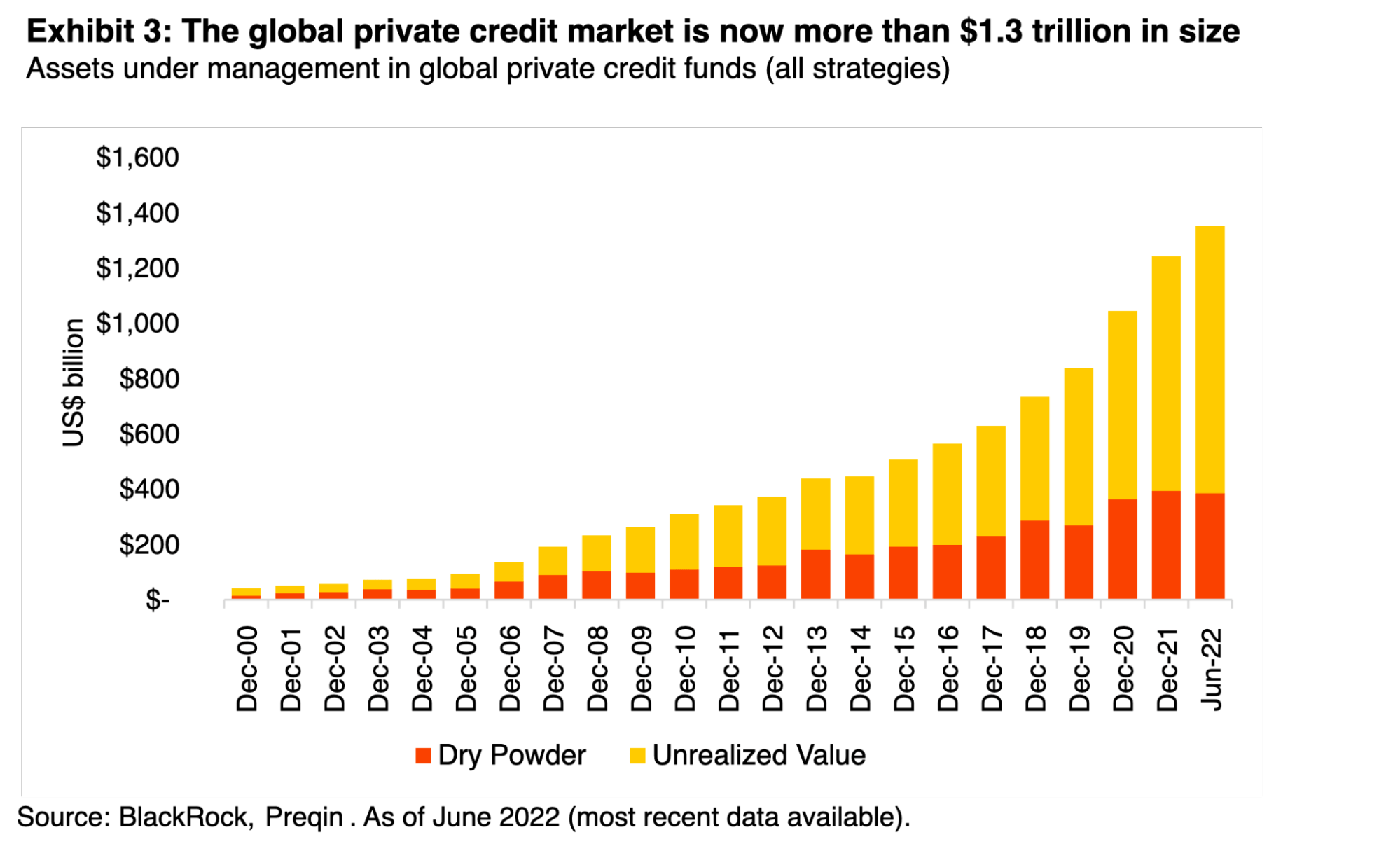

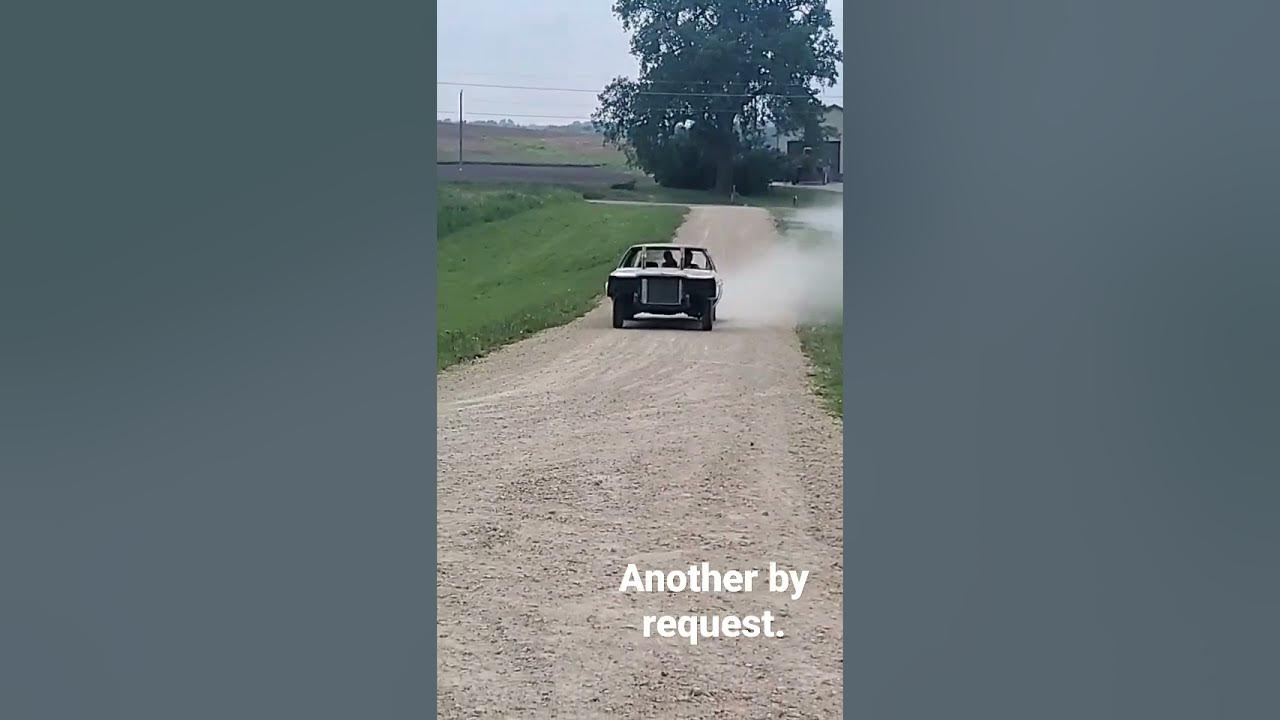

Private Credit Market Cracks: A Credit Weekly Analysis

Table of Contents

Rising Interest Rates and Their Impact on Private Credit

The aggressive interest rate hikes implemented by central banks worldwide are significantly impacting the private credit market. These increases are driving up funding costs for private credit funds and borrowers alike, leading to several critical consequences.

- Increased Funding Costs: Private credit funds, often relying on short-term borrowing to finance their investments, are facing substantially higher funding costs. This reduces their profitability and potentially their ability to originate new loans.

- Higher Default Rates: Leveraged borrowers, particularly in sectors sensitive to interest rate changes, are struggling to service their debt. This is leading to a rise in anticipated default rates across the board, creating a ripple effect throughout the market.

- Refinancing Risk: Companies with existing private debt are facing difficulties refinancing their loans at favorable terms. This refinancing risk is particularly acute for borrowers with weaker credit profiles.

- Sectoral Impact: The impact of rising interest rates isn't uniform. Sectors like real estate and leveraged buyouts, heavily reliant on debt financing, are experiencing a disproportionate effect.

- Mitigation Strategies: Private credit funds are employing various strategies to mitigate interest rate risk, including hedging strategies and increased focus on borrowers with strong creditworthiness.

Increased Default Rates and Distressed Debt

The increase in loan defaults is creating a growing volume of distressed debt in the private credit market. This presents both challenges and opportunities for investors.

