Why BofA Thinks Investors Shouldn't Be Alarmed By High Stock Valuations

Table of Contents

BofA's Rationale: Strong Corporate Earnings Justify High Prices

BofA's central thesis revolves around the idea that robust corporate performance justifies current high stock valuations. The bank's analysts point to significant earnings growth and revenue expansion across various sectors as a key supporting factor.

Robust Profitability and Revenue Growth

Strong corporate earnings and revenue growth are the bedrock of BofA's argument. Many companies are not only meeting but exceeding earnings expectations, indicating a healthy economic environment.

- Technology: The tech sector continues to show impressive revenue growth, driven by cloud computing, software-as-a-service (SaaS), and artificial intelligence.

- Financials: Banks and financial institutions are benefiting from rising interest rates, boosting their profitability.

- Energy: The energy sector has experienced a significant surge in profits due to increased demand and higher commodity prices.

Examples of companies exceeding earnings expectations include several tech giants and major players in the energy sector. This sustained earnings growth and profitability signal strong underlying fundamentals supporting current stock prices. This impressive corporate performance fuels the argument that high stock valuations are not solely based on speculation but reflect real, tangible growth. The sustained strength in revenue growth and profitability contributes significantly to the justification of higher stock valuations.

Low Interest Rates and Monetary Policy

Low interest rates and the accommodative monetary policies implemented in recent years have also played a significant role in sustaining high valuations. Low interest rates encourage investment, making borrowing cheaper for companies and increasing the attractiveness of equities over bonds.

- Low borrowing costs fuel corporate expansion and investment, leading to higher earnings.

- Quantitative easing (QE) programs have injected liquidity into the market, boosting asset prices, including stocks.

- Investor behavior shifts towards higher-risk assets in a low-interest-rate environment, pushing up demand for equities.

The impact of these monetary policies on investor behavior cannot be overstated. The prolonged period of low interest rates has significantly impacted investment choices, driving capital flows toward equities and contributing to higher stock valuations.

Addressing Inflation Concerns and Their Impact on Valuations

Inflation is undeniably a concern, but BofA believes its impact on long-term economic growth is limited. The bank argues that inflationary pressures are largely transitory and that companies are successfully adapting to the current environment.

Inflation's Limited Impact on Long-Term Growth

BofA's analysis suggests that while short-term inflationary pressures exist, they are unlikely to derail long-term economic growth. The bank cites various factors, including supply chain improvements and easing commodity price increases, to support this view. While inflation data shows some fluctuations, BofA points to long-term trends indicating a moderation of inflationary pressures, contributing to a positive long-term economic outlook.

Companies Adapting to Inflationary Pressures

Many companies are proactively managing inflationary pressures through effective cost management and price adjustments. This mitigates the negative impact on profitability and demonstrates resilience in the face of economic challenges. They are adjusting strategies, optimizing supply chains, and implementing innovative cost-saving measures.

- Cost management strategies: Companies are streamlining operations, negotiating better deals with suppliers, and improving efficiency to offset rising costs.

- Price adjustments: Many businesses are carefully increasing prices to maintain profit margins, demonstrating an ability to pass on some inflationary pressures to consumers.

- Technological innovation: Investment in technology and automation is helping companies boost productivity and reduce reliance on expensive labor.

Successful navigation of these inflationary challenges further supports the argument that current high stock valuations are not solely a reflection of inflation-driven speculation.

The Importance of Long-Term Investment Strategies Amidst Volatility

Despite market volatility, BofA emphasizes the importance of maintaining a long-term investment perspective. They stress that short-term fluctuations should not overshadow the significant long-term growth potential.

Long-Term Growth Potential Remains Strong

BofA analysts see the current market environment as a temporary phase within a broader trajectory of long-term economic expansion. The argument is that focusing on the long-term growth potential, rather than short-term market noise, is crucial for investors.

- Long-term investors can weather short-term market corrections and benefit from the market's overall upward trend.

- Historical data demonstrates the long-term growth potential of the stock market.

- Focusing on fundamental analysis and company performance is more important than reacting to daily market fluctuations.

Diversification and Risk Management

Diversification and robust risk management strategies are crucial for navigating market uncertainty. Investors should not place all their eggs in one basket.

