1050% Price Jump: AT&T's Concerns Over Broadcom's VMware Deal

Table of Contents

AT&T's Stance and the 1050% Price Increase

AT&T's vocal opposition to the Broadcom VMware acquisition is directly linked to a reported 1050% price hike on certain VMware products. This dramatic increase is not just a matter of concern for AT&T; it signals a potential shift in the market dynamics.

-

Specific Products Affected: The reported 1050% price increase affects key VMware products, including vSphere, a crucial component of many enterprise virtualization environments, and vSAN, VMware's software-defined storage solution. Other products are also expected to see significant price increases, although the exact figures are yet to be fully disclosed.

-

AT&T's Official Statement: AT&T has publicly expressed its deep concern over the potential anti-competitive effects of the merger, citing the drastic price increase as a prime example of the risks involved. Their official statements emphasize the negative impact this will have on their operational costs and the wider industry.

-

Impact on Operational Costs: This massive price hike directly impacts AT&T's operational budget, potentially forcing them to absorb increased costs or pass them onto consumers through higher service prices. This ripple effect could impact the entire telecommunications sector.

-

Anti-competitive Behavior?: The scale of the price increase raises serious questions about potential anti-competitive behavior. Critics argue that this drastic price jump suggests Broadcom intends to leverage its market power post-acquisition to stifle competition and increase profits.

The price increase isn't just a matter of AT&T's bottom line; it represents a significant potential shift in the balance of power within the enterprise software market. The resulting cost implications could cascade through various industries, impacting businesses that depend on VMware's infrastructure.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom VMware acquisition faces intense scrutiny from global regulatory bodies due to significant antitrust concerns. The sheer size of the deal and the potential for market dominance are major factors fueling these concerns.

-

Arguments Against the Acquisition: Opponents argue that the merger would create a monopoly, eliminating competition and giving Broadcom undue control over critical cloud infrastructure and enterprise software. This lack of competition could lead to higher prices, reduced innovation, and less choice for consumers.

-

Regulatory Involvement: Regulatory bodies like the Federal Trade Commission (FTC) in the US and the European Commission (EC) are currently investigating the merger, scrutinizing its potential anti-competitive effects. These investigations could significantly delay or even block the acquisition.

-

Potential Legal Challenges: Several legal challenges are anticipated, focusing on the potential for monopolistic practices and the negative impact on consumers and businesses. The success of these challenges will depend on the evidence presented and the interpretation of antitrust laws by the courts.

-

Impact on Market Share: The merger's success could significantly alter the market share in cloud infrastructure and enterprise software, potentially leading to less innovation and higher prices for consumers and businesses.

The legal battle surrounding the Broadcom VMware deal is likely to be complex and protracted. The outcome will have far-reaching consequences for the entire technology landscape.

Impact on the Cloud Computing Landscape

VMware is a significant player in the cloud computing market, providing virtualization solutions critical to many businesses' cloud infrastructure. Broadcom's acquisition has significant implications for the future of this landscape.

-

VMware's Current Position: VMware holds a substantial market share in virtualization technologies, offering a range of products and services essential to many cloud deployments.

-

Broadcom's Plans for VMware: Broadcom's intentions for VMware after the acquisition remain a subject of speculation and concern. Their strategic plans will largely determine the future competitiveness of the cloud infrastructure market.

-

Impact on Cloud Market Competition: The acquisition threatens to reduce competition, potentially leading to less innovation and higher prices for cloud services. Businesses could face reduced choices and potentially less flexibility in their cloud strategies.

-

VMware Alternatives: Businesses are already exploring alternative virtualization and cloud infrastructure solutions in anticipation of potential price increases and reduced competition following the merger.

The Broadcom VMware acquisition has the potential to reshape the cloud computing landscape, influencing the choices available to businesses and the overall dynamics of the market.

Implications for Businesses and Consumers

The proposed merger and the resultant price increases directly affect both businesses and consumers. Understanding these implications is crucial for making informed decisions.

-

Consequences for Businesses: Businesses reliant on VMware products face significant cost increases. Budget planning and long-term strategy must account for these potential price hikes and explore alternative solutions.

-

Cost-Saving Strategies: Businesses need to actively explore cost-saving strategies, including negotiating contracts, migrating to alternative solutions, and optimizing their existing infrastructure.

-

Broader Economic Impact: The increased prices could have a broader economic impact, affecting the affordability of IT services and potentially slowing down innovation across various sectors.

-

Consumer-Facing Implications: While less direct, the increased costs for businesses will likely trickle down, potentially impacting the prices of goods and services for consumers.

The Broadcom VMware deal is not just a tech story; it has implications for businesses of all sizes and ultimately affects consumers through higher prices and potentially reduced innovation.

Conclusion

AT&T's concerns regarding the Broadcom VMware acquisition are far from isolated. The reported 1050% price jump on certain VMware products highlights the potential for anti-competitive practices and the far-reaching consequences for the tech industry. Regulatory scrutiny, potential legal challenges, and the overall impact on the cloud computing landscape all contribute to a complex situation that demands careful consideration. Understanding the potential consequences of this Broadcom VMware deal is crucial for making informed business decisions. Stay informed about the developments in the Broadcom-VMware merger and its impact on VMware pricing. Follow this website for updates on the Broadcom VMware acquisition and its effects on the competitive landscape of enterprise software and cloud infrastructure.

