Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Table of Contents

What is Net Asset Value (NAV)?

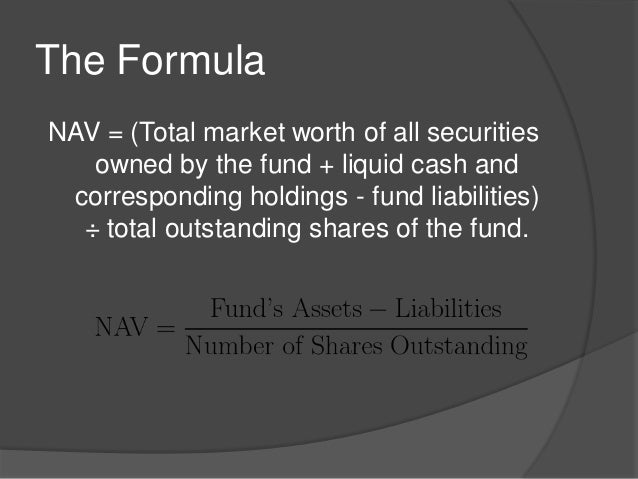

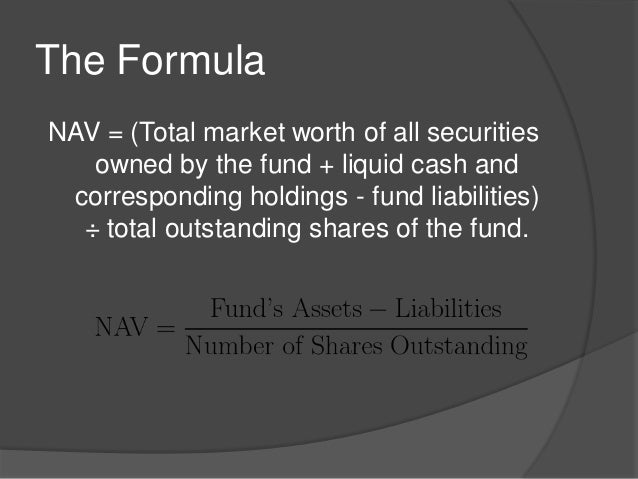

Net Asset Value (NAV) represents the theoretical price of a single share in an exchange-traded fund (ETF). It's a crucial indicator of the ETF's underlying value. Unlike the market price, which fluctuates throughout the trading day, the NAV reflects the actual value of the ETF's assets. The NAV is calculated by taking the total value of all the assets held within the ETF and dividing it by the total number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), this means the NAV reflects the collective value of its holdings, which mirror the components of the Dow Jones Industrial Average.

- NAV represents the theoretical value of a single share. This is the intrinsic worth, not necessarily the price at which it trades on the market.

- Calculated by dividing the total asset value by the number of outstanding shares. This formula ensures a fair representation of the ETF's per-share value.

- Fluctuations in NAV reflect changes in the value of the underlying assets (Dow Jones Industrial Average components in this case). If the Dow Jones increases, so too will the ETF's NAV, and vice-versa. This direct correlation is a key benefit for investors seeking exposure to the index.

Calculating the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

The Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV is calculated daily by Amundi, the ETF provider. This calculation involves a meticulous process:

- Daily calculation based on closing prices of the Dow Jones Industrial Average components. The closing prices of the 30 constituent stocks of the Dow Jones Industrial Average are used to determine the total value of the ETF's holdings at the end of each trading day.

- Consideration of expenses and other relevant factors. This includes management fees, administrative costs, and any accrued income or expenses related to the ETF's operations. These are deducted from the total asset value before calculating the NAV per share.

- Transparency in NAV calculation and publication. Amundi makes this NAV data readily available, usually on their website and through major financial data providers. This transparency allows investors to easily track the ETF's performance.

- Availability of daily NAV data on Amundi's website and financial data providers. You can access this information to monitor your investment and to make informed decisions.

Why is the NAV Important for Investors?

Understanding the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV is paramount for effective investment management. It provides a clear picture of your investment's true worth and facilitates informed decision-making.

- Benchmarking performance against other investments. By comparing the NAV over time, you can track the ETF's performance and assess its success against other investment choices.

- Understanding the true value of your investment. The NAV offers a realistic view of your holdings, unlike the fluctuating market price, which can be influenced by short-term market sentiment.

- Making informed decisions regarding buying or selling shares. Comparing the NAV to the market price can highlight potential arbitrage opportunities or reveal instances where the market price deviates significantly from the underlying asset value.

- Comparing NAV to the market price to identify potential arbitrage opportunities. If the market price trades at a significant discount or premium to the NAV, this might indicate a buying or selling opportunity.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Several factors can impact the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV:

- Changes in the Dow Jones Industrial Average index value. As the ETF tracks the Dow Jones Industrial Average, fluctuations in the index directly affect the NAV. A rising index leads to a higher NAV, and vice-versa.

- Dividend payments made to ETF shareholders. When the underlying companies in the Dow Jones Industrial Average pay dividends, this income is usually distributed to ETF shareholders, which subsequently slightly reduces the NAV.

