Understanding High Stock Market Valuations: BofA's View For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's stance on current market valuations often shifts, reflecting the dynamic nature of the economy. To understand their current perspective, it's crucial to refer to their most recent reports and publications. While a precise, up-to-the-minute summary isn't possible in a static article, we can discuss the general metrics and approaches they typically employ.

-

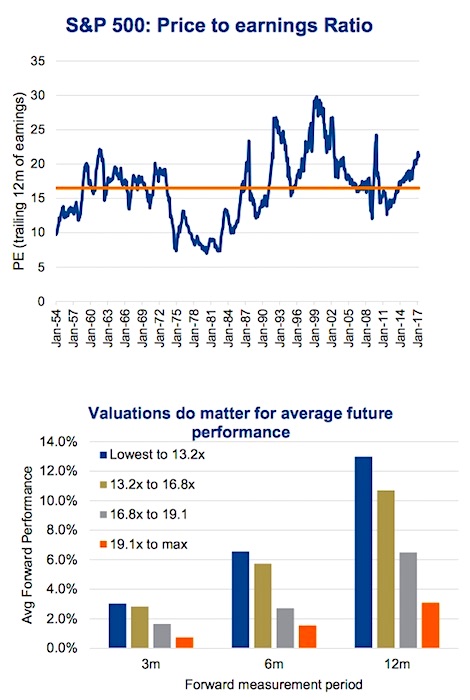

Valuation Metrics: BofA likely uses a combination of metrics to assess market valuations. These include, but are not limited to, the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various other sector-specific valuation ratios. They consider these metrics in relation to historical averages and compare them across different markets and asset classes.

-

BofA Reports and Publications: To gain the most current insights, investors should consult BofA Global Research's publications, including their regularly updated market commentaries and investment strategy reports. These often provide a detailed breakdown of their valuation assessments and the reasoning behind them.

-

Influencing Economic Indicators: BofA’s view is heavily influenced by key economic indicators such as inflation rates, interest rate movements by central banks (like the Federal Reserve), GDP growth projections, and unemployment figures. These macroeconomic factors significantly impact stock valuations and overall market sentiment.

Factors Contributing to High Stock Market Valuations

Several factors can contribute to elevated stock market valuations. BofA's analysis likely considers many of these:

-

Low Interest Rate Environment: A low-interest-rate environment makes borrowing cheaper for companies and consumers, stimulating economic activity and boosting corporate profits. This, in turn, can drive up stock prices as investors seek higher returns in a low-yield fixed-income market. Low interest rates also decrease the discount rate used in valuation models, leading to higher present values of future earnings.

-

Quantitative Easing (QE): Central banks' use of QE involves injecting liquidity into the market by purchasing government bonds and other assets. This increases the money supply, potentially leading to higher inflation and supporting asset prices, including stocks.

-

Strong Corporate Earnings: Robust corporate earnings growth can justify higher stock valuations. Companies posting consistently strong profit numbers often attract increased investor interest, leading to higher demand and consequently, higher prices.

-

Technological Advancements: Rapid technological advancements often fuel innovation and drive economic growth, leading to higher valuations for companies in technology-related sectors. The potential for future growth in these sectors can significantly impact overall market valuations.

-

Geopolitical Events: Geopolitical events and global uncertainties can influence investor sentiment and market volatility. While unpredictable, these events can either increase or decrease market valuations depending on their perceived impact on the global economy and specific sectors.

BofA's Recommendations for Investors

Given the often-high valuations, BofA's recommendations to investors likely involve a cautious and strategic approach:

-

Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and geographic regions is crucial to mitigate risk in a potentially volatile market.

-

Sector Rotation: BofA might suggest shifting investments from overvalued sectors to those with potentially higher growth prospects and more reasonable valuations.

-

Value Investing: Focus on undervalued companies with strong fundamentals can offer potentially higher returns compared to overvalued growth stocks.

-

Risk Management: Implementing robust risk management strategies, including setting stop-loss orders and diversifying investments, is essential to protect capital in a high-valuation environment.

-

Long-Term Perspective: Maintaining a long-term investment horizon can help weather short-term market fluctuations and allow investors to benefit from the long-term growth potential of the market.

Understanding the Risks Associated with High Valuations

Investing in a market with high valuations carries inherent risks:

-

Market Corrections and Crashes: High valuations often precede market corrections or crashes. While timing these events is impossible, it's important to be prepared for potential downturns.

-

Lower Future Returns: Historically, markets with high valuations tend to deliver lower future returns compared to markets with lower valuations. This is because future growth is already largely priced into the current high valuations.

-

Inflation's Impact: High inflation can erode the purchasing power of future returns, significantly impacting the real returns on investments. Understanding inflation's potential impact is crucial for making informed investment decisions.

-

Risk Management: Effective risk management strategies are essential in high-valuation markets to protect capital and limit potential losses during corrections or market downturns.

Conclusion

BofA's assessment of high stock market valuations involves a careful consideration of various economic indicators, valuation metrics, and market trends. Their recommendations typically emphasize diversification, strategic sector allocation, and a focus on risk management. While the potential for growth exists, the risks associated with high valuations should not be underestimated.

Call to Action: Stay informed on the latest insights into stock market valuations. Continuously monitor BofA's research and adapt your investment strategy accordingly to navigate the complexities of high stock market valuations. Consider consulting a financial advisor for personalized guidance tailored to your risk tolerance and investment goals. Remember, understanding high stock market valuations is crucial for making well-informed investment decisions.

Featured Posts

-

Dogovor Makrona I Tuska Frantsiya I Polsha Ukreplyayut Sotrudnichestvo Unian

May 09, 2025

Dogovor Makrona I Tuska Frantsiya I Polsha Ukreplyayut Sotrudnichestvo Unian

May 09, 2025 -

R3

May 09, 2025

R3

May 09, 2025 -

Copa Libertadores Liga De Quito Vs Flamengo Grupo C Jornada 3

May 09, 2025

Copa Libertadores Liga De Quito Vs Flamengo Grupo C Jornada 3

May 09, 2025 -

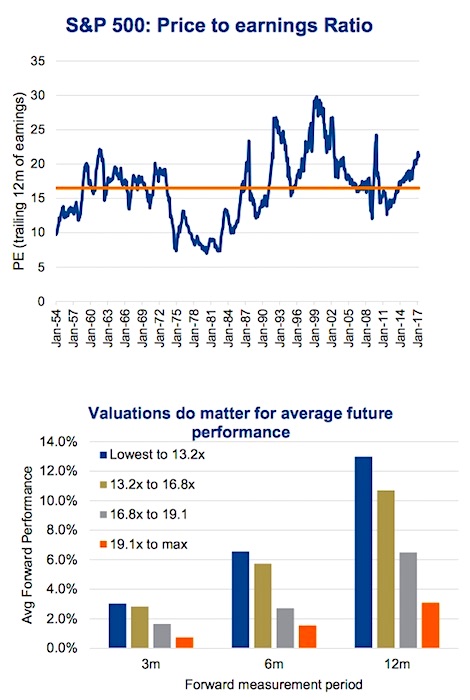

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 09, 2025

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 09, 2025 -

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 09, 2025

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 09, 2025