Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: Explained

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

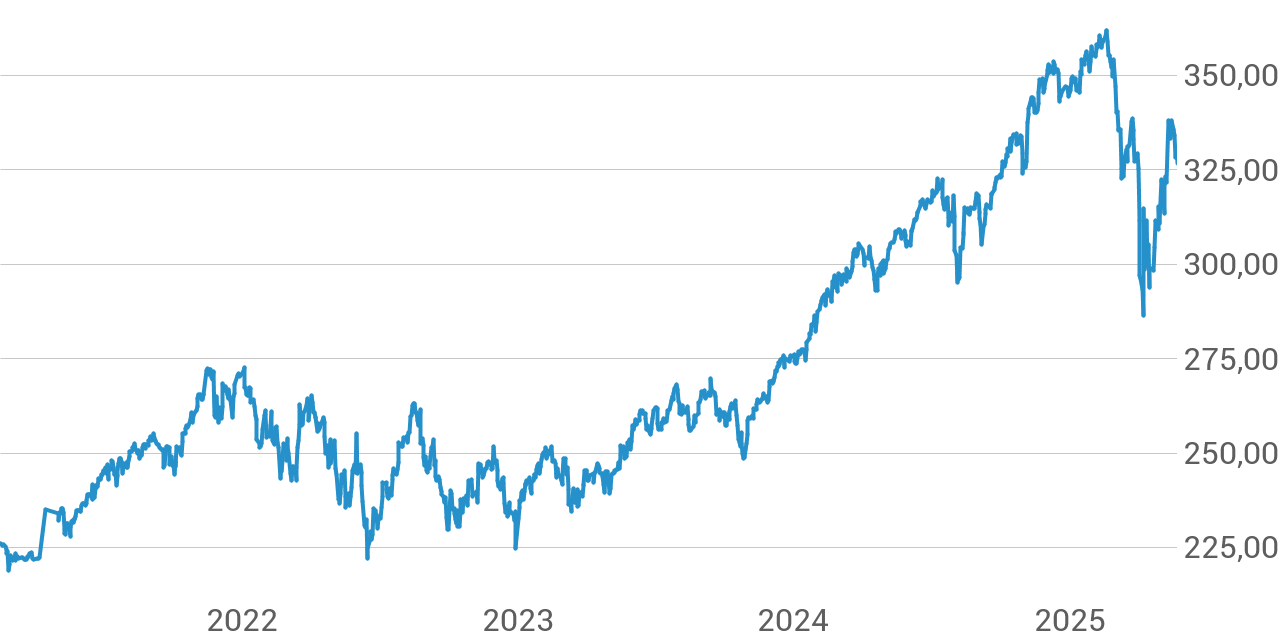

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. It's calculated daily and provides a snapshot of the ETF's worth per share. For the Amundi MSCI All Country World UCITS ETF USD Acc, understanding the NAV is critical for tracking performance and making informed investment decisions.

The NAV calculation is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

Let's break down the components:

- Total Assets: This includes the market value of all securities held by the ETF (stocks, bonds, etc.), plus cash and any receivables. The Amundi MSCI All Country World UCITS ETF USD Acc, being a globally diversified ETF, will have a diverse range of assets across various market sectors and countries.

- Total Liabilities: This encompasses all the ETF's outstanding expenses, including management fees, operational costs, and any other payable obligations. These liabilities are subtracted from the total assets to arrive at the net asset value.

- Number of Outstanding Shares: This represents the total number of ETF shares currently held by investors.

Several factors influence NAV fluctuations:

- Market Movements: Changes in the prices of the underlying assets directly impact the ETF's NAV.

- Dividends: Income received from dividends on the underlying securities is added to the assets, increasing the NAV.

- Expenses: Management fees and other expenses reduce the NAV.

Accessing the Daily NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Finding the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is relatively easy. You can typically access this information through several channels:

- Amundi's Website: The official Amundi website will usually provide daily NAV updates for all their ETFs, including the Amundi MSCI All Country World UCITS ETF USD Acc.

- Financial News Sources: Major financial news websites and data providers often publish ETF NAVs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

NAV updates are typically provided at the close of the market each trading day. It's important to note the difference between the NAV and the market price of the ETF, which we'll discuss below.

Interpreting the NAV and its Impact on Investment Decisions

Changes in the NAV directly reflect the Amundi MSCI All Country World UCITS ETF USD Acc's performance. A rising NAV indicates positive performance, while a falling NAV signifies negative performance.

- Performance Comparison: You can use the historical NAV data to compare the ETF's performance over time and against other investments.

- Understanding Holdings and Diversification: The NAV helps you indirectly understand the overall performance of the ETF's holdings and the effectiveness of its diversification strategy.

NAV vs. Market Price: Understanding the Difference

The market price of an ETF is the price at which it's currently being traded on the exchange. This price can differ from the NAV due to several factors:

- Bid-Ask Spread: The difference between the price buyers are willing to pay (bid) and the price sellers are willing to accept (ask) creates a spread.

- Supply and Demand: High demand can push the market price above the NAV (premium), while low demand can push it below (discount).

- Trading Volume: Higher trading volume generally leads to a smaller deviation between NAV and market price.

