US-China Trade Talks Boost Bitcoin: Crypto Market Analysis

Table of Contents

Bitcoin as a Safe-Haven Asset During Geopolitical Uncertainty

Understanding the Flight to Safety

During periods of economic or political instability, investors often seek out safe-haven assets – investments perceived as relatively stable and less susceptible to market fluctuations. Traditional safe-haven assets include gold and US Treasury bonds. However, the increasing uncertainty in global markets has led some investors to explore alternative options.

- Traditional Safe Havens: Gold's inherent value and US Treasury bonds' backing by a stable government make them attractive during crises.

- Decentralized Alternatives: Bitcoin, being decentralized and independent of government control, offers a unique appeal to investors seeking to diversify their portfolios and hedge against geopolitical risks. Its limited supply also contributes to its perceived value as a store of value.

- Diversification Strategies: Incorporating Bitcoin into a diversified investment portfolio can help mitigate risk associated with traditional assets during periods of high uncertainty stemming from events such as the US-China trade war.

US-China Trade War and Investor Sentiment

The US-China trade war, characterized by escalating tariffs and trade restrictions, has significantly impacted investor confidence. Periods of heightened trade tensions often lead to market volatility and a flight to safety.

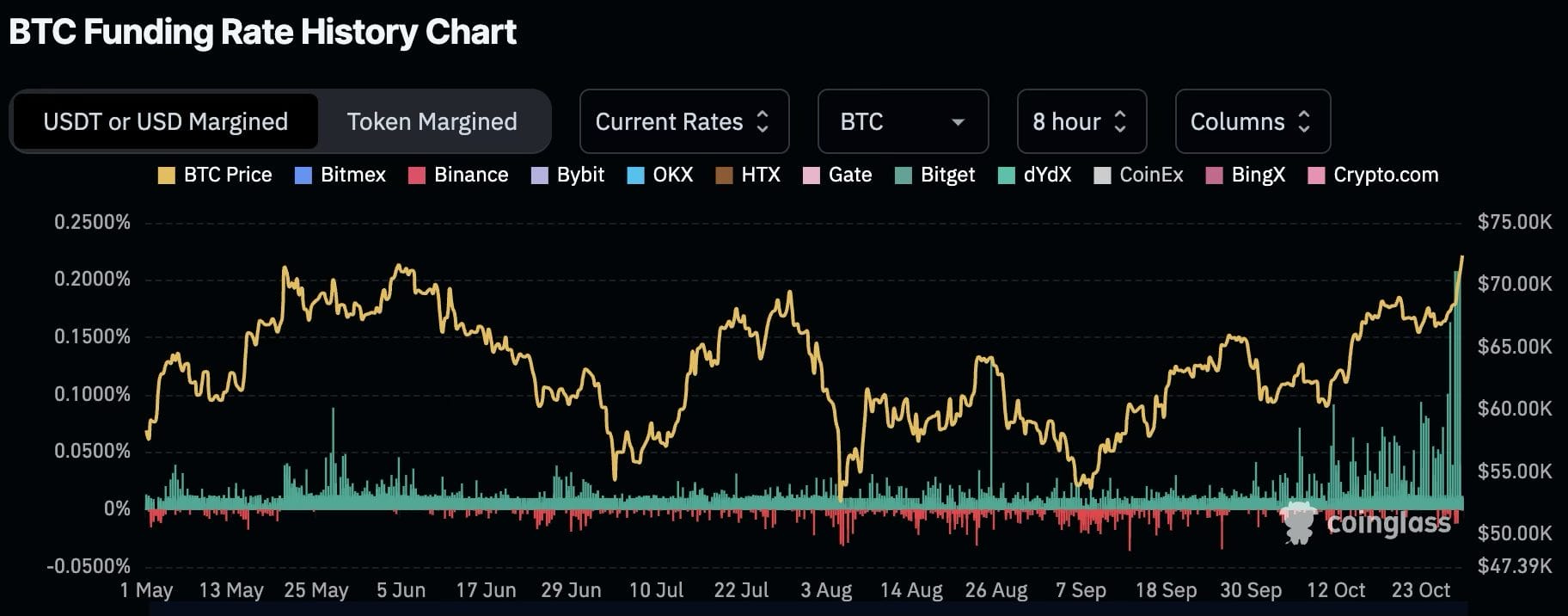

- Trade War Escalation and Bitcoin Price: Each escalation in the trade war, such as the imposition of new tariffs, has historically coincided with increased Bitcoin trading volume and price fluctuations, often resulting in a price surge.

