Weihong Liu: The Billionaire Behind The Hudson's Bay Lease Buyout

Table of Contents

Weihong Liu's Business Empire and Investment Strategy

Weihong Liu's journey to becoming a real estate magnate is a testament to his shrewd business acumen and strategic investment prowess. While details of his early career remain relatively private, his current portfolio reveals a focus on large-scale real estate acquisitions and a penchant for properties with high redevelopment potential. His investment philosophy appears to be long-term, focusing on assets that offer sustained value growth and potential for future appreciation. This contrasts with short-term, opportunistic strategies often employed by other investors. He is known for meticulously assessing risk and leveraging his expertise to secure advantageous deals.

- Examples of successful past investments: While specifics of all his past investments aren't publicly available, the Hudson's Bay buyout showcases his capability to execute large-scale, complex transactions.

- His approach to risk management: Liu's investment strategy suggests a cautious approach to risk, opting for well-researched deals with clearly defined exit strategies. This signifies a preference for minimizing potential losses, a hallmark of his sophisticated investment style.

- Key characteristics of his investment style: Liu’s investment style appears to be characterized by long-term vision, thorough due diligence, and a focus on tangible assets with demonstrable potential for growth. This suggests a patient investor who is willing to wait for the right opportunity.

Keywords: "Weihong Liu investments," "Liu's business strategy," "real estate investment strategies."