- Sectors Most Affected: Real estate, energy, and certain segments of the leveraged buyout market are witnessing some of the highest default rates.

- Distressed Debt Investing Strategies: Sophisticated investors are increasingly exploring distressed debt investing strategies, aiming to capitalize on undervalued assets and debt instruments.

- Credit Default Swaps: Credit default swaps (CDS) are playing a more significant role, offering a means of hedging against potential defaults and transferring risk.

- Market Liquidity Impact: The surge in distressed debt is impacting overall market liquidity, as investors struggle to quickly offload these assets.

- Opportunities in Distressed Debt: Despite the risks, the increasing volume of distressed debt presents opportunities for experienced investors who can identify undervalued assets and restructure debt effectively.

Liquidity Concerns and Market Volatility

Concerns around liquidity are emerging as a key challenge within the private credit market. The nature of private debt, often illiquid and lacking a readily available secondary market, exacerbates this issue.

- Illiquidity of Private Credit Investments: Quickly liquidating private credit investments can be difficult, creating a significant hurdle for investors seeking to exit their positions.

- Investor Demand for Liquidity: Increased investor demand for liquidity is putting pressure on private credit funds to provide quicker exits, potentially leading to forced asset sales.

- Capital Outflows: We are seeing potential capital outflows from private credit funds as investors seek more liquid alternatives.

- Impact on Fund Valuations: The reduced liquidity is impacting the valuations of private credit funds, creating uncertainty for investors.

- Managing Liquidity Risk: Funds are exploring various strategies to manage liquidity risk, including greater diversification and more flexible investment structures.

The Role of Regulation in the Private Credit Market

The relatively less regulated nature of the private credit market compared to traditional banking contributes to the current challenges. While this offers flexibility, it also increases the potential for systemic risk. Increased regulatory scrutiny and potential changes in regulations could significantly alter the market landscape in the coming years. This includes aspects like improved risk management frameworks and clearer reporting requirements.

Conclusion

The private credit market is facing significant headwinds, with rising interest rates, increased default rates, and liquidity concerns creating a challenging environment. However, these challenges also present opportunities for investors with the expertise to navigate the complexities of distressed debt and illiquid assets. Understanding these "cracks" in the private credit market is crucial for investors and market participants alike. It's vital to stay informed and adapt strategies to mitigate risks and capitalize on potential rewards.

Stay ahead of the curve with our ongoing Private Credit Market analysis - subscribe today!

Featured Posts

-

Jannik Sinner And The Doping Allegations Case Closed

Apr 27, 2025

Jannik Sinner And The Doping Allegations Case Closed

Apr 27, 2025 -

Pfc Suspends Eo W Transfer Following Gensol Promoters Documented Fraud

Apr 27, 2025

Pfc Suspends Eo W Transfer Following Gensol Promoters Documented Fraud

Apr 27, 2025 -

Online Shopping Guide Ariana Grande Lovenote Fragrance Set And Pricing

Apr 27, 2025

Online Shopping Guide Ariana Grande Lovenote Fragrance Set And Pricing

Apr 27, 2025 -

Gensol Promoters Fraudulent Documents Pfc Halts Eo W Transfer

Apr 27, 2025

Gensol Promoters Fraudulent Documents Pfc Halts Eo W Transfer

Apr 27, 2025 -

Repetitive Scatological Documents Ais Role In Transforming Data Into A Poop Podcast

Apr 27, 2025

Repetitive Scatological Documents Ais Role In Transforming Data Into A Poop Podcast

