Will Republican Infighting Sink Trump's Tax Bill?

Table of Contents

The Freedom Caucus and Conservative Opposition

The House Freedom Caucus, a group of fiscally conservative Republicans, presents a significant hurdle to the bill's passage. Their concerns stem from the bill's perceived shortcomings in delivering substantial tax relief for corporations and high-income earners, alongside worries about its long-term fiscal implications.

Concerns over the Tax Bill's Scope and Impact

The Freedom Caucus's opposition is rooted in several key areas:

- Opposition to the bill's proposed elimination of individual tax deductions: Members argue this disproportionately affects middle-class families and fails to deliver on promised tax cuts for everyone.

- Concerns about the long-term fiscal impact and increased national debt: They fear the tax cuts will significantly increase the national debt without sufficient offsetting measures. This concern is a central tenet of their fiscally conservative ideology. The debate focuses on responsible fiscal policy and long-term economic consequences.

- Calls for deeper corporate tax cuts: Some members believe the proposed corporate tax cuts are insufficient to stimulate economic growth and advocate for more aggressive reductions. This highlights the internal debate within the Republican party regarding the optimal approach to corporate tax reform.

Negotiating with the Freedom Caucus

Republican leadership faces a monumental challenge in negotiating with the Freedom Caucus. Concessions could alienate moderate Republicans, while a hardline stance risks losing crucial votes altogether. This internal negotiation involves delicate political maneuvering and potential compromises.

- Potential compromises involving targeted tax cuts or adjustments to the bill’s timeline: These could include adding specific provisions to address the Freedom Caucus's concerns or delaying certain aspects of the bill.

- The risk of losing moderate Republican support through excessive concessions to the Freedom Caucus: This highlights the precarious balancing act required to secure enough votes. The outcome of these negotiations could significantly alter the bill's final form.

- The influence of powerful lobbyists and interest groups on negotiations: These groups exert significant pressure, potentially exacerbating divisions within the party and influencing the final outcome. The interplay between political pressure and lobbying efforts further complicates the legislative process.

Senate Republicans and Internal Divisions

The Senate presents an even steeper climb for the Trump tax bill. With a narrower Republican majority and a wider spectrum of ideological viewpoints, the path to passage is fraught with peril. The internal divisions within the Senate Republican caucus present a serious challenge to the bill's passage.

Differing Priorities and Ideological Tensions

The Senate's diverse membership complicates matters significantly:

- Senators with concerns about the tax bill’s impact on the national debt and the deficit: Concerns about fiscal responsibility are not limited to the House Freedom Caucus; many Senators share similar anxieties. This is a significant area of contention.

- Senators who favor different approaches to tax reform, leading to disagreements over specific provisions: Differing opinions on tax policy create further obstacles to achieving a unified Republican front.

- The influence of individual senators on the bill’s fate through filibusters and amendments: Individual senators wield considerable power, capable of derailing the bill through procedural maneuvers.

The Role of Senatorial Leadership

Senate Majority Leader Mitch McConnell faces the unenviable task of unifying his caucus. His success in navigating these internal divisions will be crucial to the bill's fate. The leadership’s ability to manage these divisions will be a key determinant of the bill's success.

- McConnell's strategies for winning over reluctant senators: His political acumen and negotiation skills will be tested to their limits. Successful strategies might include tailored compromises or appealing to senators' individual priorities.

- Potential compromises and concessions to secure necessary votes: McConnell will likely have to make significant concessions to gain enough support to overcome any opposition.

- The use of procedural maneuvers to expedite the bill's passage: Strategic use of Senate rules could help McConnell to overcome procedural hurdles and push the bill through.

The Impact of Public Opinion and Media Scrutiny

Public and media reaction significantly influence the political landscape surrounding the bill:

- Public disapproval of the tax bill due to its perceived benefits for the wealthy: Negative public perception could put pressure on Republican senators to oppose the bill.

- Negative media coverage highlighting the Republican infighting and potential consequences: Media scrutiny amplifies the impact of internal disagreements, potentially further eroding public support.

