Why This New Investment Strategy May Not Suit Your Retirement Goals

Table of Contents

Many enticing new investment strategies promise high returns, but before jumping on the bandwagon, it's crucial to analyze if they truly align with your retirement goals. This article explores potential pitfalls of some trendy investment approaches and helps you determine if they're suitable for securing your financial future. Effective retirement planning requires a careful consideration of risk, diversification, and long-term growth.

High-Risk, High-Reward Strategies and Retirement Security

Chasing high returns might seem appealing, but high-risk, high-reward investment strategies can be detrimental to your retirement savings, especially as retirement nears.

Understanding Volatility and its Impact on Retirement Savings

Volatility refers to the fluctuation in an investment's price. High-volatility investments, like cryptocurrencies or certain penny stocks, can experience dramatic swings in value. While these might offer substantial gains in the short term, they also pose a significant risk of substantial losses, particularly in the years leading up to retirement. Imagine a significant market downturn just before you plan to retire; the impact on your retirement income could be devastating.

- High volatility can erode savings quickly.

- Market downturns can severely impact retirement income.

- Risk tolerance decreases as retirement approaches.

For example, investing a significant portion of your retirement portfolio in cryptocurrencies could lead to substantial gains, but it also carries the risk of losing a large chunk of your savings if the market takes a downturn. This risk becomes increasingly unacceptable as retirement approaches, because you have less time to recover from potential losses.

Time Horizon and Risk Tolerance

Your investment strategy should directly correlate with your time horizon until retirement. Younger investors with a longer time horizon can generally tolerate more risk, as they have more time to recover from potential market downturns. However, as retirement nears, a more conservative approach is necessary to protect your accumulated savings. Risk tolerance also decreases with age, as the potential for loss becomes more impactful.

- Younger investors can tolerate more risk.

- Older investors need greater capital preservation.

- A personalized risk assessment is crucial.

Your risk tolerance should be carefully considered when selecting investments for your retirement portfolio. A financial advisor can help you determine your risk profile and choose investments aligned with your comfort level and retirement timeline.

Lack of Diversification and its Consequences

Another common mistake is failing to diversify your investment portfolio. Over-reliance on a single asset class or investment strategy significantly increases your risk exposure.

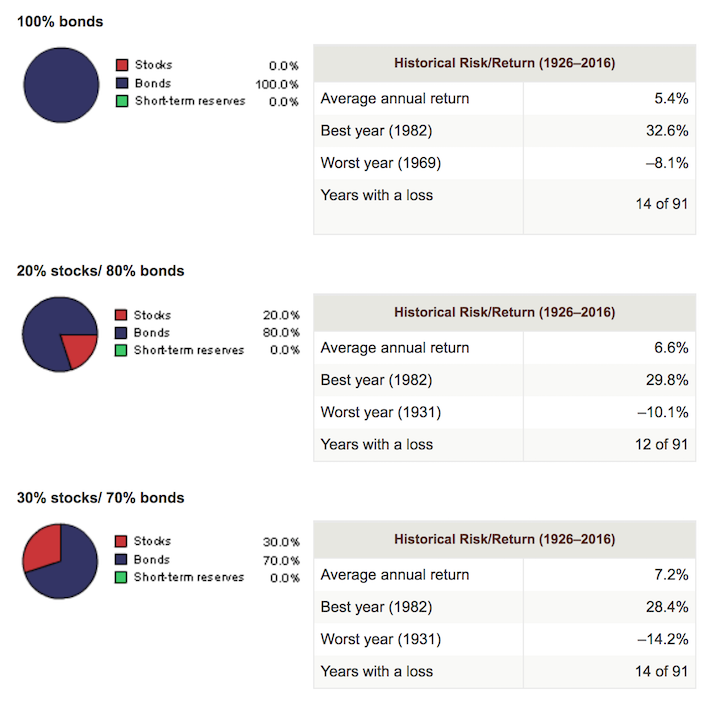

The Importance of a Diversified Portfolio

Diversification is a cornerstone of sound investment strategy. It involves spreading your investments across various asset classes to reduce the impact of losses in any one area. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and possibly other alternative investments.

- Diversification reduces portfolio volatility.

- Spread risk across various asset classes.

- Don't put all your eggs in one basket.

