Unlocking Funding For A 270MWh BESS: A Focus On The Belgian Merchant Market

Table of Contents

Understanding the Belgian Energy Landscape and BESS Potential

Belgium's energy market is undergoing a significant transformation, driven by ambitious renewable energy targets and the increasing integration of wind and solar power. This rapid growth, while positive for environmental sustainability, presents challenges to grid stability due to the intermittent nature of these renewable sources. This is where large-scale BESS projects, such as a 270MWh facility, play a crucial role.

A 270MWh BESS offers significant opportunities in the Belgian merchant market:

- Arbitrage: The ability to buy energy at low prices and sell it during peak demand periods generates substantial revenue. The volatility of the Belgian energy market presents significant arbitrage opportunities for astute BESS operators.

- Frequency Regulation: BESS can provide vital ancillary services to the grid, helping to maintain frequency stability and ensuring reliable power supply. This is particularly important given the increasing penetration of intermittent renewable energy sources.

- Ancillary Services: Beyond frequency regulation, BESS can offer other ancillary services, such as voltage support and reactive power compensation, further enhancing their value proposition.

The Belgian market's specific characteristics make it particularly attractive for BESS investment:

- High penetration of renewable energy sources (wind, solar): Creates a significant need for grid stabilization solutions.

- Growing demand for flexible capacity: To manage the intermittency of renewable energy sources.

- Lucrative opportunities in the merchant market: For BESS revenue streams through arbitrage and ancillary services.

- Government incentives and regulations: While still evolving, are increasingly supportive of BESS deployment as part of the country's energy transition.

Key Funding Sources for a 270MWh BESS Project in Belgium

Securing funding for a project of this scale requires a multifaceted approach, leveraging various funding sources:

Equity Financing

Attracting equity investors, such as private equity firms, infrastructure funds, and strategic investors with expertise in the energy sector, is crucial. These investors will thoroughly assess the project's financial viability, technical feasibility, and management team.

- Robust Business Plan: A well-structured business plan with detailed financial projections demonstrating a strong return on investment (ROI) is essential.

- High ROI Potential: Highlighting the potential for significant returns through arbitrage, ancillary services, and potential future revenue streams is paramount.

- Experienced Management Team: A team with proven experience in BESS development, operation, and finance significantly improves investor confidence.

Debt Financing

Debt financing can supplement equity investment and provide a stable funding base. Banks, specialized lenders focusing on renewable energy projects, and the issuance of green bonds are viable options.

- Creditworthiness: Banks will assess the project's creditworthiness, including the strength of the sponsor, project cash flows, and risk mitigation strategies.

- Green Bonds: Issuing green bonds can attract environmentally conscious investors and potentially secure more favorable financing terms.

- Project Finance Structures: Tailored project finance structures, designed specifically for the complexities of BESS projects, are crucial for attracting debt financing.

Government Grants and Subsidies

The Belgian government is actively promoting renewable energy integration and may offer grants or subsidies to support BESS projects. Thorough research is essential to identify relevant programs.

- Regional and National Programs: Explore both regional and national level incentives specifically designed for energy storage solutions.

- Eligibility Criteria: Understanding and fulfilling the eligibility criteria for these programs is critical to securing funding.

- Alignment with Policy Goals: Demonstrate clearly how the project aligns with the Belgian government's broader energy and climate goals.

Power Purchase Agreements (PPAs)

PPAs with off-takers provide long-term revenue streams, significantly enhancing the project's bankability and attractiveness to investors.

- Revenue Risk Mitigation: PPAs reduce revenue risk by securing committed buyers for the energy generated or services provided by the BESS.

- Favorable PPA Terms: Negotiating favorable PPA terms, including pricing mechanisms and duration, is crucial.

- PPA Structures: Different PPA structures, such as fixed-price or indexed PPAs, should be considered based on market conditions and risk tolerance.

Navigating the Regulatory Landscape and Permitting Process in Belgium

Securing the necessary permits and approvals is a critical step in the project development process. Early engagement with regulatory bodies is essential to streamline the permitting process and avoid delays.

- Grid Connection Approvals: Obtaining grid connection approvals is a crucial early step, requiring coordination with Elia (the Belgian transmission system operator).

- Environmental Impact Assessments: Conducting comprehensive environmental impact assessments and securing the necessary permits is crucial.

- Safety and Operational Standards: Ensuring compliance with all relevant safety and operational standards throughout the project lifecycle is paramount.

