XRP (Ripple) At Sub-$3 Levels: Investment Opportunities And Challenges

Table of Contents

Current Market Sentiment and Price Analysis of XRP

Understanding the current market sentiment and conducting a thorough price analysis are crucial before investing in XRP. This involves examining both technical and fundamental factors.

Technical Analysis

Technical analysis of XRP's price charts reveals valuable insights. Currently, we observe [insert current support and resistance levels]. The moving averages (e.g., 50-day, 200-day) are [insert current state of moving averages – are they crossing? What does this suggest?]. Trading volume has been [insert description of recent trading volume – high, low, increasing, decreasing]. These factors, coupled with other indicators, help us gauge potential price movements.

- Relative Strength Index (RSI): The RSI is currently [insert current RSI value] suggesting [overbought/oversold/neutral] conditions.

- Moving Average Convergence Divergence (MACD): The MACD is [insert current state of MACD – bullish, bearish, neutral] which indicates [interpretation of MACD signal].

- Recent Price Action: The recent price action shows [describe recent price movements – e.g., a period of consolidation, a sharp drop followed by a slight recovery]. This correlates with the broader cryptocurrency market trends, which are currently [describe overall market sentiment – bullish, bearish, sideways].

Fundamental Analysis

Fundamental analysis focuses on the underlying factors driving XRP's value. The ongoing legal battle with the Securities and Exchange Commission (SEC) significantly impacts investor sentiment and price.

- SEC Lawsuit Impact: The SEC lawsuit casts a shadow of uncertainty over XRP's future. A negative outcome could severely depress the price, while a positive resolution could lead to a significant price surge.

- Partnerships and Adoption: Ripple continues to expand its RippleNet network, fostering cross-border payments and increasing the utility of XRP. [Mention specific recent partnerships or adoption milestones]. This growth contributes positively to XRP's long-term prospects.

- RippleNet Growth: The expansion of RippleNet into new markets and its increasing transaction volume are key indicators of XRP’s growing utility and potential for future price appreciation. [Include data on RippleNet transaction volume or number of partners if available].

Investment Opportunities in Sub-$3 XRP

Despite the challenges, investing in XRP at sub-$3 levels presents certain opportunities.

Potential for Price Appreciation

The potential for XRP to rebound to higher price levels exists, contingent on several factors.

- Positive Legal Outcome: A favorable ruling in the SEC lawsuit would likely trigger a significant price rally, potentially exceeding previous highs.

- Increased Institutional Adoption: Increased adoption by financial institutions and corporations could drive demand and push the price upward.

- Technological Advancements: Further development and integration of XRP into existing payment systems could increase its utility and attract more investors.

- Historical Price Performance: Analyzing XRP's historical price performance can offer insights into potential price targets. [Include relevant data and analysis].

Dollar-Cost Averaging (DCA) Strategy

Mitigating the risk inherent in volatile cryptocurrencies like XRP is crucial. Dollar-cost averaging (DCA) is a proven strategy to minimize the impact of market fluctuations.

- How DCA Works: DCA involves investing a fixed amount of money at regular intervals, regardless of the price. This reduces the risk of investing a large sum at a market peak.

- Advantages of DCA: DCA helps to average out the purchase price, reducing the overall impact of price volatility. It's a less emotionally driven approach to investing, as it eliminates the pressure of trying to time the market.

- Example: Investing $100 per week in XRP over several months will reduce your exposure to sudden price drops.

Challenges and Risks of Investing in XRP at Current Levels

While opportunities exist, significant challenges and risks accompany investing in XRP at its current price.

Regulatory Uncertainty

The SEC lawsuit remains a major source of uncertainty.

- Risk of Regulatory Uncertainty: A negative ruling could result in significant price declines and potentially legal ramifications for investors.

- Potential Outcomes: Analyzing different potential outcomes of the lawsuit – a settlement, a win for the SEC, or a win for Ripple – is crucial in assessing the risk. Each outcome will drastically affect the future price of XRP.

Market Volatility

The cryptocurrency market is inherently volatile.

- High Volatility Risk: XRP's price is subject to rapid and significant swings, making it a high-risk investment.

- Risk Management: Implementing risk management strategies such as stop-loss orders can help limit potential losses during market downturns. Diversification across multiple cryptocurrencies or asset classes is also recommended.

Conclusion

XRP's sub-$3 price presents a complex investment proposition. The potential for future price appreciation driven by positive legal developments, increased adoption, and technological advancements is undeniable. However, significant risks persist, mainly due to regulatory uncertainty and inherent market volatility. A thorough understanding of both the opportunities and challenges is vital. Employing a strategy like dollar-cost averaging can help mitigate risk, but careful research, risk assessment, and possibly consultation with a financial advisor are crucial before investing in XRP or any cryptocurrency. Remember, investing in XRP involves significant risk, and you could lose some or all of your investment. Proceed cautiously and only invest what you can afford to lose.

Featured Posts

-

Cong Nhan Dien Luc Mien Nam Xay Dung Mach 500k V Kho Khan Va Chien Thang

May 01, 2025

Cong Nhan Dien Luc Mien Nam Xay Dung Mach 500k V Kho Khan Va Chien Thang

May 01, 2025 -

Train Engine Failure Halts Warri Itakpe Rail Services Nrc Announcement

May 01, 2025

Train Engine Failure Halts Warri Itakpe Rail Services Nrc Announcement

May 01, 2025 -

Kentucky Storm Damage Assessments Delays And Reasons Why

May 01, 2025

Kentucky Storm Damage Assessments Delays And Reasons Why

May 01, 2025 -

Enexis En Kampen In Juridisch Conflict Aansluiting Stroomnet In Kort Geding

May 01, 2025

Enexis En Kampen In Juridisch Conflict Aansluiting Stroomnet In Kort Geding

May 01, 2025 -

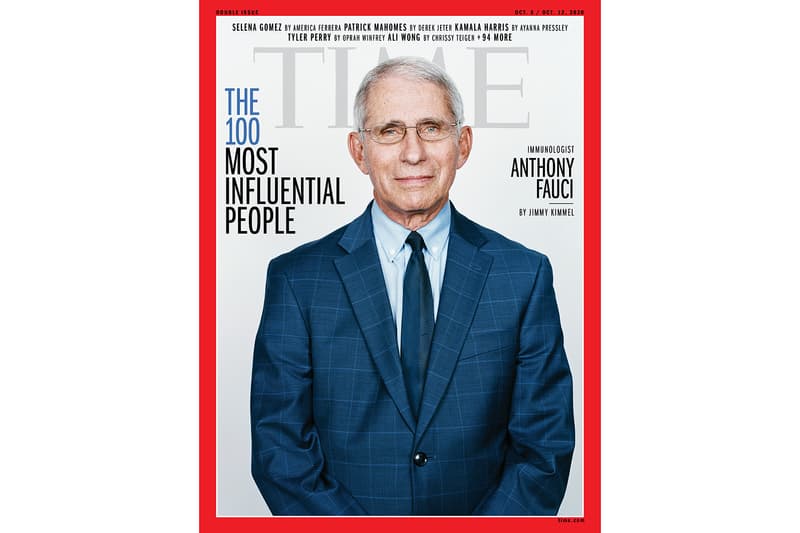

Time Magazine Names Noa Argamani Among The Worlds 100 Most Influential

May 01, 2025

Time Magazine Names Noa Argamani Among The Worlds 100 Most Influential

May 01, 2025