Why Did Bitcoin Mining Activity Explode This Week?

Table of Contents

The Role of Bitcoin Price in Mining Activity

The price of Bitcoin is a crucial determinant of Bitcoin mining profitability. A rising Bitcoin price directly impacts miners' revenue and significantly influences their participation in the network.

Increased Profitability

- Higher Bitcoin price = higher revenue per mined Bitcoin: A simple equation governs mining profitability: the higher the Bitcoin price, the greater the reward for successfully mining a block.

- Increased incentive for miners to operate: Higher profitability encourages existing miners to maintain, and even expand, their operations.

- Attracting new miners to the network: The lure of higher returns attracts new entrants into the competitive Bitcoin mining landscape, further boosting the overall hash rate.

A clear correlation exists between Bitcoin's price and the mining hash rate. (Ideally, a chart would be included here showing this correlation). For example, a 20% increase in Bitcoin's price often correlates with a noticeable rise in mining activity.

Impact on Miner Participation

The price increase doesn't just impact existing miners; it also influences the number of active miners and their investments.

- More miners join the network: Attracted by the increased profitability, new miners invest in hardware and begin contributing to the network's hash rate.

- Existing miners increase their mining capacity: Profitable periods incentivize established miners to expand their operations, purchasing more ASICs (Application-Specific Integrated Circuits) to increase their mining capacity.

- Increased competition: The influx of new miners and increased capacity from existing ones leads to heightened competition within the mining ecosystem.

Technological Advancements and Efficiency Improvements

Technological advancements play a crucial role in boosting Bitcoin mining activity. Improvements in both hardware and software contribute significantly to increased efficiency and profitability.

New Mining Hardware

The release of new, more efficient ASIC miners is a key driver of the recent surge.

- Higher hash rate per unit of power: Newer generation ASICs offer significantly higher hashing power while consuming less energy, leading to lower operational costs and higher profitability.

- Lower operating costs: Improved efficiency translates to reduced electricity bills, a major expense for Bitcoin mining operations.

- Increased profitability: The combination of higher hash rate and lower costs directly contributes to increased profitability, further stimulating mining activity.

- Examples of new hardware released: [Insert examples of recently released ASIC miners and their specifications here].

Improved Mining Software and Techniques

Advancements in mining software and techniques also contribute to increased efficiency.

- Optimized algorithms: Improved algorithms maximize mining efficiency, allowing miners to solve cryptographic puzzles more effectively.

- Better pool management: Efficient pool management strategies optimize resource allocation and reduce wasted computational power.

- Reduced latency: Minimizing latency between miners and the network improves the speed and efficiency of block propagation.

- Improved energy efficiency: Software optimizations can contribute to further energy savings, enhancing the overall profitability of mining operations.

Regulatory Changes and Geopolitical Factors

Regulatory environments and geopolitical factors significantly influence where and how Bitcoin mining takes place.

Favorable Regulatory Environments

Some regions have created more favorable environments for Bitcoin mining.

- Examples of countries with supportive regulations: [Mention countries with supportive regulatory frameworks for cryptocurrency mining].

- Impact on energy costs and taxation: Governments with supportive policies often offer lower energy costs or favorable tax treatments, making mining operations more attractive.

- Ease of doing business for mining operations: Simplified regulations and bureaucratic processes facilitate the establishment and operation of Bitcoin mining facilities.

Energy Costs and Availability

Energy costs are a critical factor determining the profitability and location of Bitcoin mining operations.

- Regions with cheap energy attract more miners: Areas with abundant and inexpensive energy sources become hubs for Bitcoin mining activities.

- Impact of renewable energy sources: The increasing use of renewable energy sources (e.g., hydropower, solar) reduces the environmental impact of Bitcoin mining and can influence its location.

- Influence of energy price fluctuations on mining profitability: Increases in energy prices can reduce mining profitability, potentially leading to a decrease in mining activity in affected regions.

Network Hash Rate and Mining Difficulty

The network hash rate and mining difficulty are intrinsically linked to Bitcoin mining activity.

Increased Hash Rate

The increased Bitcoin mining activity directly translates to a higher network hash rate.

- Definition of network hash rate: The network hash rate represents the total computational power dedicated to securing the Bitcoin network.

- Impact on network security: A higher hash rate strengthens the network's security, making it more resistant to attacks.

- Competitive landscape and market share: The hash rate reflects the competitive landscape; a larger share indicates a more dominant position within the mining community.

Mining Difficulty Adjustment

Bitcoin's ingenious difficulty adjustment mechanism maintains a consistent block generation time.

