Frankfurt Stock Market Closes Lower: DAX Below 24,000

Table of Contents

2.1 Global Economic Uncertainty Impacts DAX Performance

Global economic headwinds are significantly impacting the DAX's performance. Rising inflation, aggressive interest rate hikes by central banks worldwide, and persistent geopolitical uncertainties are creating a perfect storm of negative influences on investor sentiment. The ongoing war in Ukraine, for example, continues to disrupt supply chains and fuel energy price volatility, directly impacting German businesses and consumer confidence.

- Inflationary Pressures: Soaring inflation rates across Europe and globally are eroding consumer purchasing power and squeezing corporate profit margins. The Eurozone's inflation rate remains stubbornly high, impacting consumer spending and business investment.

- Interest Rate Hikes: The European Central Bank (ECB)'s efforts to combat inflation through interest rate hikes are increasing borrowing costs for businesses and dampening investment. Higher interest rates make it more expensive for companies to expand and invest, slowing economic growth.

- Geopolitical Instability: The war in Ukraine continues to be a major source of uncertainty, impacting energy supplies, disrupting trade routes, and fueling inflationary pressures. Other geopolitical tensions also contribute to this climate of uncertainty.

These factors combine to create significant economic uncertainty, driving down investor confidence and consequently impacting the DAX. Keywords: Global Inflation, Interest Rate Hikes, Geopolitical Risk, Economic Uncertainty, DAX Volatility.

2.2 Weak Corporate Earnings Contribute to DAX Decline

The disappointing performance of several major DAX companies is another significant contributor to the index's decline. Many corporations are reporting weaker-than-expected earnings, reflecting the challenging economic environment. Several sectors, including automotive and energy, have been particularly hard-hit.

- Underperforming Sectors: The automotive industry is facing challenges related to supply chain disruptions and weakening consumer demand. Energy companies are grappling with volatile energy prices and regulatory changes.

- Profit Warnings: Several DAX-listed companies have issued profit warnings, indicating a downward revision of their earnings expectations. This lack of confidence further dampens investor sentiment.

- Specific Company Performance: [Insert examples of specific DAX companies that have underperformed, linking to relevant financial news articles]. Analyzing individual company performance provides a clearer picture of the broader market trend.

The combined effect of weak corporate earnings and profit warnings contributes significantly to the downward pressure on the DAX. Keywords: Corporate Earnings, DAX Companies, Sector Performance, Profit Warnings, Financial Results.

2.3 Investor Sentiment and Market Reactions

Negative investor sentiment plays a crucial role in driving down the DAX. Concerns about future economic growth, coupled with the factors discussed above, have led to a significant sell-off in the market. Trading volume has increased, indicating heightened activity as investors react to the deteriorating market conditions.

- Sell-off: The recent decline reflects a considerable sell-off by investors seeking to reduce risk in their portfolios.

- Trading Volume: Increased trading volume suggests heightened investor activity and nervousness.

- Analyst Predictions: Many analysts are expressing caution regarding the short-term outlook for the DAX, citing the ongoing economic and geopolitical uncertainties. [Link to relevant analyst reports].

The prevailing negative investor sentiment and their subsequent market reactions significantly contribute to the current DAX decline. Keywords: Investor Sentiment, Market Volatility, Trading Volume, Analyst Predictions, DAX Forecast.

Conclusion: Understanding the DAX Drop and Future Outlook

The DAX's fall below 24,000 is a consequence of a confluence of factors, including global economic uncertainty, weak corporate earnings, and negative investor sentiment. Rising inflation, interest rate hikes, geopolitical instability, and disappointing corporate results have all contributed to this significant decline in the German stock market. The outlook remains uncertain, with ongoing economic and geopolitical factors likely to continue influencing market performance in the coming months.

