Unlocking Growth: How Saudi Arabia's ABS Market Is Being Reshaped

Table of Contents

The Role of Vision 2030 in Driving ABS Market Expansion

Saudi Vision 2030, the Kingdom's ambitious national transformation plan, is a pivotal driver of the expanding Saudi Arabia ABS market. Its core focus on economic diversification away from oil dependence necessitates the exploration and utilization of alternative financing mechanisms. This creates a fertile ground for the growth of the ABS market.

-

Diversification Fuels Demand: Vision 2030's aim to diversify the Saudi economy is directly fueling the demand for innovative financing solutions like ABS. Traditional reliance on oil revenues is being actively challenged by a push towards private sector growth and new industries.

-

Infrastructure Investment: Massive infrastructure projects, integral to Vision 2030's goals, require substantial funding. ABS issuance offers a compelling avenue to raise the necessary capital for these large-scale undertakings, including transportation networks, renewable energy projects, and other crucial infrastructure developments.

-

Private Sector Growth: Government initiatives to foster private sector growth are intrinsically linked to the ABS market's expansion. Businesses looking to expand and innovate are increasingly turning to ABS as a flexible and efficient financing tool. This creates a self-reinforcing cycle of growth.

-

Increased FDI: Vision 2030's success in attracting increased foreign direct investment (FDI) contributes significantly to a larger pool of capital available for ABS transactions. International investors are increasingly recognizing the potential of the Saudi market and are actively seeking investment opportunities.

The Rise of Islamic Asset-Backed Securities (IABS)

The substantial Muslim population in Saudi Arabia creates a significant demand for Sharia-compliant financial products. This directly translates into a booming market for Islamic Asset-Backed Securities (IABS) and Sukuk (Islamic bonds), a key component of the broader Saudi Arabia ABS market.

-

Sharia-Compliant Financing: IABS provide a unique and crucial avenue for financing projects that adhere to Islamic principles. This expands the potential investment pool and addresses the specific needs of the Saudi Arabian market.

-

Sukuk's Significance: Sukuk play a crucial role in the growth of Islamic finance within the broader ABS market, offering Sharia-compliant investment options to a large and growing investor base.

-

Regulatory Framework Development: The development of clear and robust regulatory frameworks for IABS is crucial to attracting further investment and maintaining the integrity of this sector. This also builds confidence among international investors.

-

Standardization and Transparency: Increased standardization and transparency in IABS structures are vital for enhancing market liquidity and attracting a wider range of participants, including both domestic and international investors.

Regulatory Reforms and Market Infrastructure Development

Government-led regulatory reforms and investments in market infrastructure are essential for the long-term growth of the Saudi Arabia ABS market. These reforms are crucial for attracting international investors and ensuring market stability.

-

Modernizing Regulations: Initiatives to modernize the regulatory framework for ABS are key to attracting international investors who seek clear, transparent, and efficient market structures.

-

Developing a Secondary Market: The development of a robust secondary market for ABS is crucial for improving liquidity and reducing the cost of financing. This allows investors to easily buy and sell ABS, thereby enhancing market efficiency.

-

Data Infrastructure and Transparency: Improved data infrastructure and increased transparency are vital for boosting investor confidence. This is achieved through better data accessibility, standardized reporting, and a commitment to ethical practices.

-

Investor Protection: Stronger investor protection measures are essential for attracting a wider range of participants to the market, thereby fostering competition and ensuring market integrity.

Challenges and Opportunities in the Saudi ABS Market

While the Saudi Arabia ABS market presents tremendous opportunities, certain challenges need to be addressed to unlock its full potential. These challenges, while significant, also present opportunities for innovation and improvement.

-

Mitigating Risks: Addressing potential risks associated with ABS, such as credit risk and liquidity risk, is crucial for ensuring market stability and maintaining investor confidence.

-

Raising Awareness: Promoting greater awareness of the benefits of ABS among potential issuers and investors remains essential for driving further market expansion.

-

Standardization and Documentation: Developing standardized ABS structures and documentation can streamline the issuance process, making it more efficient and attractive to a broader range of participants.

-

International Collaboration: Attracting international expertise and technology can further enhance the market's efficiency and competitiveness, enabling it to operate on a global scale.

Conclusion

Saudi Arabia's ABS market presents significant opportunities for growth, fueled by Vision 2030, the rise of Islamic finance, and ongoing regulatory reforms. Addressing the existing challenges and fostering a robust and transparent market environment will be key to unlocking the full potential of this sector. By actively participating in this evolving landscape, investors can capitalize on the significant growth trajectory of the Saudi Arabia ABS market, benefiting from both lucrative investment opportunities and the overall economic development of the kingdom. Explore the possibilities and learn more about investing in the dynamic Saudi Arabian asset-backed securities market today.

Featured Posts

-

Antoine Duponts Exceptional Performance Secures Frances Win Against Italy

May 02, 2025

Antoine Duponts Exceptional Performance Secures Frances Win Against Italy

May 02, 2025 -

Maria Alyokhina Of Pussy Riot To Stage Play At Edinburgh Fringe Festival

May 02, 2025

Maria Alyokhina Of Pussy Riot To Stage Play At Edinburgh Fringe Festival

May 02, 2025 -

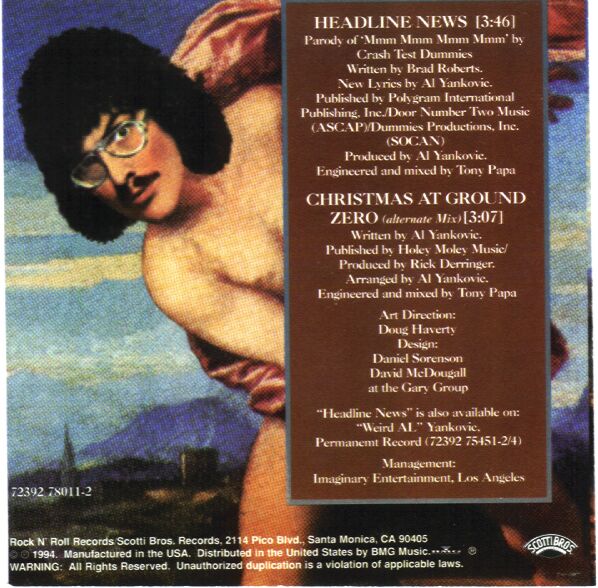

Green Day Blink 182 And Weird Al Yankovic To Headline Riot Fest 2025

May 02, 2025

Green Day Blink 182 And Weird Al Yankovic To Headline Riot Fest 2025

May 02, 2025 -

Navigating Ongoing Nuclear Litigation Insights From Holland And Knight Llp

May 02, 2025

Navigating Ongoing Nuclear Litigation Insights From Holland And Knight Llp

May 02, 2025 -

Remembering Lisa Ann Keller Obituary From East Idaho News

May 02, 2025

Remembering Lisa Ann Keller Obituary From East Idaho News

May 02, 2025