The Easiest Way To A High Dividend Income: A Simple Strategy

Table of Contents

Understanding Dividend Investing

Dividend investing is a powerful strategy focused on generating income from your investments. Companies that are profitable often distribute a portion of their earnings to shareholders as dividends. These regular payments can provide a steady stream of supplemental income, supplementing your existing income or providing a foundation for retirement. Understanding key terms is crucial:

-

Dividend Yield: The annual dividend per share, expressed as a percentage of the stock's price. A higher dividend yield suggests a higher return on investment relative to the stock price, but it's not the only factor to consider.

-

Dividend Payout Ratio: The percentage of a company's earnings paid out as dividends. A sustainable payout ratio (generally below 70%) indicates a company's ability to maintain its dividend payments.

-

Dividend Growth: The rate at which a company increases its dividend payments over time. Sustainable dividend growth is crucial for long-term income growth and outpacing inflation.

-

Key Considerations:

- Higher dividend yield doesn't always mean better investment. A high yield could signal underlying financial problems.

- Sustainable dividend growth is crucial for long-term income. Look for companies with a history of increasing their dividends.

- Diversification across different sectors is key to mitigating risk. Don't put all your eggs in one basket.

- High-yield stocks prioritize dividend payments, while growth stocks reinvest earnings for expansion, often sacrificing immediate dividend payouts. The best approach may involve a blend of both.

Identifying High-Dividend Stocks

Finding promising dividend-paying stocks requires research and a strategic approach. Several methods can help you identify opportunities:

-

Utilize Stock Screeners: Many financial websites and brokerage platforms offer stock screeners. You can filter stocks based on criteria like dividend yield, payout ratio, and historical dividend growth. Look for companies with a proven track record.

-

Consult Financial News and Analyst Reports: Stay informed about market trends and company performance through reputable financial news sources. Analyst reports often provide valuable insights into dividend-paying companies.

-

Key Factors to Consider:

- Look for companies with a long history of consistent dividend payments. This demonstrates financial stability and a commitment to shareholders.

- Analyze the company's financial health and stability. Review their balance sheets, income statements, and cash flow statements.

- Consider the dividend payout ratio and its sustainability. A high payout ratio might be unsustainable in the long term.

- Pay attention to the company's future growth prospects. A company's ability to grow its earnings supports future dividend increases.

Building a Diversified Dividend Portfolio

Diversification is crucial for minimizing risk in any investment strategy, and dividend investing is no exception. A well-diversified portfolio reduces the impact of any single stock's poor performance.

-

Diversification Strategies:

- Sector Diversification: Spread your investments across different sectors (e.g., technology, healthcare, consumer staples) to reduce your exposure to sector-specific risks.

- Market Cap Diversification: Include companies of varying market capitalizations (large-cap, mid-cap, small-cap) to balance risk and potential returns.

- Geographic Diversification: Consider international stocks to further diversify your portfolio and reduce dependence on a single market.

-

Practical Tips:

- Don't put all your eggs in one basket – diversify your holdings across multiple stocks and sectors.

- Consider investing in Dividend ETFs (Exchange Traded Funds) for instant diversification across a broad range of dividend-paying stocks.

- Regularly rebalance your portfolio to maintain your target asset allocation. This ensures your portfolio remains aligned with your risk tolerance and investment goals.

Reinvesting Dividends for Accelerated Growth

One of the most powerful aspects of dividend investing is the ability to reinvest dividends. Dividend reinvestment plans (DRIPs) allow you to automatically reinvest your dividends to purchase more shares of the same stock. This accelerates wealth building through the magic of compounding.

-

The Power of Compounding: Compounding is the process where your earnings generate more earnings. Reinvesting dividends increases your initial investment, leading to higher dividend payments in the future. This snowball effect significantly boosts long-term returns.

-

Key Considerations:

- DRIPs allow automatic reinvestment of dividends to buy more shares, simplifying the process and maximizing returns.

- The compounding effect significantly boosts long-term returns. The earlier you start, the greater the benefit.

- Consider tax implications of reinvesting dividends. Consult a financial advisor to understand the tax implications in your specific jurisdiction.