To stay informed about the Frankfurt Stock Market and DAX fluctuations, and to develop a sound investment strategy, we encourage you to subscribe to reputable financial newsletters, follow market analyses from leading financial institutions, and utilize reliable financial resources to track the DAX performance and stay updated on the latest market news. Understanding these factors is crucial for navigating the complexities of the DAX and making informed investment decisions. Keep a close eye on the DAX and its fluctuations for a clearer picture of the evolving market landscape. Keywords: DAX Performance, Frankfurt Stock Exchange Outlook, Market Analysis, Investment Strategy, Stock Market News.

Featured Posts

-

London Based Odd Burger Launches Vegan Menu At Canadian 7 Elevens

May 24, 2025

London Based Odd Burger Launches Vegan Menu At Canadian 7 Elevens

May 24, 2025 -

Joe Jonas And The Couples Unexpected Social Media Drama

May 24, 2025

Joe Jonas And The Couples Unexpected Social Media Drama

May 24, 2025 -

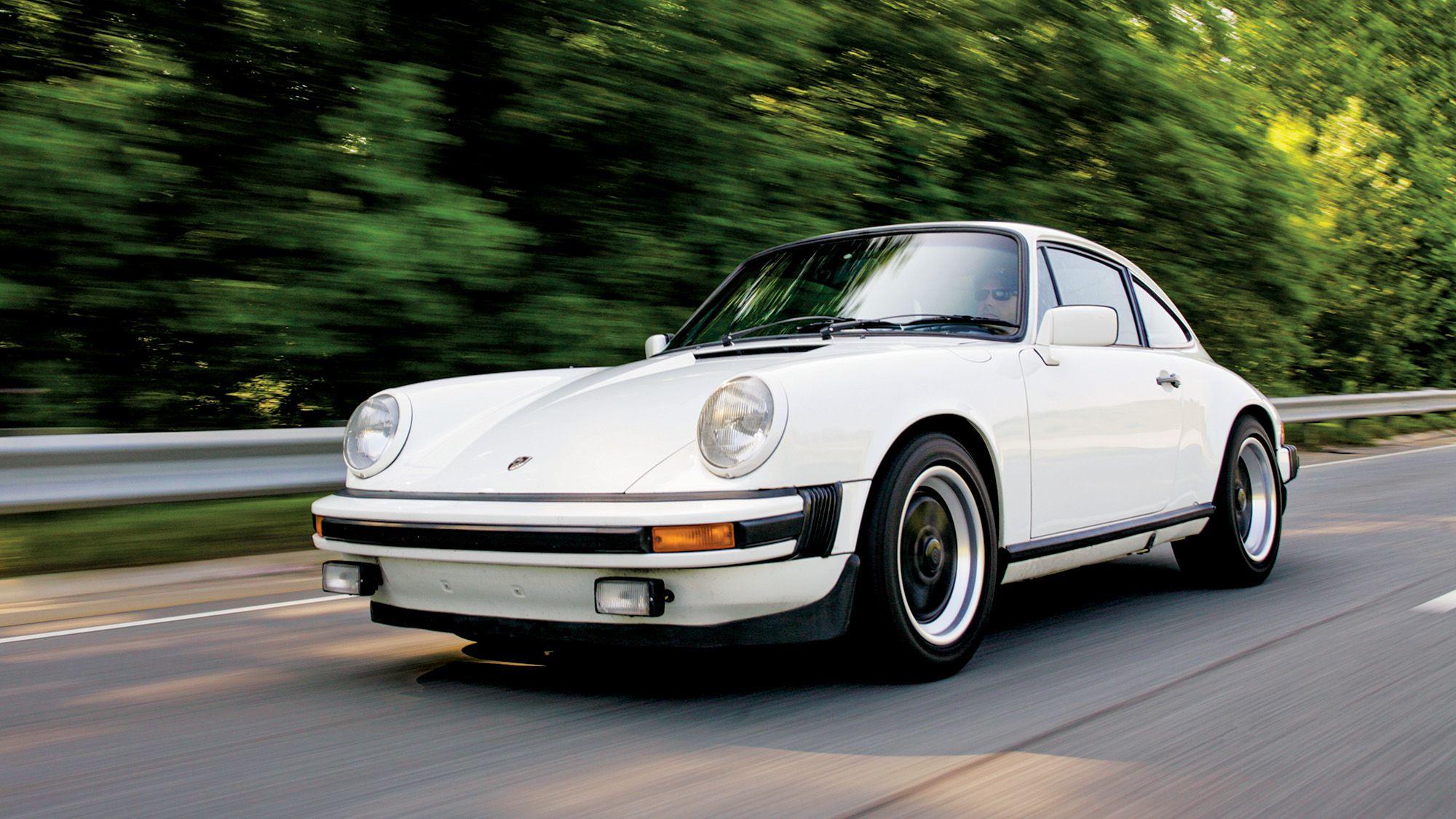

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrakban

May 24, 2025

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrakban

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

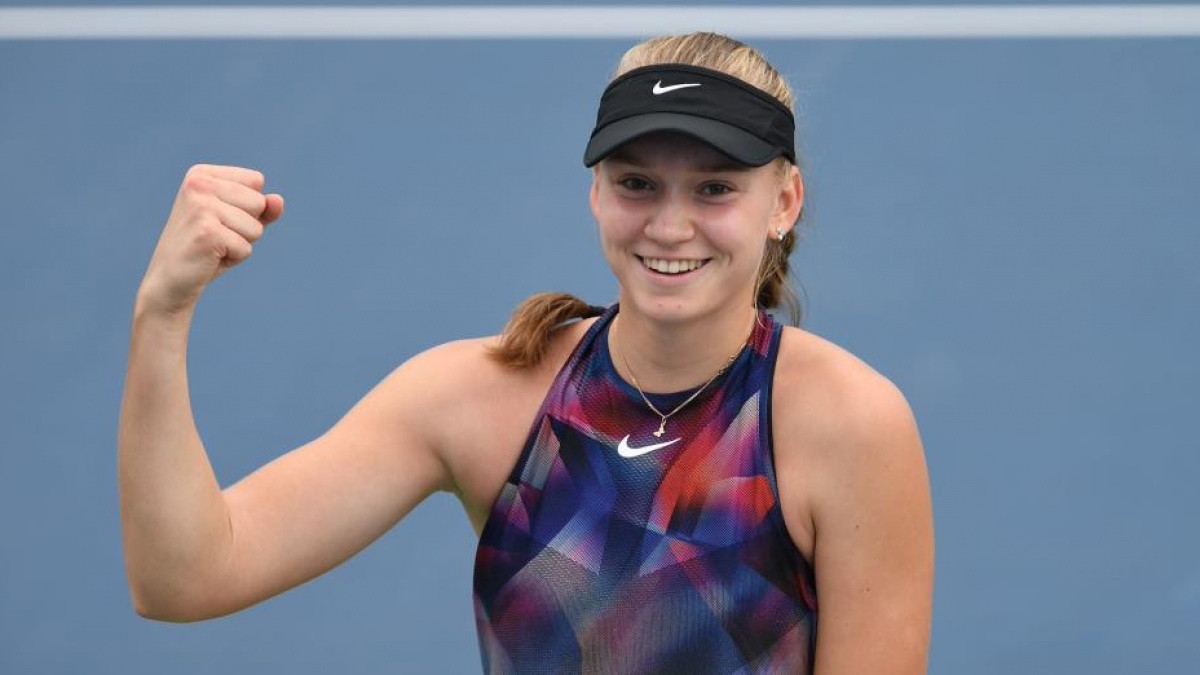

Elena Rybakina Proshla Vo Vtoroy Krug Turnira V Rime

May 24, 2025

Elena Rybakina Proshla Vo Vtoroy Krug Turnira V Rime

May 24, 2025