Westpac's (WBC) Falling Profits: A Deep Dive Into Margin Squeeze

Table of Contents

Increased Competition in the Australian Banking Sector

The Australian banking industry is experiencing a period of unprecedented competition, significantly impacting Westpac's profitability and contributing to the WBC margin squeeze. This heightened competition stems from two primary sources: the rise of fintech and challenger banks, and intense price wars among established players.

Rise of Fintech and Challenger Banks

The emergence of innovative fintech companies and challenger banks is revolutionizing the financial services sector. These agile competitors offer streamlined, often lower-cost services, directly challenging the traditional dominance of established banks like Westpac.

- Increased pressure on net interest margins (NIMs): Fintechs and challenger banks are forcing established banks to lower fees and interest rates to remain competitive, directly impacting NIMs.

- Loss of market share to more agile competitors: Westpac, along with other traditional banks, is losing market share to these digitally native competitors who offer superior customer experiences and lower costs.

- Necessity for Westpac to invest heavily in digital transformation: To stay relevant, Westpac must invest significantly in digital transformation initiatives, which represents a substantial cost in the short term. This investment is crucial to compete with the speed and innovation of their newer rivals.

Intense Price Wars Amongst Established Banks

Competition isn't limited to new entrants. Established banks, including ANZ, NAB, and the Commonwealth Bank, are engaged in fierce price wars, further eroding profit margins.

- Reduced lending rates to attract and retain customers: Banks are constantly lowering lending rates to entice customers, squeezing their profit margins on lending products.

- Pressure to offer more competitive deposit rates: The pressure extends to deposit accounts, where banks are forced to offer increasingly attractive rates to retain customer deposits.

- Impact on profitability across various banking products: This competitive pressure negatively impacts profitability across the board, from mortgages and personal loans to business banking products.

Rising Operational Costs and Regulatory Scrutiny

Beyond competitive pressures, Westpac faces increasing operational costs driven by regulatory changes and necessary investments in technology. These factors contribute significantly to the WBC margin squeeze.

Compliance and Regulatory Costs

The Australian banking sector is under intense regulatory scrutiny following past scandals. Compliance with stricter regulations adds substantial costs.

- Investment in improved risk management and compliance infrastructure: Banks must invest heavily in robust risk management systems and compliance infrastructure to meet regulatory requirements.

- Higher legal and advisory fees: The increased regulatory complexity results in higher legal and advisory fees.

- Impact on overall operating efficiency: These compliance costs directly impact overall operating efficiency and reduce profitability.

Investments in Technology and Infrastructure

Westpac, like other banks, must invest heavily in upgrading its technology and infrastructure to improve customer experience and operational efficiency. While essential for long-term success, these investments pressure short-term profits.

- Upfront costs associated with digital transformation projects: Major technology overhauls and digital transformation initiatives require significant upfront investment.

- Ongoing maintenance and support of new technologies: Maintaining and upgrading these new technologies necessitates ongoing expenditure.

- Potential long-term benefits in terms of efficiency and customer acquisition: While costly in the short term, these investments should eventually improve efficiency and help attract new customers.

Economic Headwinds and Lower Interest Rates

Macroeconomic factors, such as low interest rates and slowing economic growth, further exacerbate the margin squeeze impacting Westpac's profitability.

Impact of Low Interest Rate Environment

The Reserve Bank of Australia's (RBA) persistently low interest rate policy directly compresses net interest margins, a core component of bank profitability.

- Reduced return on lending activities: Low interest rates reduce the return on lending activities, impacting the bank's core revenue stream.

- Challenges in passing on lower costs to customers: Banks struggle to pass on the lower costs associated with low interest rates to customers, further squeezing margins.

- Difficulty in maintaining adequate profitability levels: The low interest rate environment makes it challenging for banks to maintain adequate profitability levels.

Slowing Economic Growth

Slower economic growth reduces demand for credit and increases the risk of loan defaults, directly impacting Westpac's profitability and contributing to the WBC margin squeeze.

- Impact on loan portfolio quality and potential credit losses: Slower growth increases the risk of loan defaults, negatively impacting the quality of the loan portfolio and potentially leading to credit losses.

- Reduced lending volume impacting overall revenue: Reduced demand for credit translates to lower lending volumes, directly impacting overall revenue.

- Need for more conservative lending practices: Banks must adopt more conservative lending practices, further reducing the potential for revenue growth.

