Why Are Taiwanese Investors Pulling Back From US Bond ETFs?

Table of Contents

Rising Interest Rates in the US

The Federal Reserve's monetary policy, characterized by rising interest rates, plays a significant role in the decreased appeal of US Bond ETFs for Taiwanese investors. This is because bond prices and interest rates share an inverse relationship.

- Increased yields on newly issued bonds make older bonds less attractive. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less appealing. Taiwanese investors holding US Bond ETFs might find their returns lagging compared to newer, higher-yielding options.

- Capital losses on existing bond holdings. As interest rates increase, the market value of existing bonds typically falls. This translates to potential capital losses for investors who decide to sell their holdings before maturity.

- Reduced returns compared to other investment options. The diminished returns from US Bond ETFs, coupled with the potential for capital losses, make them less competitive against other investment vehicles offering potentially higher yields.

The Federal Reserve's ongoing efforts to combat inflation directly influence interest rates, making this a persistent factor in the Taiwanese investors' decision-making process regarding US Bond ETFs.

The Strengthening US Dollar

The strengthening US dollar against the Taiwanese dollar (TWD) presents another significant challenge for Taiwanese investors in US Bond ETFs. Currency fluctuations introduce substantial risks to their returns.

- Conversion losses erode profits. When converting USD earnings back to TWD, the stronger dollar diminishes the value of the returns, effectively eroding profits. This currency risk is a substantial concern for Taiwanese investors.

- Hedging strategies and their associated costs. While hedging strategies can mitigate currency risk, they come with their own costs, reducing the overall profitability of the investment. This added expense makes US Bond ETFs less attractive.

- Uncertainty in exchange rate forecasts. The inherent unpredictability of exchange rates adds another layer of complexity and risk. Accurately predicting future USD/TWD exchange rates is difficult, increasing the uncertainty surrounding potential returns.

Recent data shows a sustained period of USD appreciation against the TWD, directly impacting the attractiveness of US dollar-denominated assets for Taiwanese investors.

Geopolitical Concerns and Global Uncertainty

Global geopolitical instability significantly influences investor sentiment and risk appetite. The current environment adds another layer of complexity to investment decisions.

- US-China relations and their impact on market sentiment. The ongoing tensions between the US and China create uncertainty in the global market, influencing investor confidence and affecting investment strategies.

- Global inflation and its effect on bond markets. High global inflation rates can lead to further interest rate hikes by central banks, negatively impacting bond prices and returns. This adds to the overall uncertainty surrounding US Bond ETFs.

- Concerns about the global economic outlook. The current economic climate, marked by inflation and potential recessionary risks, contributes to a more cautious and risk-averse investment strategy amongst Taiwanese investors.

Several significant geopolitical events, including rising tensions in Eastern Europe and persistent trade disputes, might have further contributed to this cautious approach by Taiwanese investors toward US Bond ETFs.

Attractive Alternative Investments

The reduced appeal of US Bond ETFs is also driven by the emergence of more attractive investment options. Taiwanese investors are increasingly exploring alternatives offering potentially better returns or reduced risk.

- Higher-yielding investments in other markets (e.g., emerging markets). Emerging markets might offer higher yields compared to US bonds, attracting investors seeking greater returns.

- Increased investment in Taiwanese domestic markets. Investing in the domestic market reduces currency risk and provides a more familiar investment landscape.

- Diversification into other asset classes (e.g., stocks, real estate). Investors are diversifying their portfolios by venturing into asset classes beyond bonds, reducing their reliance on any single market.

Data suggests a notable increase in Taiwanese investment in Asian emerging markets and the domestic stock market, demonstrating a clear shift away from US Bond ETFs.

Conclusion

The pullback of Taiwanese investors from US Bond ETFs is a multifaceted phenomenon driven by rising US interest rates, the strengthening US dollar, significant geopolitical uncertainty, and the availability of more attractive alternative investments. Understanding these interwoven factors is critical for both Taiwanese investors seeking to optimize their portfolios and market analysts trying to understand global investment trends. For a deeper understanding of the dynamics influencing Taiwanese investors and their choices regarding US Bond ETFs, continue researching the interplay of interest rates, currency fluctuations, and global economic trends. Stay informed on the evolving landscape of Taiwanese Investors US Bond ETFs to make informed investment decisions.

