XRP (Ripple) Price Analysis: Buy Or Sell Below $3?

Table of Contents

Technical Analysis of XRP Price

Analyzing XRP's price using technical indicators is crucial for gauging its potential future movement. By examining chart patterns and trading volume, we can form a clearer picture of the current market sentiment and potential price shifts.

Chart Patterns and Indicators

Recent XRP price action reveals key support and resistance levels. Analyzing these levels in conjunction with indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) offers valuable insights.

- Bullish Signals: A rising RSI above 50, a bullish MACD crossover, and price breaking above key resistance levels suggest potential upward momentum. This would indicate a positive trend in the XRP price chart.

- Bearish Signals: Conversely, an RSI below 30, a bearish MACD crossover, and price falling below key support levels signal potential downward pressure. A look at the XRP price chart would confirm this.

- Example: (Insert a relevant chart showing XRP price action with key support/resistance levels and indicator readings. Clearly label the chart and explain its significance.) This chart showcases a clear example of how XRP price action and technical indicators interact. Understanding these interactions is key to XRP price prediction.

Keyword integration: XRP price chart, technical indicators XRP, Ripple price prediction, support resistance levels XRP.

Volume Analysis

Examining XRP trading volume alongside price action provides crucial context. High volume during price increases confirms strength, suggesting a sustained upward trend. Conversely, high volume during price decreases indicates weakness, potentially signaling a continued downturn.

- High Volume Confirmation: Large trading volume accompanying a price breakout above resistance confirms the validity of the upward trend and increases the likelihood of further gains. This high volume is a strong indicator of significant investor confidence in the future direction of the XRP price.

- Low Volume Weakness: Low volume during price movements suggests weak momentum and a potential for reversal. Low volume periods often precede significant price changes. Analyzing this volume is crucial for any Ripple volume analysis.

- Example: (Insert a chart showing XRP price and volume, highlighting periods of high and low volume and their correlation with price movements). This visualization emphasizes the importance of integrating volume analysis into your overall XRP price strategy.

Keyword integration: XRP trading volume, Ripple volume analysis, XRP price momentum.

Ripple's Legal Battle and Regulatory Landscape

The ongoing SEC lawsuit against Ripple and the broader regulatory environment significantly impact XRP's price. Understanding these factors is crucial for assessing the risk involved.

SEC Lawsuit Impact

The SEC lawsuit alleging that XRP is an unregistered security presents substantial uncertainty. The outcome could dramatically influence XRP's price.

- Positive Ruling: A favorable ruling for Ripple could lead to a significant price surge as regulatory uncertainty diminishes, boosting investor confidence and driving up XRP's price. The market might perceive this as a positive outcome.

- Negative Ruling: An unfavorable ruling could cause a sharp price drop as investors react to the negative implications for the future of XRP. This would be a serious blow for the broader XRP market.

- Settlement: A settlement could lead to a less dramatic price reaction, depending on the terms of the agreement. The Ripple SEC lawsuit greatly affects XRP regulatory uncertainty.

Keyword integration: Ripple SEC lawsuit, XRP regulatory uncertainty, Ripple legal battle impact on price.

Global Regulatory Scrutiny of Cryptocurrencies

The broader regulatory landscape for cryptocurrencies also plays a pivotal role. Increased regulatory clarity in certain jurisdictions could benefit XRP's adoption, while stricter regulations could stifle growth.

- Positive Regulatory Developments: Clearer regulatory frameworks in major markets could lead to increased institutional adoption and drive up XRP's price. A more positive global crypto regulatory framework could be a major catalyst.

- Negative Regulatory Developments: Conversely, stringent regulations or outright bans in key markets could severely impact XRP's price. This highlights the importance of staying informed on global crypto regulations.

- Example: Discuss specific regulatory developments in different countries/regions and their potential effect on XRP.

Keyword integration: Cryptocurrency regulation, global crypto regulations, XRP regulatory compliance.

Market Sentiment and Adoption

Analyzing market sentiment and adoption rates offers insights into investor confidence and potential price movements.

Social Media Sentiment

Social media sentiment towards XRP reflects overall investor confidence. Analyzing social media platforms using sentiment analysis tools can provide a gauge of prevailing attitudes.

- Positive Sentiment: High levels of positive sentiment on social media often correlate with increased price appreciation. This positive sentiment can act as a catalyst for price increases.

- Negative Sentiment: Conversely, predominantly negative sentiment can signal downward pressure on the price. This negative sentiment can quickly drive down the price of XRP.

- Example: Mention any recent significant social media events and their impact on XRP's price. Sentiment analysis helps to determine the overall tone of conversations around XRP in the broader Ripple community.

Keyword integration: XRP social media sentiment, Ripple community sentiment, investor confidence in XRP.

Institutional Adoption of XRP

The level of institutional adoption significantly influences XRP's price. Increased institutional involvement typically signals greater stability and attracts further investment.

- Partnerships and Integrations: New partnerships and integrations that showcase real-world applications for XRP could boost its price significantly. These partnerships are a major factor in increasing the price of XRP.

- Large-scale Adoption: Significant institutional adoption can lead to increased liquidity and price stability. Institutional investors often play a major role in driving up the price.

- Example: Discuss any recent institutional adoption of XRP and its impact on the price. This highlights the importance of large-scale XRP adoption.

Keyword integration: Institutional XRP adoption, Ripple partnerships, large-scale XRP adoption.

