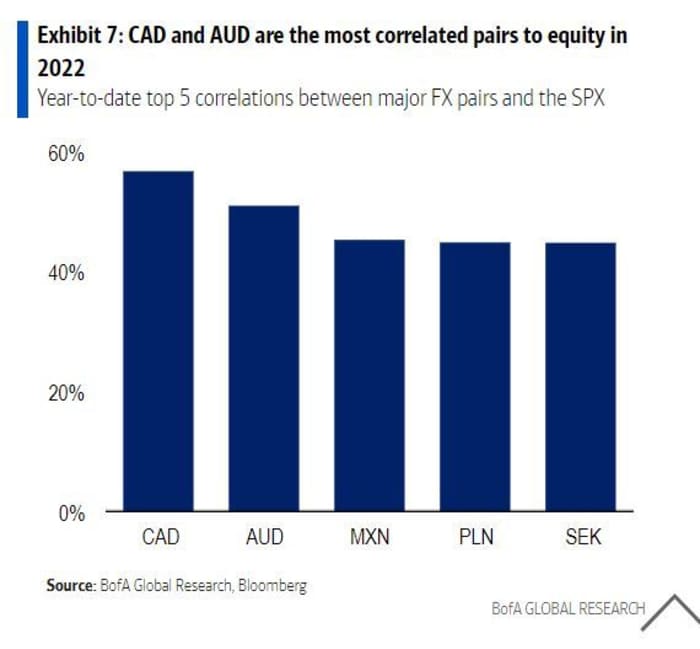

Why Current High Stock Market Valuations Shouldn't Deter Investors (BofA)

Table of Contents

The Importance of Long-Term Investing Over Short-Term Fluctuations

The most crucial element of successful stock market investing is a long-term perspective. Trying to time the market – attempting to buy low and sell high – is a notoriously difficult, if not impossible, task. Even seasoned professionals struggle with consistent market timing accuracy. Instead, focusing on long-term growth and the power of compounding returns is far more effective in navigating market volatility and high valuations.

- Historical Data: Throughout history, the stock market has consistently shown growth over the long term, even after periods of high valuations. Short-term dips are inevitable, but the overall trend tends upward.

- Compounding Interest: The magic of compounding interest allows your returns to generate further returns, exponentially increasing your wealth over time. The longer your investment horizon, the more pronounced this effect becomes.

- Ignoring Market Noise: Short-term market fluctuations, news cycles, and daily price swings are essentially noise. Focusing on these distractions can lead to impulsive decisions that undermine your long-term strategy. Maintain a disciplined approach and stick to your plan.

Understanding Current Economic Fundamentals and Growth Projections

Current high stock market valuations aren't occurring in a vacuum. Several positive economic fundamentals support the current market levels, providing a context for understanding the valuations.

- Positive Economic Indicators: Factors such as continued GDP growth (albeit potentially slowing), robust corporate earnings in many sectors, and ongoing technological innovation contribute to a positive outlook.

- Corporate Earnings Growth: While inflation has impacted margins for some companies, many continue to report strong earnings growth, justifying, at least partially, the current price-to-earnings ratios. Analyzing individual company performance is crucial here.

- BofA's Market Outlook: (Insert relevant BofA economic forecasts and projections here if available. This section should include specific data points and insights from BofA's research to add credibility and authority). This should incorporate their projections for inflation, interest rates, and overall economic growth.

Identifying Undervalued Sectors and Opportunities Within High Valuations

Even in a seemingly expensive market, opportunities exist for discerning investors. Not all sectors or individual stocks are equally valued.

- Undervalued Sectors: Thorough sector analysis can reveal areas that may be lagging the overall market, presenting potential buying opportunities. (Mention specific sectors based on current market analysis, citing credible sources).

- Value Investing Strategies: Value investing focuses on identifying stocks trading below their intrinsic value. This approach can be particularly effective in markets with high overall valuations.

- Growth Stocks and Diversification: While growth stocks often command high valuations, identifying companies with strong future growth potential can still yield high returns. Diversification across different sectors and investment styles is critical to mitigating risk.

Managing Risk and Setting Realistic Expectations

While a positive economic outlook suggests continued growth, it's crucial to acknowledge inherent market risks.

- Risk Management Strategies: Diversifying your portfolio across various asset classes (stocks, bonds, real estate, etc.) is crucial to reduce risk. Regular portfolio rebalancing ensures your asset allocation aligns with your risk tolerance.

- Determining Risk Tolerance: Understanding your own risk tolerance is paramount. Are you comfortable with higher volatility in pursuit of potentially higher returns, or do you prioritize capital preservation?

- Realistic Return Expectations: Setting realistic return expectations is essential. While long-term stock market returns historically outperform other asset classes, it's unrealistic to expect consistent, outsized gains.

Conclusion

High stock market valuations shouldn't automatically deter investors. A long-term investment strategy, focused on compounding returns and economic fundamentals, is key to navigating market volatility. By understanding current economic indicators, identifying undervalued opportunities, and managing risk effectively, investors can potentially benefit even in a high-valuation environment. Remember that even with a positive outlook, understanding your risk tolerance and setting realistic expectations are crucial.

Consult with a qualified financial advisor to develop a personalized investment strategy aligned with your goals and risk profile. Conduct thorough research and don't hesitate to utilize resources from reputable financial institutions like BofA to enhance your investment knowledge. Understanding why high stock market valuations shouldn't deter you is a crucial step towards achieving your long-term financial objectives.

Featured Posts

-

Photo 5137820 Benson Boone At The 2025 I Heart Radio Music Awards

Apr 26, 2025

Photo 5137820 Benson Boone At The 2025 I Heart Radio Music Awards

Apr 26, 2025 -

Strategic Location A Us Military Base And The Growing China Influence

Apr 26, 2025

Strategic Location A Us Military Base And The Growing China Influence

Apr 26, 2025 -

Shedeur Sanders Nfl Future Cam Newtons Prediction And Team Analysis

Apr 26, 2025

Shedeur Sanders Nfl Future Cam Newtons Prediction And Team Analysis

Apr 26, 2025 -

Ajaxs Brobbey Strength And Power To Decide Europa League Tie

Apr 26, 2025

Ajaxs Brobbey Strength And Power To Decide Europa League Tie

Apr 26, 2025 -

Ecbs Holzmann Highlights Disinflationary Effects Of Trump Tariffs

Apr 26, 2025

Ecbs Holzmann Highlights Disinflationary Effects Of Trump Tariffs

Apr 26, 2025

Latest Posts

-

David Geiers Vaccine Views And His Role In Hhs Vaccine Study Analysis

Apr 27, 2025

David Geiers Vaccine Views And His Role In Hhs Vaccine Study Analysis

Apr 27, 2025 -

Controversy Surrounds Hhss Hiring Of Vaccine Skeptic David Geier

Apr 27, 2025

Controversy Surrounds Hhss Hiring Of Vaccine Skeptic David Geier

Apr 27, 2025 -

The Hhs Decision David Geier And The Future Of Vaccine Research

Apr 27, 2025

The Hhs Decision David Geier And The Future Of Vaccine Research

Apr 27, 2025 -

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025

Analysis Of Vaccine Studies Hhss Choice Of David Geier Sparks Debate

Apr 27, 2025 -

David Geiers Appointment To Analyze Vaccine Studies An Hhs Controversy

Apr 27, 2025

David Geiers Appointment To Analyze Vaccine Studies An Hhs Controversy

Apr 27, 2025