SEC Approval Of XRP ETFs: A $800 Million Week 1 Impact?

Table of Contents

XRP ETFs, or Exchange-Traded Funds, are investment vehicles that allow investors to gain exposure to XRP, the native cryptocurrency of Ripple Labs, through traditional stock exchanges. Their significance lies in providing regulated and easily accessible investment opportunities in a previously less accessible asset class, potentially attracting a wave of institutional and retail investors. This article will explore the potential impact of SEC approval of XRP ETFs, focusing on the projected $800 million week 1 trading volume and its associated market implications.

The Potential $800 Million Week 1 Trading Volume: A Realistic Estimate?

The $800 million figure, while seemingly ambitious, is based on several estimations by analysts who have considered the pent-up demand for XRP investment vehicles. These predictions factor in the current market capitalization of XRP, the projected influx of institutional capital, and the historical trading volumes observed with other newly listed ETFs. However, it's crucial to view this as a projection, not a guaranteed outcome.

Factors contributing to high trading volume could include:

- High demand from institutional and retail investors: The SEC approval would legitimize XRP in the eyes of many institutional investors, opening the floodgates to significant capital inflows. Retail investors, too, would find it easier to access XRP through brokerage accounts.

- Increased market liquidity: ETFs significantly increase liquidity compared to trading XRP directly on exchanges. This makes it easier for investors to buy and sell large quantities without significantly impacting the price.

- Reduced regulatory uncertainty: SEC approval would dramatically reduce the regulatory uncertainty surrounding XRP, making it a more attractive investment for risk-averse investors.

Conversely, factors that could lead to lower-than-predicted volumes include:

- Market volatility: The cryptocurrency market is inherently volatile. A sudden market downturn could dampen enthusiasm and reduce trading activity.

- Competition from other crypto ETFs: If other crypto ETFs are approved concurrently, they could compete for investor interest, potentially diverting some capital away from XRP ETFs.

- Unexpected regulatory hurdles: Even with SEC approval, unforeseen regulatory challenges could arise, potentially impacting trading volume.

Impact on XRP Price and Market Capitalization

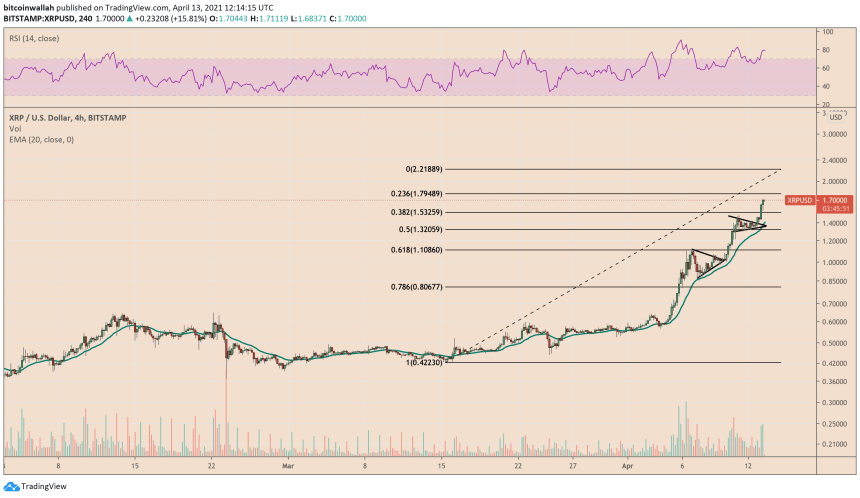

SEC approval of XRP ETFs is likely to have a significant impact on XRP's price. Many analysts predict a substantial price increase in the short term, driven by increased demand. The influx of institutional investment could further propel the price upward, leading to a significant increase in XRP's market capitalization. However, the extent of the price increase will depend on several factors, including the overall market sentiment and the level of trading volume. Short-term volatility is expected, but long-term price stability is anticipated with increased institutional adoption. (Insert chart or graph illustrating projected price movements here if available)

Increased Institutional Adoption of XRP

The approval of XRP ETFs would act as a catalyst for increased institutional adoption of XRP. This is because:

- Regulatory compliance: ETFs offer a regulatory compliant pathway for institutional investors to gain exposure to XRP, addressing concerns regarding regulatory compliance and risk management.