- Investor Behavior Statistics: Data shows a clear correlation between negative news regarding US-China trade negotiations and increased demand for Bitcoin, suggesting its increasing adoption as a hedge against geopolitical uncertainty.

- Market Sentiment Indicators: Analyzing market sentiment indicators, such as social media sentiment and news headlines related to the US-China trade war, often reveals a strong positive correlation with Bitcoin price movements.

The Role of Increased Volatility in Driving Bitcoin Demand

Volatility as a Double-Edged Sword

Bitcoin's inherent volatility is a double-edged sword. While it can lead to significant losses, it also attracts investors seeking high-potential returns. This inherent volatility is often amplified during periods of geopolitical uncertainty, such as the ongoing US-China trade talks.

- Risk Tolerance: Investors with a high-risk tolerance are often drawn to Bitcoin's potential for substantial gains, even amidst the volatility.

- High-Potential Returns: The possibility of significant price appreciation incentivizes investors to participate in the market despite the risks.

- Risk Management Strategies: Employing strategies such as dollar-cost averaging and setting stop-loss orders can help mitigate the risks associated with Bitcoin's price volatility.

Market Manipulation and Price Fluctuations

Concerns regarding market manipulation exist within the cryptocurrency market. These concerns are often amplified during periods of heightened geopolitical uncertainty, like the ongoing US-China trade negotiations.

- Regulatory Considerations: Increased regulatory scrutiny and efforts to prevent market manipulation are necessary to maintain the integrity of the cryptocurrency market and ensure investor confidence.

- Trading Volume and Order Book Data: Analyzing trading volume and order book data can help identify potential instances of market manipulation. Unusual spikes in trading activity or large, coordinated orders might indicate manipulation attempts.

- Potential Manipulation Strategies: Understanding potential manipulation strategies, such as wash trading or spoofing, is crucial for investors to navigate the market effectively and protect themselves from potential losses.

Technical Analysis of Bitcoin's Price Movements

Chart Patterns and Indicators

Technical analysis of Bitcoin's price charts, in conjunction with news regarding US-China trade talks, can offer insights into potential price movements.

