US SEC Considers XRP A Commodity: Ripple Settlement Implications

Table of Contents

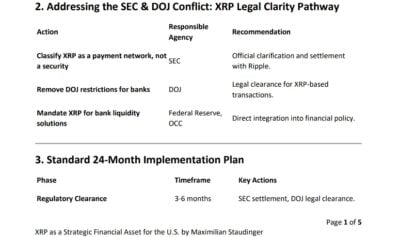

The SEC's Case Against Ripple and its Outcome

The Core Allegations

The SEC's initial case against Ripple Labs centered on allegations that Ripple's sales of XRP constituted unregistered securities offerings, violating federal securities laws. The SEC argued that Ripple’s distribution of XRP to institutional investors and through programmatic sales resembled the sale of securities, rather than the sale of a purely functional digital asset like a commodity.

- The SEC's argument heavily relied on the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security. This test considers whether there's an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

- The SEC's complaint also targeted specific Ripple executives, alleging they personally profited from the unregistered sales of XRP.

- The SEC's initial stance was that XRP, due to its centralized nature and the perceived influence Ripple had over its market, functioned more like a security than a commodity.

The Settlement Agreement

The Ripple-SEC settlement avoided a full trial. While Ripple didn't admit guilt, they agreed to pay a substantial penalty, settling the case without a definitive judicial ruling on whether XRP is a security across the board. Crucially, the settlement implied that XRP might not be a security in all contexts, leaving open the possibility for future trading and utilization without being immediately categorized as a security.

- The financial penalties imposed on Ripple were significant, impacting their resources and potentially affecting their future operations.

- The lack of an admission of guilt by Ripple is a noteworthy aspect of the settlement, preventing a clear precedent being set for future cases.

- The settlement didn’t explicitly define the exact parameters of when XRP is considered a commodity versus a security, leaving room for ongoing ambiguity.

Implications for XRP and the Crypto Market

XRP Price Volatility

The Ripple settlement significantly impacted XRP's price. Immediately following the news, XRP experienced increased volatility, with prices initially surging before settling into a more moderate range.

- Price fluctuations were dramatic in the period leading up to, during, and following the settlement, reflecting the market's uncertainty.

- Post-settlement, market sentiment towards XRP was mixed, with some investors expressing optimism and others remaining cautious.

- Factors such as market speculation, regulatory uncertainty, and overall crypto market trends continued to heavily influence XRP's price volatility.

Regulatory Clarity (or Lack Thereof)

The Ripple settlement offers limited clarity concerning broader US crypto regulation. While it provides some insight into the SEC's thinking regarding XRP, it does not definitively clarify how the SEC will classify other cryptocurrencies.

- The settlement creates uncertainty for other crypto projects, leaving them unsure of their regulatory status under US law.

- The potential for further regulatory action against other crypto projects, particularly those with centralized characteristics, remains high.

- Investor confidence in the crypto market has been affected, with many investors questioning the legal landscape and the future of digital assets under increased scrutiny.

Legal Precedents and Future of Crypto Regulation

The Howey Test and its Limitations

The Howey Test, a cornerstone of US securities law, played a central role in the SEC's case against Ripple. However, its application to the decentralized nature of many cryptocurrencies presents challenges.

- The four prongs of the Howey Test (investment of money, common enterprise, expectation of profits, and profits derived from the efforts of others) are difficult to apply consistently across various crypto projects.

- The Ripple case demonstrated some limitations of the Howey Test when applied to crypto assets; some interpretations suggest it was applied inconsistently to the different ways XRP was distributed.

- Applying the Howey Test to decentralized cryptocurrencies, where there's less centralized control, proves particularly challenging.

Potential for Future Legal Challenges

The Ripple settlement is unlikely to be the final chapter in the ongoing legal battles surrounding XRP and other cryptocurrencies.

- There's potential for future legal challenges related to XRP, particularly concerning the ambiguity surrounding its classification as a security or a commodity in different contexts.

- Ongoing legal challenges against other crypto projects and exchanges are likely to shape the future regulatory landscape.

- The long-term effects of the Ripple settlement will depend heavily on future court decisions, regulatory actions, and the evolution of the cryptocurrency market itself.

Conclusion

The Ripple-SEC settlement marks a significant, albeit ambiguous, development in the crypto regulatory landscape. The SEC's classification of XRP as a commodity in specific contexts, the resulting impact on XRP's price, and the ongoing uncertainty about future regulation represent key takeaways. The settlement highlighted the limitations of the Howey Test when applied to the complexities of decentralized cryptocurrencies.

To navigate this rapidly evolving environment, it is crucial to stay informed about the complexities surrounding the definition of "security" versus "commodity" and how this impacts your investments in XRP and the wider cryptocurrency markets. Further research into the Ripple settlement and its ramifications is essential for making informed decisions in this dynamic space.