Conclusion

Our analysis reveals a complex picture. While technical indicators offer potential clues about short-term price movements, the ongoing SEC lawsuit and broader regulatory environment introduce significant uncertainty. Positive social media sentiment and increasing institutional adoption can support the price, but regulatory headwinds remain a significant factor. Whether to buy or sell XRP below $3 depends on your risk tolerance and investment horizon.

Call to Action: Make an informed decision about whether to buy or sell XRP below $3 by conducting your own thorough research and considering the information presented in this XRP (Ripple) price analysis. Remember, cryptocurrency investment involves significant risk. Thoroughly research the XRP market before investing.

Featured Posts

-

Enhanced Cloud Streaming On Play Station Portal A Focus On Classic Games

May 02, 2025

Enhanced Cloud Streaming On Play Station Portal A Focus On Classic Games

May 02, 2025 -

Supreme Court Decision Lees Presidential Hopes Derailed By Acquittal Reversal

May 02, 2025

Supreme Court Decision Lees Presidential Hopes Derailed By Acquittal Reversal

May 02, 2025 -

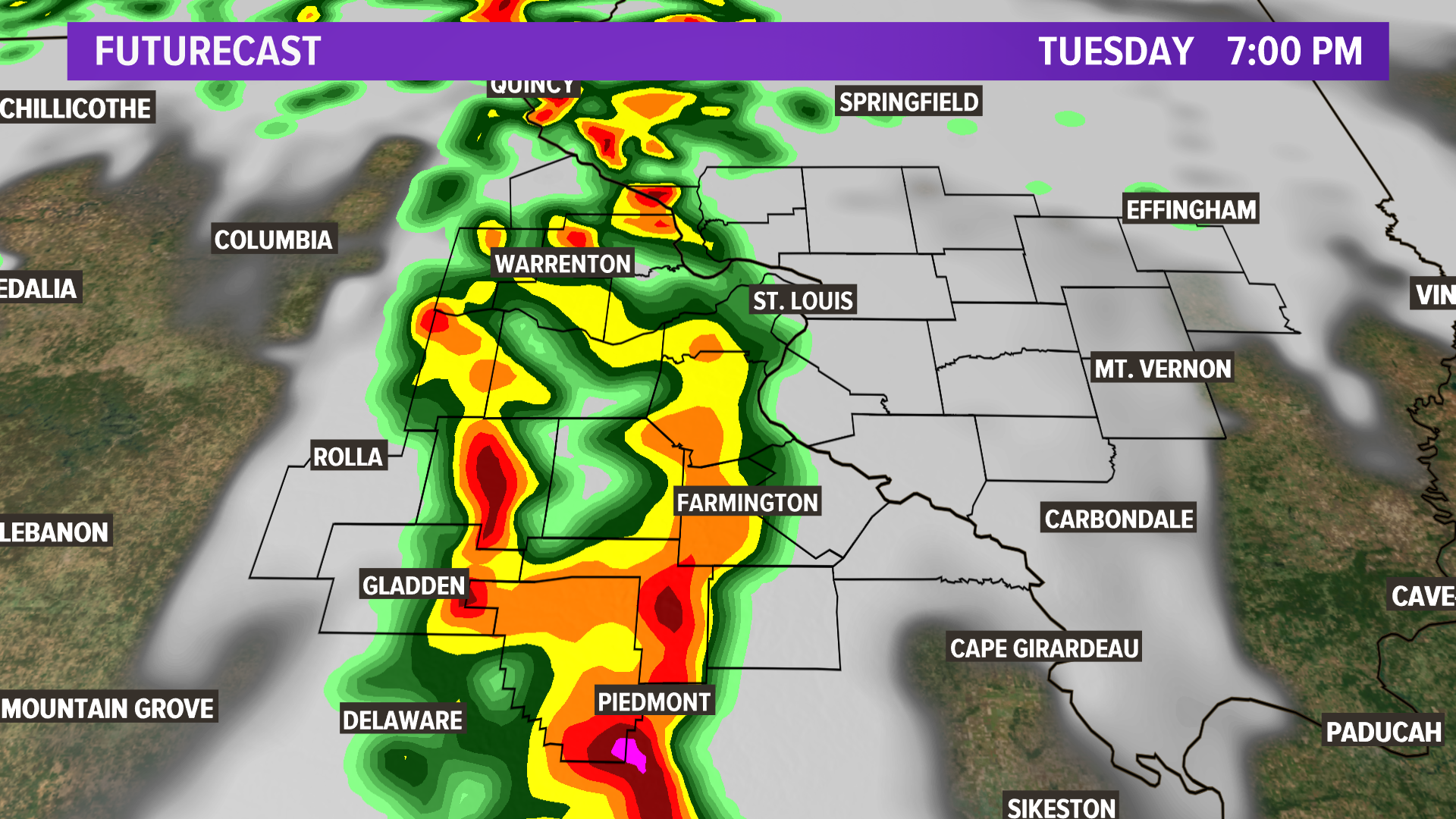

Oklahoma Strong Wind Warning Severe Weather Timeline And Impacts

May 02, 2025

Oklahoma Strong Wind Warning Severe Weather Timeline And Impacts

May 02, 2025 -

100 Year Old Actress Priscilla Pointer Amy Irvings Mother Dead

May 02, 2025

100 Year Old Actress Priscilla Pointer Amy Irvings Mother Dead

May 02, 2025 -

Fortnite X Sabrina Carpenter When Is The Event

May 02, 2025

Fortnite X Sabrina Carpenter When Is The Event

May 02, 2025