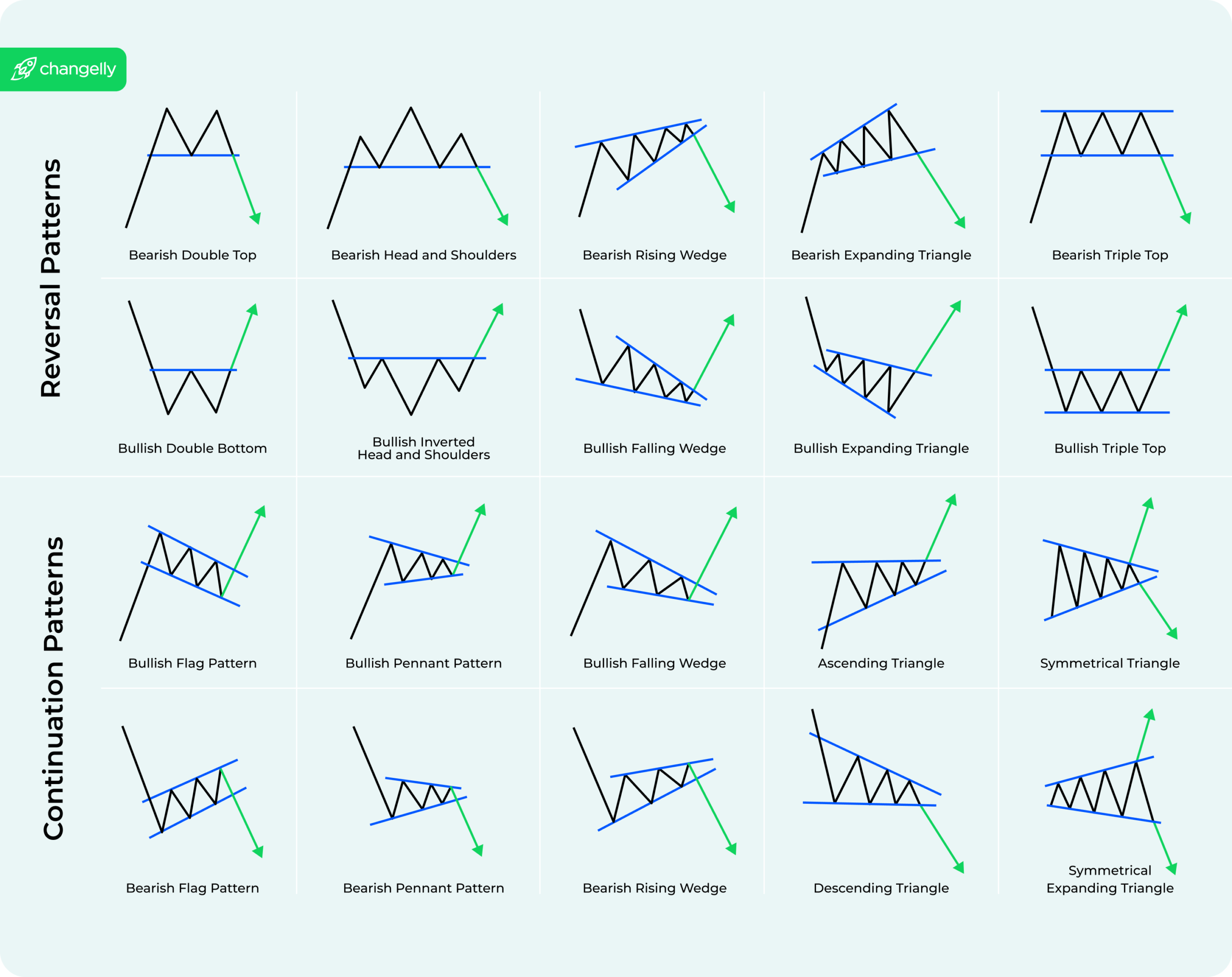

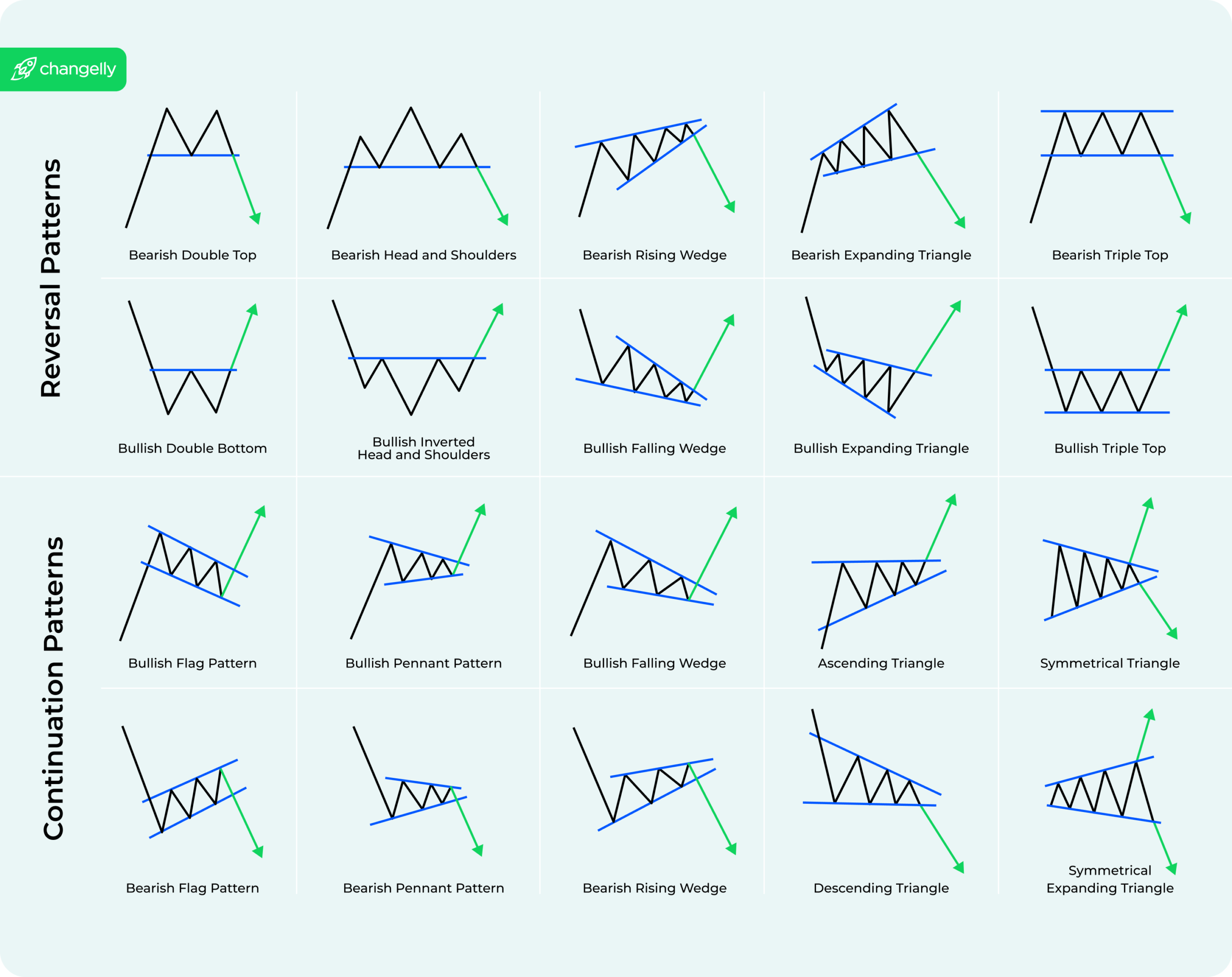

- Chart Patterns: Identifying chart patterns, such as head and shoulders or double bottom formations, can provide clues about potential price reversals or continuations.

- Technical Indicators: Using technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help assess momentum and potential trend changes.

- Price Action and Trade News: Analyzing Bitcoin's price action in relation to specific news events related to US-China trade negotiations is crucial for understanding the market's response to geopolitical factors.

Predicting Future Price Movements

Predicting Bitcoin's future price movements based solely on US-China trade developments is challenging and speculative. The cryptocurrency market is influenced by numerous factors beyond geopolitical events.

- Fundamental Analysis: Combining technical analysis with fundamental analysis, which considers factors such as adoption rates and technological advancements, is essential for a comprehensive assessment.

- Risk Management: Implementing robust risk management strategies is critical for navigating the volatility of the Bitcoin market.

- Uncertainty of Predictions: Investors should be aware that any prediction regarding Bitcoin's price is inherently uncertain, and past performance is not indicative of future results.

Conclusion

The correlation between US-China trade talks and Bitcoin's price movements is complex and dynamic. Bitcoin’s potential role as a safe-haven asset during times of geopolitical uncertainty is evident, but understanding the risks associated with investing in cryptocurrencies during such periods is crucial. While technical and fundamental analysis can provide insights, the market remains inherently volatile.

