Ignoring The Bond Crisis: A Risky Strategy For Investors

Table of Contents

Understanding the Current Bond Market Challenges

The bond market is facing a confluence of significant headwinds that are impacting yields and the overall health of fixed-income investments.

Rising Interest Rates and Their Impact

Rising interest rates pose a direct threat to bond prices. This is due to the inverse relationship between interest rates and bond prices:

- Inverse relationship between interest rates and bond prices: When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This causes a decline in the market price of existing bonds.

- Impact on bond duration and interest rate risk: Longer-duration bonds are more sensitive to interest rate changes, meaning they experience larger price swings than shorter-duration bonds. This increased interest rate risk is a significant concern for investors holding long-term bonds.

- Potential for capital losses in a rising rate environment: Investors holding bonds when interest rates rise may experience substantial capital losses if they need to sell their bonds before maturity.

Inflation's Squeeze on Bond Returns

Inflation significantly erodes the real return on bond investments.

- Real yield vs. nominal yield: The nominal yield is the stated interest rate on a bond, while the real yield accounts for inflation. High inflation reduces the real yield, diminishing the purchasing power of bond returns.

- The impact of unexpected inflation on bond portfolios: Unexpected inflation can severely damage bond portfolio performance, as the real return falls short of expectations.

- Strategies for inflation hedging within fixed-income investments: Investors can mitigate inflation risk by investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), or by diversifying into asset classes that tend to perform well during inflationary periods.

Geopolitical Uncertainty and Bond Market Volatility

Global events introduce significant uncertainty and volatility into the bond market.

- Examples of geopolitical events affecting bond yields: Geopolitical instability, such as wars or trade disputes, can trigger shifts in investor sentiment, leading to fluctuations in bond yields.

- Increased market volatility and its impact on investor confidence: Volatility makes it difficult to predict bond prices, undermining investor confidence and increasing the risk of losses.

- Diversification strategies to mitigate geopolitical risk: Diversification across different bond types, maturities, and geographies can help reduce the impact of geopolitical events on a bond portfolio.

The Risks of Ignoring the Bond Crisis

Ignoring the challenges facing the bond market exposes investors to significant risks.

Potential for Significant Capital Losses

Failing to adapt investment strategies to the current market conditions can lead to substantial capital losses.

- Scenario analysis illustrating potential losses in different bond market scenarios: Depending on the speed and magnitude of interest rate hikes and inflation, the potential for losses in bond portfolios varies considerably. Scenario analysis can help investors understand the range of potential outcomes.

- The importance of risk assessment and portfolio diversification: A thorough risk assessment and diversification across different asset classes are crucial for mitigating the risk of significant capital losses.

- The dangers of holding long-duration bonds in a rising-rate environment: Long-duration bonds are particularly vulnerable in a rising-rate environment, and investors should carefully consider their exposure to these types of bonds.

Missed Opportunities for Higher Returns

The current market environment presents opportunities for higher returns through alternative investment strategies.

- Exploring high-yield bonds or alternative fixed income strategies: High-yield bonds, also known as junk bonds, offer higher yields but carry greater risk. Other alternative fixed income strategies, like private debt, may also provide better returns.

- Considering equities or other asset classes for diversification: Diversifying into asset classes less correlated to bonds, such as equities or real estate, can help improve overall portfolio returns and reduce risk.

- The importance of professional financial advice: Seeking professional financial advice is crucial for making informed investment decisions in this complex environment.

Erosion of Purchasing Power

Inflation continues to erode the purchasing power of bond returns.

- Strategies for inflation protection: Investing in inflation-linked bonds (like TIPS), real estate, or commodities can help protect against inflation.

- The role of TIPS (Treasury Inflation-Protected Securities) and other inflation-linked bonds: TIPS offer a hedge against inflation, as their principal adjusts with the Consumer Price Index (CPI).

- The need for a long-term investment strategy that accounts for inflation: A long-term strategy is essential to account for inflation's impact on returns and adjust the investment strategy accordingly.

Conclusion

The current bond market presents significant challenges, including rising interest rates, persistent inflation, and geopolitical uncertainty. Ignoring these risks can lead to substantial capital losses and erosion of purchasing power. The key takeaways are the importance of understanding interest rate risk, the impact of inflation on real returns, the need for diversification, and the benefits of seeking professional financial advice. Don't ignore the bond crisis. Take control of your investment portfolio today. Contact a financial advisor to discuss strategies for navigating this challenging market environment and protecting your fixed-income investments. Learn more about protecting your portfolio from the bond crisis by visiting [Your Website Here].

