand Personal Loan Interest Rates Today: Make Informed Decisions

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors significantly impact the personal loan interest rates you'll receive. Understanding these factors is crucial for securing a favorable rate.

Credit Score: The Foundation of Your Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rates. Lenders use your credit score to assess your creditworthiness – essentially, your ability to repay the loan. A higher credit score demonstrates a history of responsible borrowing, leading to lower interest rates and better loan terms. Conversely, a low credit score often results in higher interest rates or even loan rejection.

-

Credit Score Ranges and Interest Rates:

- 750+ (Excellent): Potentially lowest interest rates, often prime rates or better.

- 700-749 (Good): Competitive interest rates, but potentially higher than the lowest available.

- 650-699 (Fair): Higher interest rates, potentially limited lender options.

- Below 650 (Poor): Significantly higher interest rates, loan approval may be difficult.

-

Resources to Check Your Credit Score: You can check your credit score for free annually at annualcreditreport.com. Understanding your score is the first step towards improving it and securing better loan rates.

-

Improving Your Credit Score: If your credit score is less than ideal, focus on paying bills on time, keeping credit utilization low, and maintaining a diverse credit history. These actions can significantly improve your creditworthiness over time.

Loan Amount and Term: The Size and Duration Matter

The amount you borrow and the length of your loan term also significantly impact your interest rate. Larger loan amounts and longer terms generally result in higher interest rates because they represent a greater risk to the lender.

-

Loan Amount and Term Examples: A $5,000 loan over 12 months will likely have a lower interest rate than a $20,000 loan over 60 months. The longer repayment period increases the lender's risk.

-

Amortization: Understanding amortization is key. This is the process of gradually paying off your loan over time, with each payment partially covering the principal and partially covering the interest. Longer terms mean more interest paid overall.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying interest rates and terms. Comparing offers across various lender types is crucial for securing the best deal.

-

Banks: Typically have established reputations and offer a wide range of loan products, but may have more stringent approval requirements.

-

Credit Unions: Often offer lower interest rates and more personalized service, but membership may be required.

-

Online Lenders: Provide convenience and may offer competitive rates, but may lack the personalized touch of traditional lenders. Always carefully review their fees and terms.

-

APR Comparison: Always compare the Annual Percentage Rate (APR), which includes the interest rate and all other loan fees, to get a true picture of the total cost of borrowing.

Debt-to-Income Ratio (DTI): Your Financial Health Matters

Your debt-to-income ratio (DTI) reflects the proportion of your monthly income dedicated to debt repayment. A high DTI indicates a higher financial burden, increasing the perceived risk for lenders and potentially leading to higher interest rates.

-

Understanding DTI: DTI is calculated by dividing your total monthly debt payments by your gross monthly income.

-

Acceptable DTI Ratios: Lenders typically prefer DTI ratios below 43%, but this can vary.

-

Improving Your DTI: Reducing existing debt, increasing income, or both can significantly improve your DTI and your chances of obtaining a lower interest rate.

How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rate requires proactive research and comparison.

Shop Around and Compare: The Power of Comparison

Never settle for the first offer you receive. Comparing offers from multiple lenders is crucial.

-

Online Loan Comparison Tools: Use online resources and comparison websites to quickly and easily compare rates from different lenders.

-

Pre-qualification: Many lenders offer pre-qualification options, allowing you to see estimated rates without impacting your credit score. This lets you compare potential offers before a formal application.

Check for Hidden Fees: Avoid Unexpected Costs

Beware of hidden fees that can significantly increase the overall cost of your loan.

-

Common Hidden Fees: Origination fees, late payment fees, prepayment penalties, and application fees can all add up.

-

Read the Fine Print: Always thoroughly review the loan agreement before signing to understand all fees and terms.

Negotiate: Don't Be Afraid to Ask

Don't hesitate to negotiate with lenders, especially if you have a strong credit score and a compelling financial profile.

-

Negotiation Tips: Be prepared to present alternative offers from competing lenders. Highlight your positive financial history and responsible borrowing habits.

-

Leverage Competition: Use competing loan offers to negotiate a lower rate with your preferred lender.

Conclusion

Understanding personal loan interest rates is paramount for securing a financially sound loan. We've explored key factors influencing rates – your credit score, the loan amount and term, the lender type, and your debt-to-income ratio. By actively comparing offers, checking for hidden fees, and negotiating effectively, you can significantly improve your chances of obtaining the best possible personal loan interest rates. Now that you understand the intricacies of personal loan interest rates, start comparing offers from different lenders today to secure the best possible deal for your financial needs. Use online loan comparison tools to streamline your search and consider consulting with a financial advisor for personalized guidance.

