Understanding Stock Market Valuations: Insights From BofA

Table of Contents

Key Valuation Metrics Used by BofA

Bank of America, a leading financial institution, employs several key valuation metrics to assess the attractiveness of investments. Understanding these metrics is crucial for interpreting BofA's market analysis and forming your own investment opinions.

Price-to-Earnings Ratio (P/E):

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS). It essentially tells you how much investors are willing to pay for each dollar of a company's earnings.

- Calculation: P/E Ratio = Market Value per Share / Earnings per Share

- Forward vs. Trailing P/E: BofA likely uses both forward (based on projected future earnings) and trailing (based on past earnings) P/E ratios. Forward P/E offers a view of future profitability, while trailing P/E reflects historical performance. The choice depends on the investment horizon.

- Interpretation: A high P/E ratio might suggest the market expects high future growth, but it could also indicate overvaluation. Conversely, a low P/E ratio might signal undervaluation or potential risks. BofA's research often highlights companies with P/E ratios that deviate significantly from industry averages, potentially indicating investment opportunities or areas of concern.

Price-to-Sales Ratio (P/S):

The Price-to-Sales ratio (P/S) is another crucial metric, particularly useful for companies with negative earnings or those in high-growth sectors. It compares a company's market capitalization to its revenue.

- Calculation: P/S Ratio = Market Capitalization / Revenue

- Growth Stock Valuation: BofA might favor P/S ratios when analyzing high-growth companies, as these companies often reinvest earnings for future growth, resulting in lower current earnings.

- Limitations: While valuable, the P/S ratio doesn't account for profitability or expenses. It's essential to consider other factors alongside the P/S ratio for a comprehensive valuation.

Discounted Cash Flow (DCF) Analysis:

Discounted Cash Flow (DCF) analysis is a more sophisticated valuation method that estimates a company's intrinsic value based on its projected future cash flows. This is a long-term valuation approach.

- Methodology: DCF involves projecting future free cash flows, discounting them back to their present value using a discount rate (which reflects the risk associated with the investment), and summing these present values to arrive at an intrinsic value.

- BofA's Long-Term View: BofA likely uses DCF analysis extensively in its long-term investment strategies, as it provides a comprehensive assessment of a company's long-term potential.

- Discount Rate Sensitivity: The accuracy of a DCF analysis heavily depends on the chosen discount rate. A slight change in the discount rate can significantly impact the estimated intrinsic value, reflecting the inherent uncertainty in long-term projections.

BofA's Perspective on Current Market Valuations

BofA regularly publishes research reports and commentary on market valuations. Their insights are crucial for understanding broader market trends and identifying potential opportunities.

Identifying Overvalued and Undervalued Sectors:

BofA's analysts continuously monitor various sectors, identifying potential overvaluation or undervaluation based on their valuation models.

- Overvalued Sectors: BofA's research may highlight sectors with high P/E or P/S ratios relative to their historical averages or industry peers, signaling potential overvaluation.

- Undervalued Sectors with Growth Potential: Conversely, BofA might identify sectors trading at relatively low valuations with strong growth prospects, presenting potential investment opportunities.

- Specific Stock Examples: BofA reports frequently mention specific stocks and provide valuation analysis, explaining their rationale for classifying them as overvalued or undervalued.

Impact of Macroeconomic Factors:

Macroeconomic factors significantly influence stock market valuations, and BofA carefully considers these when assessing investment opportunities.

- Rising Interest Rates: Higher interest rates generally lead to lower stock valuations, as they increase the discount rate used in DCF analyses and make bonds more attractive relative to stocks. BofA's analysis would reflect this.

- Inflation's Impact: Inflation erodes purchasing power and can impact company earnings, influencing their valuations. BofA's research would incorporate inflation expectations into its valuation models.

- Geopolitical Risks: Geopolitical events and uncertainty can significantly impact market sentiment, causing fluctuations in valuation multiples. BofA would factor in geopolitical risks to account for this market volatility.

Practical Applications and Investment Strategies Based on BofA's Insights

By incorporating BofA's valuation insights, investors can improve their investment decision-making process.

Portfolio Diversification:

BofA likely emphasizes portfolio diversification across different sectors and asset classes to mitigate risks associated with individual stock valuations. A well-diversified portfolio can help cushion against losses in any one sector.

Long-Term vs. Short-Term Investment Horizons:

BofA's valuation analyses provide crucial insights to tailor your investment strategy to your time horizon. Long-term investors might focus on intrinsic value (as assessed through DCF), while short-term traders might focus on market sentiment and short-term price movements.

Active vs. Passive Investing:

BofA's research can inform the choice between active (selecting individual stocks based on valuation analysis) and passive (investing in index funds) investment strategies. Active investors might utilize BofA's insights to identify undervalued stocks, while passive investors benefit from market diversification.