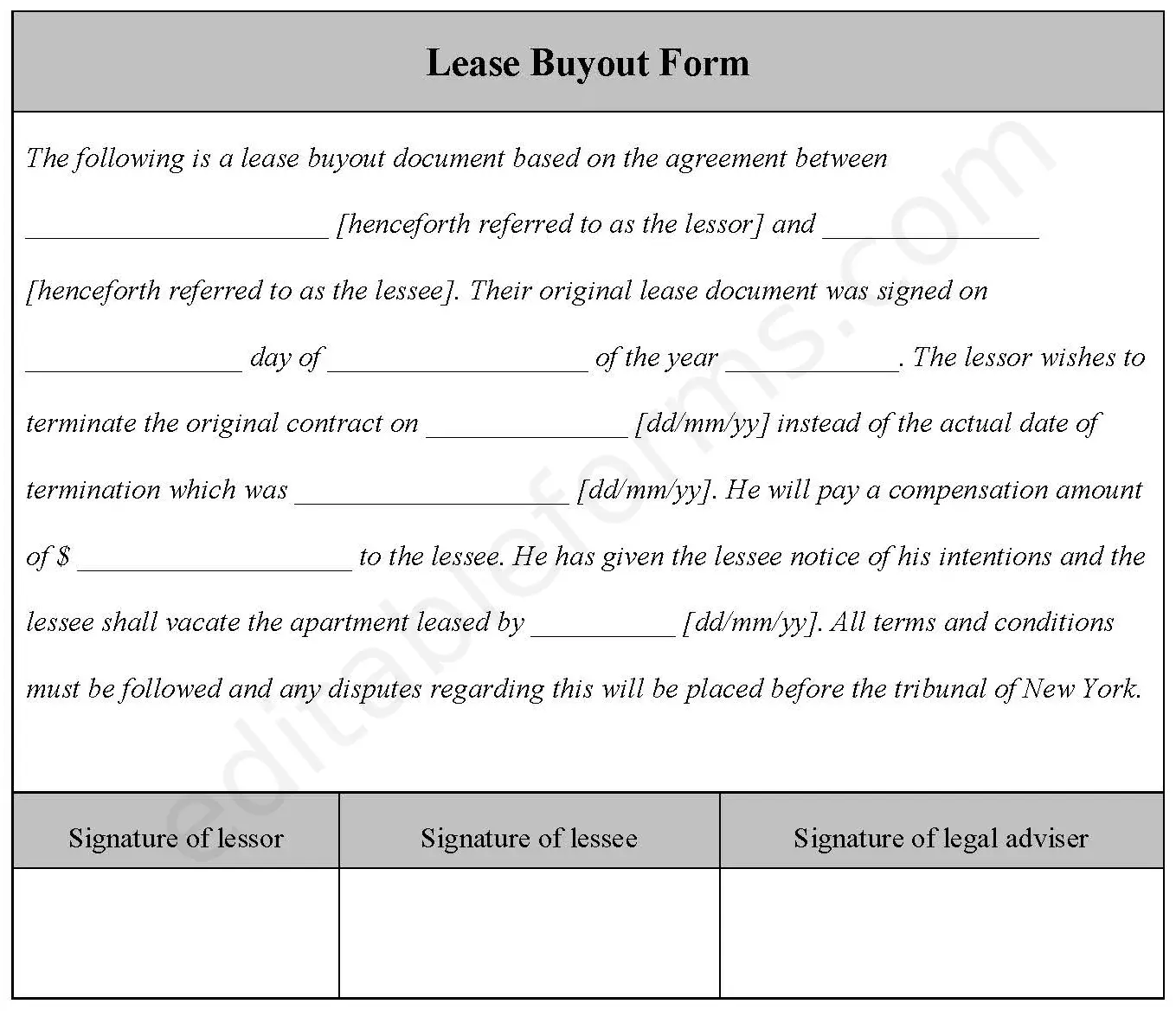

The Hudson's Bay Lease Buyout: Details and Significance

The Hudson's Bay lease buyout represents a significant milestone in Weihong Liu's investment career. While the exact financial details surrounding the transaction remain confidential to some extent, the scale of the deal is undeniable. The acquisition involved numerous prime properties formerly under the Hudson's Bay Company's lease, strategically located in major Canadian cities. This strategic move significantly expands Liu's real estate holdings and solidifies his position as a major player in the Canadian market.

- Key dates and milestones of the buyout process: The precise timeline of the negotiations and the finalization of the deal are not entirely public knowledge, adding to the intrigue surrounding this significant transaction.

- The impact on the Hudson's Bay Company's financial standing: For the Hudson's Bay Company, the lease buyout likely resulted in a substantial influx of capital, impacting their financial position positively and allowing them to pursue other strategic ventures.

- Potential future uses of the acquired properties: The acquired properties, located in prime commercial areas, are likely slated for redevelopment or repurposing, reflecting Liu's long-term vision for value creation in the Canadian real estate market.

Keywords: "Hudson's Bay lease buyout details," "impact of Hudson's Bay sale," "future of Hudson's Bay properties," "Weihong Liu real estate acquisitions."

The Impact of the Buyout on the Canadian Real Estate Market

The Weihong Liu-led Hudson's Bay lease buyout has had a demonstrable impact on the Canadian real estate market. The sheer scale of the transaction has increased the overall investor interest in prime commercial properties across the country. This has led to a closer examination of similar large-scale real estate transactions and their implications for future market trends. The buyout has certainly raised the stakes in the Canadian real estate market, potentially increasing property values and impacting investment decisions for years to come.

- Market analysis before and after the buyout: A comparison of market data before and after the transaction will provide a clearer understanding of its influence on property values, market trends and investor sentiment.

- Expert opinions on the long-term effects of the deal: Industry experts' analyses will reveal the potential long-term effects of the deal on the Canadian real estate landscape.

- Comparison with similar large-scale real estate transactions: Comparing this deal with other significant transactions provides valuable insights into the wider implications of this type of large-scale investment.

Keywords: "Canadian real estate market," "impact of large real estate deals," "Canadian property values," "real estate market analysis."

Weihong Liu's Future Plans and Potential Investments

Given his demonstrated success and strategic focus, it's reasonable to expect Weihong Liu to continue expanding his real estate portfolio in Canada. Future acquisitions might involve similar large-scale projects or a diversification into other related sectors of the real estate market. His strategic approach, focusing on prime locations and high-value properties, will likely continue to be a defining characteristic of his investment strategy. His actions will undoubtedly continue to shape the dynamics of the Canadian real estate market for years to come.

Keywords: "Weihong Liu future investments," "future of Canadian real estate," "potential real estate acquisitions."

Conclusion: The Legacy of Weihong Liu and the Hudson's Bay Buyout

The Weihong Liu-led Hudson's Bay lease buyout stands as a landmark event in Canadian real estate history. This transaction demonstrates Liu's shrewd investment strategy and underscores his significant influence on the Canadian real estate market. The implications of this buyout are far-reaching, affecting property values, investment strategies, and the future development of key commercial properties. His actions serve as a case study for future large-scale real estate transactions in Canada and beyond. Stay informed about the unfolding impact of Weihong Liu's investments in the Canadian real estate market. Learn more about other significant real estate buyouts and their impact. What are your thoughts on the Weihong Liu’s Hudson's Bay lease buyout and its implications for the future of Canadian real estate? Share your comments below!

Featured Posts

-

Revolve Nike Dunk Sale Prices Slashed

May 29, 2025

Revolve Nike Dunk Sale Prices Slashed

May 29, 2025 -

Building The Ultimate Probopass Deck In Pokemon Tcg Pocket

May 29, 2025

Building The Ultimate Probopass Deck In Pokemon Tcg Pocket

May 29, 2025 -

El Mundo De Los Arcanos Menores En El Tarot

May 29, 2025

El Mundo De Los Arcanos Menores En El Tarot

May 29, 2025 -

One Adult Harry Potter Character Hbo Must Get Right

May 29, 2025

One Adult Harry Potter Character Hbo Must Get Right

May 29, 2025 -

Qrar Brshlwnt Bshan Jwnathan Tah Mfajat Mdwyt

May 29, 2025

Qrar Brshlwnt Bshan Jwnathan Tah Mfajat Mdwyt

May 29, 2025