Understanding The Link Between Climate Risk And Home Mortgages

Table of Contents

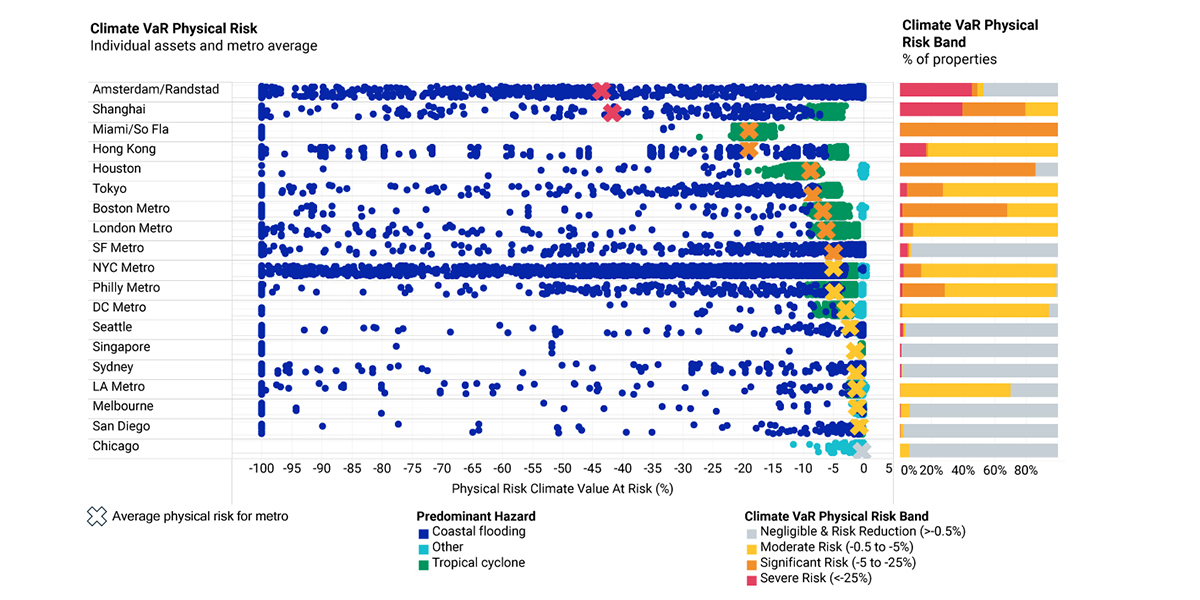

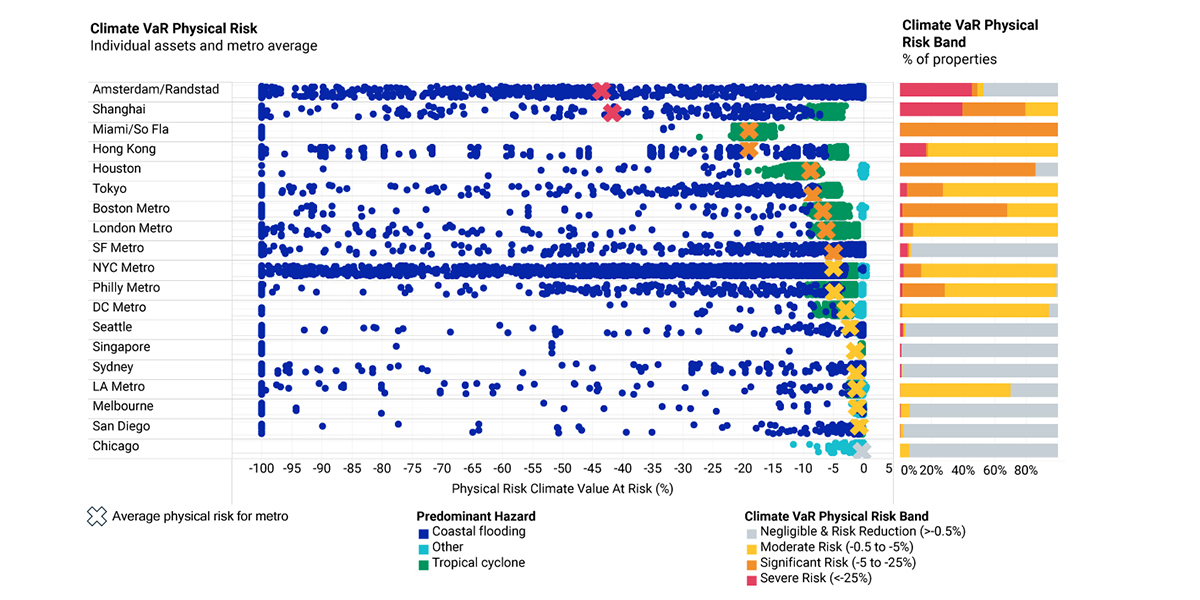

Assessing Climate Risk in Mortgage Lending

The financial implications of climate change are becoming increasingly apparent in the mortgage industry. Lenders are now factoring climate-related risks into their assessments, influencing mortgage approvals, interest rates, and insurance premiums.

Increased Flood Risk and its Impact on Property Values

Rising sea levels and increased rainfall are dramatically increasing flood risk in coastal and low-lying areas worldwide. This translates to significant impacts on property values and insurance premiums. Properties in high-risk flood zones often experience decreased value, making them less attractive to buyers and potentially difficult to sell.

- Examples of areas with high flood risk: Coastal regions, areas near rivers and lakes, and low-lying plains.

- Increased insurance costs in flood-prone zones: Flood insurance premiums can be prohibitively expensive, even rendering mortgages unaffordable in some high-risk areas.

