Is Gold A Safe Haven During Trade Wars? Understanding The Recent Price Rally

Table of Contents

Gold's Historical Role as a Safe Haven Asset

Gold has a long and storied history as a safe haven asset, consistently demonstrating its value during times of economic and political instability. Its appeal stems from several key characteristics:

- Non-correlation with Traditional Markets: Unlike stocks and bonds, gold often exhibits a negative correlation with traditional markets. This means that when stock markets decline, gold prices may rise, providing diversification and portfolio protection.

- Store of Value During Inflation: Gold has historically served as a reliable store of value, particularly during periods of high inflation. Its inherent scarcity and enduring demand make it a hedge against currency devaluation.

- Historical Performance During Conflicts: Throughout history, gold prices have frequently increased during periods of trade disputes, wars, and political upheaval. The World Gold Council provides extensive data illustrating this trend. For instance, during the Cold War and various regional conflicts, gold served as a safe haven investment.

- Tangible Asset & Hedge Against Uncertainty: Unlike digital assets, gold is a physical asset, offering a tangible sense of security and stability during times of economic uncertainty.

The Recent Gold Price Rally and its Correlation with Trade Wars

The recent surge in gold prices is undeniably linked to escalating trade tensions and the resulting global economic uncertainty.

- Price Charts and Data: Examining gold price charts from the past few years clearly reveals a correlation between intensified trade war rhetoric and periods of increased gold prices. (Note: Here, you would include a relevant chart showing this correlation, sourced from a reputable financial data provider.)

- Increased Market Volatility and Investor Sentiment: The heightened uncertainty created by trade wars fuels market volatility, prompting investors to seek the perceived safety of gold. This flight to safety significantly impacts investor sentiment, driving demand for gold.

- Impact on Other Asset Classes: Trade war uncertainty erodes investor confidence in other asset classes, like equities and bonds, further boosting the appeal of gold as a relatively stable investment.

- Negative Impacts on Specific Sectors: Sectors heavily reliant on international trade, such as technology and manufacturing, are disproportionately affected by trade wars. This negative impact can push investors towards gold as a defensive strategy.

Factors Beyond Trade Wars Influencing Gold Prices

While trade wars significantly influence gold prices, it's crucial to acknowledge other contributing factors:

- Inflation Expectations: Rising inflation expectations often lead to increased gold demand, as it acts as a hedge against inflation's erosion of purchasing power.

- Interest Rate Changes: Lower interest rates can make gold more attractive, as the opportunity cost of holding non-interest-bearing gold decreases.

- Currency Fluctuations: A weaker US dollar typically boosts gold prices, as gold is priced in US dollars and becomes more affordable for investors holding other currencies.

- Central Bank Activity: Central banks' buying and selling of gold influence the market, and their holdings of gold reserves are an important factor in overall market dynamics.

Investing in Gold During Trade Wars: Strategies and Considerations

Investing in gold during periods of trade war uncertainty requires careful consideration and a well-defined strategy:

- Investment Options: Investors can access the gold market through various options, including physical gold (bullion, coins), gold exchange-traded funds (ETFs), and gold mining stocks.

- Risks and Benefits: Each investment option has its own set of risks and benefits. Physical gold offers tangible ownership but involves storage and security concerns. ETFs offer liquidity and diversification but involve counterparty risk. Gold mining stocks offer leverage but carry higher volatility.

- Diversification: Diversification is crucial. Gold shouldn't constitute a majority of your portfolio. It should complement other asset classes to reduce overall portfolio risk.

- Professional Advice: Before investing, thorough research and consultation with a qualified financial advisor are essential. Understanding your risk tolerance and investment goals is key to making informed decisions.

Conclusion

Gold's role as a potential safe haven during trade wars is supported by historical data and recent market trends. However, its price is influenced by a complex interplay of factors beyond trade wars alone, including inflation, interest rates, and currency fluctuations. While gold can offer a degree of protection during times of economic uncertainty like trade wars, it's vital to understand its inherent volatility and diversify your investment portfolio accordingly. Learn more about diversifying your portfolio with gold and other safe haven assets to navigate the complexities of trade wars and market fluctuations. Research your options and consult with a financial advisor before investing in gold.

Featured Posts

-

Mission Impossible Dead Reckoning First Look And Stunt Highlights

Apr 26, 2025

Mission Impossible Dead Reckoning First Look And Stunt Highlights

Apr 26, 2025 -

Navalistul Trade Union Seeks Dutch Embassys Intervention In Mangalia Shipyard Dispute

Apr 26, 2025

Navalistul Trade Union Seeks Dutch Embassys Intervention In Mangalia Shipyard Dispute

