US Growth To Slow Considerably, According To Deloitte

Table of Contents

Deloitte's Methodology and Data Sources

Deloitte's prediction of a US growth slowdown is not a mere guess; it's based on a rigorous analysis of various economic indicators and sophisticated forecasting models.

Data Collection Techniques

The report draws upon a wide range of data sources to paint a comprehensive picture of the US economic landscape. Deloitte's analysts meticulously collected and analyzed vast datasets, focusing on key indicators of economic health.

- Quarterly GDP reports: The cornerstone of macroeconomic analysis, providing a measure of the total value of goods and services produced.

- Consumer Confidence Index: Gauging consumer sentiment and its impact on spending, a major driver of economic growth.

- Non-farm payroll data: Tracking employment trends, a vital indicator of economic activity and potential inflationary pressures.

- Inflation indices (CPI, PPI): Measuring the rate of price increases across various goods and services.

- Housing market data: Including housing starts, sales, and prices, reflecting the health of a significant sector of the economy.

Forecasting Models

Deloitte employs advanced econometric modeling and time-series analysis to forecast future economic trends. These models incorporate historical data, current economic conditions, and projections of future events.

- Econometric modeling: Utilizing statistical methods to quantify the relationships between various economic variables and predict future outcomes.

- Time series analysis: Analyzing historical data patterns to identify trends and forecast future values.

Assumptions and Limitations

It's crucial to acknowledge that any economic forecast involves inherent assumptions and limitations. Deloitte's analysis is no exception.

- Geopolitical uncertainty: Unforeseen global events, such as further escalation of geopolitical conflicts, could significantly alter the predicted trajectory.

- Inflationary pressures: The persistence and severity of inflation remain key uncertainties, influencing consumer spending and business investment.

- Potential policy changes: Government policy decisions, such as changes in fiscal or monetary policy, could impact the accuracy of the forecast.

Key Factors Contributing to the Slowdown

Several interconnected factors contribute to Deloitte's prediction of a slowing US economy.

Inflationary Pressures

High inflation significantly erodes purchasing power, dampening consumer spending and business investment.

- Rising energy prices: Increased energy costs impact transportation, manufacturing, and household budgets, contributing to higher prices across the board.

- Supply chain disruptions: Ongoing global supply chain bottlenecks continue to fuel inflationary pressures, limiting the availability and affordability of goods.

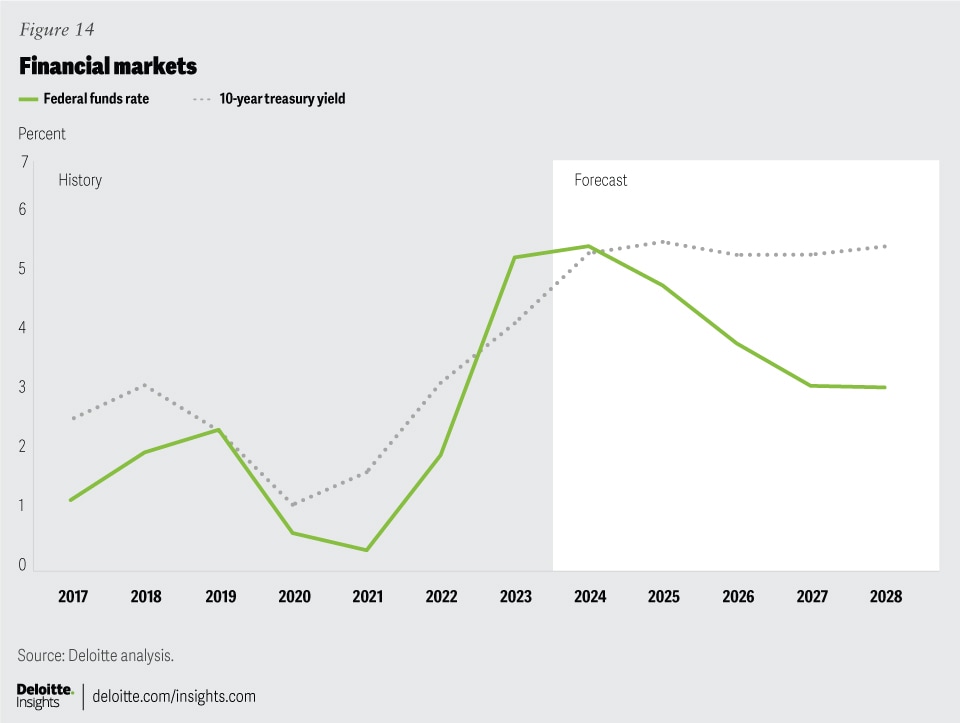

- Increased interest rates: The Federal Reserve's efforts to combat inflation through interest rate hikes increase borrowing costs, discouraging investment and potentially slowing economic growth.