Conclusion

Westpac's (WBC) falling profits are a result of a multifaceted challenge involving increased competition, rising operational costs, and a challenging macroeconomic environment. The margin squeeze is a serious issue demanding strategic adaptation. Westpac must prioritize improving operational efficiency, making strategic investments in technology, and skillfully navigating the competitive landscape to mitigate the negative impacts and restore profitability. Understanding the complexities of this Westpac profit decline and the underlying WBC margin squeeze is paramount for investors and stakeholders alike. Staying abreast of future developments in the Australian banking sector is crucial for making well-informed decisions concerning Westpac's (WBC) profitability.

Featured Posts

-

Schwarzeneggers Superman Bid Why He Lost To Corenswet

May 06, 2025

Schwarzeneggers Superman Bid Why He Lost To Corenswet

May 06, 2025 -

San Antonio Spurs L Ere Post Popovich Commence Avec Mitch Johnson

May 06, 2025

San Antonio Spurs L Ere Post Popovich Commence Avec Mitch Johnson

May 06, 2025 -

Tathyr Sbayk Ly Almhtml Ela Ttwyr Alsynma Alsewdyt

May 06, 2025

Tathyr Sbayk Ly Almhtml Ela Ttwyr Alsynma Alsewdyt

May 06, 2025 -

Understanding Papal Names History Meaning And Predictions For The Future

May 06, 2025

Understanding Papal Names History Meaning And Predictions For The Future

May 06, 2025 -

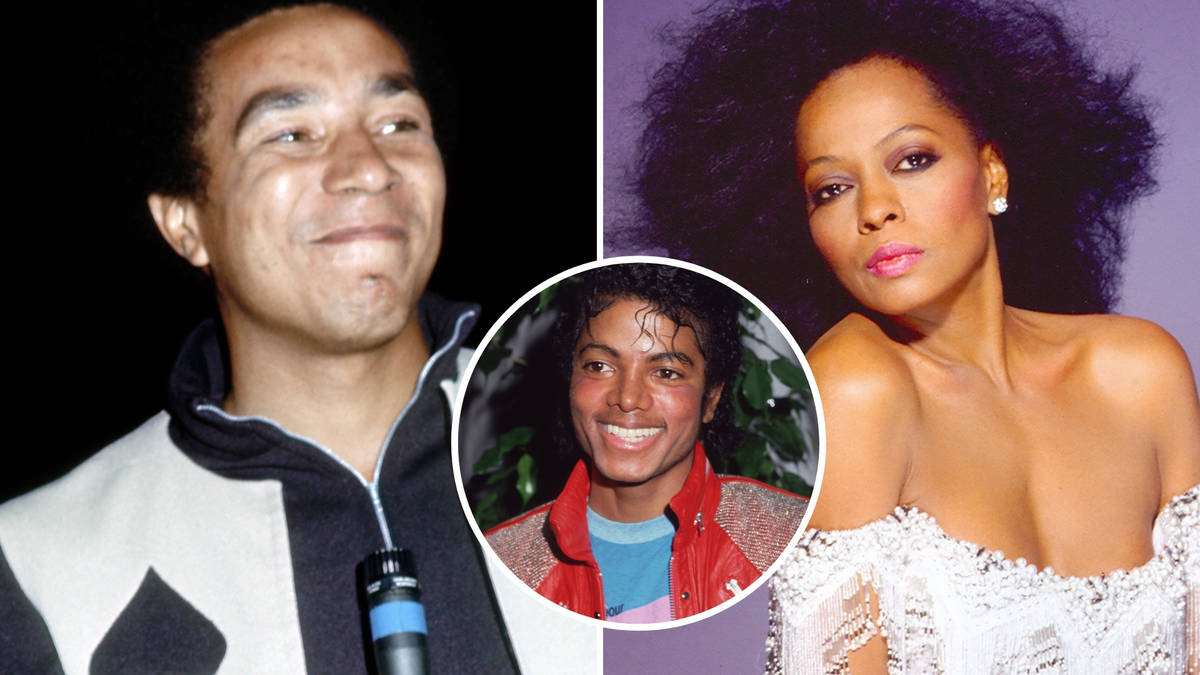

Did Smokey Robinson Write A Song About Diana Rosss Affair The Singer Responds

May 06, 2025

Did Smokey Robinson Write A Song About Diana Rosss Affair The Singer Responds

May 06, 2025