Featured Posts

-

Daily Lotto Wednesday 16th April 2025 Results

May 08, 2025

Daily Lotto Wednesday 16th April 2025 Results

May 08, 2025 -

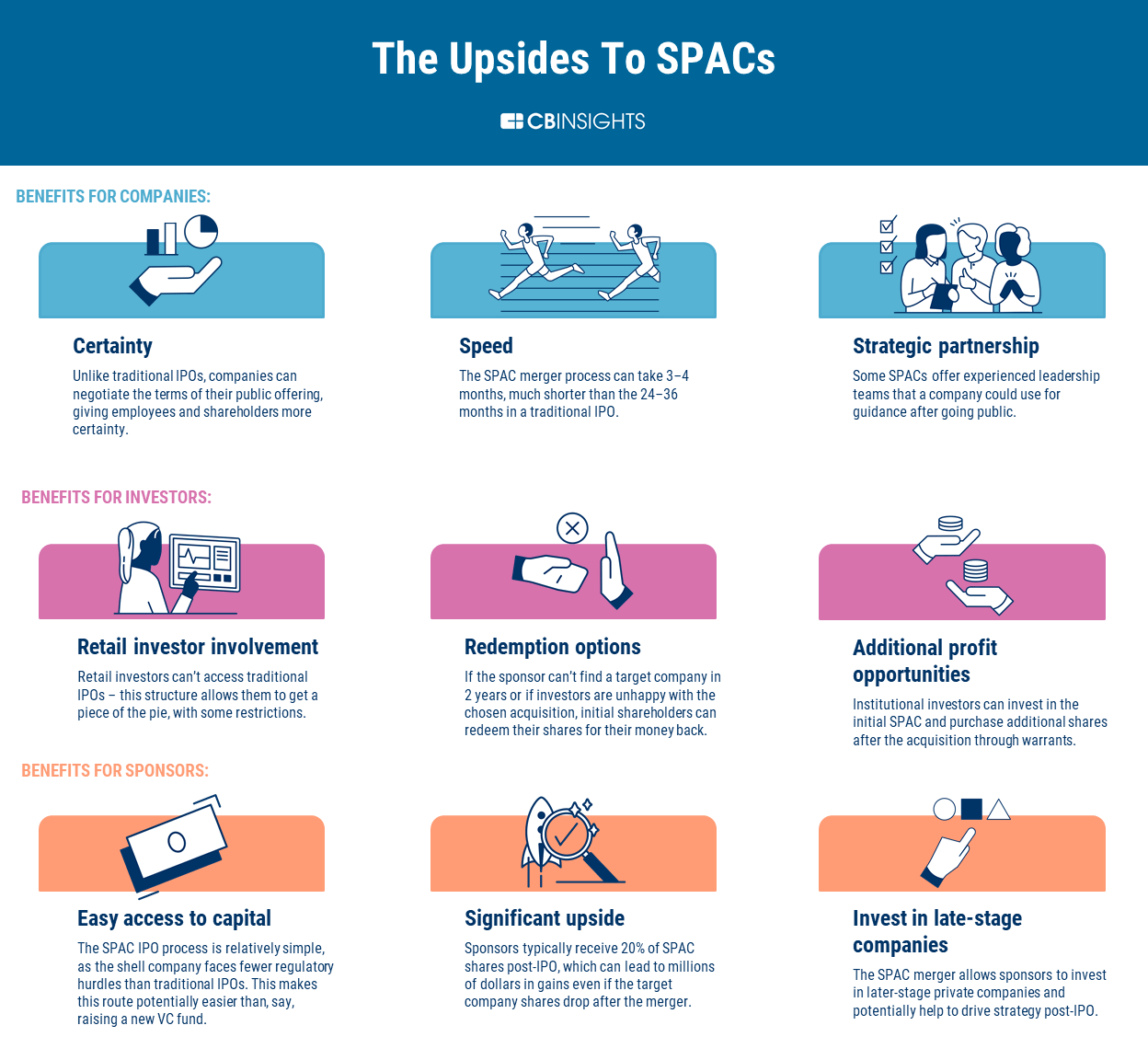

Hot New Spac Stock Challenges Micro Strategy Is It A Smart Investment

May 08, 2025

Hot New Spac Stock Challenges Micro Strategy Is It A Smart Investment

May 08, 2025 -

Surface Pro 12 Inch 799 Starting Price A Comprehensive Guide

May 08, 2025

Surface Pro 12 Inch 799 Starting Price A Comprehensive Guide

May 08, 2025 -

Desetta Pobeda Za Vesprem Vo L Sh Senzatsionalno Pa Anje Na Ps Zh

May 08, 2025

Desetta Pobeda Za Vesprem Vo L Sh Senzatsionalno Pa Anje Na Ps Zh

May 08, 2025 -

National Media Under Fire From Okc Thunder Players

May 08, 2025

National Media Under Fire From Okc Thunder Players

May 08, 2025

Latest Posts

-

The Great Decoupling Economic Implications And Global Shifts

May 08, 2025

The Great Decoupling Economic Implications And Global Shifts

May 08, 2025 -

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025

Understanding The Great Decoupling A Comprehensive Guide

May 08, 2025 -

Lahwr Ke Bazarwn Myn Gwsht Ky Blnd Tryn Qymtyn Ewam Ka Ahtjaj

May 08, 2025

Lahwr Ke Bazarwn Myn Gwsht Ky Blnd Tryn Qymtyn Ewam Ka Ahtjaj

May 08, 2025 -

Chkn Mtn Awr Byf Lahwr Myn Gwsht Ky Qymtwn Ka Bhran

May 08, 2025

Chkn Mtn Awr Byf Lahwr Myn Gwsht Ky Qymtwn Ka Bhran

May 08, 2025 -

Lahwr Myn Bhy Py Ays Ayl Trafy Ka Astqbal Zwr W Shwr Se

May 08, 2025

Lahwr Myn Bhy Py Ays Ayl Trafy Ka Astqbal Zwr W Shwr Se

May 08, 2025