Featured Posts

-

Reactie Van Der Gijp Op Potentiele Farioli Opvolger Een Onmogelijk Scenario

May 29, 2025

Reactie Van Der Gijp Op Potentiele Farioli Opvolger Een Onmogelijk Scenario

May 29, 2025 -

Haunting New Horror Film Bring Her Back First Trailer Released

May 29, 2025

Haunting New Horror Film Bring Her Back First Trailer Released

May 29, 2025 -

When Will The Stranger Things Season 5 Teaser Trailer Arrive

May 29, 2025

When Will The Stranger Things Season 5 Teaser Trailer Arrive

May 29, 2025 -

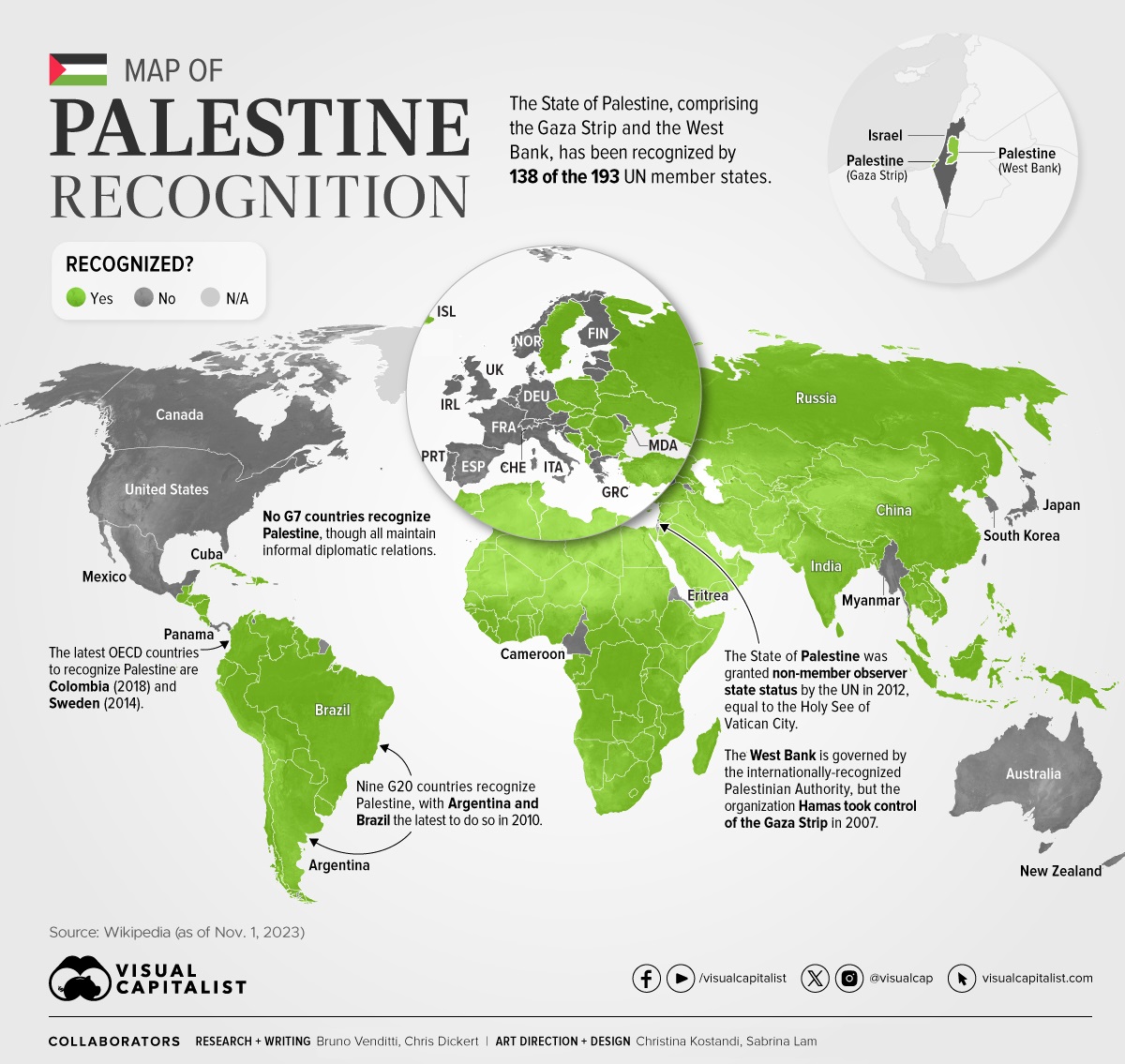

Indonesias Potential Ties With Israel Contingent On Palestine Recognition

May 29, 2025

Indonesias Potential Ties With Israel Contingent On Palestine Recognition

May 29, 2025 -

Real Madrids Pursuit Of Mbappe All The Trophies At Stake

May 29, 2025

Real Madrids Pursuit Of Mbappe All The Trophies At Stake

May 29, 2025