Understanding High Stock Market Valuations: BofA's Analysis For Investors

Table of Contents

BofA's Key Findings on Current Market Valuations

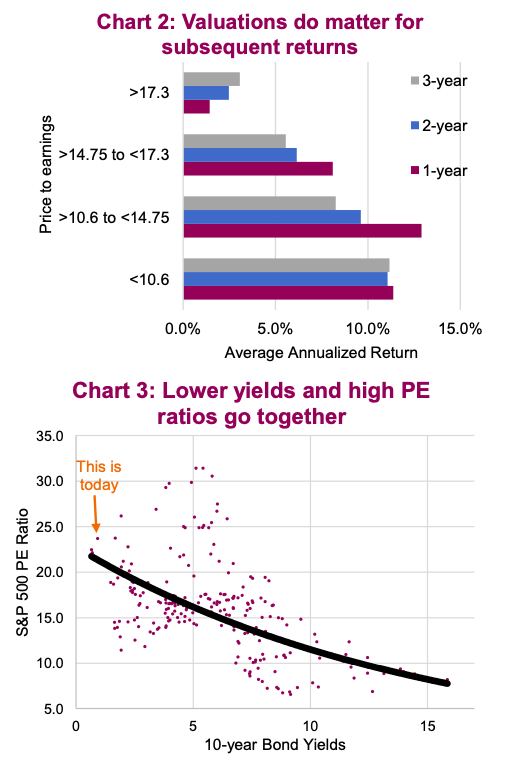

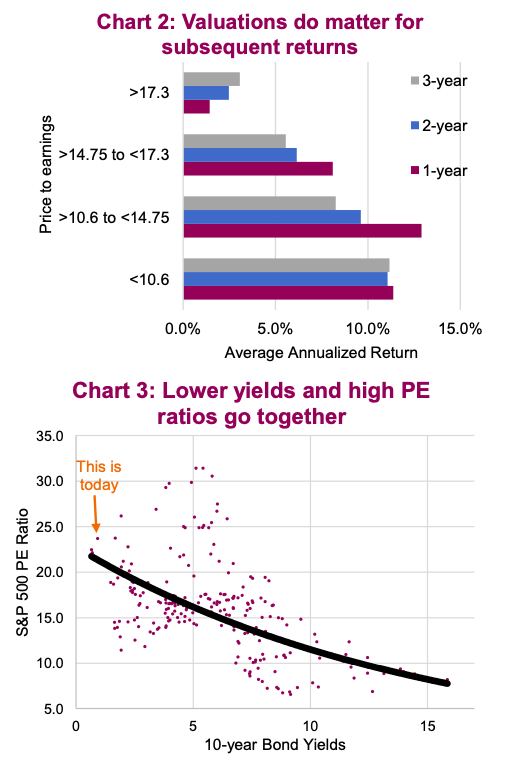

BofA's latest report paints a nuanced picture of current market valuations. While specific data points change frequently, a common theme often revolves around whether the market is overvalued, fairly valued, or potentially undervalued in certain sectors. BofA typically utilizes a variety of metrics to gauge valuations, including price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and price-to-book ratios (P/B). These ratios are compared to historical averages and industry benchmarks to determine whether specific stocks or the overall market is trading at a premium or discount.

- Summary of BofA's valuation metrics: BofA usually presents a range of valuation metrics, highlighting discrepancies between different sectors and asset classes. They might indicate that certain sectors are trading at historically high P/E ratios, suggesting overvaluation, while others show more modest valuations.

- Key sectors identified as overvalued or undervalued by BofA: BofA’s reports frequently pinpoint specific sectors. For example, at one time, they may have flagged technology stocks as overvalued due to high growth expectations, while highlighting undervalued opportunities in cyclical sectors poised for recovery.

- Comparison to historical valuation levels: A core element of BofA’s analysis is comparing current valuations to historical averages. This allows them to assess whether the current market is trading at exceptionally high or low levels relative to its own history.

- BofA's outlook for future market performance: Based on their valuation analysis and macroeconomic forecasts, BofA typically offers a perspective on the likely direction of the market. This can range from cautious optimism to a more bearish outlook depending on their assessment of risk factors.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these factors is vital for comprehending the market's dynamics.