Featured Posts

-

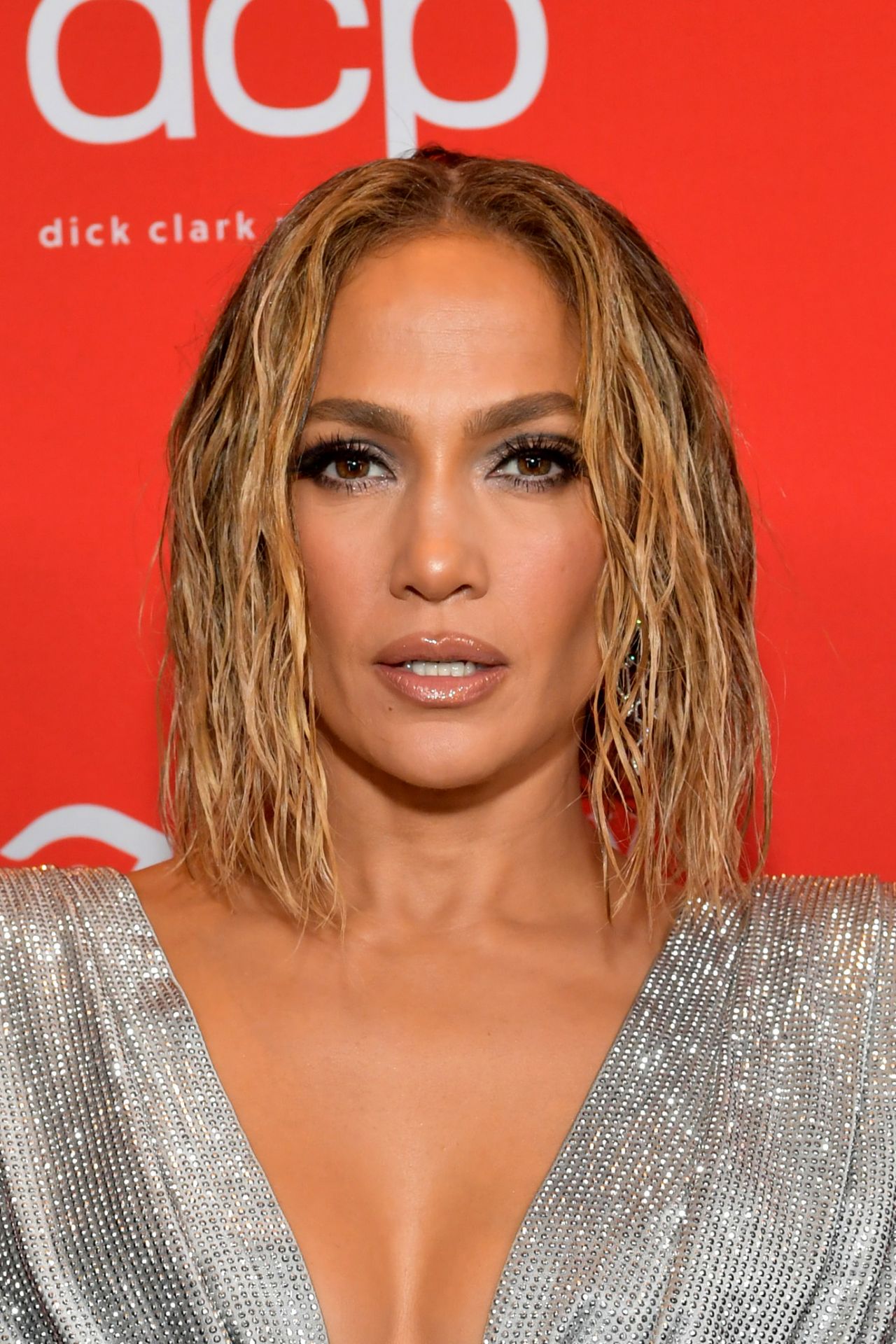

2025 American Music Awards Jennifer Lopezs Hosting Gig Announced

May 28, 2025

2025 American Music Awards Jennifer Lopezs Hosting Gig Announced

May 28, 2025 -

Serena Williams On Jannik Sinner Doping Allegations I D Have Been Banned For 20 Years

May 28, 2025

Serena Williams On Jannik Sinner Doping Allegations I D Have Been Banned For 20 Years