Featured Posts

-

Huge Savings On Sneakers Nike Air Dunks Jordans And More At Foot Locker

May 15, 2025

Huge Savings On Sneakers Nike Air Dunks Jordans And More At Foot Locker

May 15, 2025 -

Will Berlins U Bahn Become The Next Techno Hotspot

May 15, 2025

Will Berlins U Bahn Become The Next Techno Hotspot

May 15, 2025 -

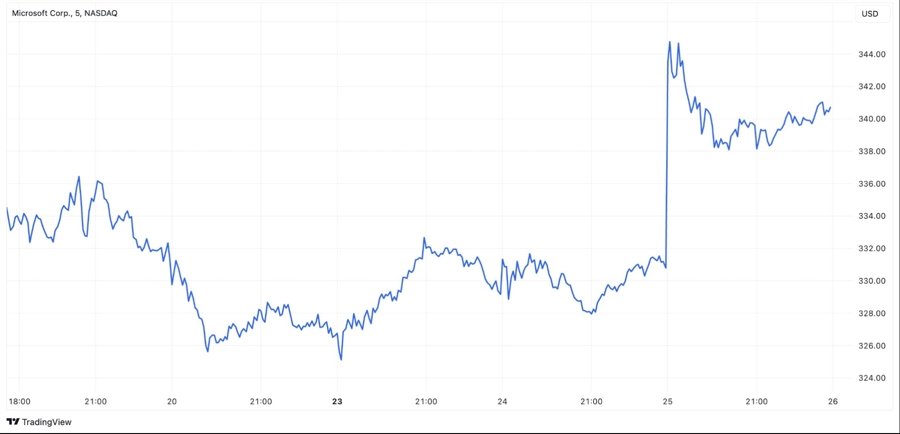

Tariff Troubles Why Microsoft Stock Offers Stability

May 15, 2025

Tariff Troubles Why Microsoft Stock Offers Stability

May 15, 2025 -

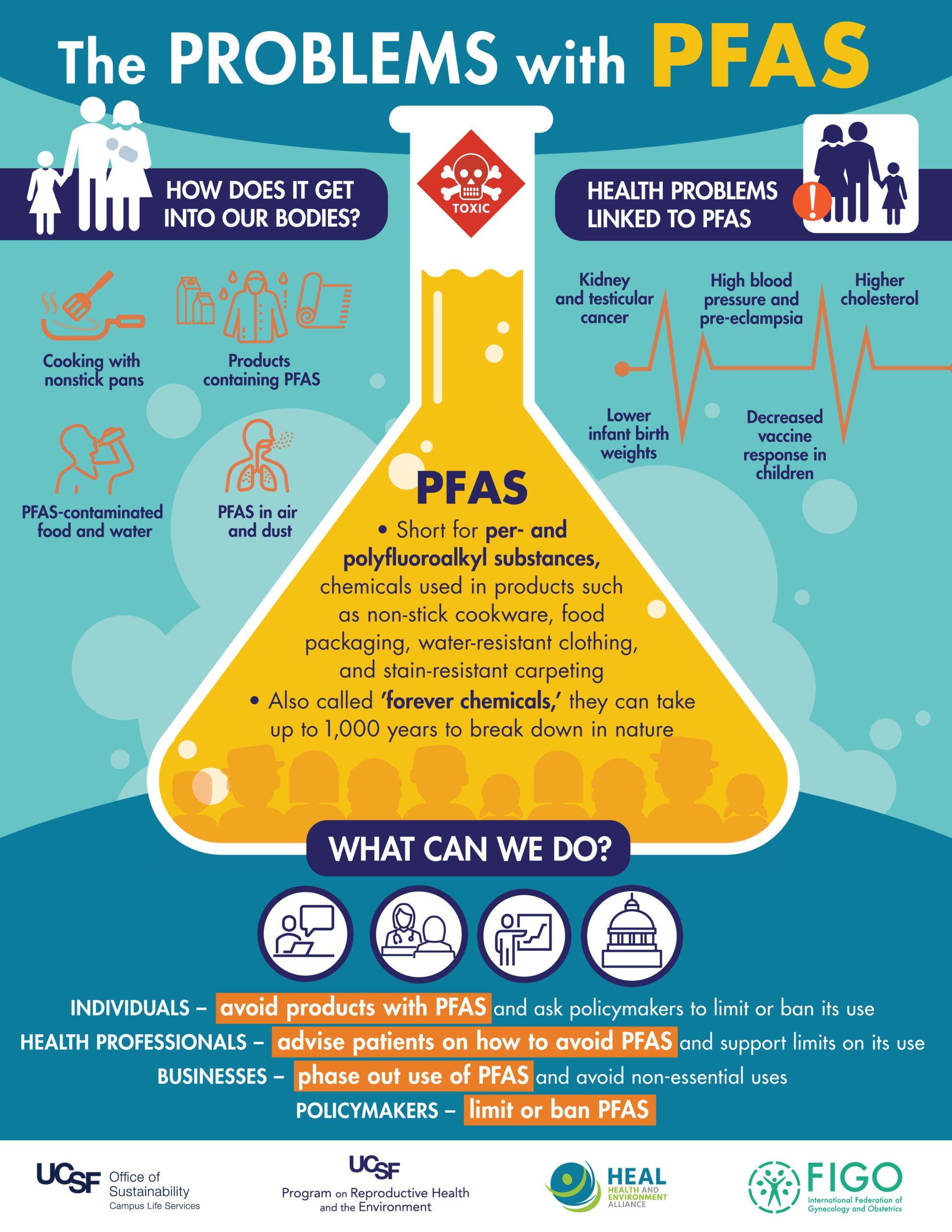

Blue Mountains Reservoir Investigation Into High Pfas Contamination

May 15, 2025

Blue Mountains Reservoir Investigation Into High Pfas Contamination

May 15, 2025 -

Portland Timbers 4 1 Defeat Against San Jose Earthquakes

May 15, 2025

Portland Timbers 4 1 Defeat Against San Jose Earthquakes

May 15, 2025