Trade War Fears Trigger 7% Crash In Amsterdam Stock Market Opening

Table of Contents

The Role of Escalating Trade Tensions

The primary catalyst for the Amsterdam stock market crash was the renewed intensification of US-China trade war tensions. The uncertainty surrounding global trade agreements and the implementation of new tariffs created a perfect storm of investor anxiety. This global trade uncertainty significantly impacted investor confidence, leading to a rapid sell-off in the Amsterdam market. Specific events that exacerbated investor anxieties include:

- Increased tariffs between the US and China: The announcement of new or increased tariffs on billions of dollars worth of goods between the two economic giants sent a ripple effect through global markets. This directly affected Dutch companies involved in export-oriented industries, leading to immediate concerns about decreased profitability and future growth.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding the future trajectory of trade negotiations between major global powers created a climate of uncertainty, making investors hesitant to commit capital. This uncertainty is a major factor contributing to market volatility.

- Negative impact on global supply chains: The trade war significantly disrupted global supply chains, forcing companies to re-evaluate their strategies and potentially incur higher costs. This had a knock-on effect on many Amsterdam-listed companies reliant on international trade.

- Decline in investor confidence in global markets: The escalating trade tensions eroded investor confidence not just in the US and China, but globally, leading to a general flight from riskier assets, including those listed on the Amsterdam stock exchange.

Impact on Key Amsterdam-Listed Companies

The 7% crash in the Amsterdam stock market wasn't uniformly distributed across all sectors. Export-oriented industries and technology companies, particularly those heavily reliant on international trade with the US and China, were disproportionately affected. The AEX index, a key indicator of the Amsterdam stock market's performance, plummeted, reflecting the widespread impact.

- Significant drops in the share prices of major Dutch corporations: Several major Dutch corporations experienced double-digit percentage drops in their share prices within the first hour of trading. This highlighted the immediate and significant impact of the trade war fears on investor sentiment.

- Analysis of the performance of different sectors within the AEX index: The technology sector, for example, suffered steeper losses than more domestically focused sectors. This underscores the vulnerability of companies heavily involved in global trade to trade war uncertainties.

- Impact on investor portfolios and pension funds: The sharp decline in the AEX index had significant implications for individual investors, pension funds, and institutional investors holding Dutch equities. Many portfolios suffered substantial losses.

- Potential for further losses depending on the resolution of the trade war: The longer the trade war continues unresolved, the greater the potential for further losses and economic damage for Dutch companies and the overall economy.

Wider Economic Implications for the Netherlands

The Amsterdam stock market crash has far-reaching economic consequences for the Netherlands. The impact extends beyond the immediate losses suffered by investors and companies. The overall economic health of the nation is at risk.

- Potential slowdown in economic growth: The market downturn could significantly reduce economic growth in the Netherlands, impacting GDP figures and potentially leading to a broader economic slowdown.

- Impact on Dutch exports and international trade: The uncertainty stemming from the trade war negatively impacts Dutch exports, reducing the competitiveness of Dutch businesses in global markets.

- Uncertainty regarding future economic forecasts: The escalating trade tensions make it difficult to provide accurate economic forecasts for the Netherlands, increasing the uncertainty for businesses and investors.

- Government response and potential economic stimulus measures: The Dutch government is likely to respond with measures to mitigate the economic fallout, potentially including economic stimulus packages to support businesses and boost investor confidence.

Investor Sentiment and Market Volatility

The Amsterdam stock market crash reflects a dramatic shift in investor sentiment. The heightened uncertainty surrounding the trade war led to increased risk aversion and significantly higher market volatility.

- Sharp increase in trading volume as investors react to the news: The opening hours of trading saw a surge in trading volume as investors rushed to react to the news, either selling off assets or attempting to capitalize on the sudden price drops.

- Decline in investor confidence and increased risk aversion: The crash significantly eroded investor confidence, with investors exhibiting a marked increase in risk aversion, leading to a sell-off in various asset classes.

- Potential for further market fluctuations in the short-term: Given the ongoing uncertainties surrounding the trade war, the potential for further short-term market fluctuations remains high.

- Strategies investors may employ to mitigate risks: Investors are likely to employ risk mitigation strategies, such as diversification, hedging, and reassessing their investment portfolios, to reduce their exposure to further losses.

Conclusion

The 7% crash in the Amsterdam stock market, triggered by escalating trade war fears, had a significant impact on key Dutch companies, the national economy, and investor confidence. The market volatility underscores the vulnerability of global markets to geopolitical uncertainty. The immediate consequences include substantial losses for investors and a potential slowdown in economic growth for the Netherlands. Understanding the complexities of the Amsterdam stock market and global trade tensions is crucial for investors. Stay informed about the evolving situation and consider diversifying your portfolio to mitigate risks associated with future Amsterdam stock market fluctuations and global trade war impacts. Monitor news regarding the Amsterdam stock market crash and its ongoing consequences to make informed investment decisions.

