Wall Street's Palantir Prediction: Should You Buy Before May 5th?

Table of Contents

Analyzing Wall Street's Palantir Predictions for May 5th

The upcoming May 5th date is generating considerable buzz around Palantir stock. Analysts offer a mixed bag of Palantir predictions, creating a landscape of both optimism and caution for potential investors considering whether to buy Palantir.

Positive Predictions and Their Rationale

Several analysts hold a bullish outlook on Palantir, citing several key reasons to buy Palantir stock before May 5th. Their positive Palantir predictions are largely fueled by:

- Strong Q1 Earnings Expectations: Many anticipate Palantir to report strong first-quarter earnings, exceeding market expectations. This would significantly boost investor confidence.

- New Contract Wins: Rumors of substantial new government and commercial contracts are contributing to the positive sentiment. These contracts could significantly bolster Palantir's revenue stream.

- Technological Advancements: Palantir's continued innovation and development of cutting-edge data analytics solutions are seen as a major catalyst for growth. This positions them strongly within the competitive landscape.

For example, Analyst X has issued a "buy" rating with a price target of $XX, while Analyst Y predicts a price target of $YY, citing the strong potential for Palantir to capitalize on its growing market share.

- Increasing government contracts, particularly in defense and intelligence.

- Successful expansion into the commercial sector, diversifying revenue streams.

- Demonstrating improved profitability and efficient cost management.

Negative Predictions and Potential Risks

Despite the optimism, some analysts remain cautious, voicing concerns that could impact the Palantir prediction for May 5th. These negative predictions highlight potential risks associated with buying Palantir stock:

- Intense Competition: The data analytics market is highly competitive, with established players posing a significant challenge to Palantir's growth.

- High Valuation: Palantir's current valuation is considered high by some analysts, potentially leaving room for a correction.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government spending or policy could negatively impact the company's performance.

Potential negative factors include:

- An economic slowdown impacting government and commercial spending.

- Geopolitical instability creating uncertainty in the global market.

- Regulatory hurdles and compliance challenges affecting growth.

The Significance of May 5th

May 5th is a crucial date for Palantir, likely coinciding with the release of their Q1 earnings report. This report will provide crucial financial data, potentially influencing investor sentiment and the price of Palantir stock significantly.

The market reaction to the May 5th announcement will likely depend on several scenarios:

- Exceeding Expectations: Positive surprises could lead to a substantial price surge.

- Meeting Expectations: Meeting forecasts might result in a relatively stable price, or a slight increase/decrease depending on other market factors.

- Missing Expectations: Disappointing results could trigger a significant price drop.

Fundamental and Technical Analysis of Palantir Stock

Before considering whether to buy Palantir, a thorough analysis of its fundamentals and technical indicators is necessary.

Fundamental Analysis

Palantir's financial health shows a mixed picture. While revenue growth has been impressive, profitability remains a work in progress. Debt levels also need to be considered when evaluating the company's long-term sustainability. Analyzing its competitive landscape and long-term growth prospects requires a careful look at its technological advancements and market penetration strategies.

Key financial metrics to consider:

- Revenue growth rate (YoY and QoQ)

- Profit margins (gross, operating, net)

- Debt-to-equity ratio

- Free cash flow

Technical Analysis

A technical analysis of Palantir's stock chart can reveal potential support and resistance levels, identifying possible entry and exit points for traders. Examining trading volume and using technical indicators like moving averages and RSI can help predict short-term and long-term price movements.

Key technical indicators include:

- Moving averages (50-day, 200-day)

- Relative Strength Index (RSI)

- Support and resistance levels

- Trading volume

Considering Your Investment Strategy Before Buying Palantir

Before making any investment decision concerning Palantir stock, carefully consider your personal financial situation and investment goals.

Risk Tolerance and Investment Goals

Palantir stock is considered a high-risk, high-reward investment. It's crucial to assess your risk tolerance and whether the potential rewards align with your investment goals and timeline.

Before investing in Palantir, ask yourself:

- What is my risk tolerance? (High, medium, low)

- What are my investment goals? (Long-term growth, short-term gains, etc.)

- What is my investment timeline? (Short-term, mid-term, long-term)

Diversification and Portfolio Allocation

Always diversify your investments across different asset classes to mitigate risk. Palantir should be only a part of a well-diversified portfolio, not its entirety.

Examples of diversification strategies:

- Investing in a mix of stocks, bonds, and real estate.

- Diversifying across different sectors and industries.

- Using index funds or ETFs for broader market exposure.

Conclusion: Should You Buy Palantir Before May 5th?

The Palantir prediction for May 5th is complex, with both bullish and bearish arguments. While the potential for substantial gains exists, significant risks remain. Wall Street's varied predictions, coupled with the company's fundamental and technical characteristics, paint a picture of high volatility. Ultimately, the decision of whether to buy Palantir stock rests on your individual risk tolerance, investment goals, and a thorough understanding of the company's prospects. While the May 5th deadline looms large, thoroughly research Palantir's prospects before deciding whether to buy Palantir stock. Remember to conduct your own due diligence and consult with a financial advisor before making any investment decisions.