- The influence of public opinion on individual senators' votes: Senators are sensitive to public opinion and might adjust their stance based on public pressure.

Conclusion

The fate of Trump's tax bill remains deeply uncertain, significantly hampered by the deep divisions and infighting within the Republican party. The ability of Republican leadership to bridge the chasm between the Freedom Caucus, moderate Republicans, and diverse Senate factions will determine whether this ambitious tax plan becomes law. The ongoing Republican infighting over Trump's tax bill poses a serious threat to its passage, highlighting the challenges of governing with a narrow majority and significant internal ideological differences. Will Republicans overcome their internal struggles? Only time will tell. Stay informed on the latest developments regarding this critical legislation and the ongoing Republican infighting over Trump's tax bill to understand the potential consequences.

Featured Posts

-

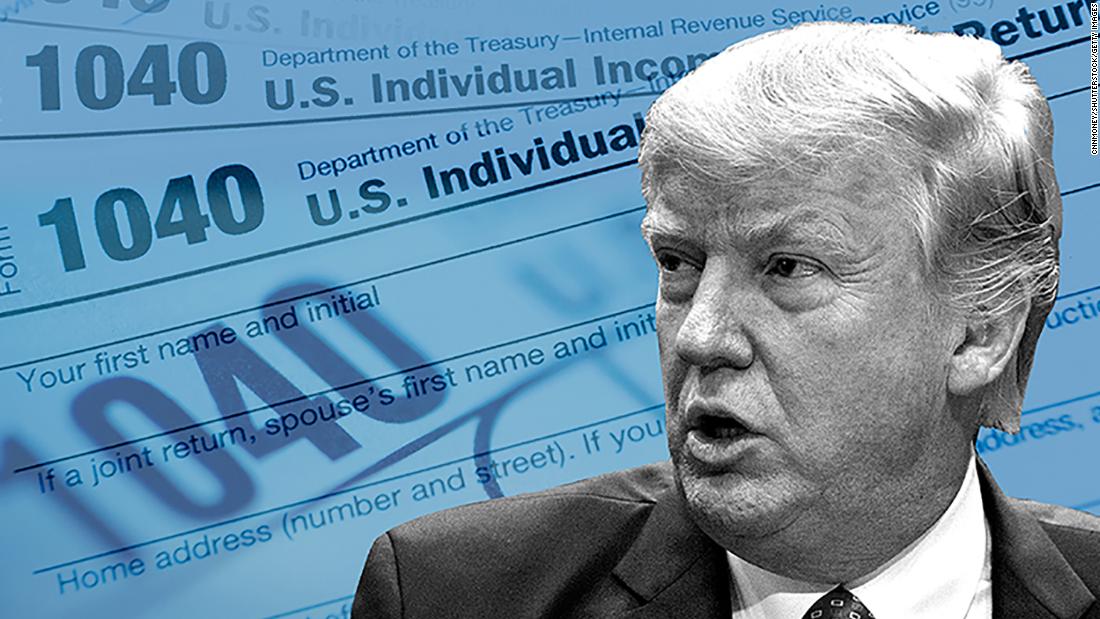

Con Alberto Ardila Olivares La Garantia De Gol Esta Asegurando

Apr 29, 2025

Con Alberto Ardila Olivares La Garantia De Gol Esta Asegurando

Apr 29, 2025 -

Seven Injured In North Carolina University Shooting One Dead

Apr 29, 2025

Seven Injured In North Carolina University Shooting One Dead

Apr 29, 2025 -

Metro Vancouver Housing Market Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025

Metro Vancouver Housing Market Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025 -

1 33 Mln Zl Za Porsche 911 Czy To Oplacalna Inwestycja Analiza Polskiego Rynku

Apr 29, 2025

1 33 Mln Zl Za Porsche 911 Czy To Oplacalna Inwestycja Analiza Polskiego Rynku

Apr 29, 2025 -

Black Hawk Helicopter Crash Pilot Ignored Instructors Warnings

Apr 29, 2025

Black Hawk Helicopter Crash Pilot Ignored Instructors Warnings

Apr 29, 2025