Is Refinancing Federal Student Loans Worth It? A Practical Analysis

Table of Contents

Potential Benefits of Refinancing Federal Student Loans:

Lower Interest Rates: One of the most significant advantages of refinancing federal student loans is the potential to secure a lower interest rate. Private lenders often offer more competitive rates than the government, leading to significant savings over the life of the loan.

- Example: Let's say you have $50,000 in federal student loans with a 6% interest rate. Refinancing to a 4% interest rate could save you thousands of dollars in interest over the loan term. Use a student loan refinancing calculator to see your potential savings.

- Fixed vs. Variable Rates: Be aware that refinancing options include both fixed and variable interest rates. Fixed rates offer predictability, while variable rates can fluctuate, potentially increasing your monthly payments. Carefully consider your risk tolerance when making your choice.

- Keyword Integration: Focus your search on "student loan refinancing rates" to find the best deals.

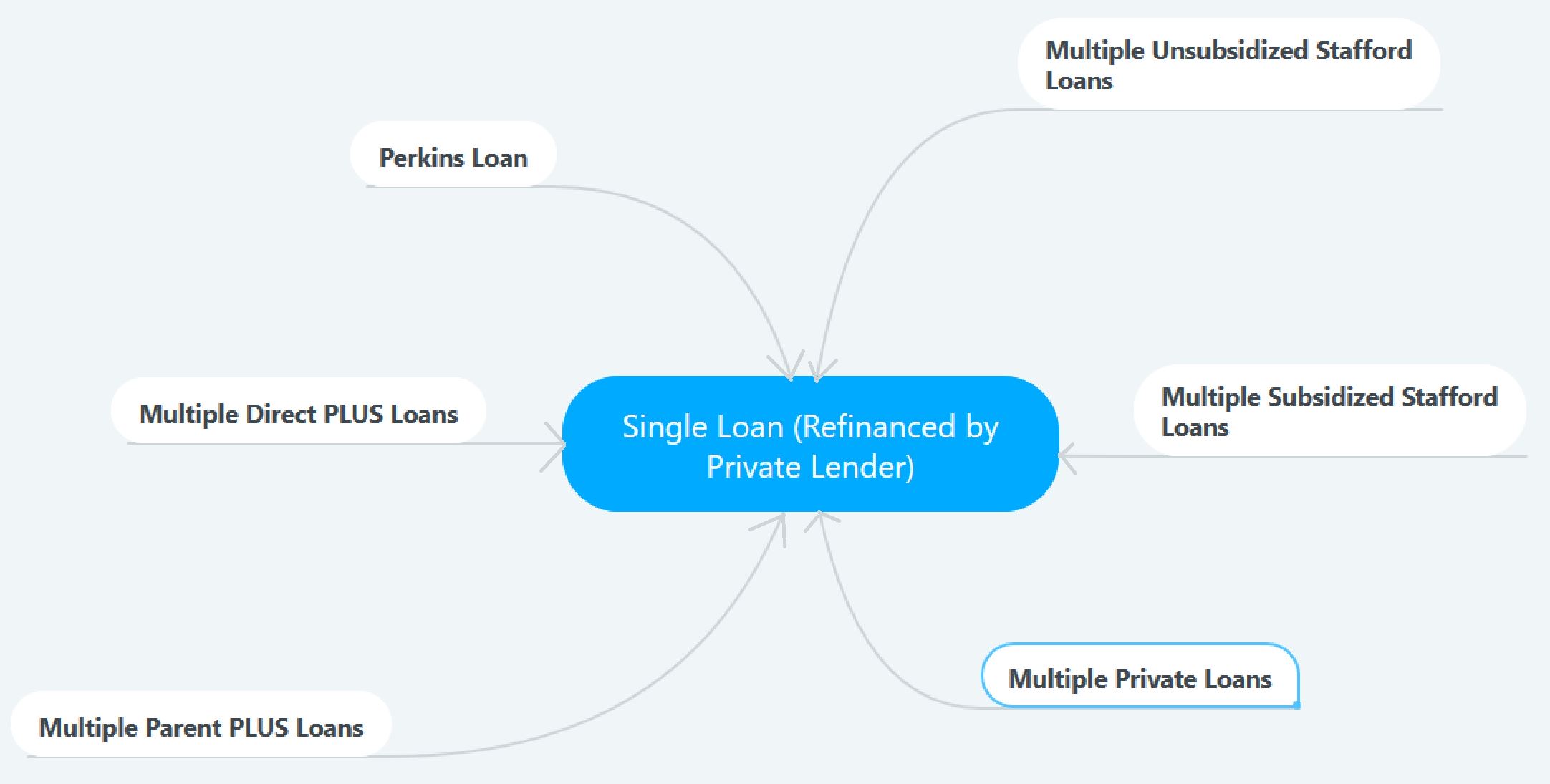

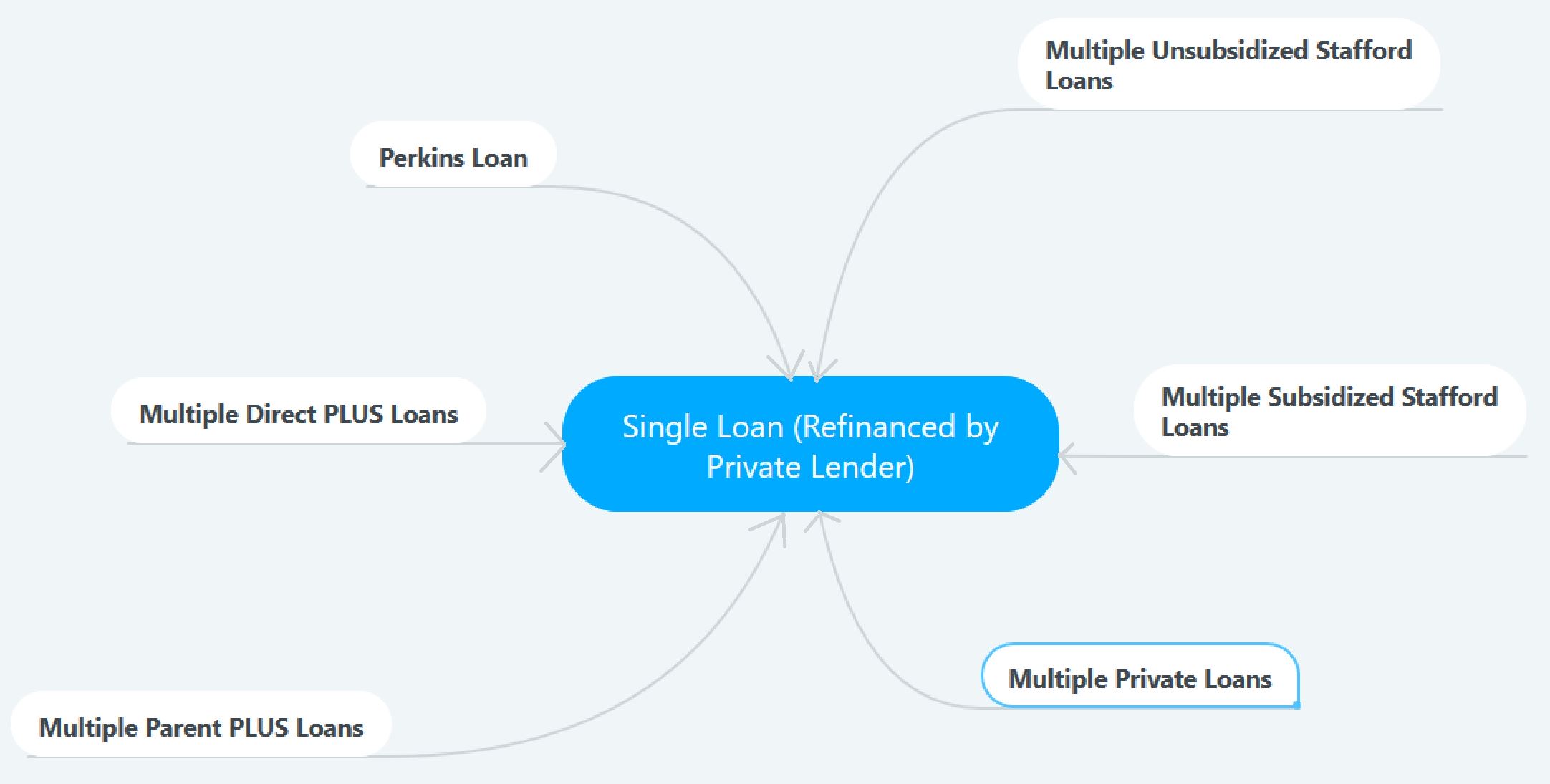

Simplified Repayment: Managing multiple federal student loans can be a headache. Refinancing consolidates these loans into a single, manageable payment.

- Easier Tracking: Instead of juggling multiple due dates and logins, you'll have one streamlined payment process.

- Single Monthly Payment: This simplifies budgeting and reduces the risk of missed payments.

- Shorter Repayment Term (Potential): While not always the case, refinancing can allow you to choose a shorter repayment term, leading to faster loan payoff. However, remember that this will result in higher monthly payments.