Apr 26, 2025 -

Bizarre Injury Sidelines Formula 1 Star Lando Norris

Apr 26, 2025

Bizarre Injury Sidelines Formula 1 Star Lando Norris

Apr 26, 2025 -

George Santos Mounts Last Ditch Defense Against Mounting Charges

Apr 26, 2025

George Santos Mounts Last Ditch Defense Against Mounting Charges

Apr 26, 2025 -

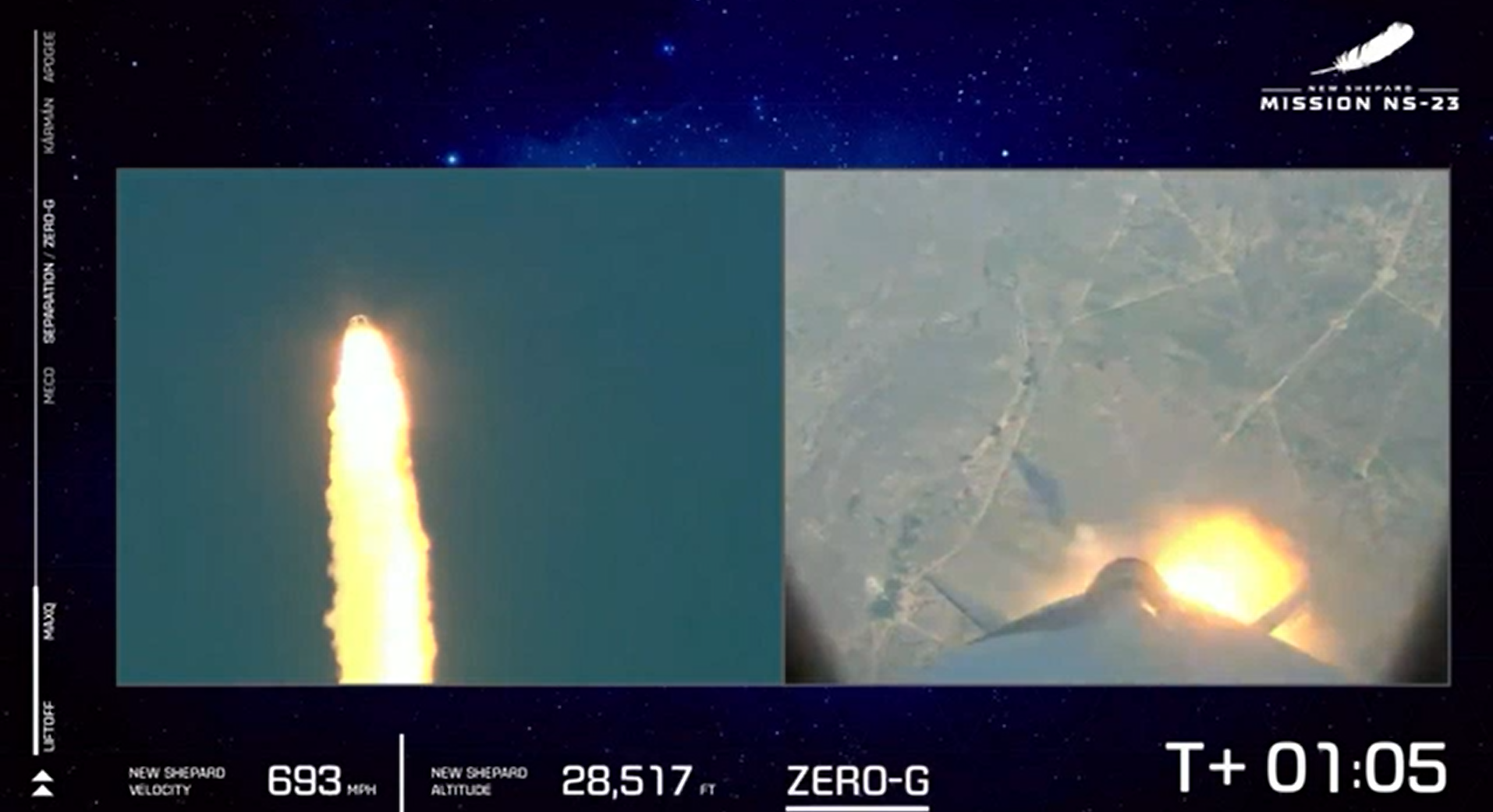

Blue Origins Launch Abort A Technical Glitch Grounds The Rocket

Apr 26, 2025

Blue Origins Launch Abort A Technical Glitch Grounds The Rocket

Apr 26, 2025

Latest Posts

-

2024 Open Ai Developer Event Highlights Streamlined Voice Assistant Creation

Apr 27, 2025

2024 Open Ai Developer Event Highlights Streamlined Voice Assistant Creation

Apr 27, 2025 -

Repetitive Scatological Documents Ais Role In Transforming Data Into A Poop Podcast

Apr 27, 2025

Repetitive Scatological Documents Ais Role In Transforming Data Into A Poop Podcast

Apr 27, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 27, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 27, 2025 -

From Scatological Data To Engaging Podcast The Power Of Ai Digest Technology

Apr 27, 2025

From Scatological Data To Engaging Podcast The Power Of Ai Digest Technology

Apr 27, 2025 -

Open Ai Simplifies Voice Assistant Development At 2024 Event

Apr 27, 2025

Open Ai Simplifies Voice Assistant Development At 2024 Event

Apr 27, 2025