Featured Posts

-

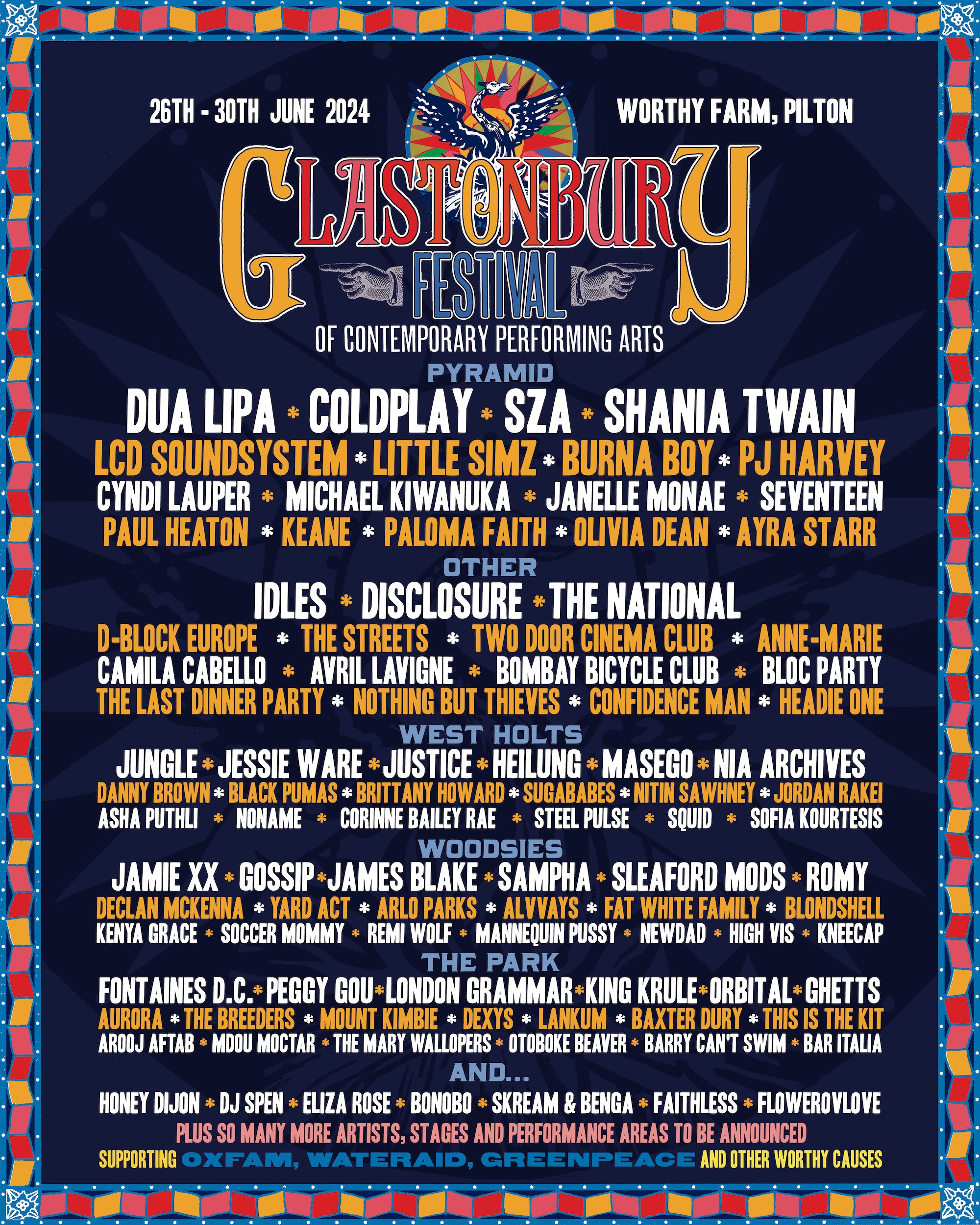

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

F1 Motorral Hajtott Porsche A Teljesitmeny Uj Definicioja

May 24, 2025

F1 Motorral Hajtott Porsche A Teljesitmeny Uj Definicioja

May 24, 2025 -

Znaete Li Vy Roli Olega Basilashvili Test

May 24, 2025

Znaete Li Vy Roli Olega Basilashvili Test

May 24, 2025 -

Dylan Farrows Woody Allen Accusation Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusation Sean Penns Skepticism

May 24, 2025 -

700 000 Profit Nicki Chapmans Escape To The Country Property Investment Strategy

May 24, 2025

700 000 Profit Nicki Chapmans Escape To The Country Property Investment Strategy

May 24, 2025