May 28, 2025 -

Find The Best Personal Loan Interest Rates Today Simple Steps

May 28, 2025

Find The Best Personal Loan Interest Rates Today Simple Steps

May 28, 2025 -

Cristiano Ronaldo Nun Gelecegi Netlesti Al Nassr Ile 2 Yil Daha

May 28, 2025

Cristiano Ronaldo Nun Gelecegi Netlesti Al Nassr Ile 2 Yil Daha

May 28, 2025 -

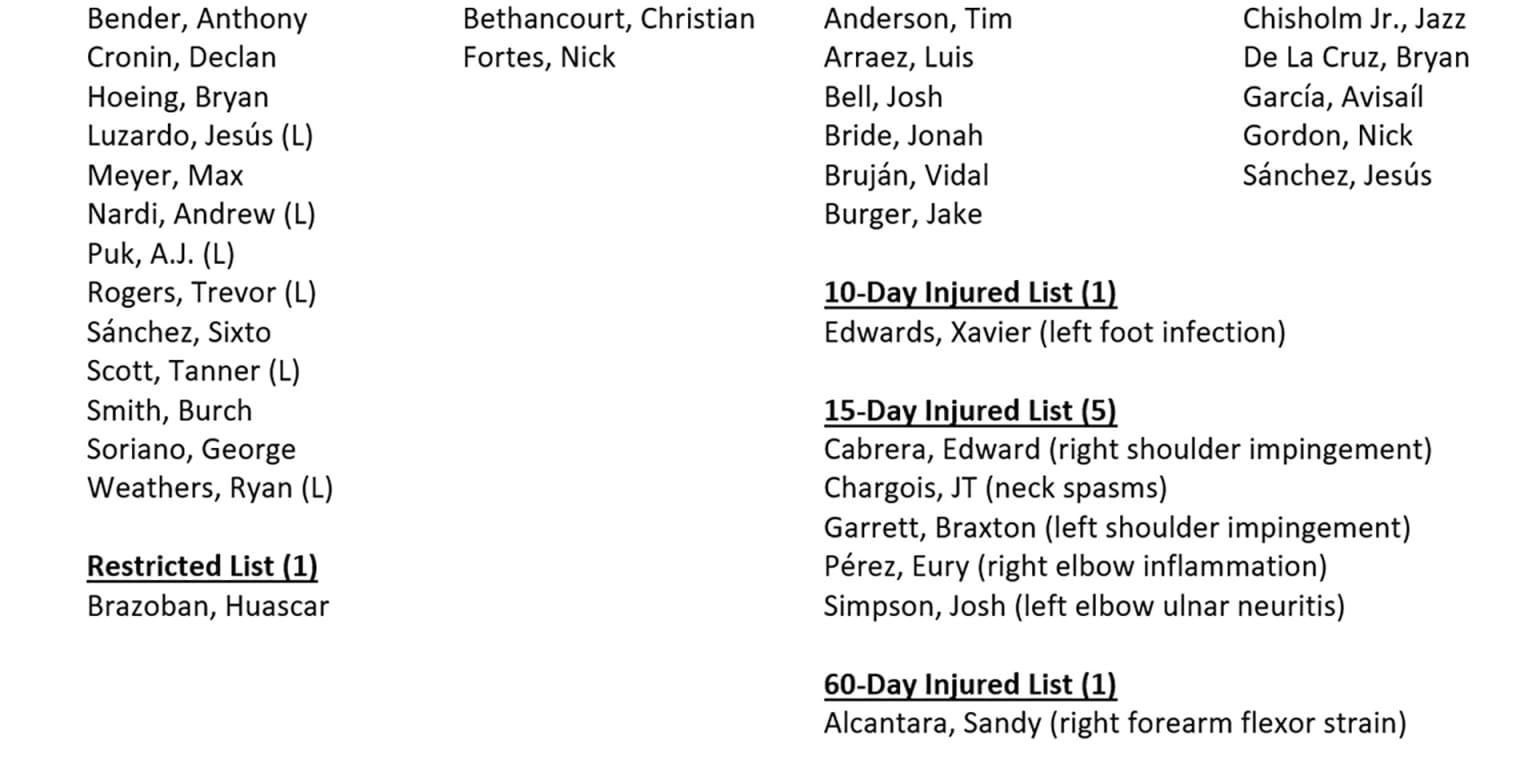

Analyzing The Miami Marlins 2025 Opening Day Roster Competition

May 28, 2025

Analyzing The Miami Marlins 2025 Opening Day Roster Competition

May 28, 2025