- Difficulty securing mortgages in high-risk areas: Lenders are increasingly reluctant to offer mortgages on properties with significant flood risk, demanding higher down payments or rejecting applications altogether.

Wildfire Risk and its Implications for Mortgage Approvals

The growing threat of wildfires, fueled by climate change and drought conditions, poses another significant challenge to the mortgage industry. The destruction caused by wildfires can render properties uninhabitable and significantly reduce their value.

- Factors lenders consider: Proximity to wildfire-prone areas, vegetation density around the property, building materials (fire-resistant materials are preferred), and the presence of firebreaks.

- Higher insurance costs in high-risk areas: Insurance premiums for properties located in wildfire-prone areas are substantially higher, reflecting the increased risk.

- Potential for mortgage denial in extreme cases: In areas with extremely high wildfire risk, lenders may deny mortgage applications altogether.

The Role of Climate Data in Mortgage Underwriting

Lenders are increasingly incorporating climate data into their risk assessments to better understand and manage the financial implications of climate change. This involves utilizing various data sources to predict future climate impacts.

- Examples of data providers: Government agencies (e.g., FEMA, NOAA), private companies specializing in climate risk modeling, and insurance companies.

- Increasing accuracy of climate risk modeling: Advances in technology and data availability are leading to more accurate predictions of climate-related risks.

- Challenges of predicting future climate impacts: Accurately predicting the long-term effects of climate change remains a challenge, making risk assessment inherently complex.

Protecting Yourself as a Homeowner

Understanding and mitigating climate risks is crucial for homeowners seeking to protect their investment. Proactive measures can significantly reduce potential financial losses.

Understanding Your Property's Climate Risk

Before purchasing a home or refinancing your mortgage, it's essential to thoroughly assess your property's climate risk.

- Websites and tools for assessing climate risk: FEMA's flood maps, wildfire risk assessment tools from various state and local agencies, and specialized online resources.

- Steps to mitigate risk: Elevating your home, installing flood barriers, creating defensible space around your property by removing flammable vegetation, and investing in fire-resistant building materials.

Disclosure and Transparency in Mortgage Applications

Full disclosure of climate risks to lenders is paramount. Failing to disclose potential risks can have serious consequences.

- Potential penalties for misrepresenting climate risk: Lenders can cancel the mortgage or pursue legal action if they discover undisclosed climate-related risks.

- The lender's right to cancel the mortgage in case of undisclosed risks: Lenders reserve the right to terminate a mortgage if material information related to climate risk was omitted from the application.

Insurance and Mitigation Strategies

Securing adequate insurance coverage and implementing mitigation strategies are vital steps in protecting your home from climate-related risks.

- Types of insurance coverage: Flood insurance, wildfire insurance, and comprehensive homeowner's insurance with appropriate endorsements.

- Examples of mitigation strategies: Installing flood barriers, removing flammable vegetation, upgrading to fire-resistant roofing materials, and creating defensible space around the property.

Conclusion

The link between climate risk and home mortgages is undeniable and growing stronger. By understanding the increased risks associated with climate change—from floods to wildfires—both lenders and homeowners can take proactive steps to mitigate potential financial losses. Homebuyers should thoroughly research the climate risks associated with their potential properties and ensure full transparency with their lenders. Lenders, in turn, must integrate climate data into their risk assessment models to make informed decisions. Ignoring the implications of climate risk in home mortgages can lead to significant financial consequences. Take action today to understand the implications of climate risk and home mortgages and protect your future.

Featured Posts

-

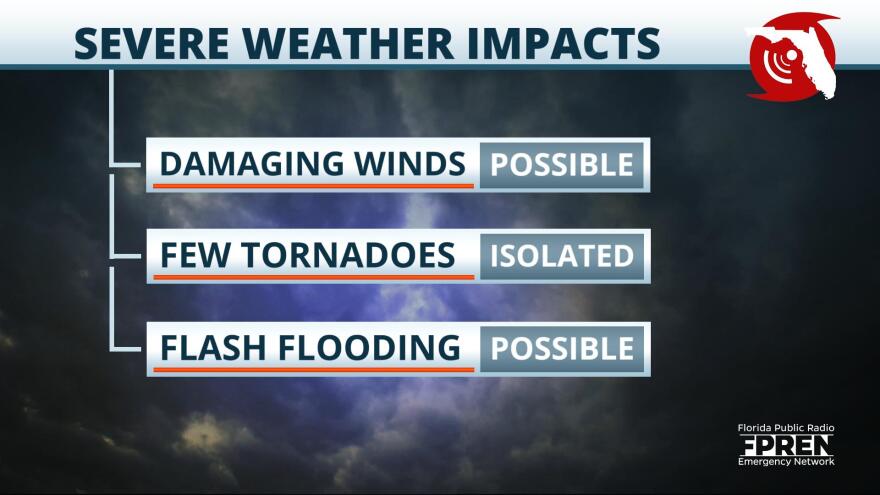

Watch Out For Damaging Winds Fast Moving Storms

May 20, 2025

Watch Out For Damaging Winds Fast Moving Storms

May 20, 2025 -

Navys Bribery Case Guilty Verdict For Commander Burke In Exchange Scheme

May 20, 2025

Navys Bribery Case Guilty Verdict For Commander Burke In Exchange Scheme

May 20, 2025 -

4eme Pont D Abidjan Clarifications Sur Le Projet Et Son Financement

May 20, 2025

4eme Pont D Abidjan Clarifications Sur Le Projet Et Son Financement

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Nousu

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Nousu

May 20, 2025 -

Bbc Uses Ai For Agatha Christie Writing Classes

May 20, 2025

Bbc Uses Ai For Agatha Christie Writing Classes

May 20, 2025