Monitoring and Adjusting Your Portfolio

Building a high-dividend income portfolio is not a set-it-and-forget-it endeavor. Regular monitoring and adjustments are essential to ensure your portfolio remains aligned with your goals and adapts to changing market conditions.

- Regular Portfolio Review:

- Regularly review your dividend stocks' performance. Track dividend payments, stock price fluctuations, and company news.

- Adjust your portfolio based on changing market conditions. Economic shifts and company performance may require rebalancing.

- Consider selling underperforming stocks and reinvesting in better opportunities. Don't be afraid to cut your losses and reallocate funds.

Achieving Your High Dividend Income Goals

Building a robust high-dividend income portfolio involves understanding dividends, identifying strong stocks, diversifying your holdings, reinvesting dividends, and monitoring your investments regularly. This strategy offers significant advantages, including passive income generation, enhanced financial security, and long-term wealth building. Start building your path to a high dividend income today! Research promising dividend stocks and begin creating your diversified portfolio. Your financial future will thank you.

Featured Posts

-

Houston Hosts Prestigious Astros Foundation College Classic

May 11, 2025

Houston Hosts Prestigious Astros Foundation College Classic

May 11, 2025 -

Cybercriminals Office365 Scheme Yields Millions Says Fbi

May 11, 2025

Cybercriminals Office365 Scheme Yields Millions Says Fbi

May 11, 2025 -

Analyzing Cody Bellingers Role In The Yankees Lineup Protecting Aaron Judge

May 11, 2025

Analyzing Cody Bellingers Role In The Yankees Lineup Protecting Aaron Judge

May 11, 2025 -

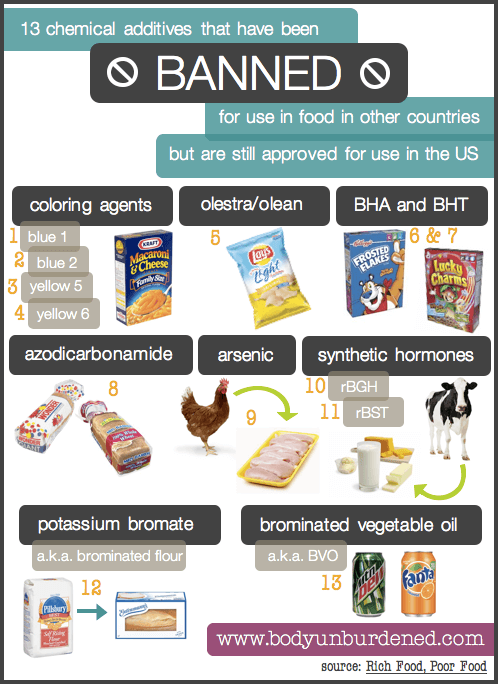

Legal Battle Over Banned Chemicals Sold On E Bay Section 230 Implications

May 11, 2025

Legal Battle Over Banned Chemicals Sold On E Bay Section 230 Implications

May 11, 2025 -

Us Automakers Uk Trade Deal Worries Dismissed By White House

May 11, 2025

Us Automakers Uk Trade Deal Worries Dismissed By White House

May 11, 2025

Latest Posts

-

Jon M Chu Discusses The Potential For A Crazy Rich Asians Tv Series

May 11, 2025

Jon M Chu Discusses The Potential For A Crazy Rich Asians Tv Series

May 11, 2025 -

Will There Be A Crazy Rich Asians Tv Show Jon M Chu Weighs In

May 11, 2025

Will There Be A Crazy Rich Asians Tv Show Jon M Chu Weighs In

May 11, 2025 -

Upcoming Crazy Rich Asians Tv Show Cast Plot And Release Date Speculation

May 11, 2025

Upcoming Crazy Rich Asians Tv Show Cast Plot And Release Date Speculation

May 11, 2025 -

Crazy Rich Asians Tv Series Jon M Chus Update

May 11, 2025

Crazy Rich Asians Tv Series Jon M Chus Update

May 11, 2025 -

Max Developing Crazy Rich Asians Television Series

May 11, 2025

Max Developing Crazy Rich Asians Television Series

May 11, 2025