While the relationship between US-China trade talks and Bitcoin price is complex and dynamic, understanding this interaction is crucial for navigating the cryptocurrency market. Continue to monitor US-China trade developments and their potential impact on Bitcoin and other cryptocurrencies for informed investment decisions. Stay updated on the latest analysis of US-China trade talks and their influence on the Bitcoin market to make better-informed decisions about your cryptocurrency investments.

Featured Posts

-

Bitcoin Price Surge Bullish Bets On Us China Trade Deal

May 08, 2025

Bitcoin Price Surge Bullish Bets On Us China Trade Deal

May 08, 2025 -

Nereden Izleyebilirim Arsenal Psg Macini Sifresiz Canli Yayinla Izleyin

May 08, 2025

Nereden Izleyebilirim Arsenal Psg Macini Sifresiz Canli Yayinla Izleyin

May 08, 2025 -

Will Xrp Etfs Generate 800 Million In First Week Trading

May 08, 2025

Will Xrp Etfs Generate 800 Million In First Week Trading

May 08, 2025 -

Zdravstveno Stanje Papeza Zadnji Podatki In Ocena Zdravnikov

May 08, 2025

Zdravstveno Stanje Papeza Zadnji Podatki In Ocena Zdravnikov

May 08, 2025 -

Antibiotic Resistance In Fungi Preparing For The Next Pandemic

May 08, 2025

Antibiotic Resistance In Fungi Preparing For The Next Pandemic

May 08, 2025

Latest Posts

-

Could Buying Xrp Ripple Today Set You Up For Life A Realistic Look

May 08, 2025

Could Buying Xrp Ripple Today Set You Up For Life A Realistic Look

May 08, 2025 -

Xrp Soars Analysis Of Ripples Potential To Hit 3 40

May 08, 2025

Xrp Soars Analysis Of Ripples Potential To Hit 3 40

May 08, 2025 -

Ripples Xrp Potential For 3 40 Breakout

May 08, 2025

Ripples Xrp Potential For 3 40 Breakout

May 08, 2025 -

Xrp Price Prediction Breaking Resistance To Hit 3 40

May 08, 2025

Xrp Price Prediction Breaking Resistance To Hit 3 40

May 08, 2025 -

Significant Xrp Purchase Analysis Of A Whales Recent Activity

May 08, 2025

Significant Xrp Purchase Analysis Of A Whales Recent Activity

May 08, 2025