- Diversifying across different asset classes (stocks, bonds, real estate) reduces overall portfolio risk.

- Risk mitigation techniques, such as hedging strategies, can help protect against potential losses.

- Regular portfolio rebalancing ensures alignment with long-term investment goals.

Implementing these strategies allows investors to mitigate the potential negative effects of high stock valuations.

Conclusion: Why High Stock Valuations Shouldn't Necessarily Trigger Investor Alarm

BofA's analysis reveals that while high stock valuations are indeed present, they are supported by strong corporate earnings, manageable inflationary pressures, and the long-term growth potential of the market. The bank argues that focusing on robust fundamental analysis, diversification, and a long-term investment horizon is key. Don't let high stock valuations trigger unnecessary alarm. Consider BofA's perspective and develop a robust, long-term investment strategy based on thorough research and risk management. Remember, a well-informed approach to investing is crucial when dealing with high stock valuations.

Featured Posts

-

58m Bid Rejected Arsenals Pursuit Of Striker Intensifies

May 28, 2025

58m Bid Rejected Arsenals Pursuit Of Striker Intensifies

May 28, 2025 -

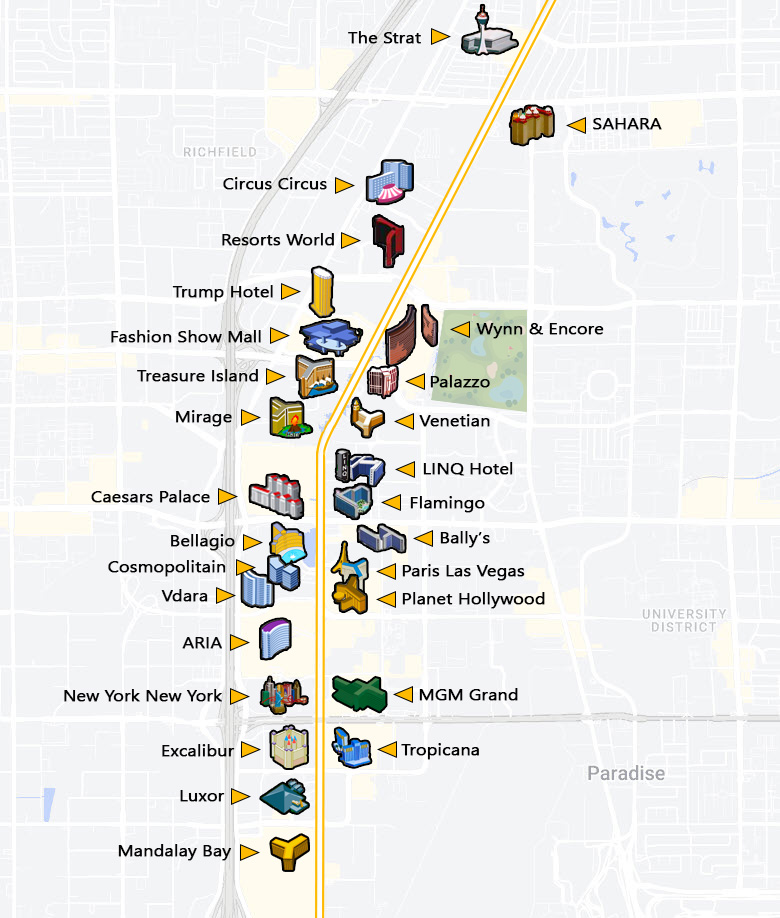

Las Vegas Strips American Music Awards Free Ticket Opportunities

May 28, 2025

Las Vegas Strips American Music Awards Free Ticket Opportunities

May 28, 2025 -

Bianca Censoris Nearly Nude Outfit Another Bold Appearance

May 28, 2025

Bianca Censoris Nearly Nude Outfit Another Bold Appearance

May 28, 2025 -

Seattle Weather Forecast Rain Through The Weekend

May 28, 2025

Seattle Weather Forecast Rain Through The Weekend

May 28, 2025 -

Climate Whiplash Urgent Action Needed To Protect Global Cities

May 28, 2025

Climate Whiplash Urgent Action Needed To Protect Global Cities

May 28, 2025