- Mechanism of difficulty adjustment: The network automatically adjusts the mining difficulty every 2016 blocks to maintain a target block generation time of approximately 10 minutes.

- Impact of increased hash rate on difficulty: A higher hash rate leads to a more challenging mining difficulty, ensuring the network maintains its intended pace of block creation.

- Long-term effects on mining profitability: The difficulty adjustment mechanism prevents runaway increases in profitability; it's a self-regulating system ensuring long-term sustainability.

Conclusion

The recent explosion in Bitcoin mining activity is a confluence of several factors. A rising Bitcoin price has significantly increased profitability, attracting new miners and incentivizing existing ones to expand. Technological advancements, particularly in ASIC mining hardware and software, have dramatically improved efficiency and lowered costs. Favorable regulatory environments and access to cheap energy in certain regions have also played a vital role. Finally, the network's inherent difficulty adjustment mechanism ensures the long-term health and security of the Bitcoin network despite fluctuations in mining activity.

Key Takeaways: This surge in Bitcoin mining activity reinforces the security and decentralization of the Bitcoin network. The increasing hash rate makes the network more resistant to attacks and strengthens its overall resilience.

Call to Action: Stay updated on the latest developments in Bitcoin mining activity to understand the evolving dynamics of this crucial aspect of the Bitcoin ecosystem. Follow reputable sources for the most accurate and timely information about Bitcoin mining trends and the influence of the Bitcoin price.

Featured Posts

-

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025 -

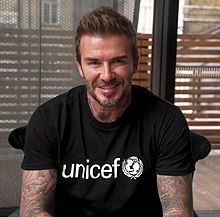

Zoshto De Vid Bekam E Na Golemiot Fudbaler

May 09, 2025

Zoshto De Vid Bekam E Na Golemiot Fudbaler

May 09, 2025 -

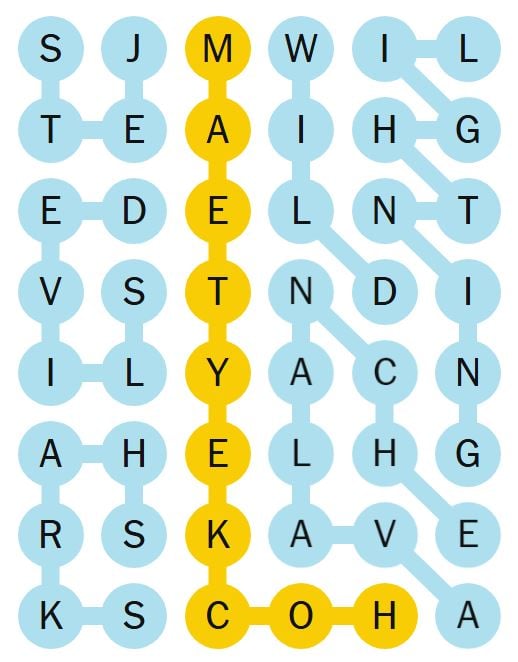

Solve Nyt Strands Game 349 Saturday February 15th Hints And Answers

May 09, 2025

Solve Nyt Strands Game 349 Saturday February 15th Hints And Answers

May 09, 2025 -

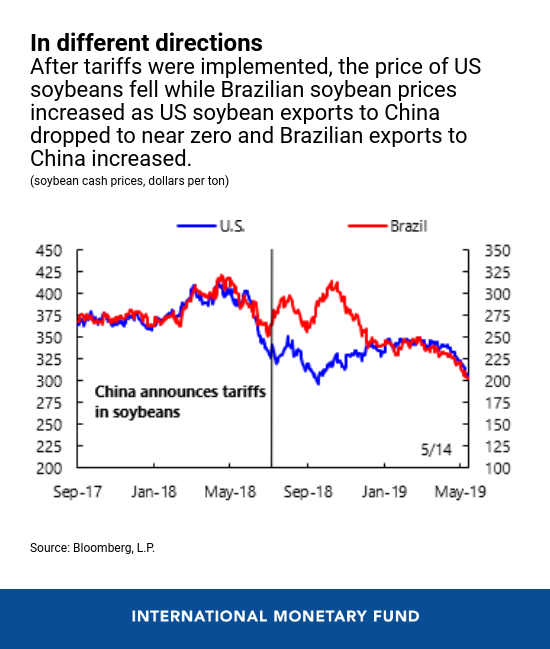

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 09, 2025

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 09, 2025 -

Fed Holds Interest Rates Balancing Inflation And Job Growth Risks

May 09, 2025

Fed Holds Interest Rates Balancing Inflation And Job Growth Risks

May 09, 2025