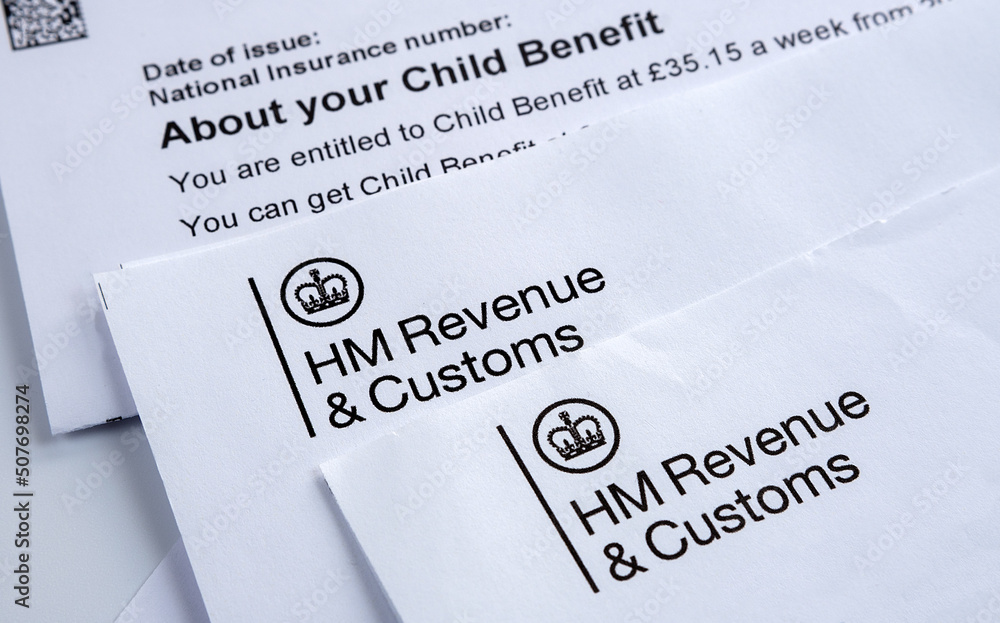

Urgent HMRC Child Benefit Update: Important Messages Not To Dismiss

Table of Contents

Changes to Child Benefit Eligibility

Recent updates from HMRC have introduced changes to Child Benefit eligibility, impacting many recipients. Understanding these changes is crucial to avoid unexpected repercussions.

Income Thresholds

HMRC regularly reviews the income thresholds that determine Child Benefit eligibility. Exceeding these limits can lead to repayment demands.

- Examples of income changes impacting eligibility: Increased salary, bonus payments, self-employment income exceeding the threshold.

- Implications of exceeding the income threshold: You may be required to repay a portion or all of the Child Benefit received since exceeding the limit. This repayment can be substantial and may impact your financial planning. HMRC will typically contact you directly if your income exceeds the threshold.

- Keyword integration: Understanding the current "Child Benefit income limits" is vital to avoid unexpected "HMRC eligibility criteria" changes. Stay informed about any "Child Benefit income threshold changes" announced by HMRC.

Residency Requirements

Changes to your residency status can also affect your eligibility for Child Benefit. This applies whether you're moving abroad or becoming a UK resident.

- Examples of situations that might affect residency status: Moving abroad temporarily or permanently, changes in visa status, becoming a UK citizen.

- Process for notifying HMRC of changes in residency: It's crucial to promptly inform HMRC of any changes to your residency. Failure to do so can lead to delays in payments or demands for repayment. You can update your information through the HMRC online portal.

- Keyword integration: Be aware of the updated "Child Benefit residency rules" and ensure your circumstances comply with "HMRC residency requirements." Understand the implications of "claiming Child Benefit abroad."

Updates to the Child Benefit Application Process

HMRC is continuously improving its services, including the Child Benefit application process. Familiarize yourself with these updates to ensure a smooth application.

Online Application Changes

The online application for Child Benefit has undergone significant improvements. This makes it easier and more efficient to apply or update your information.

- New features: Simplified forms, improved navigation, online progress tracking.

- Instructions on accessing and using the updated online application portal: Visit the official GOV.UK website to access the secure online portal. Follow the clear instructions provided.

- Keyword integration: Use the "HMRC online Child Benefit application" for quick and convenient access. "Applying for Child Benefit online" is now more efficient than ever thanks to the updated "digital Child Benefit application."

Supporting Documentation Requirements

Changes might occur in the documents required for Child Benefit applications or updates. Ensure you have the necessary documentation to avoid delays.

- Specific documents and their importance: Proof of identity, National Insurance number, evidence of children's birth, details of income.

- Consequences of submitting incomplete or incorrect documentation: Incomplete information can lead to processing delays, potentially affecting your payments. Incorrect information may lead to investigations and potential repayment demands.

- Keyword integration: Ensure you have all the necessary "Child Benefit application documents" ready. Provide accurate "HMRC supporting evidence" to avoid complications with your "Child Benefit application process."

Important Messages to Watch Out For

Stay vigilant against scams and fraudulent communication pretending to be from HMRC.

Fraudulent Communication

Be wary of phishing emails, fake letters, or phone calls requesting personal information relating to your Child Benefit claim.