Featured Posts

-

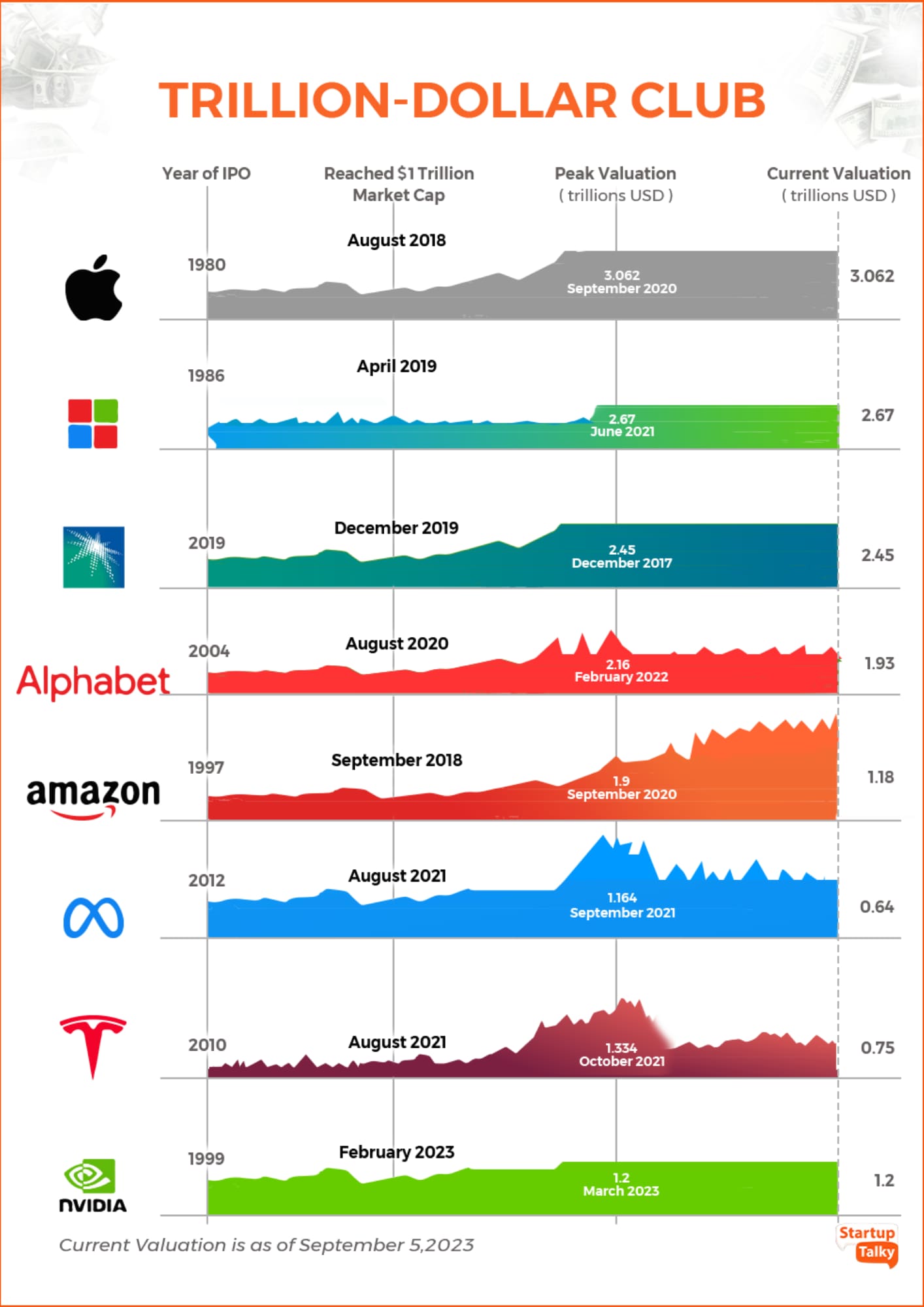

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 09, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Projection

May 09, 2025 -

Clarification Politique Borne Explore La Fusion De Renaissance Et Du Modem

May 09, 2025

Clarification Politique Borne Explore La Fusion De Renaissance Et Du Modem

May 09, 2025 -

Has The Bitcoin Bear Market Ended Analyzing The Recent Rebound

May 09, 2025

Has The Bitcoin Bear Market Ended Analyzing The Recent Rebound

May 09, 2025 -

Stalking And Vandalism Charges Filed Against Man Who Crashed Into Jennifer Anistons Property

May 09, 2025

Stalking And Vandalism Charges Filed Against Man Who Crashed Into Jennifer Anistons Property

May 09, 2025 -

Upcoming India Us Trade Talks Potential Outcomes And Impacts

May 09, 2025

Upcoming India Us Trade Talks Potential Outcomes And Impacts

May 09, 2025