Understanding The Canadian Preference Against Decade-Long Mortgages

Table of Contents

Higher Interest Rate Risk with 10-Year Mortgages in Canada

One of the primary reasons for the hesitation surrounding 10-year mortgages is the significant interest rate risk involved. Locking into a fixed mortgage rate for a decade exposes borrowers to potential fluctuations in the market. While a fixed mortgage rate offers predictability in the short term, it eliminates the opportunity to benefit from potential rate decreases.

- Uncertainty in predicting long-term interest rate trends: Accurately forecasting interest rates ten years into the future is virtually impossible. Economic conditions can change dramatically, influencing the Bank of Canada's monetary policy and subsequently impacting Canadian mortgage rates.

- Possibility of missing out on lower rates if rates decline during the term: If interest rates fall during the 10-year term, borrowers are locked into a potentially higher rate, missing out on savings they could have achieved by refinancing with a lower rate.

- Increased financial burden if rates rise significantly: Conversely, if interest rates increase significantly, the fixed monthly payments could become a substantial financial burden, potentially straining the homeowner's budget. This is particularly concerning given the size of mortgages in the Canadian market.

Understanding fixed mortgage rates versus variable mortgage rates is crucial in this context. While variable rates carry their own risks, they offer more flexibility in the face of market changes. The potential for substantial mortgage prepayment penalties with a longer-term mortgage also adds to the risk.

Financial Flexibility and the Preference for Shorter-Term Mortgages

Canadians value financial flexibility, and shorter-term mortgages (like 5-year terms) offer greater control and adaptability. The ability to refinance or switch lenders every five years allows homeowners to respond to changing market conditions and personal financial circumstances.

- Ability to take advantage of lower interest rates after 5 years: After a 5-year term, borrowers can shop around for the best rates available, potentially securing a more favorable mortgage rate for their renewal.

- Option to switch to a different mortgage product (e.g., variable to fixed): The shorter term allows for a reassessment of risk tolerance and financial goals, permitting a switch between a fixed and a variable mortgage rate, depending on market conditions and personal preferences.

- Greater control over financial decisions: This flexibility offers a sense of security and control, allowing homeowners to adjust their mortgage strategy according to their evolving financial situation. This is especially important during periods of economic uncertainty. Mortgage refinancing is a key benefit of shorter terms.

Considering Canadian mortgage lenders and their diverse offerings is crucial when making this decision. Many lenders cater specifically to the 5-year term market, providing competitive rates and options.

The Role of Mortgage Prepayment Penalties in Canada

Mortgage prepayment penalties play a significant role in the choice of mortgage term. Longer-term mortgages generally come with substantially higher penalties for breaking the contract early. This can create a major barrier for homeowners considering a decade-long mortgage.

- Higher prepayment penalties for longer terms: The longer the term, the higher the potential penalty for paying off the mortgage early, whether through refinancing or selling the property.

- Impact on affordability and potential financial strain: These high penalties can significantly impact affordability, making it a risky choice if circumstances necessitate an early mortgage payoff.

- Comparison of prepayment penalty structures between lenders: It's crucial to compare mortgage prepayment penalties across various lenders, as structures and calculations differ. Understanding the specific terms of the break clause is essential.

Careful calculation of mortgage penalty calculation methods is necessary before committing to a long-term mortgage.

Limited Availability and Understanding of Decade-Long Mortgages in Canada

Another factor contributing to the unpopularity of decade-long mortgages is their limited availability and the relative lack of consumer understanding.

- Limited product offerings by major banks: Many major Canadian banks don't actively promote or offer 10-year fixed-rate mortgages, limiting consumer choice.

- Lack of consumer education about the pros and cons: There's limited consumer education about the nuances of decade-long mortgages, leaving many unaware of the potential risks and benefits.

- The perceived complexity associated with longer-term planning: Planning ten years into the future can feel overwhelming for many homeowners, adding to the hesitation around choosing such a long-term commitment.

This lack of availability and knowledge often leads potential borrowers to Canadian mortgage brokers, who can offer a wider range of options and expertise to navigate the complexities of different mortgage products. Improving financial literacy around mortgage product availability is essential to inform better decision-making.

Conclusion: Weighing the Pros and Cons of Decade-Long Mortgages in Canada

The Canadian preference against decade-long mortgages stems from a combination of factors: the higher interest rate risk associated with long-term fixed rates, the importance of financial flexibility, substantial mortgage prepayment penalties, and the limited availability and understanding of these products. Before choosing a mortgage term, carefully weigh these factors and your own risk tolerance. Remember to consider the potential impact of rate fluctuations, the importance of having the flexibility to refinance or switch lenders, and the potential financial strain of significant mortgage prepayment penalties.

To make the best decision for your individual financial situation, consult with a Canadian mortgage advisor. They can help you navigate the complexities of different mortgage options, including the possibility of a decade-long mortgage, and ensure you find the best mortgage term for your needs. Don't hesitate to seek professional advice to find the right mortgage—your future financial well-being depends on it.