Conclusion

Securing funding for a 270MWh BESS project in the Belgian merchant market requires a strategic and comprehensive approach. By effectively leveraging various funding sources, navigating the regulatory landscape, and showcasing the project's significant potential for return on investment and contribution to the Belgian energy transition, developers can successfully attract the necessary capital. Begin exploring your options for BESS funding in Belgium today! Learn more about strategies for securing BESS funding and maximizing your project's potential in the dynamic Belgian market.

Featured Posts

-

Eight Hours In A Tree A Migrants Escape From Ice

May 04, 2025

Eight Hours In A Tree A Migrants Escape From Ice

May 04, 2025 -

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy

May 04, 2025

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy

May 04, 2025 -

Unlocking Funding For A 270 M Wh Bess A Focus On The Belgian Merchant Market

May 04, 2025

Unlocking Funding For A 270 M Wh Bess A Focus On The Belgian Merchant Market

May 04, 2025 -

La Seine Musicale Saison 2025 2026 Evenements Pour Tous

May 04, 2025

La Seine Musicale Saison 2025 2026 Evenements Pour Tous

May 04, 2025 -

Chinas Electric Vehicle Revolution Is America Prepared To Compete

May 04, 2025

Chinas Electric Vehicle Revolution Is America Prepared To Compete

May 04, 2025

Latest Posts

-

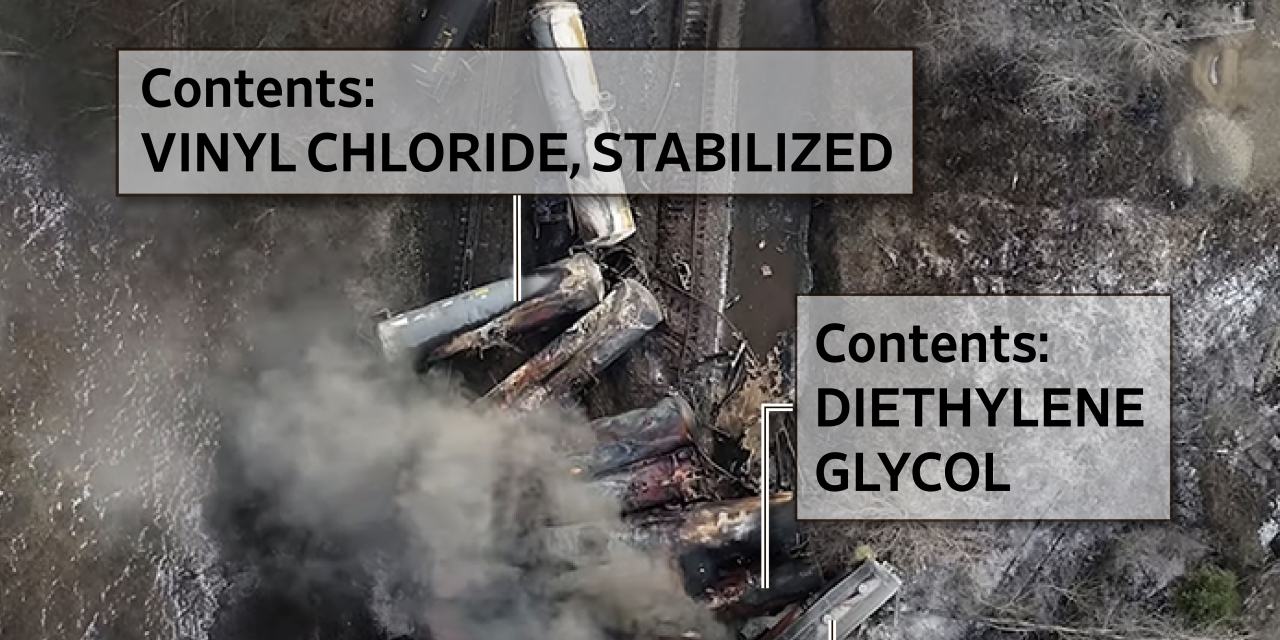

Investigation Into Persistent Toxic Chemicals From Ohio Train Derailment In Buildings

May 04, 2025

Investigation Into Persistent Toxic Chemicals From Ohio Train Derailment In Buildings

May 04, 2025 -

Executive Office365 Accounts Targeted In Multi Million Dollar Hacking Scheme

May 04, 2025

Executive Office365 Accounts Targeted In Multi Million Dollar Hacking Scheme

May 04, 2025 -

Office365 Security Breach Millions Stolen Through Executive Email Compromise

May 04, 2025

Office365 Security Breach Millions Stolen Through Executive Email Compromise

May 04, 2025 -

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 04, 2025

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 04, 2025 -

Millions Made From Executive Office365 Account Hacks Federal Investigation

May 04, 2025

Millions Made From Executive Office365 Account Hacks Federal Investigation

May 04, 2025