Apr 27, 2025

Latest Posts

-

Investigation Into Toxic Chemical Persistence After Ohio Train Derailment

Apr 28, 2025

Investigation Into Toxic Chemical Persistence After Ohio Train Derailment

Apr 28, 2025 -

Ohio Train Derailment The Lingering Threat Of Toxic Chemicals

Apr 28, 2025

Ohio Train Derailment The Lingering Threat Of Toxic Chemicals

Apr 28, 2025 -

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

Apr 28, 2025

Toxic Chemicals From Ohio Train Derailment Persistence In Buildings

Apr 28, 2025 -

Months Long Lingering Of Toxic Chemicals After Ohio Train Derailment

Apr 28, 2025

Months Long Lingering Of Toxic Chemicals After Ohio Train Derailment

Apr 28, 2025 -

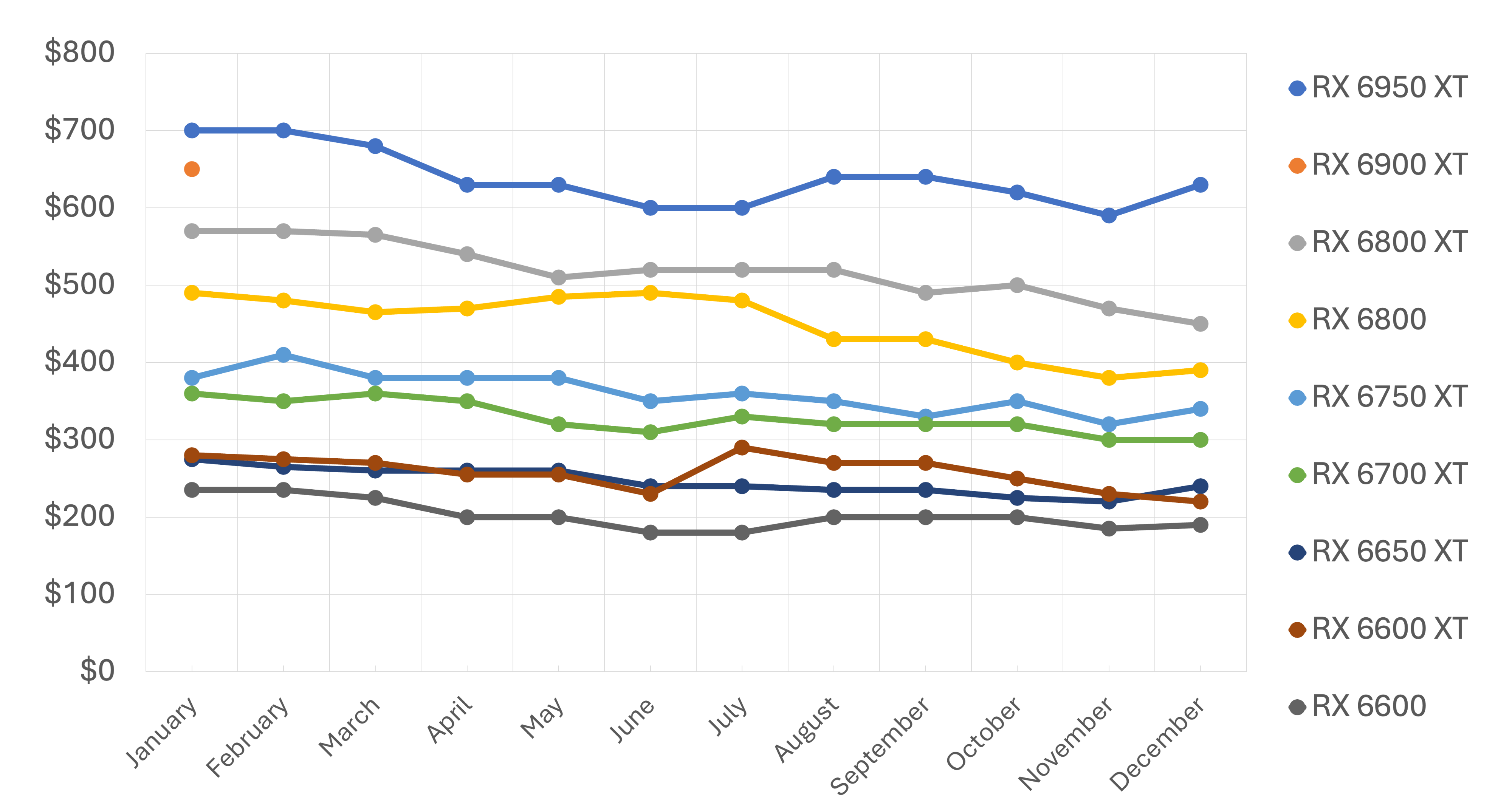

The Current State Of Gpu Pricing A Buyers Guide

Apr 28, 2025

The Current State Of Gpu Pricing A Buyers Guide

Apr 28, 2025