Understanding HMRC's Nudge Letters For Online Sellers (eBay, Vinted, Depop)

Table of Contents

What are HMRC Nudge Letters?

HMRC nudge letters aren't formal tax assessments or investigations; they're friendly reminders. They indicate that HMRC has information suggesting you may have undeclared income from online selling platforms, and they're encouraging you to check your tax position. These letters aren't demands but rather an opportunity to rectify any discrepancies before penalties are incurred.

- Information typically included: The letter will likely detail transaction data they've gathered, comparing it to your submitted tax returns (if any). It might highlight the potential tax liability based on their assessment of your sales.

- Distinguishing from formal assessments: A nudge letter differs significantly from a formal tax assessment. A formal assessment demands payment and carries significant penalties for non-compliance. A nudge letter is a chance to prevent that.

- Examples of HMRC nudge letter content: While the exact wording varies, you'll typically find details of your online sales activity, the potential tax due, and instructions on how to rectify the situation.

Why is HMRC Targeting Online Sellers?

The growth of online marketplaces has presented a significant challenge for HMRC in accurately collecting tax revenue. The sheer volume of transactions and the diverse nature of online platforms make it difficult to track income effectively. HMRC is leveraging data analysis and sophisticated algorithms to identify individuals who may not be fully declaring their online sales income. This is part of a broader effort to ensure fair tax collection within the platform economy.

- HMRC data matching: HMRC uses data matching techniques to compare information received from online platforms with the income declared on self-assessment tax returns. Discrepancies trigger further investigation, potentially leading to a nudge letter.

- Online marketplace tax: The taxation of income from online marketplaces is complex and depends on various factors, including the nature of the goods sold, your trading status, and your overall income.

- Addressing tax evasion: HMRC's increased focus on online sellers is a direct response to concerns about tax evasion within the rapidly growing online marketplace sector.

Common Scenarios Triggering Nudge Letters:

Several scenarios can trigger an HMRC nudge letter. These include:

- Consistent sales without filed tax returns: Regular sales on platforms like eBay, Vinted, or Depop without registering for self-assessment and filing tax returns is a major red flag.

- Discrepancies between declared income and reported sales data: If HMRC’s data significantly differs from your declared income, you are likely to receive a nudge letter.

- Suspicious trading patterns identified by HMRC algorithms: Algorithmic analysis can identify unusual trading patterns that may indicate undeclared income.

- Lack of self-assessment registration: Failing to register for self-assessment if your online sales exceed the thresholds is a surefire way to attract HMRC's attention.

How to Respond to an HMRC Nudge Letter

Responding promptly to an HMRC nudge letter is critical. Ignoring it will only escalate the situation and could lead to significant penalties.

- Review the letter carefully: Understand the information provided, particularly the alleged discrepancies and the potential tax liability.

- Gather necessary documentation: Collect all relevant documents such as sales records, expense receipts, and bank statements. Maintain meticulous tax record keeping.

- Contact HMRC if needed: If you have questions or require clarification, contact HMRC directly using the contact details provided in the letter.

- File or amend your tax return: If you haven't filed a tax return, do so immediately. If you have, amend it to correct any discrepancies.

- Avoiding penalties: Prompt and accurate action demonstrates your commitment to tax compliance.

Avoiding HMRC Nudge Letters in the Future

Proactive tax planning is the best way to avoid future HMRC nudge letters. This includes:

- Maintaining accurate sales records: Keep detailed records of all sales, including dates, amounts, and buyer details. Consider using accounting software for efficient record-keeping.

- Tracking expenses: Maintain accurate records of all business expenses, including postage, packaging, and any other costs incurred.

- Registering for self-assessment: Register for self-assessment if your online sales exceed the threshold for tax registration.

- Filing tax returns on time: File your self-assessment tax returns by the deadline to avoid penalties.

- Understanding your tax obligations: Familiarize yourself with the specific tax rules and regulations that apply to online sellers.

Conclusion: Understanding and Acting on HMRC Nudge Letters for Online Success

HMRC is actively monitoring online selling platforms, and nudge letters are a clear indication of this scrutiny. Understanding your online selling tax obligations and responding promptly to any communication from HMRC is crucial. Ignoring HMRC nudge letters can lead to serious consequences. By maintaining accurate records, registering for self-assessment, and filing your returns on time, you can significantly reduce the risk of receiving these letters and maintain your tax compliance. If you’ve received an HMRC nudge letter or have concerns about your online selling tax obligations, seek professional advice immediately. Don't delay; proactive tax planning ensures peace of mind and avoids potential penalties. Learn more about managing your online selling tax and stay compliant.

Featured Posts

-

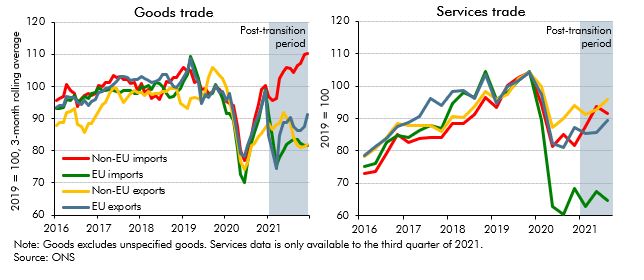

Uk Luxury Sector Brexits Impact On Eu Trade

May 20, 2025

Uk Luxury Sector Brexits Impact On Eu Trade

May 20, 2025 -

Postman Tricks Hidden Features For Efficiency

May 20, 2025

Postman Tricks Hidden Features For Efficiency

May 20, 2025 -

Jalkapallo Jacob Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Penkillae

May 20, 2025

Jalkapallo Jacob Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Penkillae

May 20, 2025 -

Michael Kors Expands Reach Luxury Brand Now Available On Amazon

May 20, 2025

Michael Kors Expands Reach Luxury Brand Now Available On Amazon

May 20, 2025 -

Eksereynontas Ta Tampoy Apokalypseis Poy Sproxnoyn Ta Oria

May 20, 2025

Eksereynontas Ta Tampoy Apokalypseis Poy Sproxnoyn Ta Oria

May 20, 2025