Wedbush's Apple Outlook: Bullish Despite Price Target Reduction

Table of Contents

H2: Wedbush's Revised Price Target and Rationale

Wedbush's revised price target for Apple stock reflects a nuanced perspective on the tech giant's future. They recently lowered their target, though the exact figures should be confirmed via their official reports and releases (always consult original sources for the most up-to-date information). This reduction isn't necessarily a sign of bearish sentiment; rather, it's a recalibration based on several factors.

The rationale behind the price target reduction primarily stems from concerns surrounding the broader macroeconomic environment. Specific concerns cited by Wedbush (again, refer to their official reports for precise data) may include:

- Concerns about macroeconomic conditions: Global economic uncertainty, inflation, and potential recessionary pressures all impact consumer spending, potentially affecting demand for Apple products.

- Potential slowdown in iPhone sales: While the iPhone remains a flagship product, sales growth may be slowing compared to previous years. This could be attributed to market saturation, increased competition, or lengthening upgrade cycles.

- Impact of increased competition: The smartphone market is increasingly competitive, with strong rivals offering compelling alternatives at various price points. This competition impacts Apple's market share and pricing power.

Let's look at some specifics (using hypothetical figures for illustrative purposes, replace with actual data from Wedbush's report):

- Original price target: $200

- Revised price target: $180

- Percentage change in the price target: -10%

- Key macroeconomic factors cited in the report: High inflation, potential recession, supply chain disruptions.

- Specific concerns regarding iPhone sales: Slower-than-expected sales growth in key markets like China and Europe.

H2: Maintaining a Bullish Outlook: Why Wedbush Remains Positive on Apple

Despite the reduced price target, Wedbush maintains a bullish long-term outlook for Apple, highlighting several key strengths:

- Strong performance of Apple's services segment: Apple's services division, encompassing subscriptions like Apple Music, iCloud, and the App Store, demonstrates consistent growth and high profitability, providing a stable revenue stream.

- Growth potential in emerging markets: Apple continues to see significant growth opportunities in developing economies. Increased smartphone penetration and rising disposable incomes in these markets offer considerable potential for future sales.

- Innovation in new product categories: Apple's investment in innovative technologies such as augmented reality (AR)/virtual reality (VR) and electric vehicles (EVs) presents avenues for future revenue growth and market expansion.

- Resilience of the Apple ecosystem: The strong loyalty within Apple's ecosystem, encompassing hardware, software, and services, fosters customer retention and creates a strong barrier to entry for competitors.

Illustrative data points (replace with actual figures from Wedbush’s report):

- Growth projections for key product categories: Services revenue projected to grow by 15% annually.

- Analysis of market share and competitive advantage: Apple maintains a dominant market share in the premium smartphone segment.

- Potential for future innovation and revenue streams: AR/VR headsets projected to generate significant revenue in the coming years.

- Strengths of Apple's business model and ecosystem: High customer retention rates and strong brand loyalty.

H3: Implications for Investors

Wedbush's analysis presents both opportunities and risks for investors. In the short term, the lowered price target might lead to some market volatility. However, Wedbush's continued bullish outlook suggests a positive long-term perspective.

- Potential risks associated with investing in Apple stock: Macroeconomic uncertainty, increased competition, and potential slowing of iPhone sales growth.

- Potential rewards for long-term investors: Growth in services revenue, expansion in emerging markets, and innovation in new product categories.

- Suggestions for investors based on risk tolerance and investment horizon: Long-term investors with a higher risk tolerance may consider accumulating Apple stock at the current price, while risk-averse investors may prefer a more cautious approach.

3. Conclusion

Wedbush's revised price target for Apple reflects a cautious yet optimistic view. While they've lowered their target due to macroeconomic concerns and potential iPhone sales slowdown, their bullish outlook persists, fueled by the strength of Apple's services segment, growth potential in emerging markets, and ongoing innovation. The implications for investors depend on individual risk tolerance and investment horizons.

While Wedbush's Apple outlook remains bullish despite the price target reduction, investors should conduct their own thorough research before making any investment decisions. Stay informed about Wedbush’s ongoing Apple analysis and other expert opinions to make well-informed decisions regarding your Apple stock portfolio. Consider the implications for your own investment strategy based on the information presented and conduct further due diligence concerning the Wedbush’s Apple outlook.

