Tracking The Net Asset Value (NAV) Of The Amundi MSCI World Ex-United States UCITS ETF Acc

Table of Contents

Understanding the Amundi MSCI World ex-United States UCITS ETF NAV

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi MSCI World ex-United States UCITS ETF Acc, the NAV reflects the total value of its holdings in international equities, minus liabilities, divided by the number of outstanding shares. This ETF aims to track the performance of the MSCI World ex-USA Index, providing exposure to a broad range of developed and emerging market companies outside the United States. The NAV is calculated daily by valuing each asset in the ETF's portfolio at its market price.

- NAV represents the net asset value per share. This is the price you would theoretically receive if you redeemed your shares.

- Daily NAV fluctuations reflect market changes of the underlying assets. Positive market movements generally lead to a higher NAV, and vice-versa.

- Understanding NAV helps investors assess ETF performance. Tracking NAV changes over time allows you to measure the ETF's growth or decline.

- NAV is a key indicator for buy/sell decisions. While not the only factor, NAV changes can inform your investment strategy.

Methods for Tracking the Amundi MSCI World ex-United States UCITS ETF NAV

Several methods allow you to track the Amundi MSCI World ex-United States UCITS ETF NAV. Choosing the right method depends on your needs and access to resources.

Official Sources

The most reliable sources are official channels:

- Amundi's investor relations section: Check Amundi's official website for daily NAV updates. This is typically the most accurate and up-to-date source.

- Bloomberg Terminal: This professional-grade financial data platform provides real-time NAV data and other market information.

- Refinitiv Eikon: Similar to Bloomberg, Eikon offers comprehensive financial data, including real-time NAVs.

- Google Finance: While convenient, Google Finance might have a slight delay compared to official sources.

Brokerage Platforms

Most brokerage accounts display the NAV of ETFs held within your portfolio:

- Interactive Brokers: Provides access to real-time and historical NAV data.

- TD Ameritrade: Offers comprehensive tools to monitor your investments, including daily NAV updates.

- Fidelity: Displays NAV alongside other key performance indicators in your account.

- Schwab: Provides clear and accessible NAV information for held ETFs.

Note: Brokerage platform displays might have a slight delay compared to official sources.

Interpreting NAV Changes and their Implications

NAV fluctuations are influenced by several factors:

- Global market trends: Positive global market sentiment generally leads to higher NAVs, while negative sentiment can decrease the NAV.

- Currency exchange rates: Since this ETF invests in non-US companies, currency fluctuations between the currencies of the underlying assets and the ETF's base currency (likely EUR) will impact the NAV.

- Individual stock performance: The performance of individual companies within the ETF's portfolio will also contribute to the overall NAV.

It's crucial to understand the difference between NAV and the market price. The market price reflects the price at which you can buy or sell the ETF shares, which may differ slightly from the NAV due to the bid-ask spread.

- Global market trends impact NAV directly. A rising market generally results in a rising NAV.

- Currency fluctuations affect the NAV if the ETF holds non-domestic assets. Exchange rate changes can positively or negatively affect the NAV.

- Consider comparing NAV to benchmarks. Compare the ETF's NAV performance to its benchmark index (MSCI World ex-USA) to assess its tracking efficiency.

- Avoid making impulsive decisions based on short-term NAV changes. Focus on long-term trends and your overall investment strategy.

Tools and Resources for Monitoring Amundi MSCI World ex-United States UCITS ETF NAV

Several tools can assist in monitoring the Amundi MSCI World ex-United States UCITS ETF NAV:

- Dedicated financial news websites: Many websites provide real-time or near real-time ETF data, including NAVs.

- Investment tracking apps: Apps like Yahoo Finance, Google Finance, or dedicated portfolio trackers offer convenient ways to monitor your investments, including NAV.

- Spreadsheet software for manual tracking (advanced users): For those comfortable with spreadsheets, you can manually download NAV data and track it over time.

Conclusion

Successfully tracking the Amundi MSCI World ex-United States UCITS ETF NAV is essential for informed investment decisions. By utilizing the methods and resources outlined above, investors can gain a clear understanding of their investment's performance and make strategic choices. Remember to monitor the Amundi MSCI World ex-United States UCITS ETF NAV regularly and consider the long-term trends to optimize your investment strategy. Start tracking your Amundi MSCI World ex-United States UCITS ETF NAV today!

Featured Posts

-

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025

Memorial Day Weekend 2025 Ocean City Rehoboth And Sandy Point Beach Forecast

May 24, 2025 -

Tu Horoscopo Semanal Del 11 Al 17 De Marzo De 2025

May 24, 2025

Tu Horoscopo Semanal Del 11 Al 17 De Marzo De 2025

May 24, 2025 -

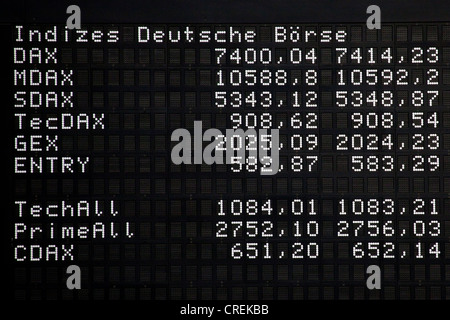

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025 -

House Passes Trump Tax Bill Key Changes And Impact

May 24, 2025

House Passes Trump Tax Bill Key Changes And Impact

May 24, 2025 -

Sse Cuts 3 Billion Spending Impact Of Slowing Growth

May 24, 2025

Sse Cuts 3 Billion Spending Impact Of Slowing Growth

May 24, 2025