- Keyword Integration: Search for "consolidate student loans" to learn more about simplifying your repayment.

Potential for a Lower Monthly Payment: A lower monthly payment can significantly ease your financial burden. However, achieving this often involves extending the loan term.

- Example: A longer repayment period can reduce your monthly payment, but it will likely increase the total interest paid over the life of the loan.

- Caution: Carefully weigh the benefits of a lower monthly payment against the potential for paying more interest overall. Use a "monthly payment calculator" to explore various scenarios.

- Keyword Integration: Explore options for "affordable student loan payments."

Potential Drawbacks of Refinancing Federal Student Loans:

Loss of Federal Protections: This is perhaps the most significant drawback. Refinancing federal student loans means losing access to valuable federal protections.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust your monthly payments based on your income, offering crucial flexibility during financial hardship.

- Deferment and Forbearance: These options temporarily suspend or reduce your payments during periods of unemployment or financial distress.

- Public Service Loan Forgiveness (PSLF): If you work in public service, refinancing will likely eliminate your eligibility for PSLF.

- Keyword Integration: Understand the implications of losing "federal student loan benefits" before you refinance.

Higher Overall Interest Paid (potentially): While refinancing might offer a lower monthly payment, this is often achieved by extending the loan term. This can lead to paying significantly more interest over the life of the loan.

- Example: A longer loan term can negate the benefits of even a lower interest rate.

- Keyword Integration: Use a "refinancing calculator" to compare the total interest paid under different scenarios.

Credit Score Requirements: Private lenders have stricter credit score requirements than the federal government. Borrowers with lower credit scores may be denied refinancing or offered less favorable terms.

- Typical Thresholds: Most lenders require a credit score of at least 660-680 to qualify for the best rates.

- Alternatives: If you have a poor credit score, consider improving your credit before applying or exploring options like "bad credit student loan refinancing," though these will usually come with higher interest rates.

- Keyword Integration: Check the "credit score requirements" for various lenders.

When Refinancing Federal Student Loans Makes Sense:

High Credit Score and Low Interest Rates: Refinancing is most beneficial for borrowers with excellent credit scores (700+) who qualify for significantly lower interest rates than their current federal loans.

- Ideal Profile: A borrower with a high credit score, stable income, and a clear understanding of their financial goals.

- Keyword Integration: Search for "high credit score refinancing" and "low interest rate refinancing" to find the best deals.

Clear Financial Goals and Stability: Before refinancing, ensure you have a solid financial plan in place. This includes a budget, debt management strategy, and a stable income.

- Responsible Refinancing: Avoid refinancing impulsively. Carefully analyze your finances and ensure you can comfortably manage the new repayment terms.

- Keyword Integration: Focus on "responsible refinancing" and "financial planning for student loans."

Conclusion:

Refinancing federal student loans can offer significant benefits, such as lower interest rates and simplified repayment. However, it also involves losing valuable federal protections. It's not a one-size-fits-all solution. Carefully weigh the pros and cons, research different lenders, and use online tools to compare rates before making a decision. Make an informed decision about whether refinancing your federal student loans is the right choice for your financial situation. Explore your "student loan refinance options" and find the "best student loan refinancing rates" to suit your needs.