Featured Posts

-

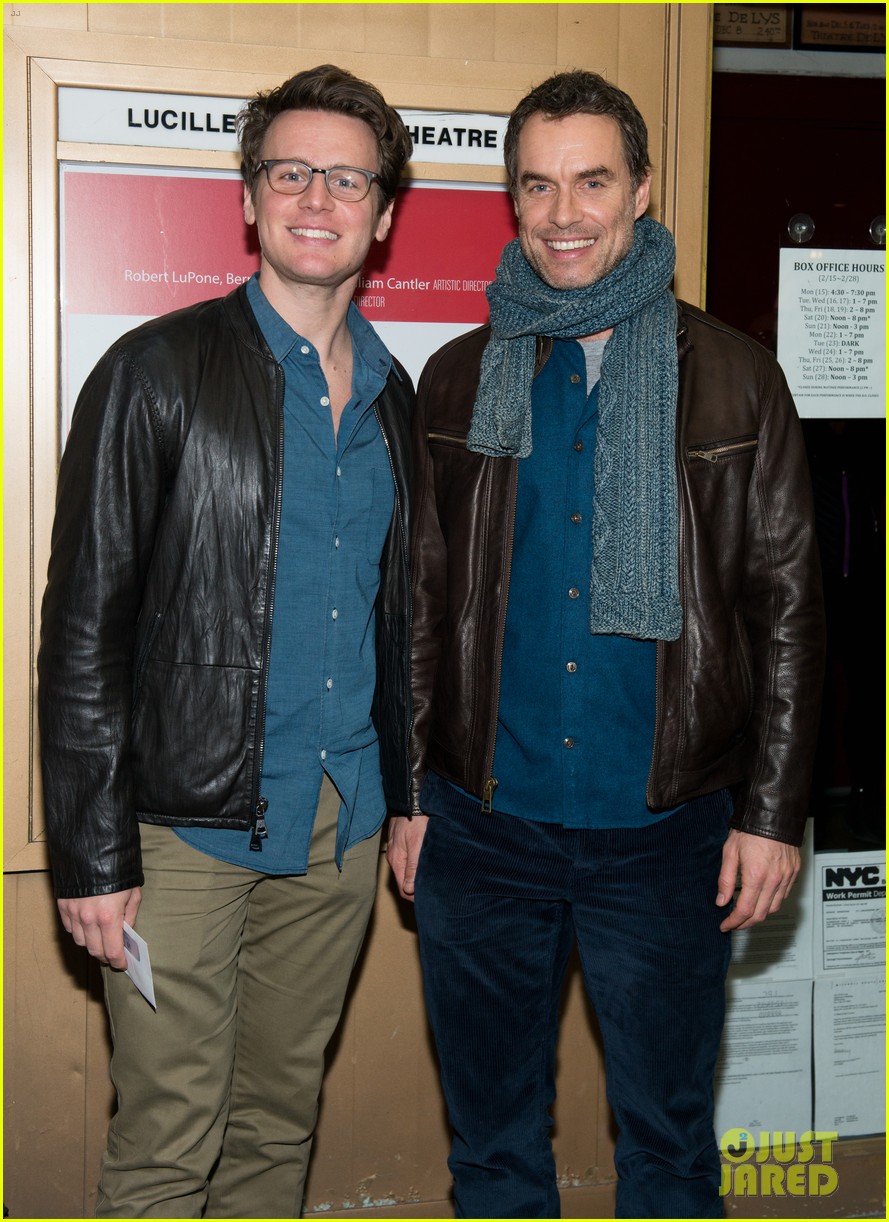

Broadways Just In Time Star Studded Support For Jonathan Groffs Opening Night

May 24, 2025

Broadways Just In Time Star Studded Support For Jonathan Groffs Opening Night

May 24, 2025 -

Astrologicheskie Predskazaniya I Goroskopy Na Mesyats

May 24, 2025

Astrologicheskie Predskazaniya I Goroskopy Na Mesyats

May 24, 2025 -

Escape To The Country Overcoming Common Challenges

May 24, 2025

Escape To The Country Overcoming Common Challenges

May 24, 2025 -

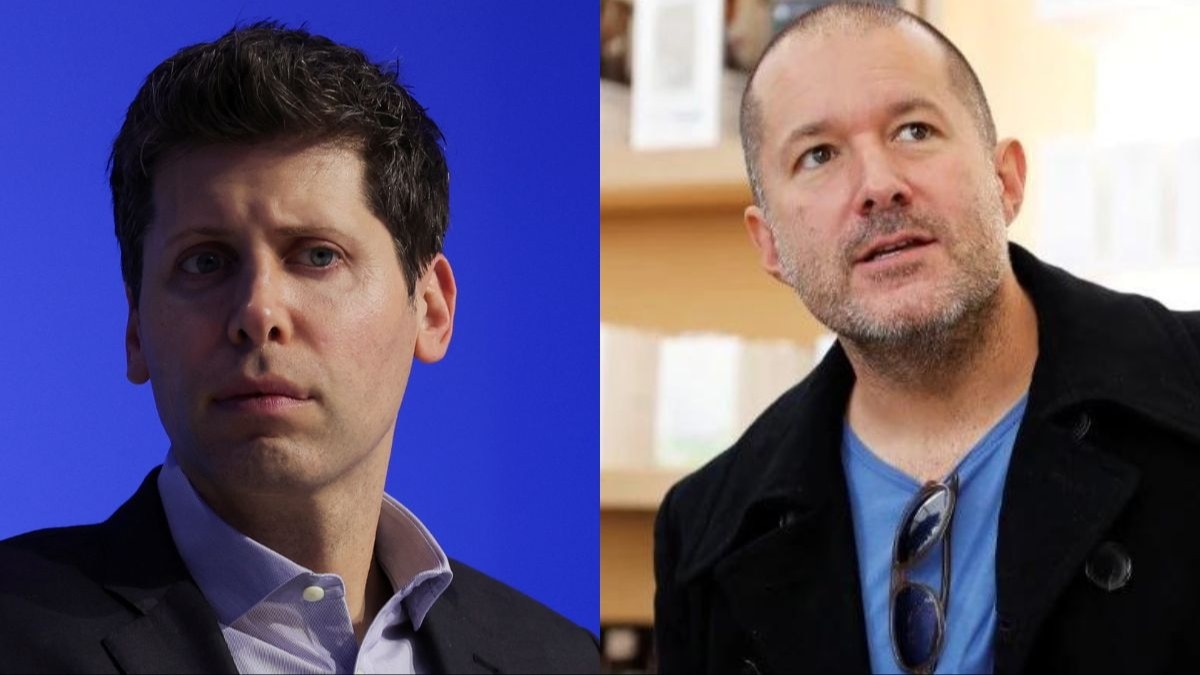

Report Open Ai In Talks To Acquire Jony Ives Ai Business

May 24, 2025

Report Open Ai In Talks To Acquire Jony Ives Ai Business

May 24, 2025 -

Porsche 911 S T Pts Riviera Blue For Sale Detailed Specifications

May 24, 2025

Porsche 911 S T Pts Riviera Blue For Sale Detailed Specifications

May 24, 2025