By diversifying your portfolio, you're mitigating the risk of significant losses. If one asset class underperforms, the others might compensate, providing a more stable overall return.

Identifying Overly Concentrated Investments

Focusing solely on a single sector (e.g., technology stocks) or a single emerging market can expose your retirement savings to substantial losses if that sector or market underperforms. Similarly, concentrating your investments in a single company, even a seemingly strong one, is extremely risky.

- Analyze your portfolio for over-concentration.

- Consider professional financial advice for diversification.

- Rebalance your portfolio periodically.

Regularly reviewing and rebalancing your portfolio is crucial to maintaining an appropriate level of diversification and aligning your investments with your evolving risk tolerance.

Ignoring Fees and Expenses

Hidden fees and expenses can significantly eat into your investment returns over time.

The Hidden Costs of Investment Strategies

Various investment strategies come with associated fees, including management fees, transaction fees, and other charges. These fees, often overlooked, can significantly erode your returns over the long term, especially for high-fee investments like actively managed mutual funds.

- High fees can dramatically reduce long-term returns.

- Compare expense ratios across different investment options.

- Consider low-cost index funds or ETFs.

Before investing in any product, carefully review the fee schedule and compare it to similar investment options. Low-cost index funds and exchange-traded funds (ETFs) are often a more cost-effective alternative.

The Impact of Fees on Retirement Savings

The cumulative impact of even seemingly small fees can be substantial over several decades. A seemingly small annual fee of 1% might not seem significant, but it can significantly reduce your final retirement nest egg.

- Even small fees can make a big difference over decades.

- Calculate the long-term impact of fees on your retirement.

- Seek transparent and low-cost investment options.

Use online calculators to quantify the long-term effect of fees on your investment growth. This will highlight the importance of selecting low-cost investment options for your retirement planning.

Conclusion

Choosing the right investment strategy is paramount for achieving your retirement goals. High-risk strategies, lack of diversification, and high fees can severely jeopardize your financial security in retirement. Thorough research, understanding your risk tolerance, and seeking professional financial advice are essential steps in building a successful retirement plan.

Call to Action: Before committing to any new investment strategy, carefully consider whether it truly aligns with your retirement goals. Seek professional financial advice to create a personalized plan that minimizes risk and maximizes your chances of a comfortable retirement. Don't let a flashy new investment strategy derail your retirement planning.

Featured Posts

-

Jack Black Hosts Snl Ego Nwodim Steals The Show With Improv Highlights

May 18, 2025

Jack Black Hosts Snl Ego Nwodim Steals The Show With Improv Highlights

May 18, 2025 -

The Next Chapter A Former Red Sox Closers Free Agency Plans

May 18, 2025

The Next Chapter A Former Red Sox Closers Free Agency Plans

May 18, 2025 -

Is This Hot New Investment A Retirement Risk

May 18, 2025

Is This Hot New Investment A Retirement Risk

May 18, 2025 -

Netflixs Bin Laden Documentary A Delayed American Manhunt

May 18, 2025

Netflixs Bin Laden Documentary A Delayed American Manhunt

May 18, 2025 -

Kanie Goyest Zitei Syggnomi Apo Ton Jay Z Kai Tin Mpigionse

May 18, 2025

Kanie Goyest Zitei Syggnomi Apo Ton Jay Z Kai Tin Mpigionse

May 18, 2025

Latest Posts

-

Detroit Tigers Star Riley Greene Achieves Mlb First

May 18, 2025

Detroit Tigers Star Riley Greene Achieves Mlb First

May 18, 2025 -

Riley Greenes Historic Night Two Home Runs In The Final Inning

May 18, 2025

Riley Greenes Historic Night Two Home Runs In The Final Inning

May 18, 2025 -

Detroit Tigers Riley Greenes Historic Two Home Run Ninth Inning

May 18, 2025

Detroit Tigers Riley Greenes Historic Two Home Run Ninth Inning

May 18, 2025 -

Riley Greene Mlb History Maker With Two 9th Inning Home Runs

May 18, 2025

Riley Greene Mlb History Maker With Two 9th Inning Home Runs

May 18, 2025 -

White Sox Fall To Angels 1 0 Sorianos Outstanding Performance

May 18, 2025

White Sox Fall To Angels 1 0 Sorianos Outstanding Performance

May 18, 2025