Urgent Action Needed: The Overvalued Canadian Dollar And Its Implications

Table of Contents

Impact on Canadian Exports

A strong CAD presents a significant challenge to Canadian exporters. When the Canadian dollar is overvalued, Canadian goods and services become more expensive for international buyers, reducing their competitiveness in the global marketplace. This directly impacts export volumes and profitability. Industries heavily reliant on exports, such as manufacturing and agriculture, are particularly vulnerable.

- Decreased export volumes: Higher prices lead to a drop in demand for Canadian goods, resulting in fewer exports.

- Reduced profitability for export-oriented businesses: Companies struggle to maintain profit margins when their products are priced higher than competitors.

- Potential job losses in export-related sectors: Reduced demand forces businesses to cut costs, which often translates into job losses.

- Increased reliance on domestic markets: Companies may shift their focus to the domestic market, limiting growth opportunities.

The consequences of a strong CAD on Canadian export competitiveness cannot be overstated. Addressing this issue is crucial for maintaining a healthy global trade balance and supporting the livelihoods of Canadians employed in export-related industries. Understanding the impact on key sectors like agriculture and manufacturing is crucial for developing effective strategies to mitigate the negative effects of an overvalued Canadian dollar on the Canadian exports. The resulting trade deficit only exacerbates the problem, highlighting the need for urgent attention to the issue of global trade competitiveness in the face of a strong CAD.

Consequences for the Tourism Sector

The overvalued Canadian dollar also significantly impacts the Canadian tourism sector. A strong CAD makes Canada a more expensive destination for international tourists, discouraging travel and reducing overall tourism revenue. This ripple effect negatively impacts businesses directly and indirectly involved in the tourism industry.

- Fewer international tourists: Higher travel costs for international visitors lead to a decline in tourist arrivals.

- Decreased revenue for tourism-related businesses: Hotels, restaurants, transportation companies, and other businesses reliant on tourism experience a drop in revenue.

- Potential job losses in the tourism industry: Reduced revenue forces businesses to cut costs, potentially leading to layoffs.

- Reduced economic activity in tourism hotspots: Communities heavily reliant on tourism revenue experience a slowdown in economic activity.

The tourism sector, a vital part of the Canadian economy, is especially vulnerable to fluctuations in the exchange rate. Maintaining a competitive exchange rate is essential to attracting international tourists and ensuring the long-term health of this important industry. The implications of a strong CAD for the Canadian tourism industry extend beyond the immediate financial losses and necessitate a strategic approach to mitigate the adverse effects.

Effects on Foreign Investment

An overvalued Canadian dollar can also deter foreign investment. When the CAD is strong, Canadian assets become more expensive for foreign investors, making them less attractive compared to investments in other countries. This reduction in foreign direct investment (FDI) can have long-term consequences for economic growth and job creation.

- Reduced foreign direct investment (FDI): The higher cost of acquiring Canadian assets discourages foreign investors.

- Slower economic growth: Reduced FDI limits capital inflow, hindering economic expansion.

- Limited job creation opportunities: Lower investment translates to fewer job creation opportunities.

- Increased reliance on domestic investment: The economy becomes more reliant on domestic investment, potentially limiting growth potential.

Attracting foreign investment is essential for fueling economic growth and creating jobs in Canada. A competitive exchange rate is key to attracting this crucial capital. The effects of an overvalued Canadian dollar on foreign investment are far-reaching and underscore the need for policies that encourage capital inflow and support sustainable economic growth. Understanding the implications of a strong CAD on FDI is critical for developing strategies to enhance the attractiveness of the Canadian market to foreign investors.

Potential Government Interventions

Several policy options exist to address the issue of the overvalued Canadian dollar. However, each approach has its pros and cons. Effective exchange rate management requires careful consideration of the potential implications of each intervention.

- Monetary policy adjustments: The Bank of Canada can adjust interest rates to influence the value of the CAD. Lowering interest rates can weaken the currency, but this could also lead to inflation.

- Fiscal policy measures: Government spending and taxation policies can also indirectly affect the exchange rate.

- Trade agreements and negotiations: Negotiating favorable trade agreements can help improve the competitiveness of Canadian exports.