Interest Rate Hikes

The Federal Reserve's aggressive interest rate hikes aim to curb inflation, but they also have a cooling effect on economic activity.

- Impact on mortgage rates: Higher interest rates make borrowing more expensive, leading to decreased housing demand and potentially a slowdown in the housing market.

- Business loans: Increased borrowing costs for businesses can discourage investment in new projects and hiring, impacting job growth.

- Consumer credit: Higher interest rates on credit cards and other forms of consumer debt can reduce consumer spending and increase household financial strain.

Geopolitical Uncertainty

Global events introduce significant uncertainty into the economic outlook, affecting supply chains, energy prices, and investor confidence.

- War in Ukraine: The ongoing conflict significantly disrupts global supply chains, impacting energy markets and contributing to inflation.

- Trade tensions: Escalating trade disputes can disrupt international commerce, negatively affecting economic growth.

Projected Impacts Across Sectors

Deloitte's forecast anticipates significant impacts across various sectors of the US economy.

Impact on Consumer Spending

The predicted slowdown will likely lead to a reduction in consumer spending, particularly in discretionary categories.

- Changes in discretionary spending: Consumers may cut back on non-essential purchases as inflation erodes their purchasing power and uncertainty looms.

- Impact on retail sales: Retailers can expect decreased sales volumes and potentially increased pressure on profit margins.

Impact on Business Investment

Businesses may become more cautious in their investment decisions due to economic uncertainty and higher borrowing costs.

- Reduced capital investments: Firms might postpone or cancel expansion projects and reduce capital expenditures in response to a slowing economy.

- Hiring freezes: Companies may implement hiring freezes or even layoffs in an effort to control costs and manage uncertainty.

Impact on Employment

The projected slowdown could lead to increased unemployment, particularly in sectors sensitive to interest rate changes.

- Increased unemployment in interest-sensitive industries: Sectors such as housing and construction, heavily reliant on borrowing, may experience job losses.

Conclusion: Understanding and Preparing for the US Growth Slowdown

Deloitte's report highlights a significant predicted slowdown in US economic growth, driven by a confluence of factors including high inflation, rising interest rates, and geopolitical uncertainty. Understanding the potential impact of this forecast is crucial for businesses, investors, and consumers. The projected impacts across various sectors, including reduced consumer spending, decreased business investment, and potential job losses, underscore the need for proactive planning and adaptation. Stay informed about the evolving economic landscape and consult Deloitte's full report for a comprehensive understanding of the predicted US growth slowdown and to prepare for the challenges ahead. [Link to Deloitte's Report (if available)]

Featured Posts

-

Considerable Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025

Considerable Us Growth Slowdown Predicted By Deloitte

Apr 27, 2025 -

Alberto Ardila Olivares Estrategia Y Garantia De Gol

Apr 27, 2025

Alberto Ardila Olivares Estrategia Y Garantia De Gol

Apr 27, 2025 -

Your Happy Day Guide February 20 2025

Apr 27, 2025

Your Happy Day Guide February 20 2025

Apr 27, 2025 -

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025 -

Robert Pattinson A Horror Movies Unexpected Aftermath

Apr 27, 2025

Robert Pattinson A Horror Movies Unexpected Aftermath

Apr 27, 2025

Latest Posts

-

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025 -

Robert Pattinson A Horror Movies Unexpected Aftermath

Apr 27, 2025

Robert Pattinson A Horror Movies Unexpected Aftermath

Apr 27, 2025 -

Robert Pattinsons Night Terror Knives Horror Movies And A Sleepless Night

Apr 27, 2025

Robert Pattinsons Night Terror Knives Horror Movies And A Sleepless Night

Apr 27, 2025 -

Binoche Named President Of The 2025 Cannes Film Festival Jury

Apr 27, 2025

Binoche Named President Of The 2025 Cannes Film Festival Jury

Apr 27, 2025 -

Cannes Film Festival 2025 Juliette Binoche To Head Jury

Apr 27, 2025

Cannes Film Festival 2025 Juliette Binoche To Head Jury

Apr 27, 2025