- Currency fluctuations if the underlying assets are denominated in a different currency. While unlikely for a US-focused index like the Dow, currency exchange rate movements could influence the NAV if a significant portion of the underlying assets were held in a foreign currency.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is essential for making informed investment decisions. This involves comprehending how NAV is calculated, its significance in performance evaluation, and the factors influencing its fluctuations. Regularly monitor the NAV of your Amundi Dow Jones Industrial Average UCITS ETF (Dist) holdings to stay informed about your investment's performance and make strategic adjustments as needed. Learn more about Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV and ETF investing strategies today!

Featured Posts

-

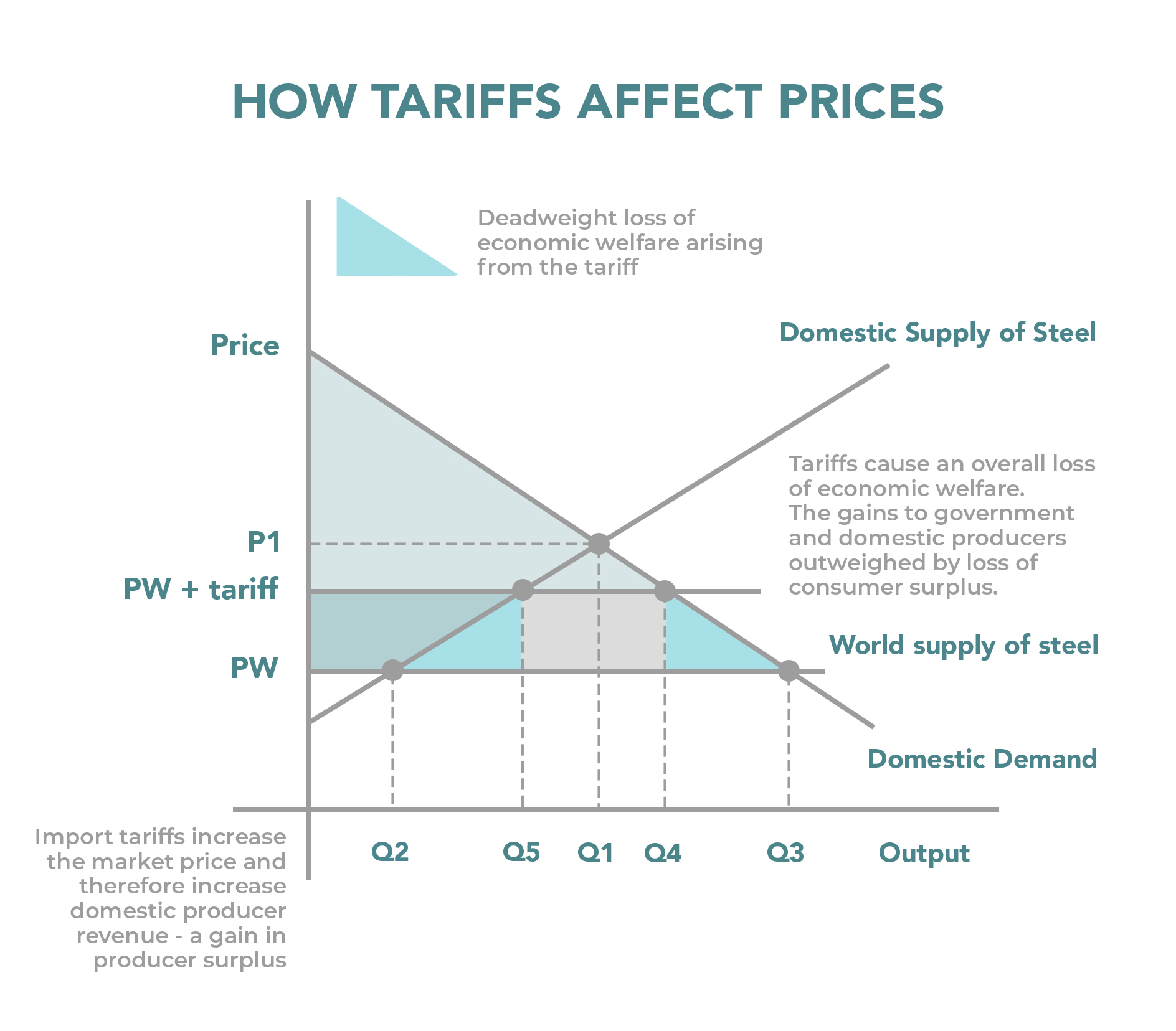

G 7 To Discuss Lowering Tariffs On Chinese Goods Impact And Implications

May 25, 2025

G 7 To Discuss Lowering Tariffs On Chinese Goods Impact And Implications

May 25, 2025 -

Toxic Chemical Residues From Ohio Train Derailment A Months Long Impact On Buildings

May 25, 2025

Toxic Chemical Residues From Ohio Train Derailment A Months Long Impact On Buildings

May 25, 2025 -

Svadby Na Kharkovschine 600 Brakov Za Mesyats Prichiny Rosta

May 25, 2025

Svadby Na Kharkovschine 600 Brakov Za Mesyats Prichiny Rosta

May 25, 2025 -

Dr Terrors House Of Horrors The Ultimate Walkthrough

May 25, 2025

Dr Terrors House Of Horrors The Ultimate Walkthrough

May 25, 2025 -

Following Fatal Crash Hells Angels Hold Memorial Service

May 25, 2025

Following Fatal Crash Hells Angels Hold Memorial Service

May 25, 2025