Conclusion

Understanding stock market valuations is crucial for successful investing. This article has provided key insights from Bank of America (BofA) research, outlining critical valuation metrics like P/E, P/S, and DCF analysis. We've explored BofA's perspectives on current market valuations, including overvalued and undervalued sectors, and the influence of macroeconomic factors. By applying these insights, you can develop informed investment strategies tailored to your risk tolerance and financial goals. Start leveraging BofA's expertise and enhance your understanding of stock market valuations today!

Featured Posts

-

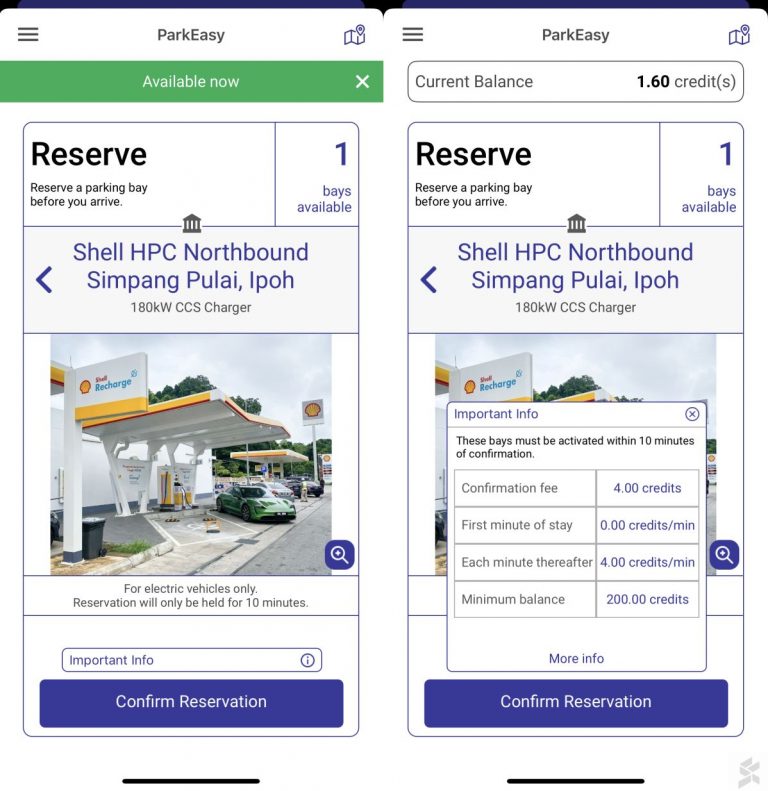

Shell Recharge Raya Promotion 100 Rebate On East Coast Hpc Ev Chargers

May 04, 2025

Shell Recharge Raya Promotion 100 Rebate On East Coast Hpc Ev Chargers

May 04, 2025 -

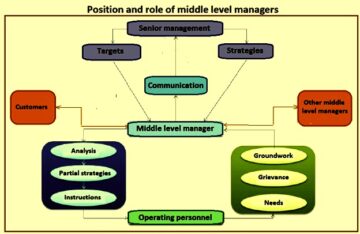

The Critical Role Of Middle Managers In Organizational Effectiveness And Employee Development

May 04, 2025

The Critical Role Of Middle Managers In Organizational Effectiveness And Employee Development

May 04, 2025 -

Strathdearn Community Project Reaches Milestone Tomatin Affordable Housing

May 04, 2025

Strathdearn Community Project Reaches Milestone Tomatin Affordable Housing

May 04, 2025 -

Barkley Predicts Oilers And Leafs Playoff Success

May 04, 2025

Barkley Predicts Oilers And Leafs Playoff Success

May 04, 2025 -

Explosive Texts Detail Fresh Dispute Between Nigel Farage And Rupert Lowe

May 04, 2025

Explosive Texts Detail Fresh Dispute Between Nigel Farage And Rupert Lowe

May 04, 2025

Latest Posts

-

Major Setback For Ufc 314 Geoff Neal Carlos Prates Fight Cancelled

May 04, 2025

Major Setback For Ufc 314 Geoff Neal Carlos Prates Fight Cancelled

May 04, 2025 -

Ufc 314 Neal Vs Prates Cancellation Shakes Up Star Studded Card

May 04, 2025

Ufc 314 Neal Vs Prates Cancellation Shakes Up Star Studded Card

May 04, 2025 -

Controversy Brews Paddy Pimblett Addresses Michael Chandlers Behavior Before Ufc 314

May 04, 2025

Controversy Brews Paddy Pimblett Addresses Michael Chandlers Behavior Before Ufc 314

May 04, 2025 -

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested

May 04, 2025

Pimblett Vs Chandler Ufc 314 Referee Intervention Requested

May 04, 2025 -

Ufc 314 Pimbletts Concerns About Chandlers Fighting Style

May 04, 2025

Ufc 314 Pimbletts Concerns About Chandlers Fighting Style

May 04, 2025