- Impact of low interest rates on stock valuations: Low interest rates make borrowing cheaper, boosting corporate investment and increasing the attractiveness of stocks relative to bonds. This can drive up stock prices and valuations.

- Role of quantitative easing in boosting asset prices: Central banks' quantitative easing (QE) programs inject liquidity into the market, increasing demand for assets and driving up their prices. This has undoubtedly played a significant role in inflating market valuations.

- Influence of strong corporate earnings growth: Robust corporate earnings growth can justify higher stock valuations as companies demonstrate their ability to generate profits. However, this must be considered in relation to other valuation metrics to avoid overpaying.

- Analysis of investor sentiment and its effect on market valuations: Investor optimism and confidence often push valuations higher, creating a feedback loop where rising prices reinforce positive sentiment. This can lead to valuations exceeding fundamental justifications in the short term.

Investment Strategies in a High-Valuation Market

Investing in a market with high valuations demands a cautious and strategic approach.

- Strategies for mitigating risk in a high-valuation market: Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial to reduce portfolio risk. Consider hedging strategies to protect against potential market downturns.

- Sectors with potentially higher growth prospects despite high valuations: While overall valuations might be high, some sectors might still offer attractive growth potential. Thorough research and due diligence are critical here. Focusing on companies with strong fundamentals and sustainable competitive advantages can be beneficial.

- Defensive investment options to protect against market corrections: Defensive stocks in sectors like consumer staples and utilities are often less sensitive to economic fluctuations and can provide stability during market corrections. High-quality bonds can also serve as a buffer.

- Importance of long-term investment horizons: Long-term investors are often better positioned to weather short-term market volatility. Focusing on a long-term investment plan can help mitigate the impact of fluctuations in market valuations.

Risks Associated with High Stock Market Valuations

High valuations inherently carry increased risk.

- Probability of a market correction and its potential impact: Markets with high valuations are more susceptible to corrections. A sharp decline in prices can significantly impact portfolios.

- Risks associated with specific sectors or asset classes: Certain sectors might be particularly vulnerable to a correction, especially those with stretched valuations.

- Importance of risk management strategies: Implementing robust risk management strategies is crucial. This includes setting stop-loss orders, diversifying investments, and regularly rebalancing your portfolio.

- Steps to protect your investment portfolio: Diversification, hedging strategies, and a focus on high-quality assets can help safeguard against market downturns.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions. BofA's analysis provides valuable insights into the current market environment, highlighting both the potential rewards and risks. While strong corporate earnings and supportive monetary policy have contributed to high valuations, the probability of a market correction remains a significant concern. Therefore, investors should adopt a cautious yet strategic approach, diversifying their portfolios and focusing on companies with strong fundamentals. Remember to conduct thorough research, consider your personal risk tolerance, and consult with a financial advisor to develop a robust investment strategy that accounts for the current high stock market valuations and BofA’s insights. Making informed investment decisions based on BofA's analysis and understanding high stock market valuations are key to navigating the complexities of the current market.

Featured Posts

-

Jon Jones On Hasbulla Daily Fights And A Kick To The Mouth

May 30, 2025

Jon Jones On Hasbulla Daily Fights And A Kick To The Mouth

May 30, 2025 -

Taylor Swift Fans Ticketmaster Updates On Queue Position

May 30, 2025

Taylor Swift Fans Ticketmaster Updates On Queue Position

May 30, 2025 -

Analyzing The Effects Of Trumps Trade War On Canada 8 Economic Indicators

May 30, 2025

Analyzing The Effects Of Trumps Trade War On Canada 8 Economic Indicators

May 30, 2025 -

San Diego Issues Inclement Weather Alert For Tonight

May 30, 2025

San Diego Issues Inclement Weather Alert For Tonight

May 30, 2025 -

Jacobelli Defend Le Pen Au Dessus Ou En Dessous Des Lois

May 30, 2025

Jacobelli Defend Le Pen Au Dessus Ou En Dessous Des Lois

May 30, 2025