Stock Market Valuations: BofA's Reassuring Argument For Investors

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

BofA's optimistic assessment rests on several key pillars, providing reassurance to cautious investors. Their analysis points towards a resilient economy underpinning continued market growth, despite ongoing headwinds. This positive outlook is supported by:

-

Strong Corporate Earnings Growth: Despite economic slowdowns in certain sectors, many corporations continue to report robust earnings growth. This suggests a degree of underlying strength in the economy that can support stock prices. BofA highlights the adaptability and resilience of businesses in navigating current challenges.

-

Resilient Consumer Spending: Consumer spending remains a significant driver of economic growth. While inflation is impacting purchasing power, BofA's data indicates continued consumer activity, suggesting sustained demand.

-

Positive Long-Term Growth Projections: BofA's analysts project positive long-term growth for the US and global economies, forecasting [insert specific growth percentage if available] over the next [insert timeframe] years. This positive outlook forms the basis for their valuation models.

-

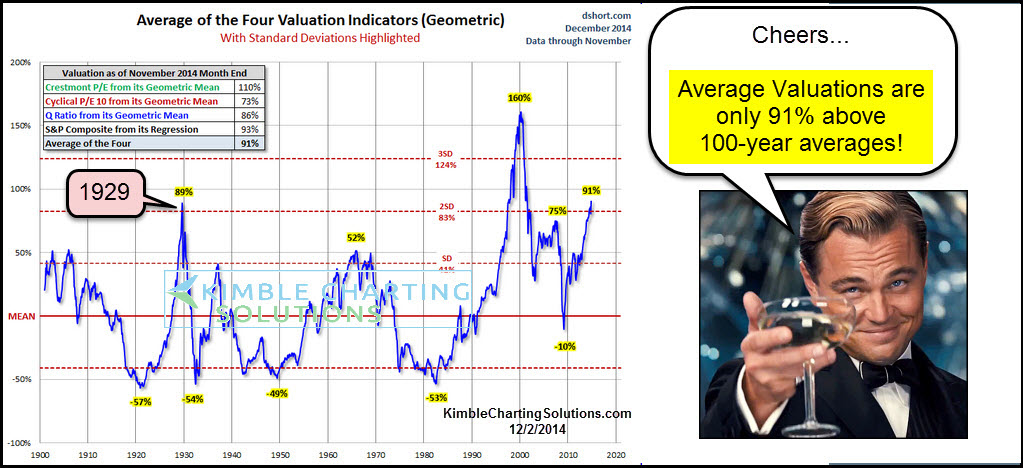

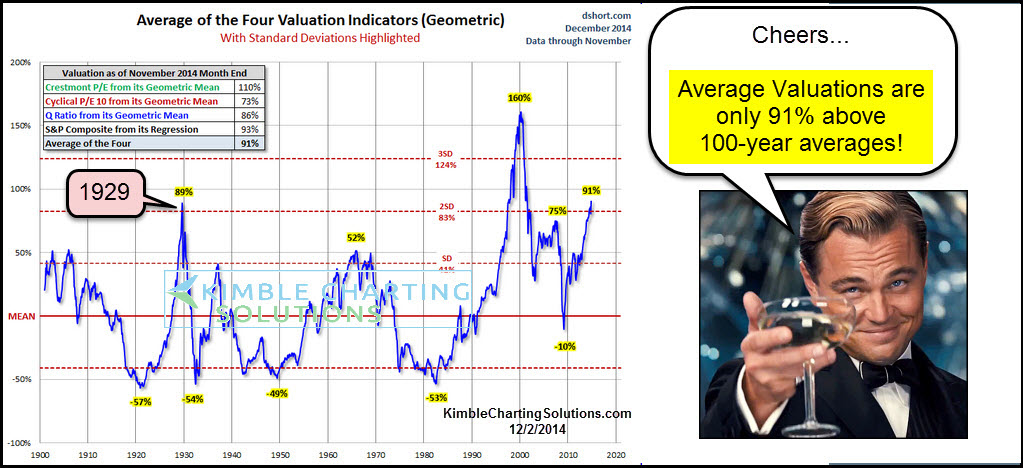

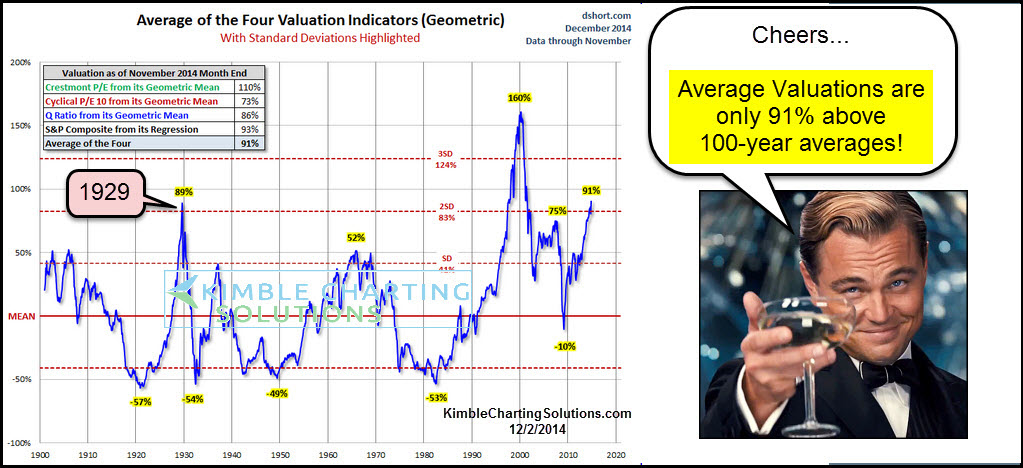

Attractive Valuations Relative to Historical Averages: While valuations may seem high compared to recent years, BofA’s analysis suggests they are still relatively attractive compared to historical averages when considering factors like interest rates and inflation. Specific metrics, such as the Price-to-Earnings (P/E) ratio, are compared to historical data to support this claim. [Insert specific P/E ratio comparisons if available].