- Regulatory changes: Changes to regulations impacting investment or trade could also indirectly influence the exchange rate.

The government plays a crucial role in managing the Canadian dollar and mitigating the negative impacts of overvaluation. A coordinated approach involving monetary and fiscal policies, along with strategic trade negotiations, is essential to ensuring a stable and competitive exchange rate. The need for effective government intervention in managing the Canadian dollar cannot be overstated given the far-reaching implications of a strong CAD.

Addressing the Overvalued Canadian Dollar – A Call to Action

The overvalued Canadian dollar presents a serious challenge to the Canadian economy, impacting exports, tourism, and foreign investment. The urgency of addressing this issue cannot be overemphasized. The consequences of inaction could lead to slower economic growth, job losses, and a weakened competitive position in the global marketplace.

We urge readers to stay informed about the fluctuations of the CAD and advocate for policies that promote a more balanced and competitive exchange rate. Understanding the implications of a strong CAD and actively engaging in discussions about mitigating the effects of an overvalued Canadian dollar is crucial for the long-term health of the Canadian economy. Understanding how to manage the Canadian dollar effectively is vital. For further information, refer to resources like the Bank of Canada website [link to Bank of Canada] and relevant financial news sources.

Featured Posts

-

Angels Hitters Woes Continue 13 More Strikeouts In Twins Sweep

May 08, 2025

Angels Hitters Woes Continue 13 More Strikeouts In Twins Sweep

May 08, 2025 -

Angels Defeat Dodgers Despite Missing Shortstops

May 08, 2025

Angels Defeat Dodgers Despite Missing Shortstops

May 08, 2025 -

Zalost Ob Izgubi Kako Se Spopasti Z Zalovanjem

May 08, 2025

Zalost Ob Izgubi Kako Se Spopasti Z Zalovanjem

May 08, 2025 -

Dembele Injury Update Arsenal Face Major Setback

May 08, 2025

Dembele Injury Update Arsenal Face Major Setback

May 08, 2025 -

Van Rams Motorcycle In Apparent Road Rage Incident Cnn Report

May 08, 2025

Van Rams Motorcycle In Apparent Road Rage Incident Cnn Report

May 08, 2025

Latest Posts

-

Stephen Kings The Long Walk Trailer Breakdown And Release Date Speculation

May 08, 2025

Stephen Kings The Long Walk Trailer Breakdown And Release Date Speculation

May 08, 2025 -

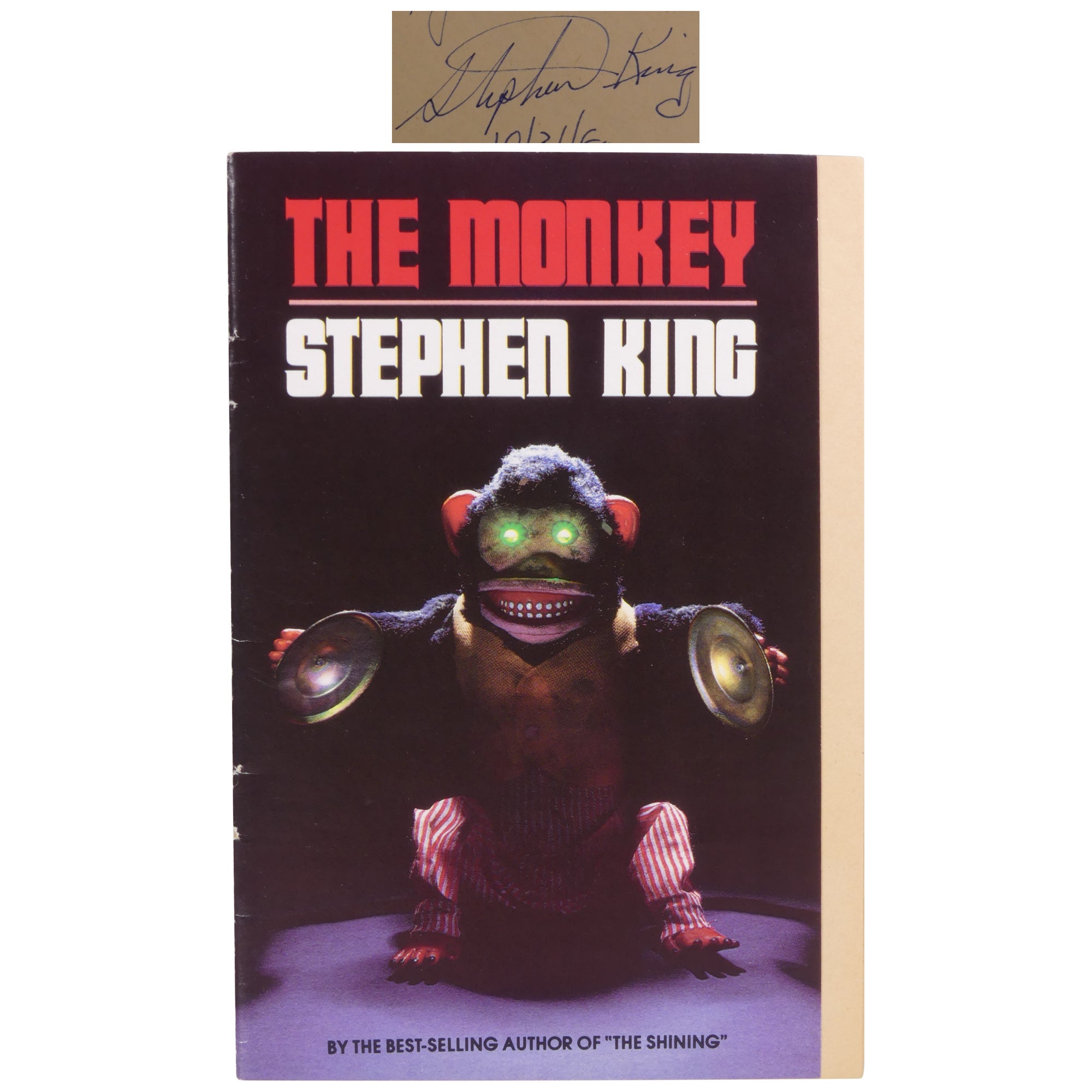

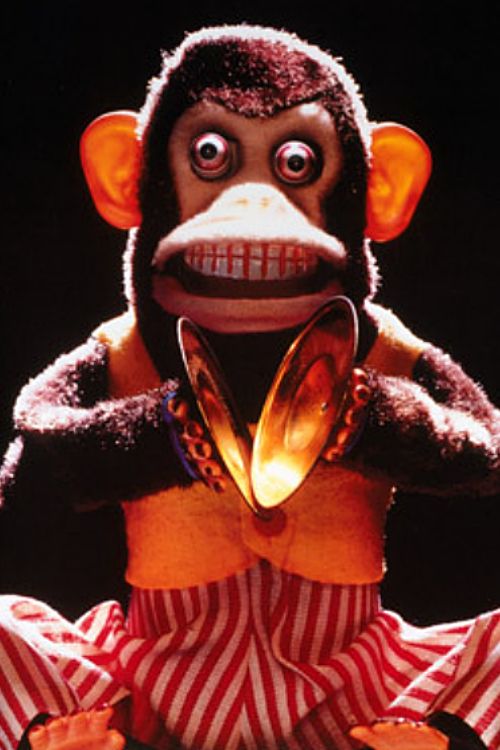

Assessing The Monkey Will It Be Stephen Kings Low Point In 2025

May 08, 2025

Assessing The Monkey Will It Be Stephen Kings Low Point In 2025

May 08, 2025 -

The Long Walk Movie Trailer A Chilling Adaptation Of Stephen Kings Novel

May 08, 2025

The Long Walk Movie Trailer A Chilling Adaptation Of Stephen Kings Novel

May 08, 2025 -

Stephen King In 2025 Even A Bad Monkey Movie Cant Dim His Year

May 08, 2025

Stephen King In 2025 Even A Bad Monkey Movie Cant Dim His Year

May 08, 2025 -

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation

May 08, 2025

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation

May 08, 2025