- Examples of fraudulent communication: Emails asking for bank details, letters threatening legal action if you don't respond, phone calls demanding immediate payment.

- How to report suspicious communications to HMRC: Never disclose personal or financial information unless you are absolutely certain it is a legitimate HMRC communication. Report suspicious contact immediately through the official HMRC channels.

- Keyword integration: Learn how to identify and avoid "HMRC Child Benefit scams" and protect yourself from "Child Benefit fraud." Knowing how to "avoid Child Benefit scams" is crucial.

HMRC Contact and Support

Need help with your Child Benefit? Here's how to get in touch with HMRC.

- Telephone numbers, email addresses, online portal links: Find the contact details on the GOV.UK website.

- Best ways to contact HMRC for assistance: The online portal is often the most efficient method, but you can also contact them via phone or letter.

- Keyword integration: Find the correct "HMRC Child Benefit contact" details for efficient support. Use the "HMRC helpline" or explore the options provided on the HMRC website for "Child Benefit support."

Conclusion

This HMRC Child Benefit Update highlights crucial changes affecting eligibility, the application process, and important security measures. Staying informed is critical to avoid potential financial penalties or interruptions to your payments. Review your Child Benefit status to ensure compliance with the latest guidelines. Stay informed about the latest HMRC Child Benefit updates. Check your HMRC Child Benefit eligibility today. Don't ignore this crucial HMRC Child Benefit Update; your prompt action could prevent future complications. Ignoring these updates could have significant consequences.

Featured Posts

-

Michael Schumacher Poznavanje Njegove Kceri Gina Marie

May 20, 2025

Michael Schumacher Poznavanje Njegove Kceri Gina Marie

May 20, 2025 -

Cote D Ivoire Le Cout Reel Du 4eme Pont D Abidjan

May 20, 2025

Cote D Ivoire Le Cout Reel Du 4eme Pont D Abidjan

May 20, 2025 -

Going Solo Planning Your Independent Adventure

May 20, 2025

Going Solo Planning Your Independent Adventure

May 20, 2025 -

Cameroun 2032 Macron Troisieme Mandat Referendum Et Enjeux Politiques

May 20, 2025

Cameroun 2032 Macron Troisieme Mandat Referendum Et Enjeux Politiques

May 20, 2025 -

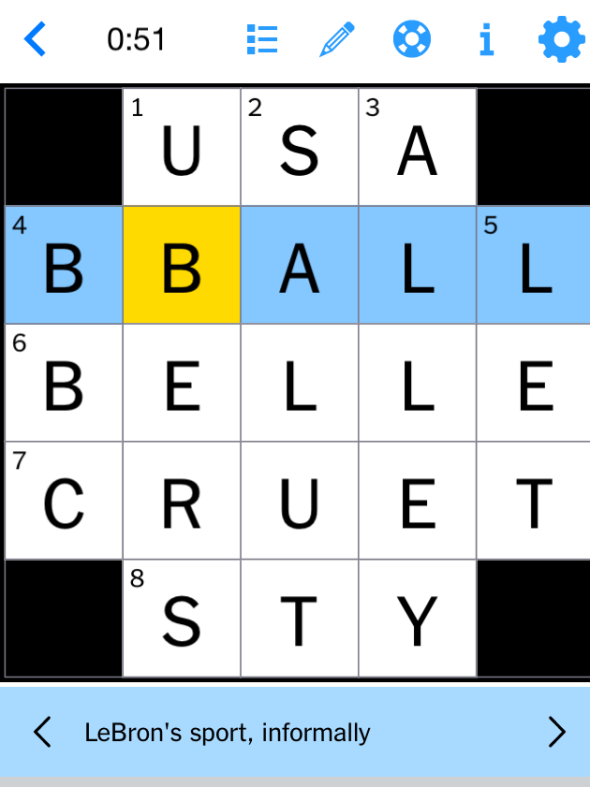

Nyt Mini Crossword Answers March 8th

May 20, 2025

Nyt Mini Crossword Answers March 8th

May 20, 2025

Latest Posts

-

The Suki Waterhouse Twinks Tik Tok A Deep Dive 97 1 Zht

May 20, 2025

The Suki Waterhouse Twinks Tik Tok A Deep Dive 97 1 Zht

May 20, 2025 -

Viral Tik Tok Suki Waterhouses Hilarious Twinks Comment On Z94

May 20, 2025

Viral Tik Tok Suki Waterhouses Hilarious Twinks Comment On Z94

May 20, 2025 -

Suki Waterhouse And Surface A Look Inside The North American Tour

May 20, 2025

Suki Waterhouse And Surface A Look Inside The North American Tour

May 20, 2025 -

Suki Waterhouses Viral Tik Tok Understanding The Twinks Reference 97 1 Zht

May 20, 2025

Suki Waterhouses Viral Tik Tok Understanding The Twinks Reference 97 1 Zht

May 20, 2025 -

Suki Waterhouses Hilarious Twinks Tik Tok Goes Viral On Z94

May 20, 2025

Suki Waterhouses Hilarious Twinks Tik Tok Goes Viral On Z94

May 20, 2025