-

Promising Investment Sectors: BofA's analysis identifies specific sectors, such as [mention specific sectors mentioned in BofA's report, e.g., technology, healthcare, or renewable energy], as particularly promising investment opportunities, offering attractive growth potential.

Addressing Concerns about Inflation and Interest Rates

The current market is undeniably concerned about inflation and rising interest rates. These concerns directly impact stock market valuations and investor sentiment. BofA acknowledges these risks but offers a nuanced perspective:

-

Inflation Forecast: BofA predicts [insert BofA's inflation forecast], suggesting that inflation may be peaking or already in a downward trend. This projection impacts their long-term valuation models.

-

Interest Rate Hikes: The impact of interest rate hikes on stock valuations is explicitly factored into BofA's models. They argue that while higher rates can impact borrowing costs and valuations, the positive economic fundamentals should outweigh the negative effects in the long term.

-

Federal Reserve's Monetary Policy: BofA analyzes the Federal Reserve's (the Fed's) monetary policy and its likely trajectory, concluding that the Fed's actions are not expected to trigger a significant market downturn, especially given the ongoing strength of the economy in various sectors.

Analyzing BofA's Valuation Metrics and Methodology

BofA employs a range of valuation metrics to arrive at its conclusions, including widely accepted methods like:

-

Price-to-Earnings (P/E) Ratio: This classic metric compares a company's stock price to its earnings per share. BofA likely uses this in conjunction with other metrics to paint a complete picture.

-

Price-to-Sales (P/S) Ratio: This metric relates a company's stock price to its revenue. It's especially useful for evaluating companies that are not yet profitable.

-

Discounted Cash Flow (DCF) Analysis: This more sophisticated approach projects future cash flows and discounts them back to their present value to determine a fair stock price.

The strengths of BofA's methodology include its transparency and reliance on extensive data. However, limitations exist in all valuation models; the assumptions made in forecasting future performance can significantly impact results. Therefore, comparing BofA's findings to other analysts’ opinions is crucial for a well-rounded perspective.

Practical Implications for Investors Based on BofA's Analysis

BofA's analysis translates into several actionable strategies for investors:

-

Investment Strategies: BofA likely suggests a sector allocation strategy that favors the promising sectors identified in their analysis. Consideration of overall asset allocation, considering bonds and other assets, is also advised for diversification.

-

Risk Management: While BofA offers a positive outlook, risk management remains crucial. Investors should maintain a diversified portfolio and adjust their investment strategy based on their individual risk tolerance.

-

Long-Term Investing: BofA's analysis strongly emphasizes the importance of long-term investing over short-term trading. The positive long-term growth projections support a buy-and-hold strategy, mitigating the impact of short-term market fluctuations.

Conclusion: Investing with Confidence Based on Stock Market Valuations – BofA's Perspective

BofA's analysis suggests a more positive outlook on stock market valuations than many initially perceive. Their arguments, based on strong corporate earnings, resilient consumer spending, and positive long-term growth projections, provide reassurance for investors concerned about inflation and interest rate hikes. While BofA's perspective is valuable, it’s crucial to remember it represents just one viewpoint among many. Conduct thorough research and consider diverse opinions before making investment decisions. Use BofA's insights to inform your own strategy and make informed choices about your stock market investments using sound stock market valuation strategies. Don't let market volatility dictate your long-term investment plans; instead, use careful analysis of stock market valuations to navigate the market with confidence.

Featured Posts

-

Ancelotti Vs Tebas Clash Over Real Madrids Game Schedule

May 16, 2025

Ancelotti Vs Tebas Clash Over Real Madrids Game Schedule

May 16, 2025 -

New Ge Force Now Games Doom The Dark Ages Blades Of Fire And Others Arrive In May

May 16, 2025

New Ge Force Now Games Doom The Dark Ages Blades Of Fire And Others Arrive In May

May 16, 2025 -

Stock Market Valuations Bof As Reassuring Argument For Investors

May 16, 2025

Stock Market Valuations Bof As Reassuring Argument For Investors

May 16, 2025 -

Is Jimmy Butler Playing For The Warriors Today Latest News And Game Status

May 16, 2025

Is Jimmy Butler Playing For The Warriors Today Latest News And Game Status

May 16, 2025 -

Hall Of Famers Comments Exacerbate Jimmy Butler Miami Heat Jersey Number Dispute

May 16, 2025

Hall Of Famers Comments Exacerbate Jimmy Butler Miami Heat Jersey Number Dispute

May 16, 2025