Featured Posts

-

Verstappens Fatherhood Christian Horners Reaction

May 05, 2025

Verstappens Fatherhood Christian Horners Reaction

May 05, 2025 -

West Bengal Weather Four Districts Face Severe Heatwave Conditions

May 05, 2025

West Bengal Weather Four Districts Face Severe Heatwave Conditions

May 05, 2025 -

Verstappen And Piquets Daughter Lily Announcing The Arrival

May 05, 2025

Verstappen And Piquets Daughter Lily Announcing The Arrival

May 05, 2025 -

Formula 1 News Verstappen And Piquet Become Parents To Baby Girl Lily

May 05, 2025

Formula 1 News Verstappen And Piquet Become Parents To Baby Girl Lily

May 05, 2025 -

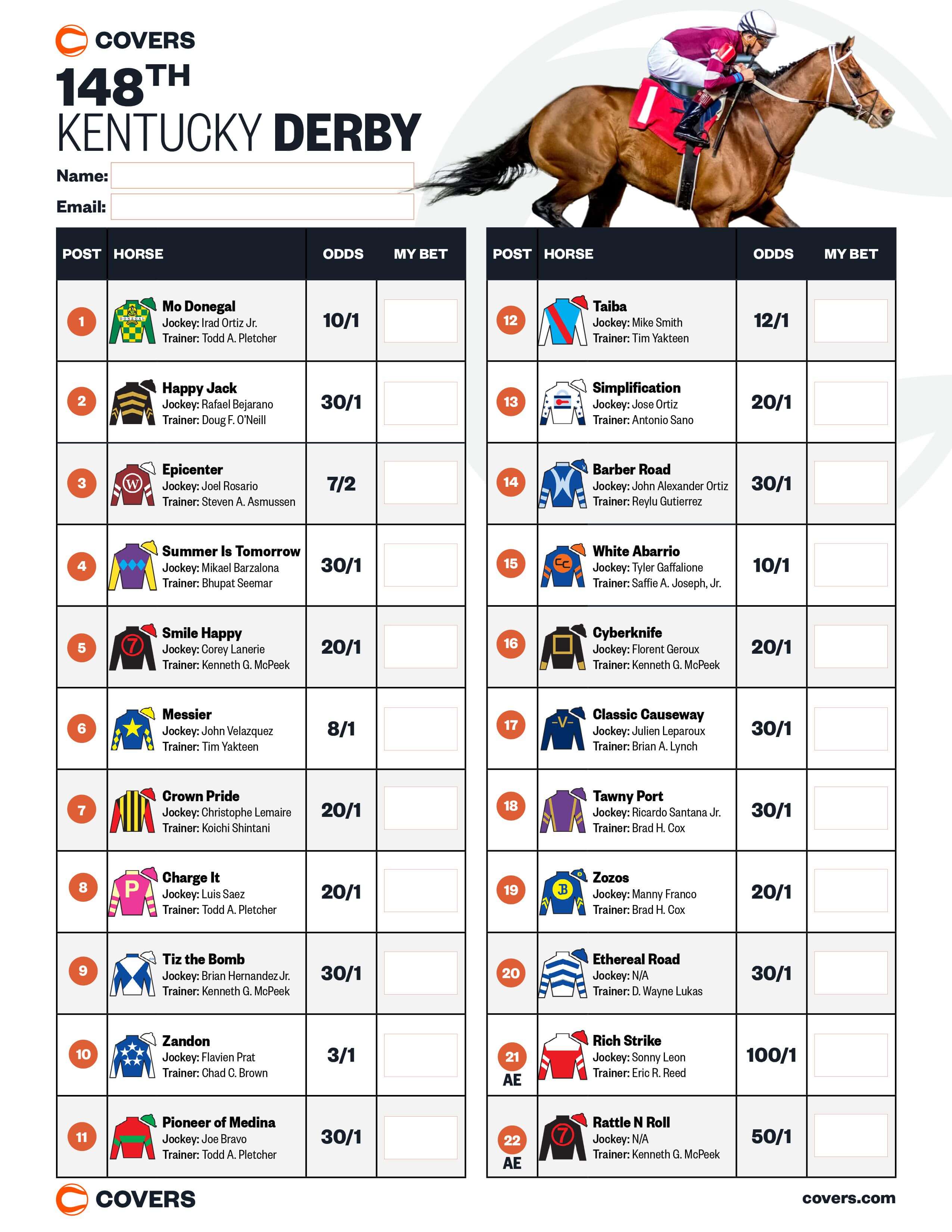

Understanding Kentucky Derby 2025 Odds A Guide For Bettors

May 05, 2025

Understanding Kentucky Derby 2025 Odds A Guide For Bettors

May 05, 2025

Latest Posts

-

Fleetwood Macs Upcoming Album What Fans Can Expect

May 05, 2025

Fleetwood Macs Upcoming Album What Fans Can Expect

May 05, 2025 -

A Critical Look At Dope Girls World War I Reimagined

May 05, 2025

A Critical Look At Dope Girls World War I Reimagined

May 05, 2025 -

Murder And Torture Charges Filed Against Stepfather Of 16 Year Old Victim

May 05, 2025

Murder And Torture Charges Filed Against Stepfather Of 16 Year Old Victim

May 05, 2025 -

Dope Girls Film Review Exploring War Drugs And Glamour

May 05, 2025

Dope Girls Film Review Exploring War Drugs And Glamour

May 05, 2025 -

Dope Girls Cocaine Electronica And Glamour In The Trenches

May 05, 2025

Dope Girls Cocaine Electronica And Glamour In The Trenches

May 05, 2025