It's important to remember that while the NAV provides a fundamental valuation, the market price reflects the current trading dynamics.

Conclusion: Making Informed Investment Decisions Using the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Regularly monitoring the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for successful ETF investing. Understanding the NAV calculation, where to find it, and how it relates to the market price are all essential for making informed investment decisions. By tracking the NAV and understanding its implications, you can better assess the performance of your investment and adjust your strategy accordingly. Stay informed and make smart investment decisions based on this key indicator, not only for the Amundi MSCI All Country World UCITS ETF USD Acc, but also for other similar ETFs you may hold.

Featured Posts

-

Crack The Code 5 Dos And Don Ts For A Private Credit Job

May 24, 2025

Crack The Code 5 Dos And Don Ts For A Private Credit Job

May 24, 2025 -

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025 -

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025 -

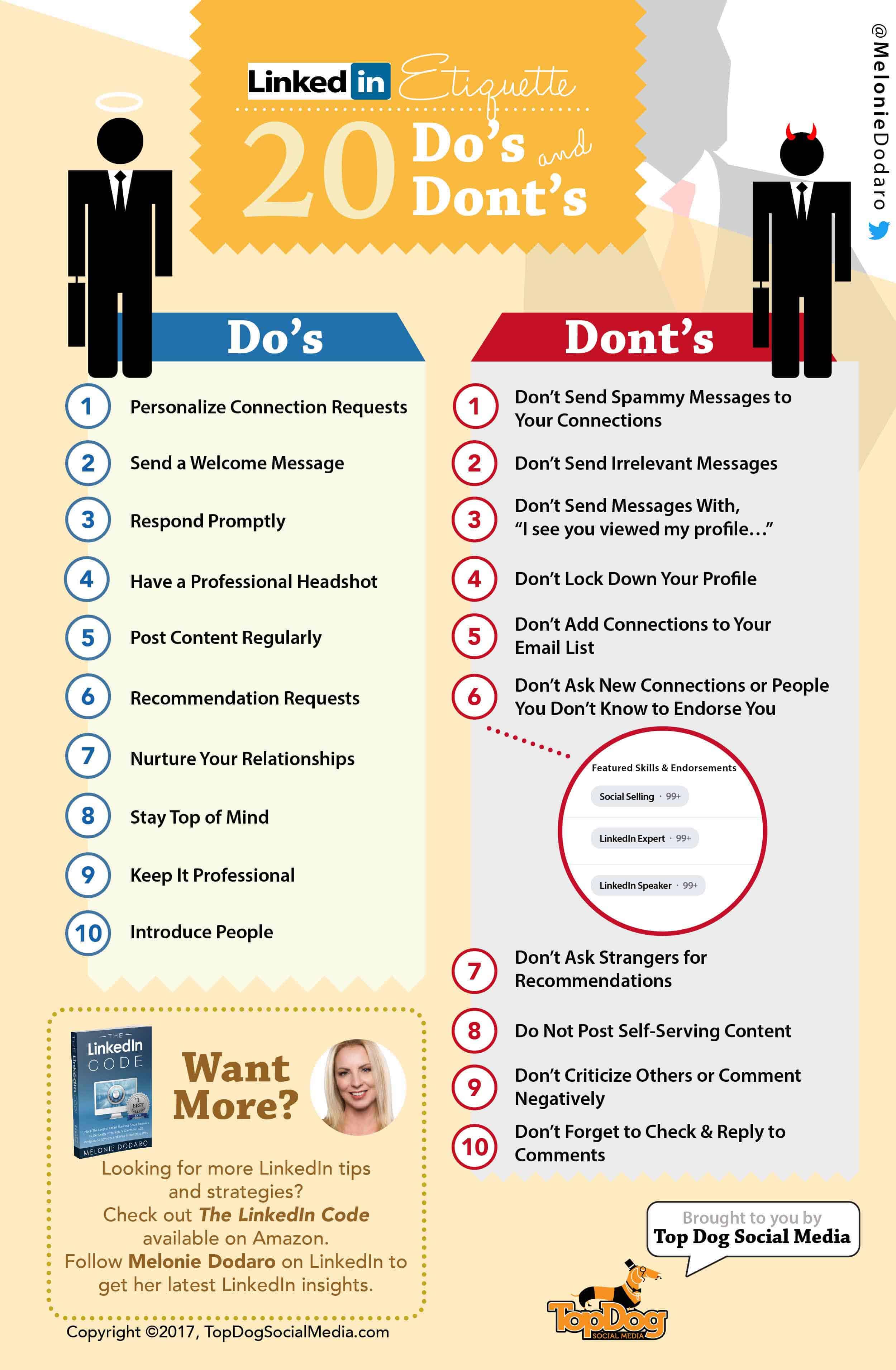

Hl Yshyr Artfae Daks Alalmany Ila Anteash Aqtsady Awrwby

May 24, 2025

Hl Yshyr Artfae Daks Alalmany Ila Anteash Aqtsady Awrwby

May 24, 2025 -

Car Accident On M56 Overturn Results In Casualty Treatment

May 24, 2025

Car Accident On M56 Overturn Results In Casualty Treatment

May 24, 2025