- Easier access to XRP: ETFs provide simpler and more efficient access to XRP compared to trading on decentralized exchanges.

- Diversification opportunities: XRP offers a unique diversification opportunity within institutional portfolios, given its distinct position within the crypto landscape and its utility in cross-border payments.

This increased institutional interest will contribute significantly to XRP's overall adoption and enhance its legitimacy within the broader financial ecosystem.

Ripple's Role and Future Prospects

SEC approval would be a significant boon for Ripple Labs, the company behind XRP. It would likely boost the company's reputation, attracting further investment and partnerships. The positive impact on XRP's price could also increase the value of Ripple's holdings. While the ongoing legal battles faced by Ripple could still pose challenges, a positive SEC ruling on XRP ETFs would significantly strengthen their position. This sets the stage for Ripple to execute its long-term strategy centered around its on-demand liquidity (ODL) solution and its growing global payments network.

Regulatory Implications and Future of Crypto ETFs

The SEC's decision on XRP ETFs has significant implications for the wider cryptocurrency market. A positive decision could pave the way for the approval of other crypto ETFs, signaling a greater acceptance of cryptocurrencies by regulatory bodies. This could unlock substantial investment and drive further innovation within the crypto space. However, the regulatory landscape remains complex and dynamic, and the path to widespread crypto ETF adoption is likely to be gradual.

Conclusion: The Future of XRP and SEC Approval of XRP ETFs

The potential SEC Approval of XRP ETFs represents a pivotal moment for the cryptocurrency market. The projected $800 million in week 1 trading volume, while an estimate, underscores the enormous potential impact of this decision. This approval could drastically alter XRP's price and market capitalization, increase institutional adoption, and significantly benefit Ripple Labs. It also points towards a broader acceptance of cryptocurrencies within the traditional finance world, fostering innovation and investment. Stay updated on the SEC Approval of XRP ETFs and learn more about the potential impact of XRP ETFs to make informed investment decisions. Invest wisely in the emerging world of XRP ETFs, but always conduct thorough research before making any investment decisions.

Featured Posts

-

Barcelona And Inter Milans Champions League Semi Final A Six Goal Epic

May 08, 2025

Barcelona And Inter Milans Champions League Semi Final A Six Goal Epic

May 08, 2025 -

Bitcoin Price Rebound Is This The Start Of A Long Term Uptrend

May 08, 2025

Bitcoin Price Rebound Is This The Start Of A Long Term Uptrend

May 08, 2025 -

Investigating The Price Increase Of Dogecoin Shiba Inu And Sui

May 08, 2025

Investigating The Price Increase Of Dogecoin Shiba Inu And Sui

May 08, 2025 -

Is Xrp Ready To Soar 3 Indicators Pointing To A Parabolic Rise

May 08, 2025

Is Xrp Ready To Soar 3 Indicators Pointing To A Parabolic Rise

May 08, 2025 -

Krypto The Super Dog New Superman Footage Shows A Good Boy

May 08, 2025

Krypto The Super Dog New Superman Footage Shows A Good Boy

May 08, 2025

Latest Posts

-

Universal Credit And The Dwp Important Updates And Potential Benefit Loss

May 08, 2025

Universal Credit And The Dwp Important Updates And Potential Benefit Loss

May 08, 2025 -

Psl 10 Ticket Sales Everything You Need To Know

May 08, 2025

Psl 10 Ticket Sales Everything You Need To Know

May 08, 2025 -

Urgent Dwp Sending Letters Uk Benefit Payments At Risk

May 08, 2025

Urgent Dwp Sending Letters Uk Benefit Payments At Risk

May 08, 2025 -

Dwp Reform Impacts Universal Credit Recipients Key Changes And Warnings

May 08, 2025

Dwp Reform Impacts Universal Credit Recipients Key Changes And Warnings

May 08, 2025 -

Pakistan Super League 10 Dont Miss Out Tickets On Sale

May 08, 2025

Pakistan Super League 10 Dont Miss Out Tickets On Sale

May 08, 2025