Featured Posts

-

Warmer Weather Could Boost Russias Stalled Spring Offensive

May 01, 2025

Warmer Weather Could Boost Russias Stalled Spring Offensive

May 01, 2025 -

Ray Epps Vs Fox News A Deep Dive Into The January 6th Defamation Case

May 01, 2025

Ray Epps Vs Fox News A Deep Dive Into The January 6th Defamation Case

May 01, 2025 -

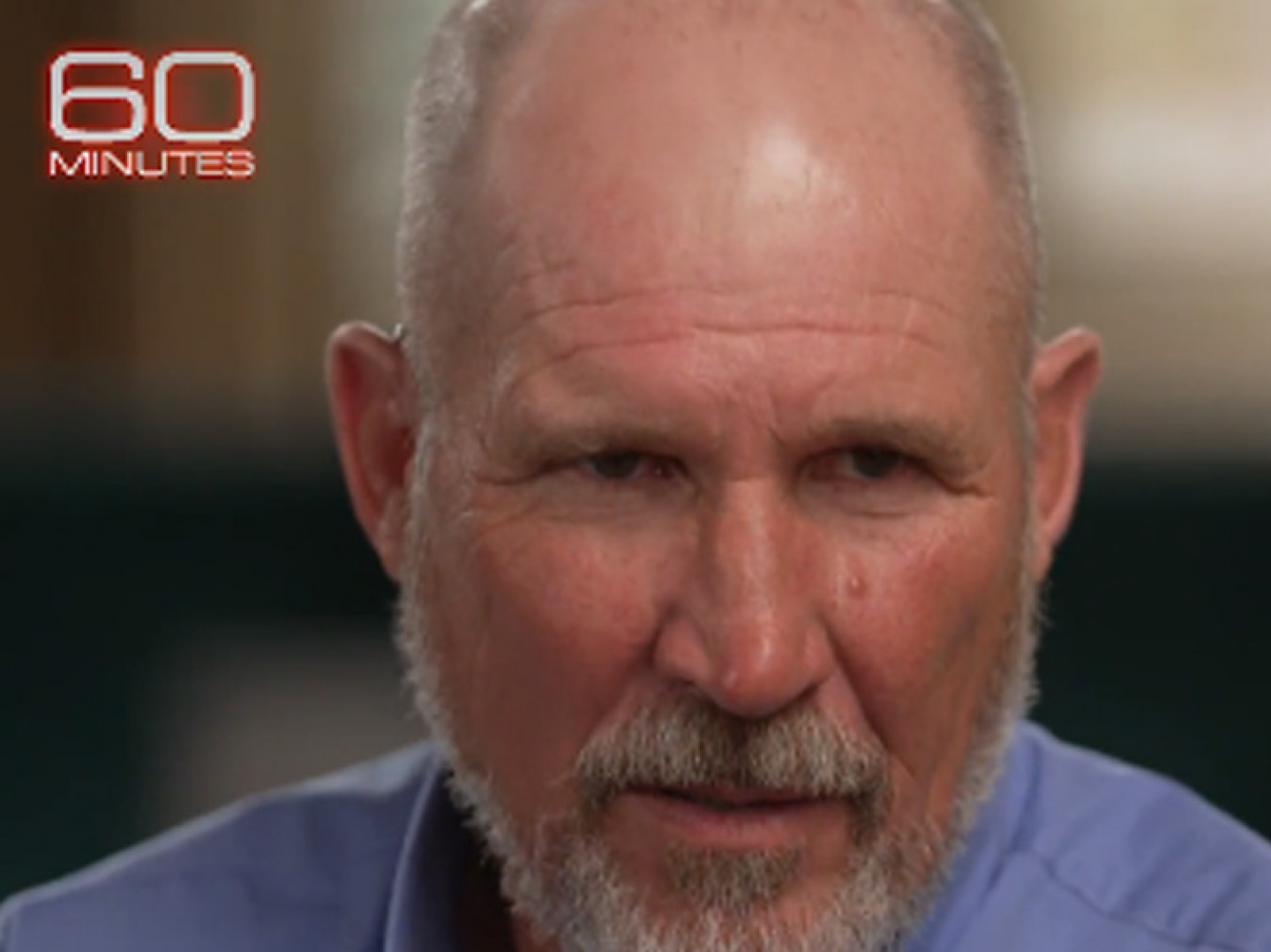

The Dragons Den Application Process A Step By Step Guide

May 01, 2025

The Dragons Den Application Process A Step By Step Guide

May 01, 2025 -

Baitulmal Sarawak Salurkan Rm 36 45 Juta Bantuan Kepada Asnaf Mac 2025

May 01, 2025

Baitulmal Sarawak Salurkan Rm 36 45 Juta Bantuan Kepada Asnaf Mac 2025

May 01, 2025 -

Hollywood Actor Donates R8 7 Crore After Tata Steel Layoffs

May 01, 2025

Hollywood Actor Donates R8 7 Crore After Tata Steel Layoffs

May 01, 2025