Featured Posts

-

Recent Fortnite Refunds A Look At Potential Cosmetic System Changes

May 17, 2025

Recent Fortnite Refunds A Look At Potential Cosmetic System Changes

May 17, 2025 -

Anchor Brewing A San Francisco Icon Closes Its Doors

May 17, 2025

Anchor Brewing A San Francisco Icon Closes Its Doors

May 17, 2025 -

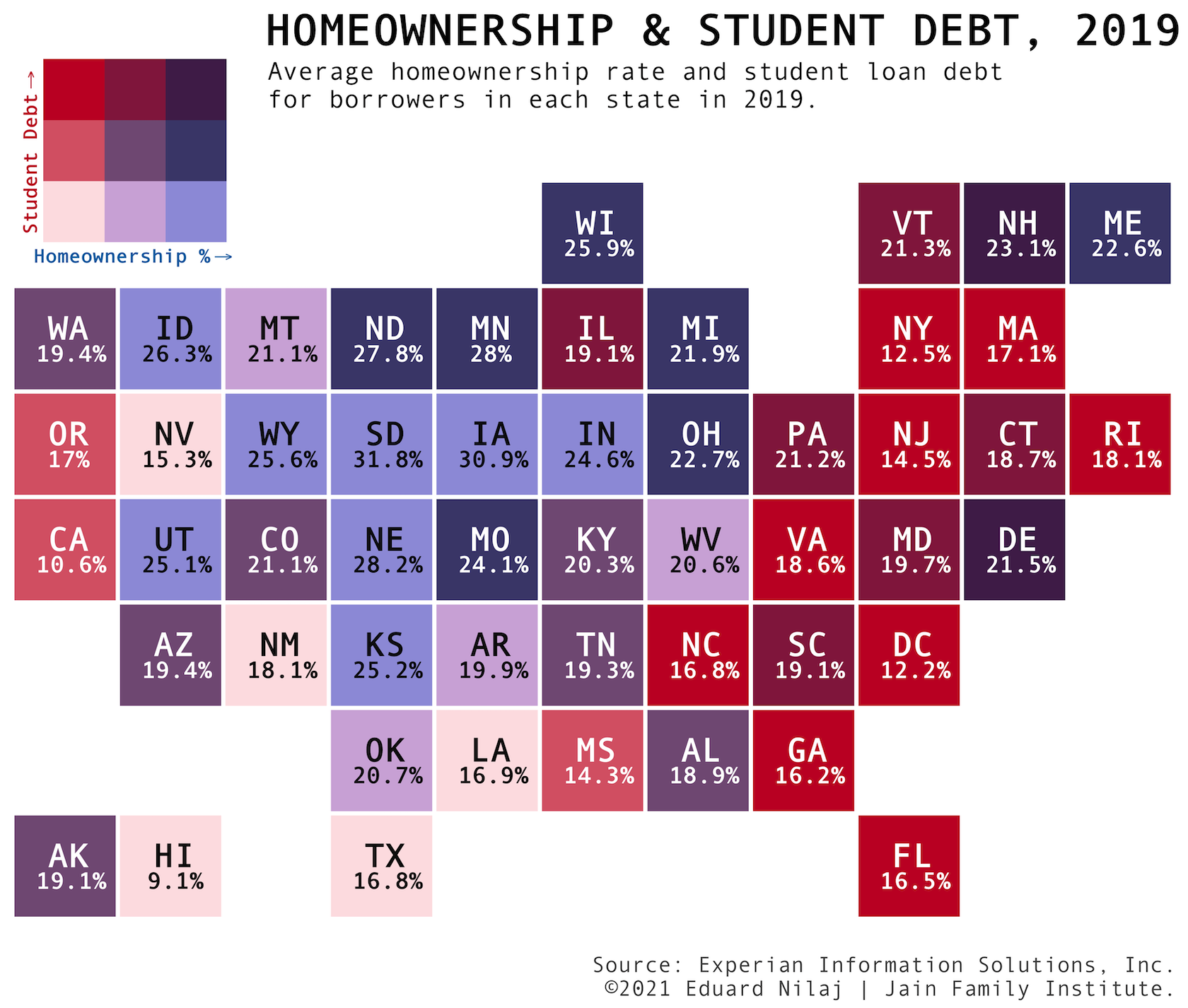

Homeownership With Student Loans Tips And Strategies For Success

May 17, 2025

Homeownership With Student Loans Tips And Strategies For Success

May 17, 2025 -

Analisis Laporan Keuangan Untuk Pengambilan Keputusan Bisnis Yang Lebih Baik

May 17, 2025

Analisis Laporan Keuangan Untuk Pengambilan Keputusan Bisnis Yang Lebih Baik

May 17, 2025 -

Trump Tariffs How They Affected The Cost Of Replacing Your Phone Battery

May 17, 2025

Trump Tariffs How They Affected The Cost Of Replacing Your Phone Battery

May 17, 2025

Latest Posts

-

The Trump Family Tree A New Addition With Tiffany And Michaels Baby

May 17, 2025

The Trump Family Tree A New Addition With Tiffany And Michaels Baby

May 17, 2025 -

Donald Trumps Expanding Family Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trumps Expanding Family Tiffany And Michaels Son Alexander

May 17, 2025 -

Trump Family Grows Alexander Arrives Expanding The Family Tree

May 17, 2025

Trump Family Grows Alexander Arrives Expanding The Family Tree

May 17, 2025 -

The 2016 Election Analyzing The Influence Of Donald Trumps Scandals On Voter Behavior

May 17, 2025

The 2016 Election Analyzing The Influence Of Donald Trumps Scandals On Voter Behavior

May 17, 2025 -

Donald Trumps Path To The Presidency Navigating Allegations Of Sexual Misconduct And Multiple Affairs

May 17, 2025

Donald Trumps Path To The Presidency Navigating Allegations Of Sexual Misconduct And Multiple Affairs

May 17, 2025